Cybersecurity software maker Rapid7 (NASDAQ:RPD) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 11.3% year on year to $205.3 million. The company expects next quarter's revenue to be around $204 million, in line with analysts' estimates. It made a non-GAAP profit of $0.72 per share, improving from its profit of $0.35 per share in the same quarter last year.

Rapid7 (RPD) Q4 FY2023 Highlights:

- Revenue: $205.3 million vs analyst estimates of $201.4 million (1.9% beat)

- EPS (non-GAAP): $0.72 vs analyst estimates of $0.48 (51.6% beat)

- Revenue Guidance for Q1 2024 is $204 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $852 million at the midpoint, missing analyst estimates by 2.2% and implying 9.6% growth (vs 13.6% in FY2023)

- Free Cash Flow of $60.25 million is up from -$582,000 in the previous quarter

- Customers: 11,526, up from 11,412 in the previous quarter

- Gross Margin (GAAP): 70.9%, in line with the same quarter last year

- Market Capitalization: $3.51 billion

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7's software scans all computers, servers and other devices on their customer’s network and finds vulnerabilities that can be exploited by malware or hackers, like computers that haven’t had patches installed. It then automatically alerts responsible personnel and provides them with guidance on how to patch them, reducing average time to fix a vulnerability from days to hours.

Rapid7 also provides companies with a real-time monitoring dashboard with an overview of the activity on their network and alerts them about any suspicious activity, for example a user that has logged in from two different countries. When Rapid7 detects a successful attack it alerts the IT security personnel, scans the network to identify the size of the breach and then provides suggestions on which users should have their access revoked and which parts of the network should be quarantined.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

The market is highly competitive, and Rapid7 is competing with companies like Tenable (NASDAQ:TENB), Qualys (NASDAQ:QLYS) and Crowdstrike (NASDAQ:CRWD).

