Educational publishing and media company Scholastic (NASDAQ:SCHL) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 3.2% year on year to $544.6 million. Its GAAP profit of $1.71 per share was 25.7% below analysts’ consensus estimates.

Is now the time to buy Scholastic? Find out by accessing our full research report, it’s free.

Scholastic (SCHL) Q4 CY2024 Highlights:

- Revenue: $544.6 million vs analyst estimates of $554 million (3.2% year-on-year decline, 1.7% miss)

- Adjusted EPS: $1.71 vs analyst expectations of $2.30 (25.7% miss)

- Adjusted EBITDA: $108.7 million vs analyst estimates of $109.9 million (20% margin, 1.1% miss)

- Operating Margin: 13.7%, down from 18% in the same quarter last year

- Free Cash Flow Margin: 7.8%, down from 15.7% in the same quarter last year

- Market Capitalization: $693.6 million

Company Overview

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

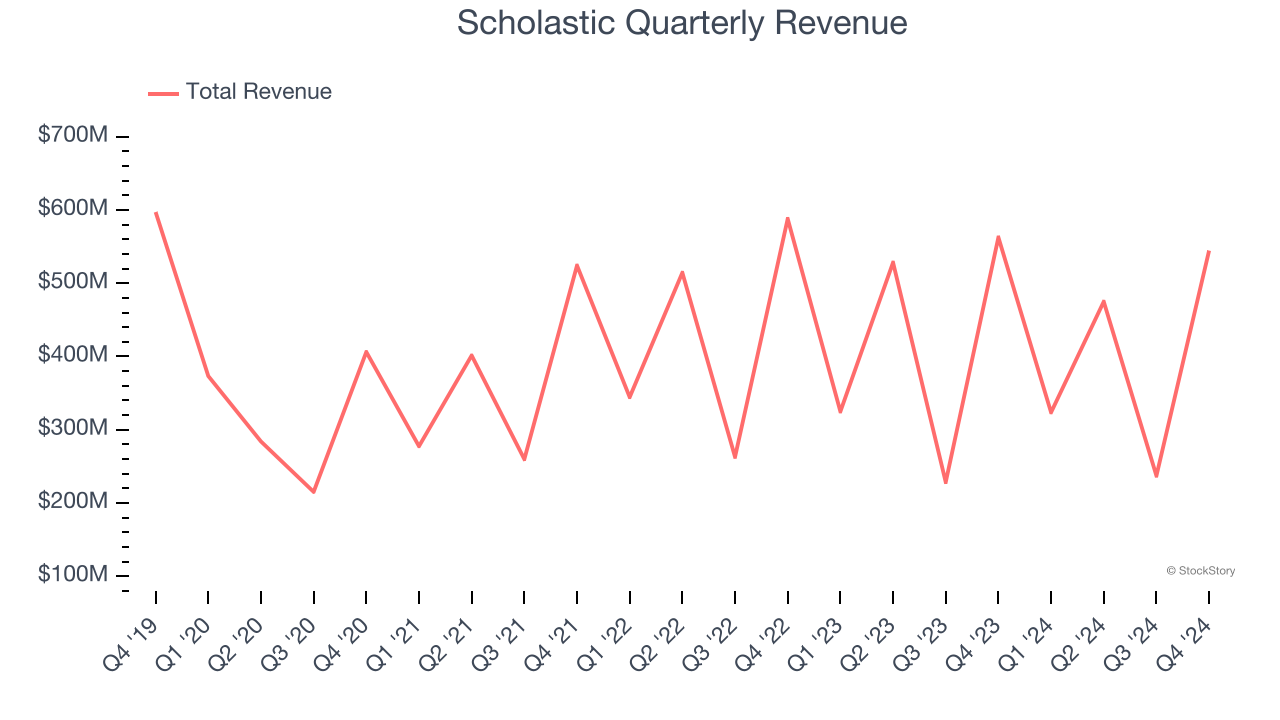

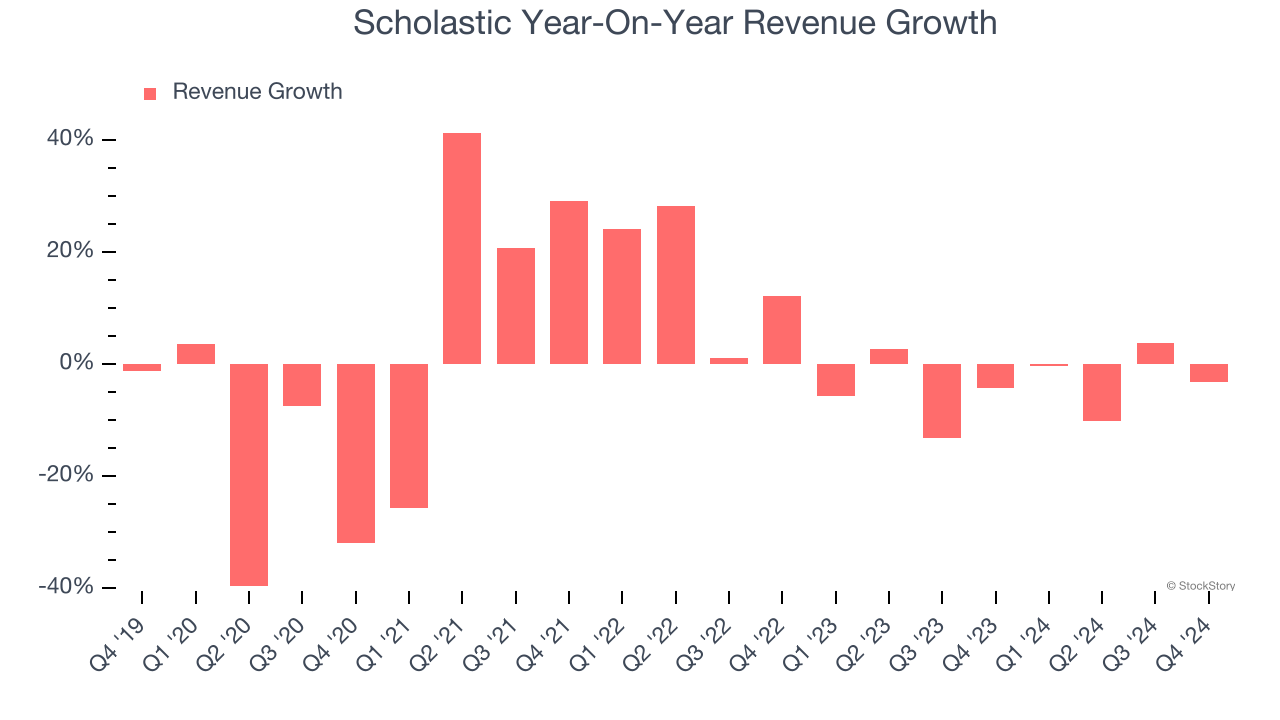

