Educational publishing and media company Scholastic (NASDAQ:SCHL) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $323.7 million. It made a GAAP loss of $0.91 per share, down from its loss of $0.57 per share in the same quarter last year.

Scholastic (SCHL) Q1 CY2024 Highlights:

- Revenue: $323.7 million vs analyst estimates of $329.2 million (1.7% miss)

- EPS: -$0.91 vs analyst expectations of -$0.80 (13.7% miss)

- Gross Margin (GAAP): 54.1%, up from 50.4% in the same quarter last year

- Free Cash Flow was -$7.1 million, down from $88.6 million in the previous quarter

- Market Capitalization: $1.12 billion

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

Scholastic was founded in 1920 with the launch of "The Western Pennsylvania Scholastic" magazine, aimed at enriching the educational experience of students and teachers. This initial step marked the beginning of Scholastic's journey toward becoming a key player in children's education through the production of materials and content for young readers.

Today, Scholastic's offerings encompass books, magazines, educational software, and digital resources, addressing the challenge of keeping children engaged and informed. These products and services cater to both classroom and home education environments, promoting literacy and creativity.

Scholastic's revenue is derived from book sales, subscriptions to educational programs, and content distribution and licensing. Its business model combines educational value with entertainment, making Scholastic a preferred choice among educators, parents, and children.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Competitors in the publishing industry include John Wiley & Sons (NYSE:JW.A), Disney (NYSE:DIS), and The New York Times (NYSE:NYT).Sales Growth