Sales Growth

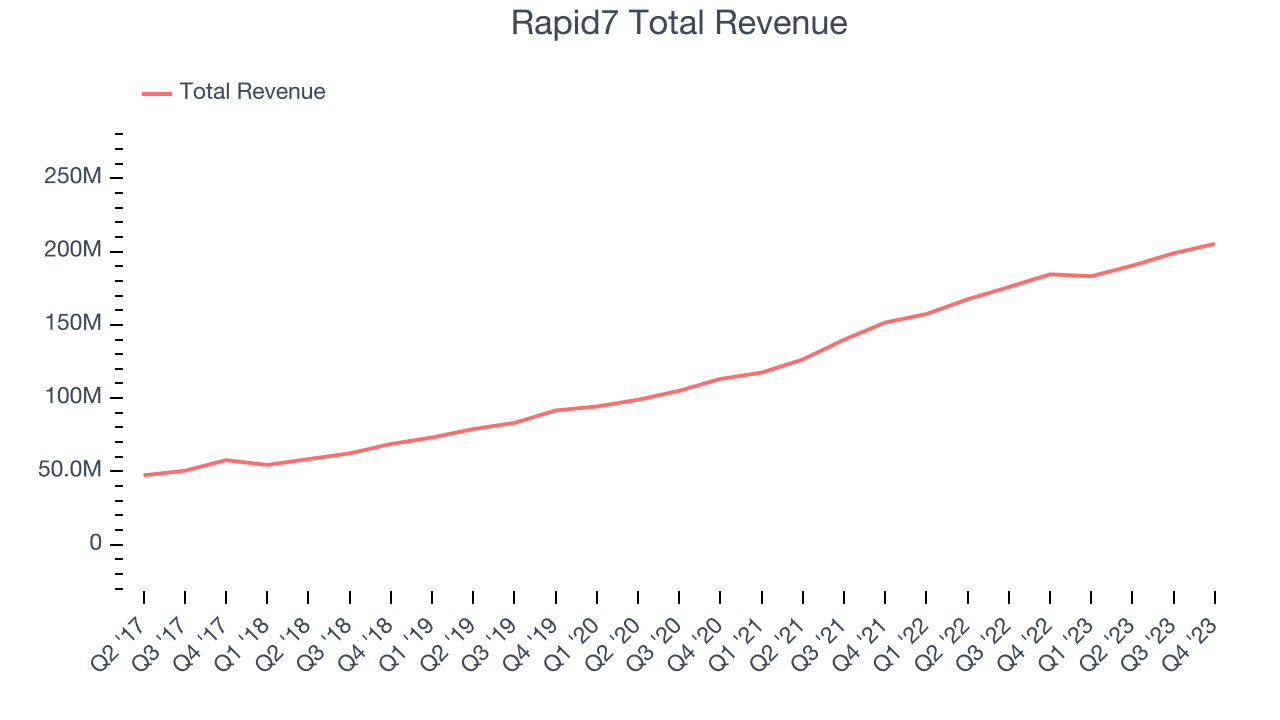

As you can see below, Rapid7's revenue growth has been strong over the last two years, growing from $151.6 million in Q4 FY2021 to $205.3 million this quarter.

This quarter, Rapid7's quarterly revenue was once again up 11.3% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $6.43 million in Q4 compared to $8.42 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Rapid7 is expecting revenue to grow 11.4% year on year to $204 million, slowing down from the 16.4% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $852 million at the midpoint, growing 9.6% year on year compared to the 13.5% increase in FY2023.

