Cybersecurity software maker Rapid7 (NASDAQ:RPD) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 8% year on year to $214.7 million. The company expects next quarter’s revenue to be around $212 million, close to analysts’ estimates. Its non-GAAP profit of $0.66 per share was also 27.6% above analysts’ consensus estimates.

Is now the time to buy Rapid7? Find out by accessing our full research report, it’s free.

Rapid7 (RPD) Q3 CY2024 Highlights:

- Revenue: $214.7 million vs analyst estimates of $210.1 million (2.2% beat)

- Adjusted EPS: $0.66 vs analyst estimates of $0.52 (27.6% beat)

- EBITDA: $50.08 million vs analyst estimates of $42.83 million (16.9% beat)

- Revenue Guidance for Q4 CY2024 is $212 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $2.30 at the midpoint, a 5.5% increase

- Gross Margin (GAAP): 70.6%, in line with the same quarter last year

- Operating Margin: 6.5%, up from -8.1% in the same quarter last year

- EBITDA Margin: 23.3%, up from 21.6% in the same quarter last year

- Free Cash Flow Margin: 17.9%, up from 14% in the previous quarter

- Annual Recurring Revenue: $823.1 million at quarter end, up 6% year on year

- Customers: 11,619, up from 11,484 in the previous quarter

- Market Capitalization: $2.52 billion

“Rapid7 continued to see positive momentum across key areas of our business in the third quarter, highlighted by growth in our threat detection and response business, and strong demand for our consolidated offerings, which resulted in revenue and operating income exceeding guided ranges. There are also a number of promising indicators on the horizon, including a stronger sales pipeline and early positive traction from our newly launched Command platform,” said Corey Thomas, Chairman and CEO of Rapid7.

