Educational publishing and media company Scholastic (NASDAQ:SCHL) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 3.8% year on year to $237.2 million. Its GAAP loss of $2.21 per share was also 10.9% above analysts’ consensus estimates.

Is now the time to buy Scholastic? Find out by accessing our full research report, it’s free.

Scholastic (SCHL) Q3 CY2024 Highlights:

- Revenue: $237.2 million vs analyst estimates of $233.5 million (1.6% beat)

- EPS: -$2.21 vs analyst estimates of -$2.48 (10.9% beat)

- EBITDA guidance for the full year is $145 million at the midpoint, above analyst estimates of $140.6 million

- Gross Margin (GAAP): 45.9%, up from 43.1% in the same quarter last year

- EBITDA Margin: -25.5%, up from -33% in the same quarter last year

- Free Cash Flow was -$68.7 million compared to -$52.4 million in the same quarter last year

- Market Capitalization: $838.6 million

Peter Warwick, President and Chief Executive Officer, said, "During our first quarter, Scholastic prepared for another important back-to-school season, as we executed on our long-term growth initiatives. In the seasonally quiet quarter for our school-based channels, first quarter's operating loss improved modestly versus the prior year."

Company Overview

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

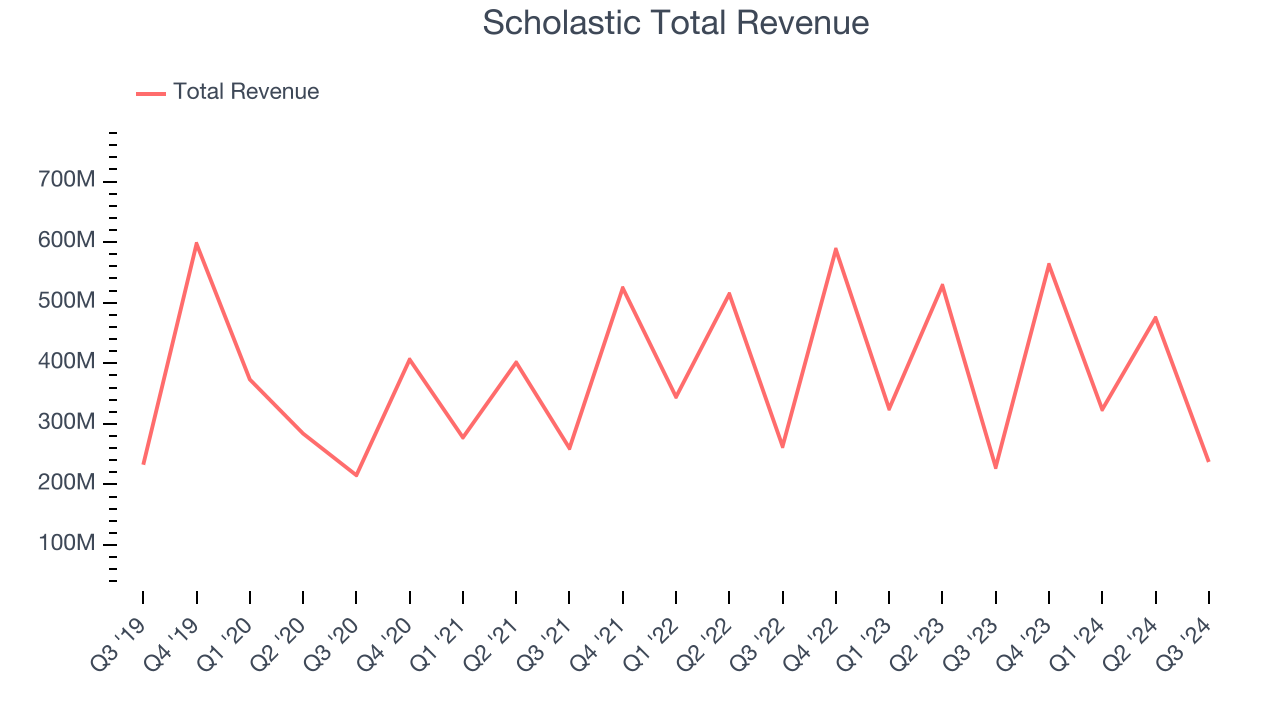

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Scholastic’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Scholastic’s annualized revenue declines of 1.5% over the last two years align with its five-year trend, suggesting its demand consistently shrunk.