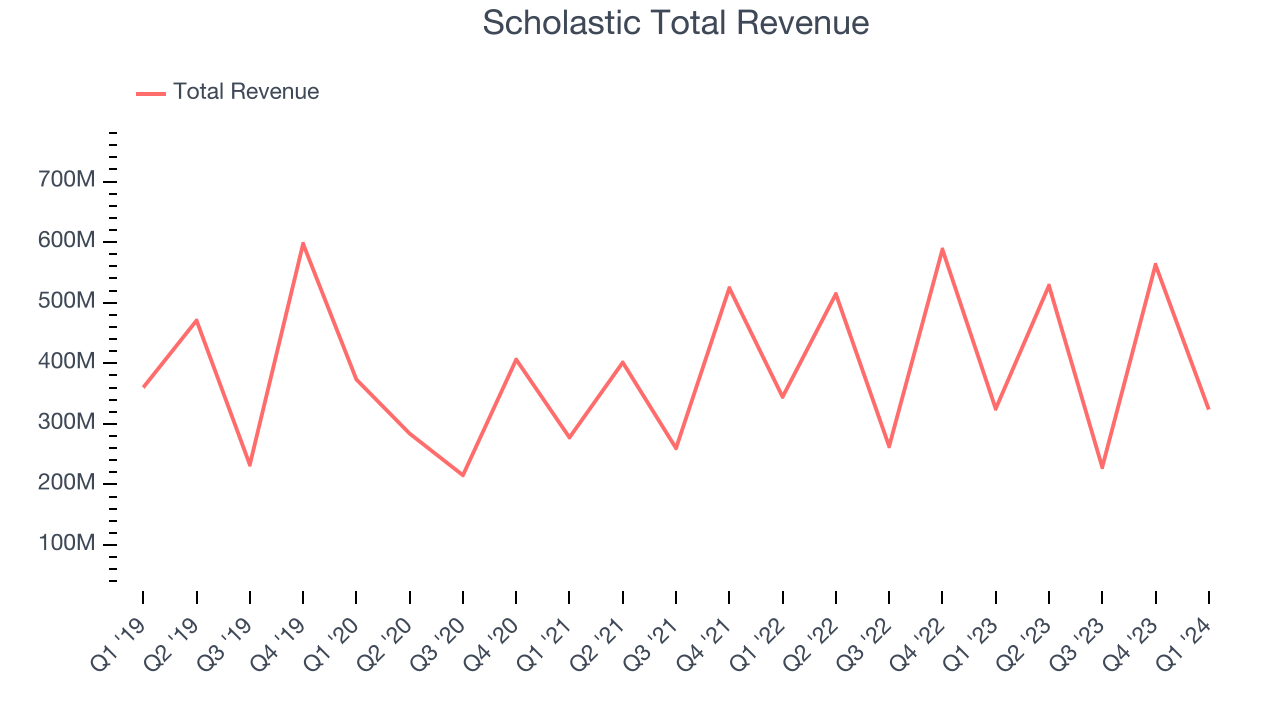

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Scholastic's revenue declined over the last five years, dropping 1.7% annually.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Scholastic's annualized revenue growth of 3.6% over the last two years is a reversal from its five-year trend, suggesting some bright spots.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Scholastic's annualized revenue growth of 3.6% over the last two years is a reversal from its five-year trend, suggesting some bright spots.

This quarter, Scholastic missed Wall Street's estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $323.7 million of revenue. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

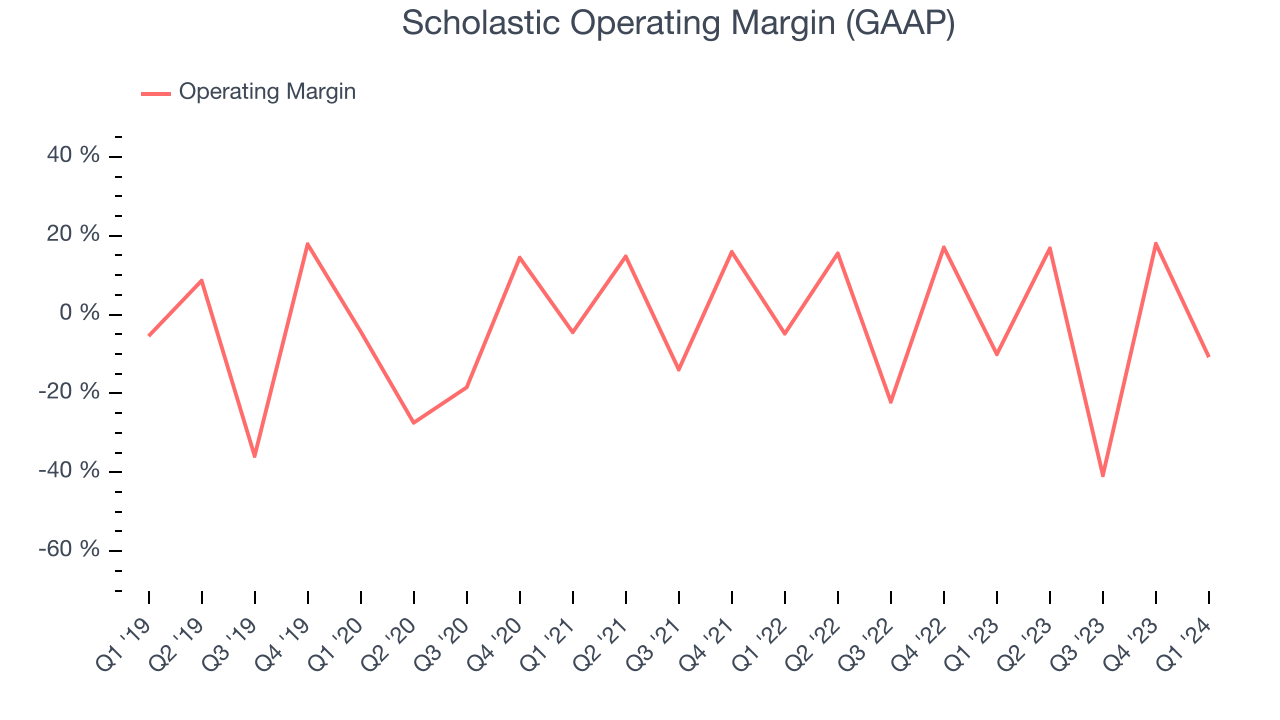

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Scholastic was profitable over the last two years but held back by its large expense base. Its average operating margin of 4.5% has been paltry for a consumer discretionary business.