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Scholastic struggled to consistently increase demand as its $1.58 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Scholastic’s recent history shows its demand has stayed suppressed as its revenue has declined by 3.9% annually over the last two years.

This quarter, Scholastic missed Wall Street’s estimates and reported a rather uninspiring 3.2% year-on-year revenue decline, generating $544.6 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

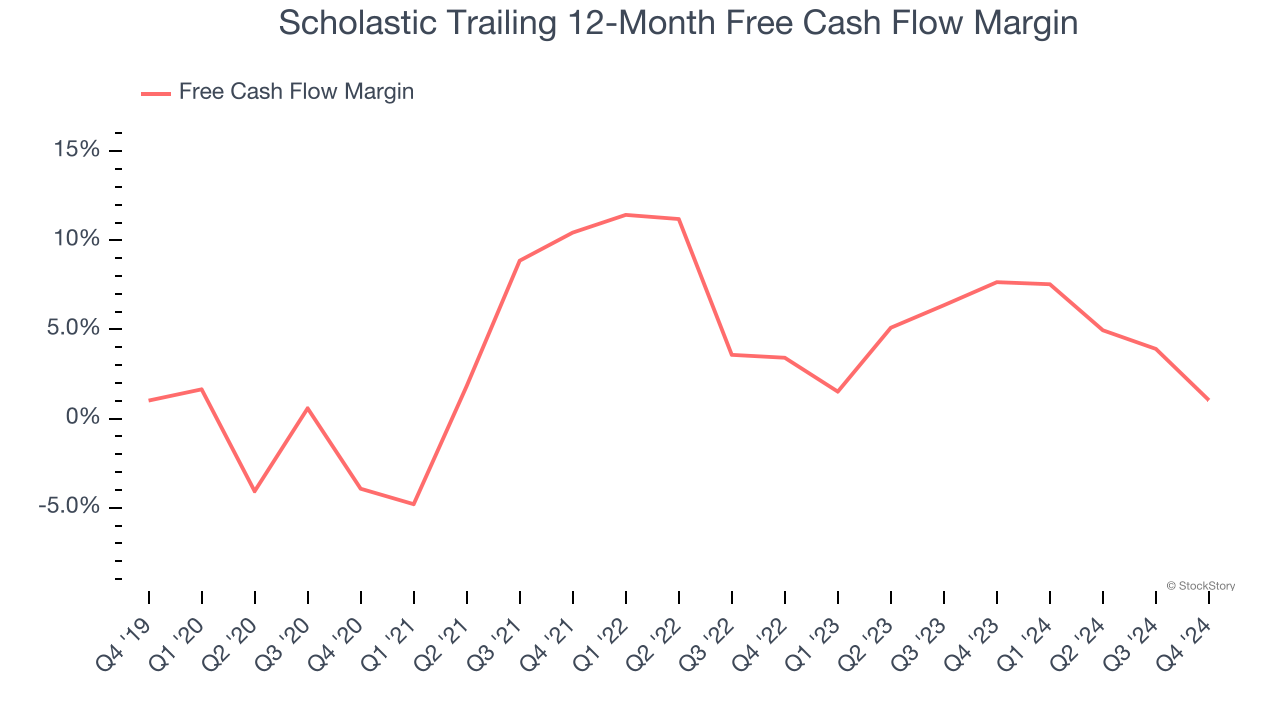

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Scholastic has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, lousy for a consumer discretionary business.

Scholastic’s free cash flow clocked in at $42.4 million in Q4, equivalent to a 7.8% margin. The company’s cash profitability regressed as it was 8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

Key Takeaways from Scholastic’s Q4 Results

We struggled to find many resounding positives in these results as its revenue, EBITDA, and EPS missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.4% to $23.26 immediately after reporting.

Scholastic’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.