This quarter, Scholastic reported reasonable year-on-year revenue growth of 3.8%, and its $237.2 million of revenue topped Wall Street’s estimates by 1.6%. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

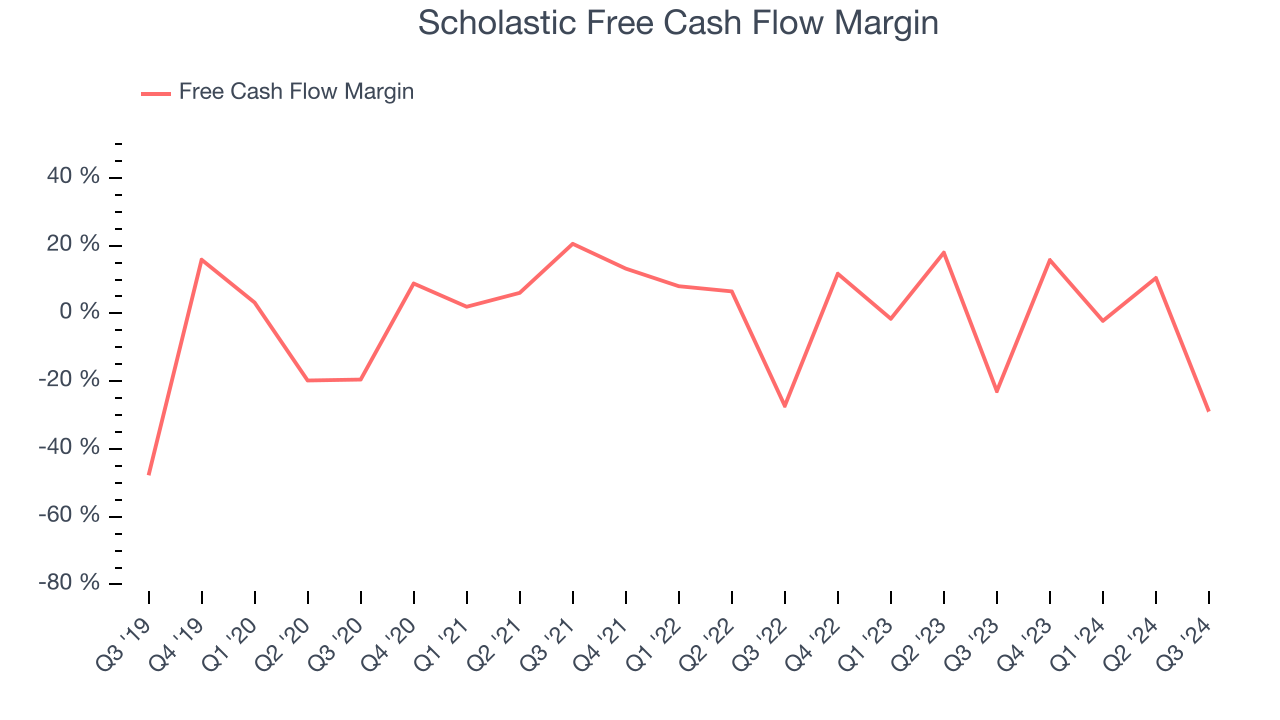

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling. Free cash flow accounts for operating and capital expenses, making it tough to manipulate. Cash is king.

Scholastic has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.2%, subpar for a consumer discretionary business.

Scholastic burned through $68.7 million of cash in Q3, equivalent to a negative 29% margin. The company’s cash burn increased by 31.1% year on year and is a deviation from its longer-term margin, raising some eyebrows.

Key Takeaways from Scholastic’s Q3 Results

It was good to see Scholastic beat analysts’ revenue and EPS expectations this quarter. We were also happy its full-year EBITDA guidance topped Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 9.2% to $32.97 immediately after reporting.

Scholastic may have had a good quarter, but does that mean you should invest right now?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.