Travel technology company Sabre (NASDAQ:SABR) missed Wall Street’s revenue expectations in Q3 CY2024 as sales rose 3.3% year on year to $764.7 million. The company expects next quarter’s revenue to be around $715 million, slightly below analysts’ estimates. Its GAAP loss of $0.16 per share was 2% above analysts’ consensus estimates.

Is now the time to buy Sabre? Find out by accessing our full research report, it’s free.

Sabre (SABR) Q3 CY2024 Highlights:

- Revenue: $764.7 million vs analyst estimates of $775.5 million (1.4% miss)

- EPS (GAAP): -$0.16 vs analyst estimates of -$0.16 (beat by $0)

- EBITDA: $130.6 million vs analyst estimates of $133.9 million (2.5% miss)

- Revenue Guidance for Q4 CY2024 is $715 million at the midpoint, below analyst estimates of $721.8 million

- EBITDA guidance for the full year is $515 million at the midpoint, below analyst estimates of $527.8 million

- Gross Margin (GAAP): 57.9%, down from 60.3% in the same quarter last year

- Operating Margin: 9.2%, up from 7% in the same quarter last year

- EBITDA Margin: 17.1%, up from 14.9% in the same quarter last year

- Free Cash Flow Margin: 1%, down from 5.3% in the same quarter last year

- Airline Bookings: 78,648 at quarter end

- Market Capitalization: $1.58 billion

Company Overview

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

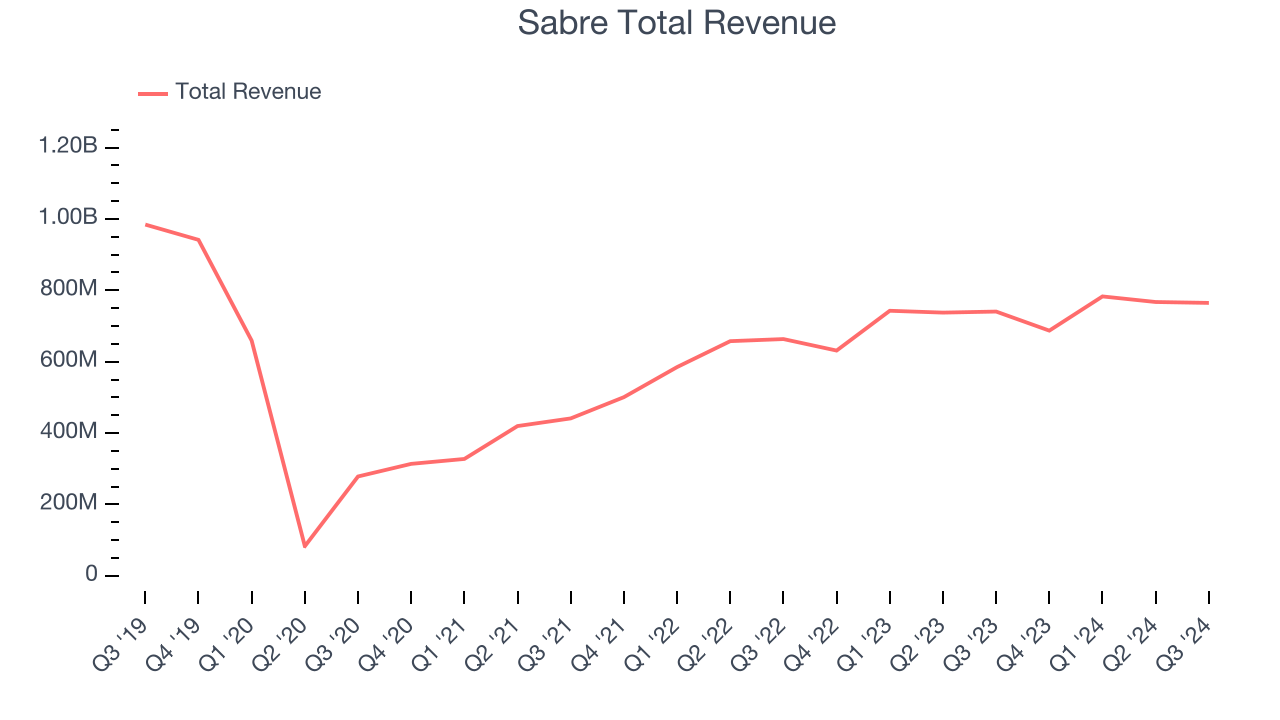

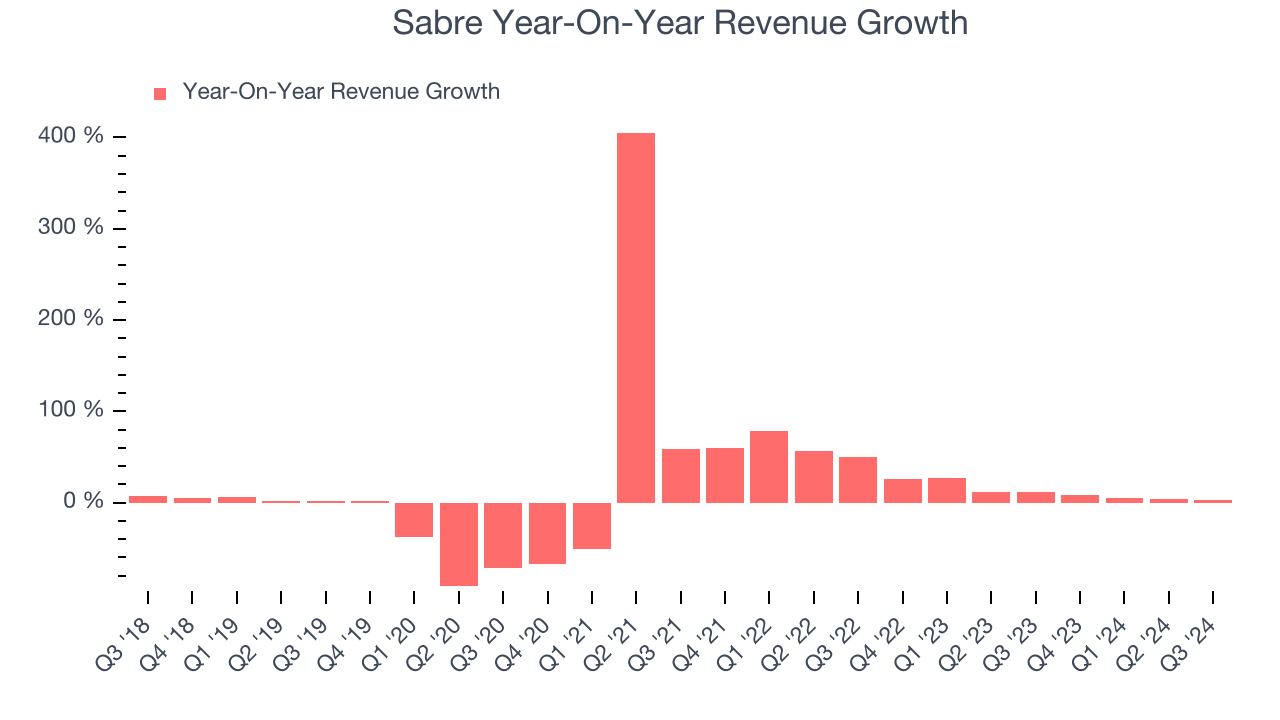

