Cybersecurity software maker Rapid7 (NASDAQ:RPD) will be announcing earnings results tomorrow after market hours. Here's what to look for.

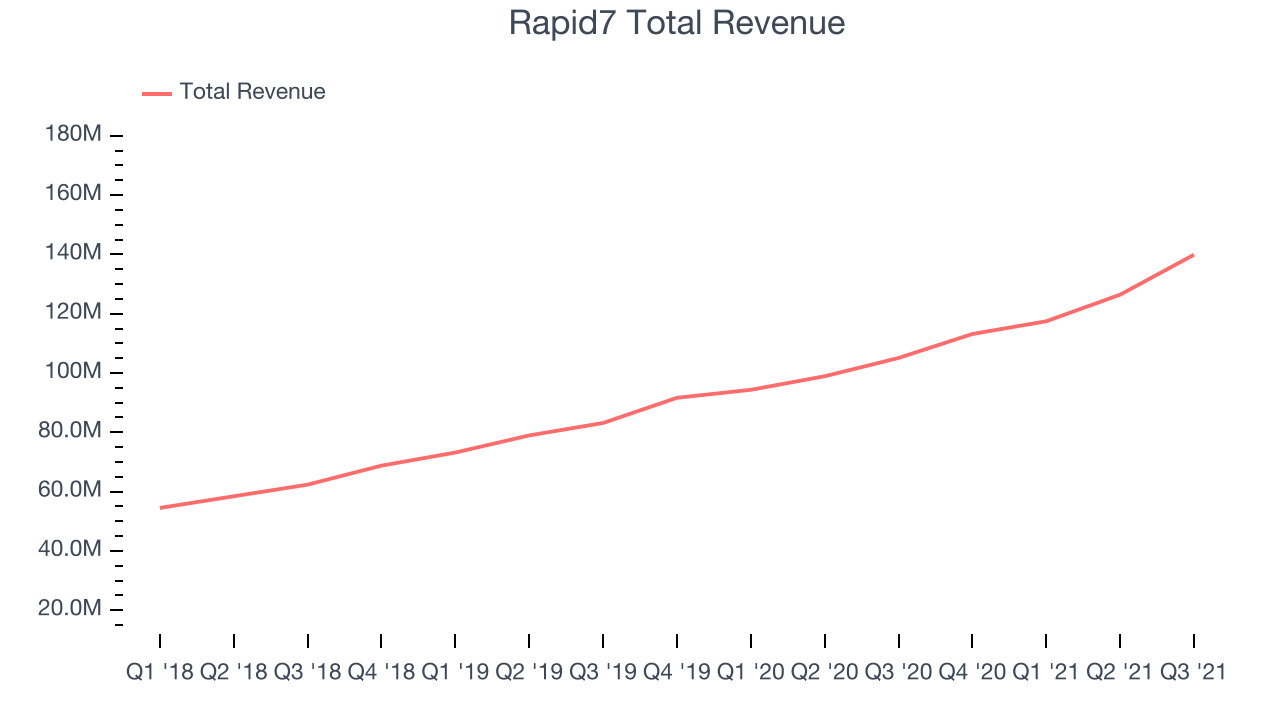

Last quarter Rapid7 reported revenues of $139.8 million, up 33.1% year on year, beating analyst revenue expectations by 4.28%. It was an impressive quarter for the company, with accelerating customer growth and strong top line growth.

Is Rapid7 a buy or sell heading into the earnings? Read our full analysis here, it's free.

This quarter analysts are expecting Rapid7's revenue to grow 27.4% year on year to $144.2 million, improving on the 23.4% year-over-year increase in revenue the company had recorded in the same quarter last year. Loss is expected to come in at -$0.17 per share.

The company has a history of exceeding Wall St's expectations, beating revenue estimates every single time over the past two years on average by 3.15%.

Looking at Rapid7's peers in the cybersecurity segment, only Tenable (NASDAQ:TENB) has so far reported results, delivering top-line growth of 26.1% year on year, and beating analyst estimates by 3.09%. The stock was down 2.81% on the results. Read our full analysis of Tenable's earnings results here.

The whole tech sector has been facing a sell-off since late last year and while some of the software stocks have fared somewhat better, they have not been spared, with share price declining 6.46% over the last month. Rapid7 is down 5.74% during the same time, and is heading into the earnings with analyst price target of $133.4, compared to share price of $96.88.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.