Company Overview

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

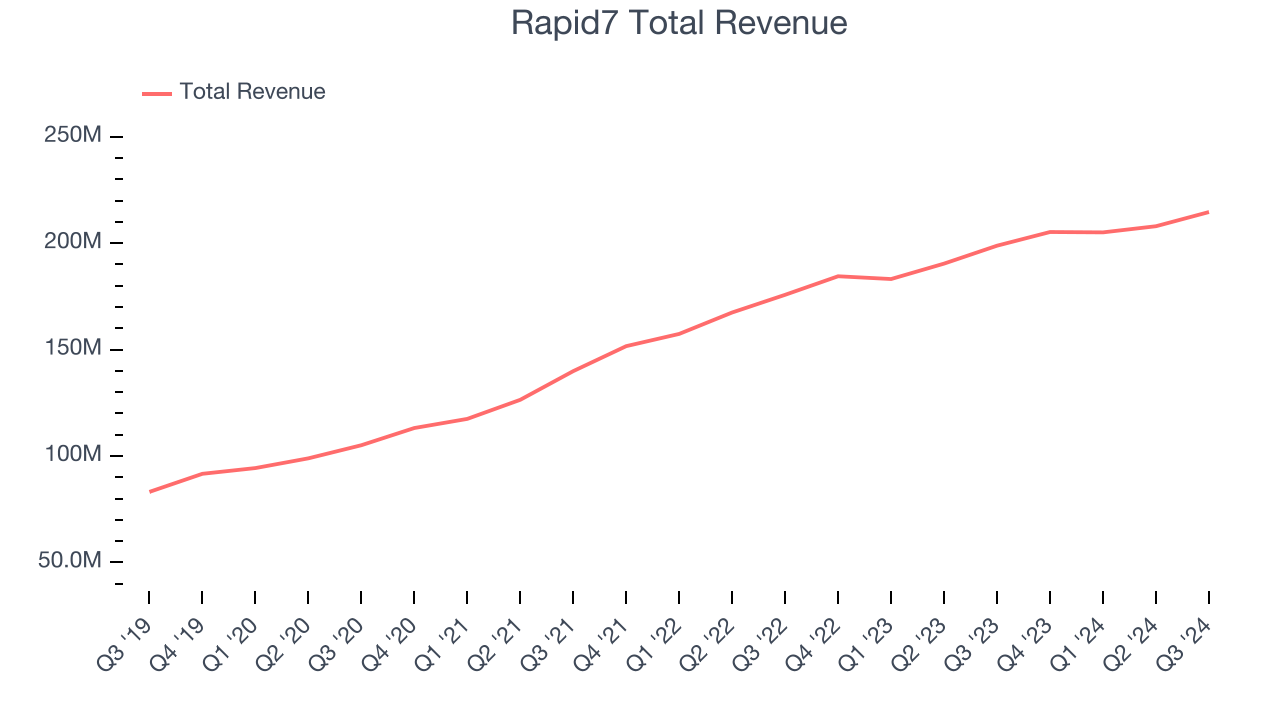

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Rapid7’s 18.8% annualized revenue growth over the last three years was mediocre.

This quarter, Rapid7 reported year-on-year revenue growth of 8%, and its $214.7 million of revenue exceeded Wall Street’s estimates by 2.2%. Management is currently guiding for a 3.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates the market believes its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

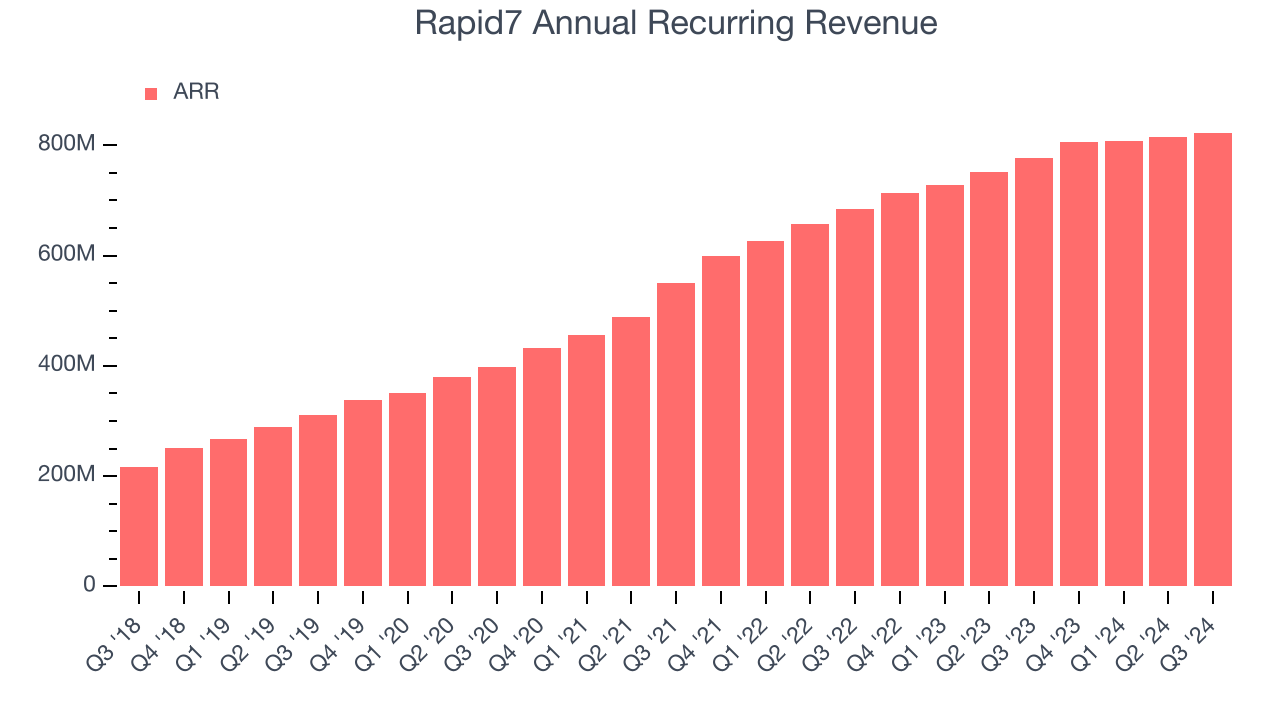

Annual Recurring Revenue

Investors interested in Rapid7 should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Rapid7’s ARR growth has slightly underperformed the sector, averaging 9.6% year-on-year increases and coming in at $823.1 million in the latest quarter. This performance mirrored its revenue and suggests there may be increasing competition that is causing challenges in securing longer-term commitments.