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Sabre’s revenue declined by 5.4% per year. This shows demand was weak, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Sabre’s annualized revenue growth of 11.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Sabre’s revenue grew 3.3% year on year to $764.7 million, falling short of Wall Street’s estimates. Management is currently guiding for a 4.1% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market thinks its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

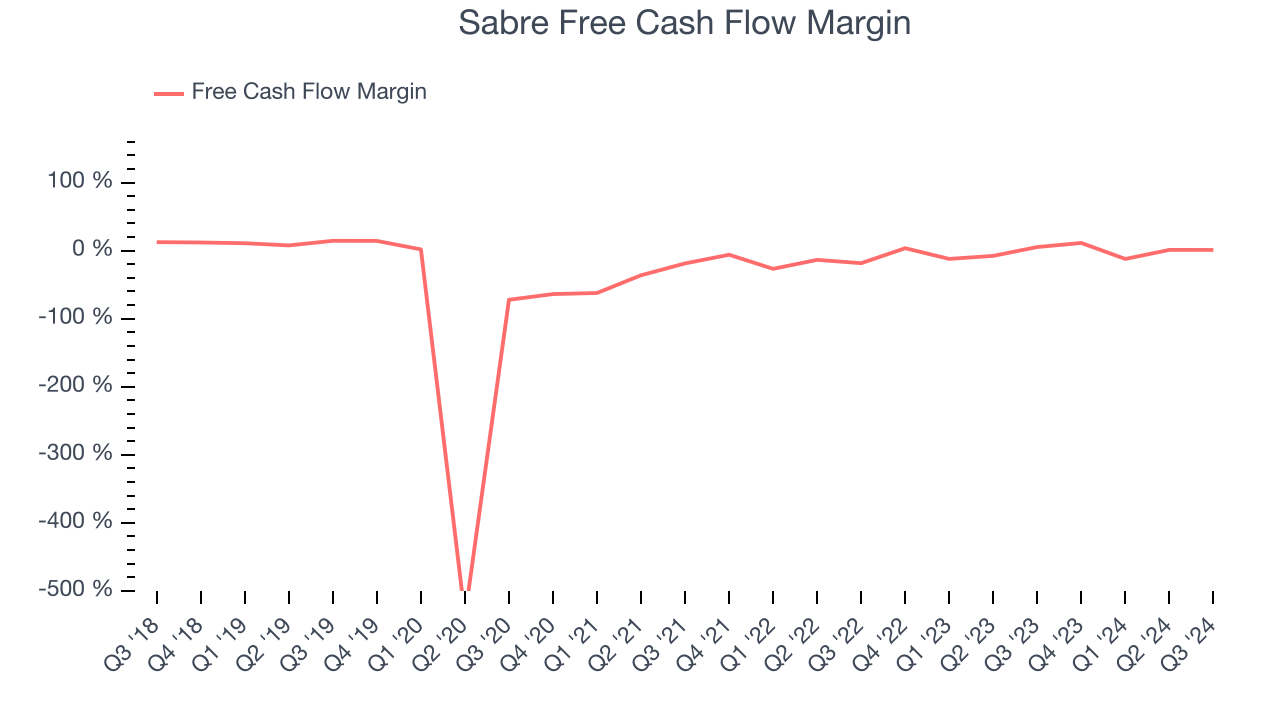

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Sabre’s free cash flow broke even this quarter, the broader story hasn’t been so clean. Over the last two years, Sabre’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 1.5%, meaning it lit $1.52 of cash on fire for every $100 in revenue.

Sabre broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 4.3 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Sabre’s cash conversion will improve. Their consensus estimates imply its breakeven free cash flow margin for the last 12 months will increase to 5.9%, giving it more money to invest.

Key Takeaways from Sabre’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA forecast for next quarter was underwhelming and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 10.2% to $3.70 immediately after reporting.

The latest quarter from Sabre’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.