Travel technology company Sabre (NASDAQ:SABR) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 5.4% year on year to $782.9 million. On the other hand, the company expects next quarter's revenue to be around $750 million, slightly below analysts' estimates. It made a non-GAAP loss of $0.02 per share, improving from its loss of $0.32 per share in the same quarter last year.

Sabre (SABR) Q1 CY2024 Highlights:

- Revenue: $782.9 million vs analyst estimates of $753.6 million (3.9% beat)

- Adjusted EBITDA: $142 million vs analyst estimates of $116 million (big beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.06

- The company lifted its revenue guidance for the full year from $3 billion to $3.04 billion at the midpoint, a 1.3% increase (also lifted adjusted EBITDA guidance for the same period)

- Gross Margin (GAAP): 59%, in line with the same quarter last year

- Free Cash Flow was -$95.77 million, down from $77.21 million in the previous quarter

- Airline Bookings: 85,170

- Market Capitalization: $1.10 billion

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre serves a wide range of customers, including airlines, hotels, travel agencies, and other travel companies. As such, it operates through three main business segments: Travel Network, Airline Solutions, and Hospitality Solutions.

Sabre's largest segment, Travel Network, operates one of the largest electronic travel marketplaces. This marketplace enables travel agents, online travel agencies (OTAs), and corporate travel departments to search, price, book, and manage travel services provided by airlines, hotels, car rental companies, rail providers, cruise lines, and tour operators.

The Airline Solutions segment provides a comprehensive suite of software and services for airlines globally. This includes systems for reservations, inventory, and departure control, as well as data-driven solutions for pricing, revenue management, flight scheduling, and customer experience management.

Sabre's Hospitality Solutions segment offers technology solutions to hoteliers and other accommodation providers. Services provided include central reservation systems, property management systems, and marketing and consulting services. These tools help hoteliers optimize distribution and improve operational efficiency, revenue management, and the overall guest experience.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sabre’s primary competitors include Amadeus IT (AMS:AMS), Expedia (NASDAQ:EXPE), Booking Holdings (NASDAQ:BKNG), Trip.com (NASDAQ:TCOM), and private company Travelport.Sales Growth

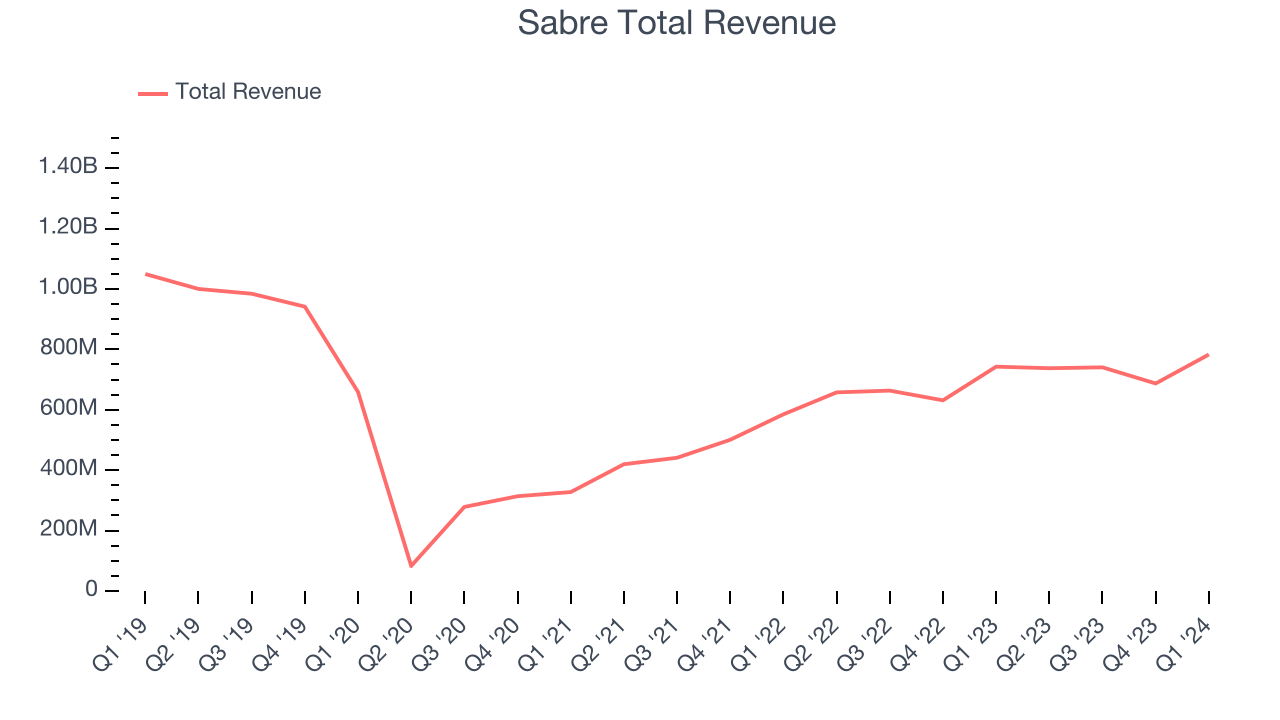

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Sabre's revenue declined over the last five years, dropping 5.6% annually.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Sabre's annualized revenue growth of 23.1% over the last two years is a reversal from its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Sabre's annualized revenue growth of 23.1% over the last two years is a reversal from its five-year trend, suggesting some bright spots.