Customer Growth

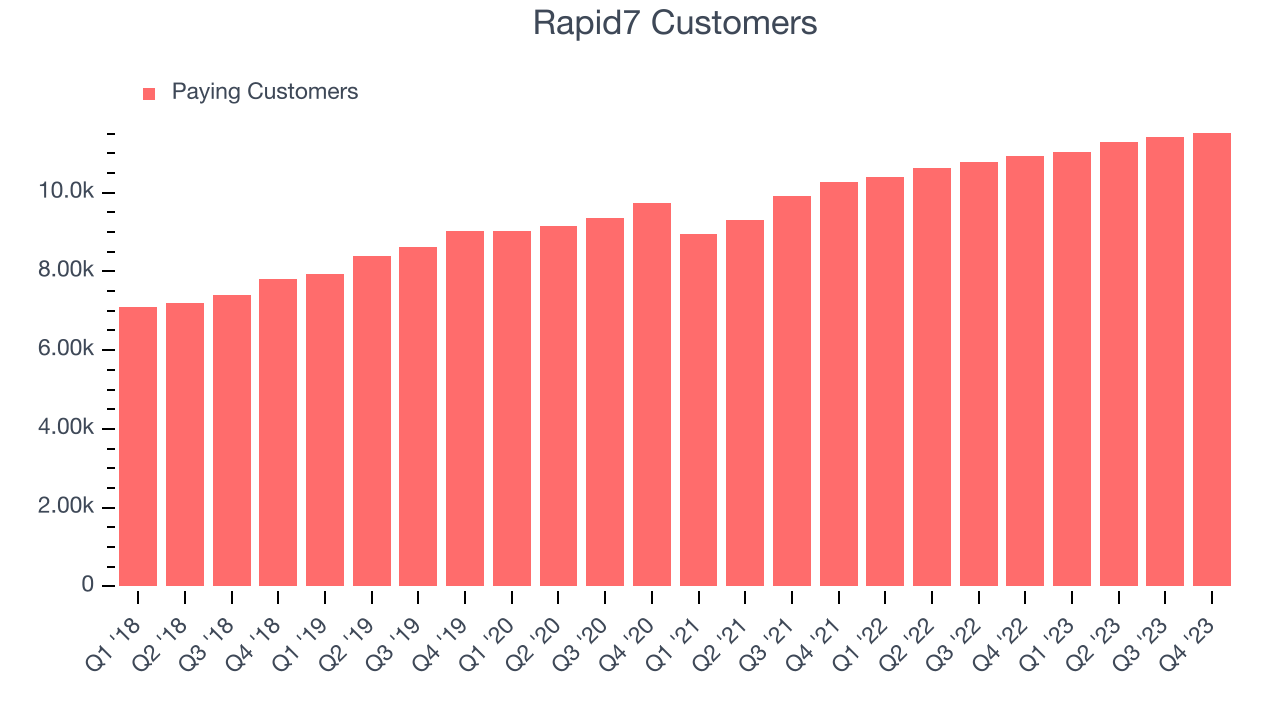

Rapid7 reported 11,526 customers at the end of the quarter, an increase of 114 from the previous quarter. That's in line with the customer growth we observed last quarter but a bit below what we've typically seen over the last year, suggesting that sales momentum may be slowing a little. Rapid7 updated its customer count methodology in Q1 2021, which is the reason for the related drop in the number of customers.

Profitability

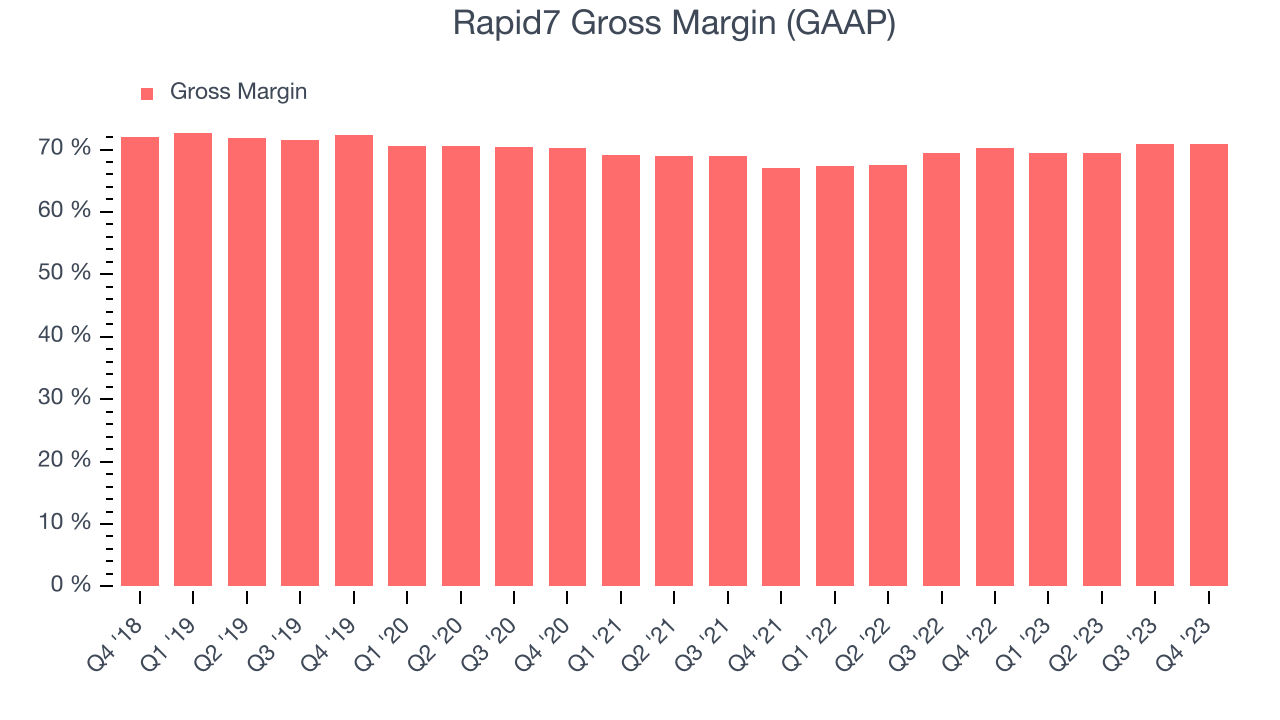

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Rapid7's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 70.9% in Q4.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Rapid7's gross margin is lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

