Over the last six months, Rapid7’s shares have sunk to $40.45, producing a disappointing 6.3% loss - a stark contrast to the S&P 500’s 7.5% gain. This might have investors contemplating their next move.

Is now the time to buy Rapid7, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even with the cheaper entry price, we're cautious about Rapid7. Here are three reasons why you should be careful with RPD and a stock we'd rather own.

Why Is Rapid7 Not Exciting?

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

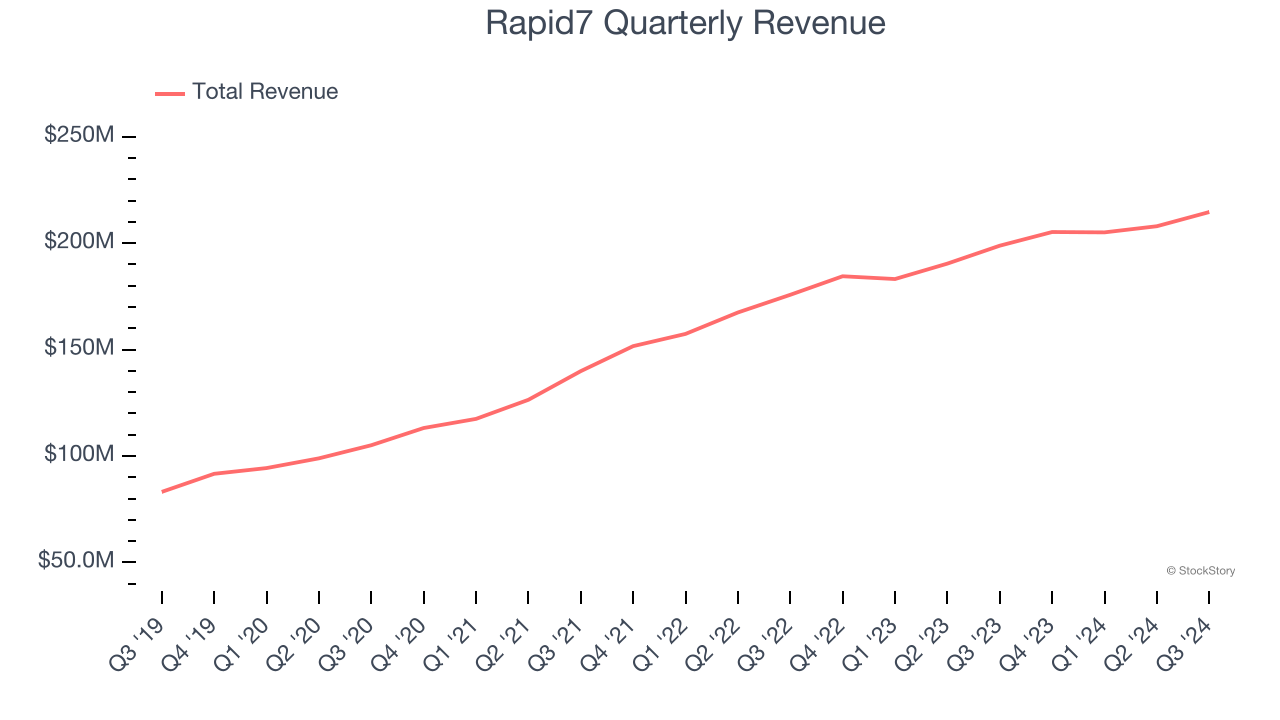

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Rapid7 grew its sales at a 18.8% annual rate. Although this growth is solid on an absolute basis, it fell slightly short of our benchmark for the software sector.

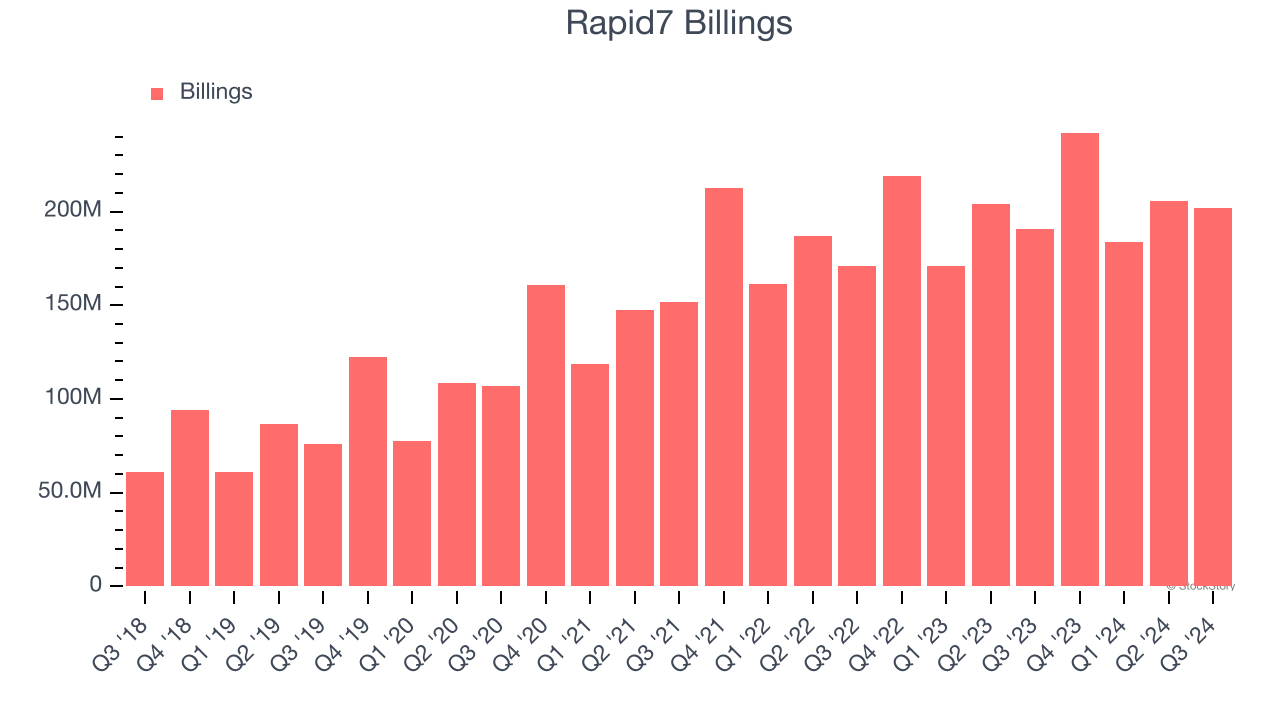

2. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Rapid7’s billings came in at $201.8 million in Q3, and over the last four quarters, its year-on-year growth averaged 6.2%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Rapid7’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Rapid7’s products and its peers.

Final Judgment

Rapid7 isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 3.4× forward price-to-sales (or $40.45 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Rapid7

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.