Television broadcasting and media company Sinclair (NASDAQ:SBGI) fell short of analysts' expectations in Q2 CY2024, with revenue up 7.9% year on year to $829 million. On the other hand, next quarter's outlook exceeded expectations with revenue guided to $913.5 million at the midpoint, or 2.4% above analysts' estimates. It made a GAAP profit of $0.27 per share, improving from its loss of $1.39 per share in the same quarter last year.

Is now the time to buy Sinclair? Find out by accessing our full research report, it's free.

Sinclair (SBGI) Q2 CY2024 Highlights:

- Revenue: $829 million vs analyst estimates of $838.3 million (1.1% miss)

- EPS: $0.27 vs analyst estimates of -$0.14 ($0.41 beat)

- Revenue Guidance for Q3 CY2024 is $913.5 million at the midpoint, above analyst estimates of $891.8 million

- EBITDA Margin: 19.1%, up from 13.9% in the same quarter last year

- Market Capitalization: $864.3 million

"Sinclair delivered solid second-quarter results, meeting our guidance expectations across major financial metrics, including a $105 million monetization of an investment in our Ventures portfolio," commented Chris Ripley, Sinclair's President and Chief Executive Officer.

Founded in 1971, Sinclair (NASDAQ:SBGI) is an American media company operating numerous television stations and providing multi-platform broadcasting services.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

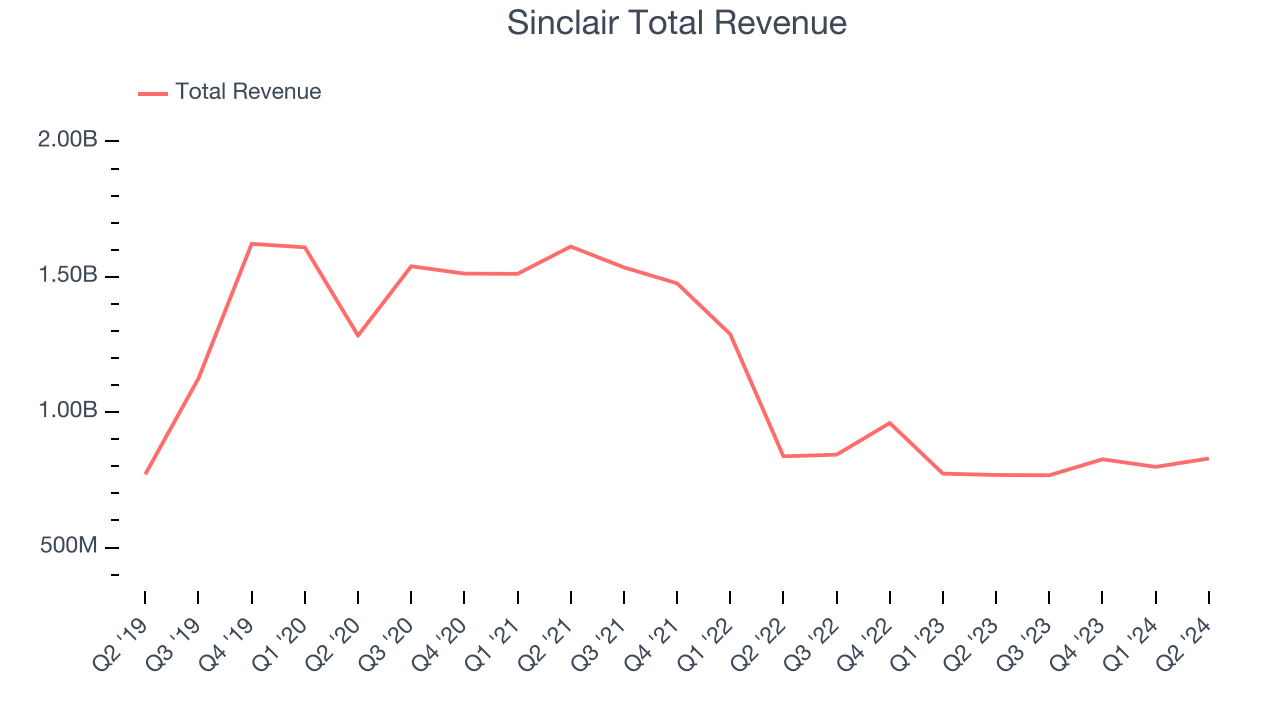

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Sinclair struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Sinclair's recent history shows its demand has stayed suppressed as its revenue has declined by 20.8% annually over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Distribution and Advertising, which are 52.5% and 36.6% of revenue. Over the last two years, Sinclair's Distribution revenue (content distribution) averaged 21.1% year-on-year declines while its Advertising revenue (advertising sales) averaged 7.7% declines.