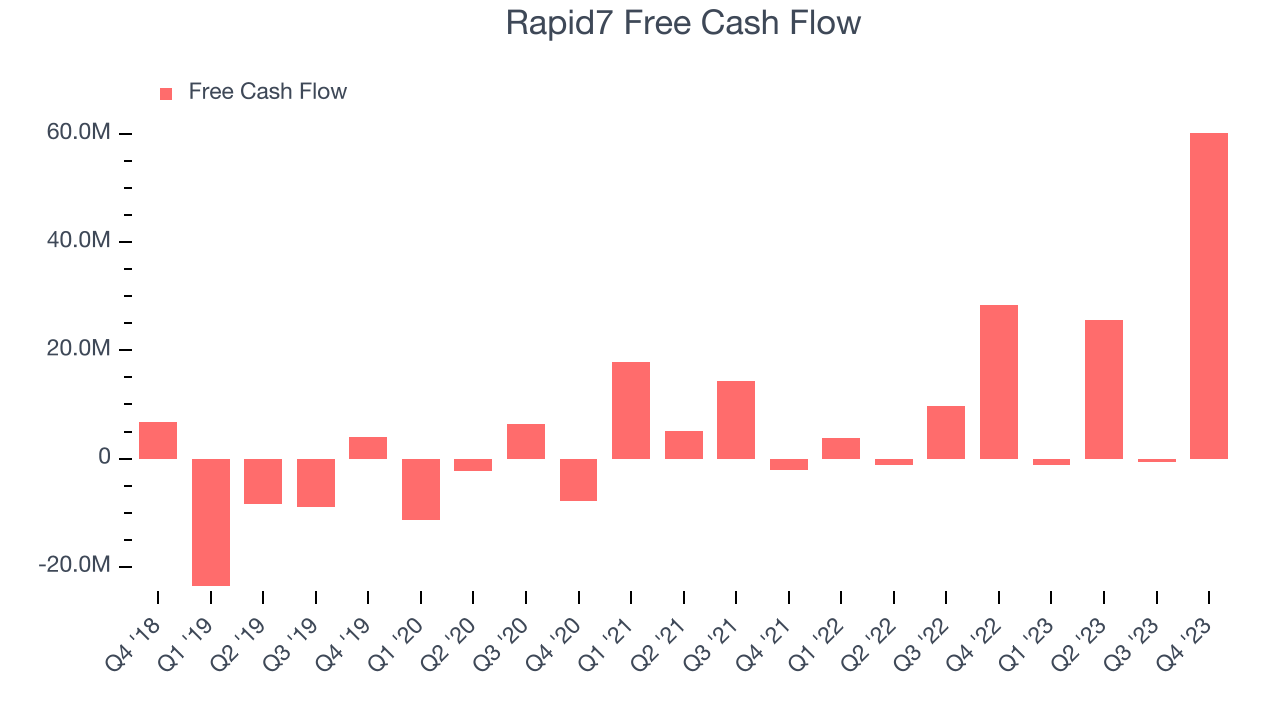

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Rapid7's free cash flow came in at $60.25 million in Q4, up 112% year on year.

Rapid7 has generated $84.03 million in free cash flow over the last 12 months, a solid 10.5% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Rapid7's Q4 Results

It was encouraging to see Rapid7 top analysts' revenue expectations this quarter, even if just narrowly. Strong free cash flow was also a good sign. That stood out as a positive in these results. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand. The company is down 2.6% on the results and currently trades at $55.5 per share.

Is Now The Time?

Rapid7 may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for everyone who's making the lives of others easier through technology, but in case of Rapid7, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last two years, Wall Street expects growth to deteriorate from here. And while its strong free cash flow generation gives it re-investment options, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins aren't as good as other tech businesses we look at.

Rapid7's price-to-sales ratio based on the next 12 months is 4.8x, suggesting that the market does have lower expectations of the business, relative to the high growth tech stocks. While we have no doubt one can find things to like about the company, and the price is not completely unreasonable, we think that at the moment there might be better opportunities in the market.

Wall Street analysts covering the company had a one-year price target of $59.37 per share right before these results (compared to the current share price of $55.50).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.