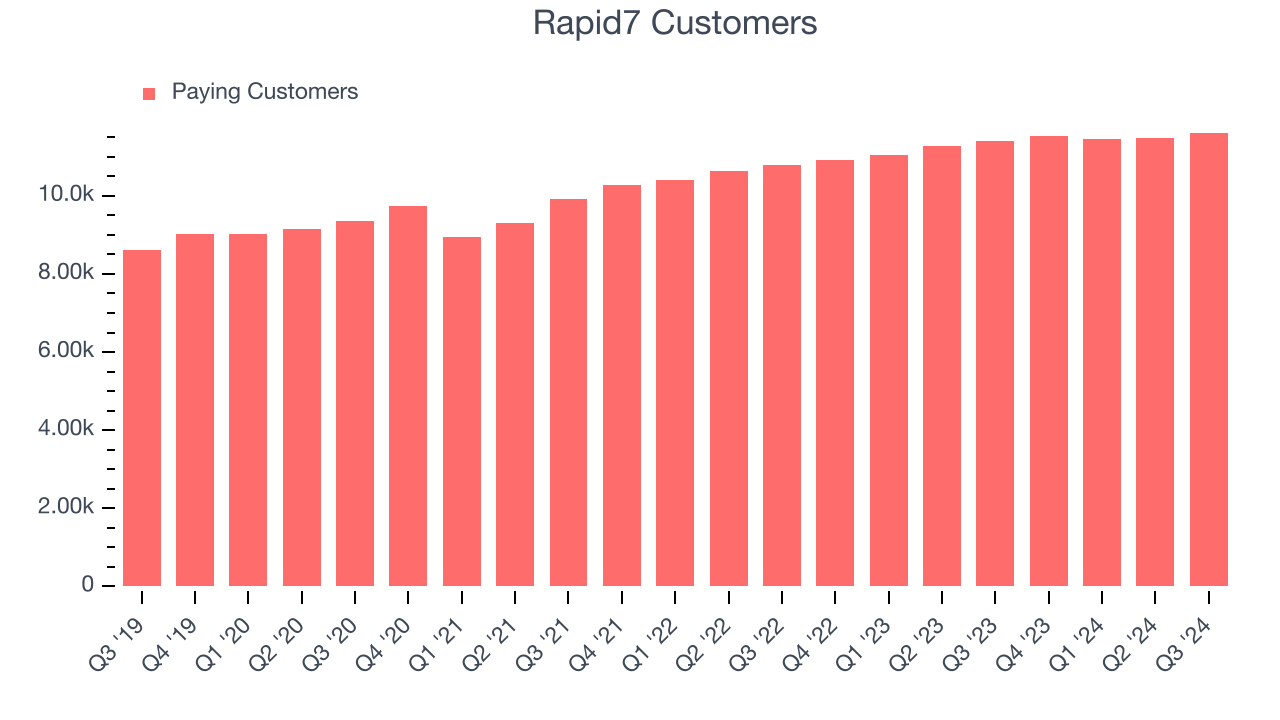

Customer Growth

Rapid7 reported 11,619 customers at the end of the quarter, an increase of 135 from the previous quarter. That’s a little better customer growth than last quarter and quite a bit above the typical growth we’ve seen in past quarters, demonstrating that the business has strong sales momentum. We’ve no doubt shareholders will take this as an indication that Rapid7’s go-to-market strategy is working very well. Rapid7 updated its customer count methodology in Q1 2021, which is the reason for the related drop in the number of customers.

Key Takeaways from Rapid7’s Q3 Results

We were impressed by Rapid7’s strong growth in customers this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS forecast for next quarter missed. Overall, this quarter had some key positives. The stock remained flat at $41.70 immediately following the results.

Sure, Rapid7 had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.