This quarter, Sinclair's revenue grew 7.9% year on year to $829 million, missing Wall Street's estimates. The company is guiding for revenue to rise 19.1% year on year to $913.5 million next quarter, improving from the 9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 11.1% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

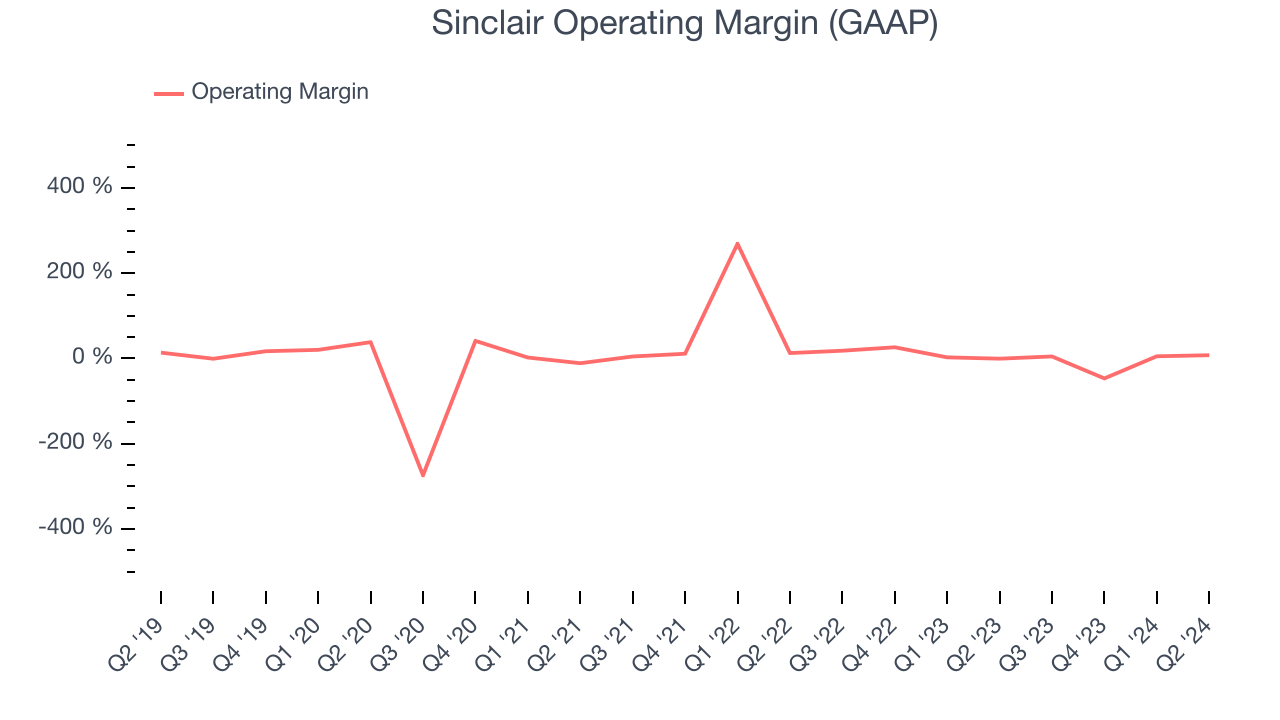

Operating Margin

Sinclair's operating margin has been trending down over the last year and averaged 2.8%. The company's profitability was mediocre for a consumer discretionary business and shows it couldn't pass its higher operating expenses onto its customers.

In Q2, Sinclair generated an operating profit margin of 7.7%, up 8.1 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Key Takeaways from Sinclair's Q2 Results

We were impressed by how significantly Sinclair blew past analysts' EPS expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. On the other hand, its Distribution revenue unfortunately missed and its revenue fell short of Wall Street's estimates. Overall, this quarter still was mixed but with some key positives. The stock traded up 3.5% to $13.50 immediately following the results.

Sinclair may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.