This quarter, Sabre reported solid year-on-year revenue growth of 5.4%, and its $782.9 million of revenue outperformed Wall Street's estimates by 3.9%. The company is guiding for revenue to rise 1.7% year on year to $750 million next quarter, slowing from the 12.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 4.5% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Sabre was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer discretionary business.This quarter, Sabre generated an operating profit margin of 12.5%, up 12.6 percentage points year on year.

Over the next 12 months, Wall Street expects Sabre to become more profitable. Analysts are expecting the company’s LTM operating margin of 4.9% to rise to 15.6%.EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Sabre's EPS dropped 216%, translating into 25.8% annualized declines. Thankfully, Sabre has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q1, Sabre reported EPS at negative $0.02, up from negative $0.32 in the same quarter last year. This print beat analysts' estimates by 66.5%. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Sabre's LTM EPS of negative $1.28 to reach break even.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Sabre's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 5.6%.

Sabre burned through $95.77 million of cash in Q1, equivalent to a negative 12.2% margin, reducing its cash burn by 5.8% year on year. Over the next year, analysts predict Sabre will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 1.2% will increase to positive 1.8%.

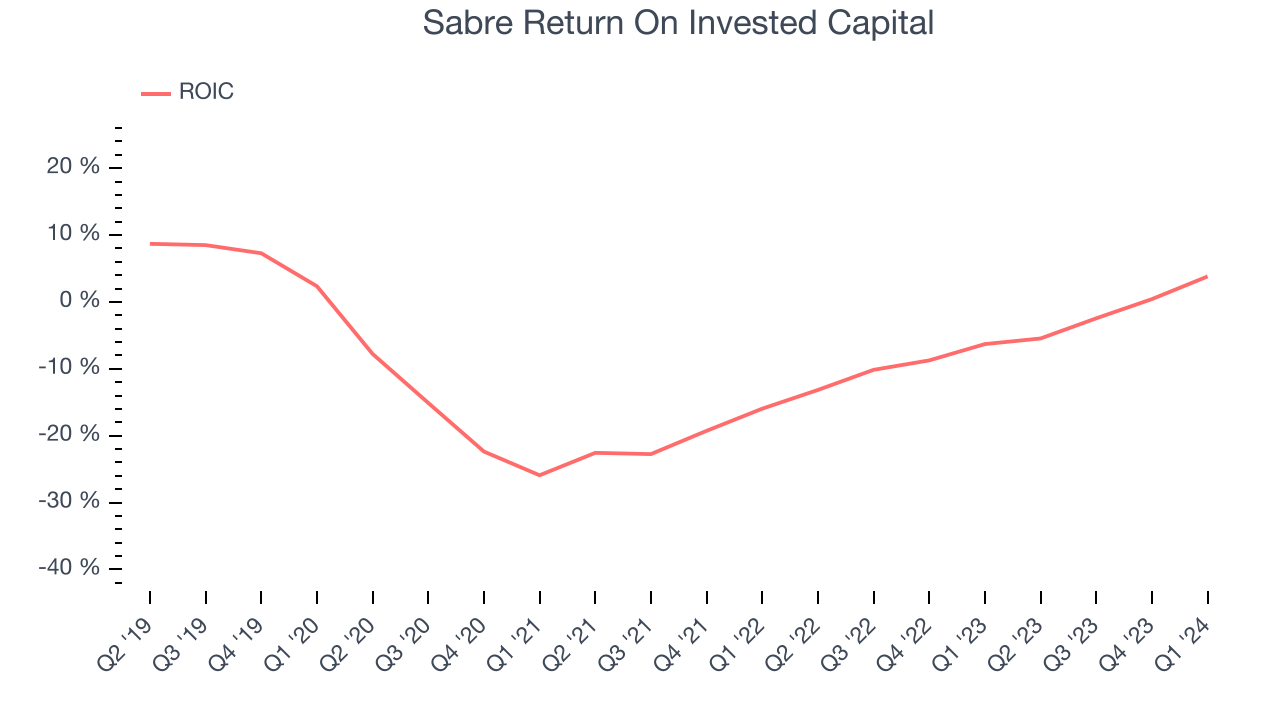

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Sabre's five-year average return on invested capital was negative 8.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Sabre's ROIC averaged 10.5 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Sabre's $4.99 billion of debt exceeds the $629.1 million of cash on its balance sheet. Furthermore, its 10x net-debt-to-EBITDA ratio (based on its EBITDA of $421.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Sabre could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Sabre can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Sabre's Q1 Results

This was a 'beat and raise' quarter that investors cheer. We were impressed by how significantly Sabre blew past analysts' adjusted EBITDA and EPS expectations this quarter. We were also excited that the company raised its full year revenue and adjusted EBITDA guidance. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 7.6% after reporting and currently trades at $3.12 per share.

Is Now The Time?

Sabre may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Sabre, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While we've no doubt one can find things to like about Sabre, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.31 per share right before these results (compared to the current share price of $3.12).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.