In Q1, Scholastic generated an operating profit margin of negative 10.8%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Scholastic to become more profitable. Analysts are expecting the company’s LTM operating margin of 3.8% to rise to 6.6%.EPS

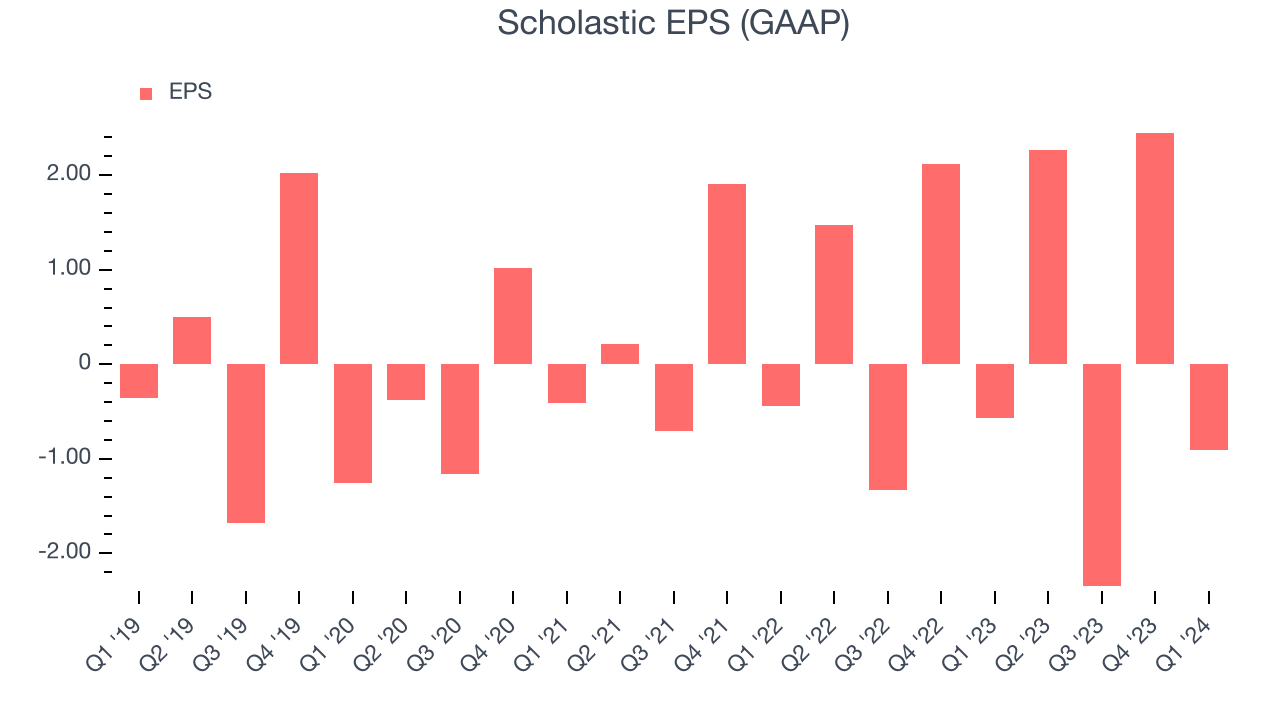

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Scholastic's EPS dropped 5.8%, translating into 1.1% annualized declines. Thankfully, Scholastic has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q1, Scholastic reported EPS at negative $0.91, down from negative $0.57 in the same quarter a year ago. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects Scholastic to grow its earnings. Analysts are projecting its LTM EPS of $1.46 to climb by 100% to $2.91.

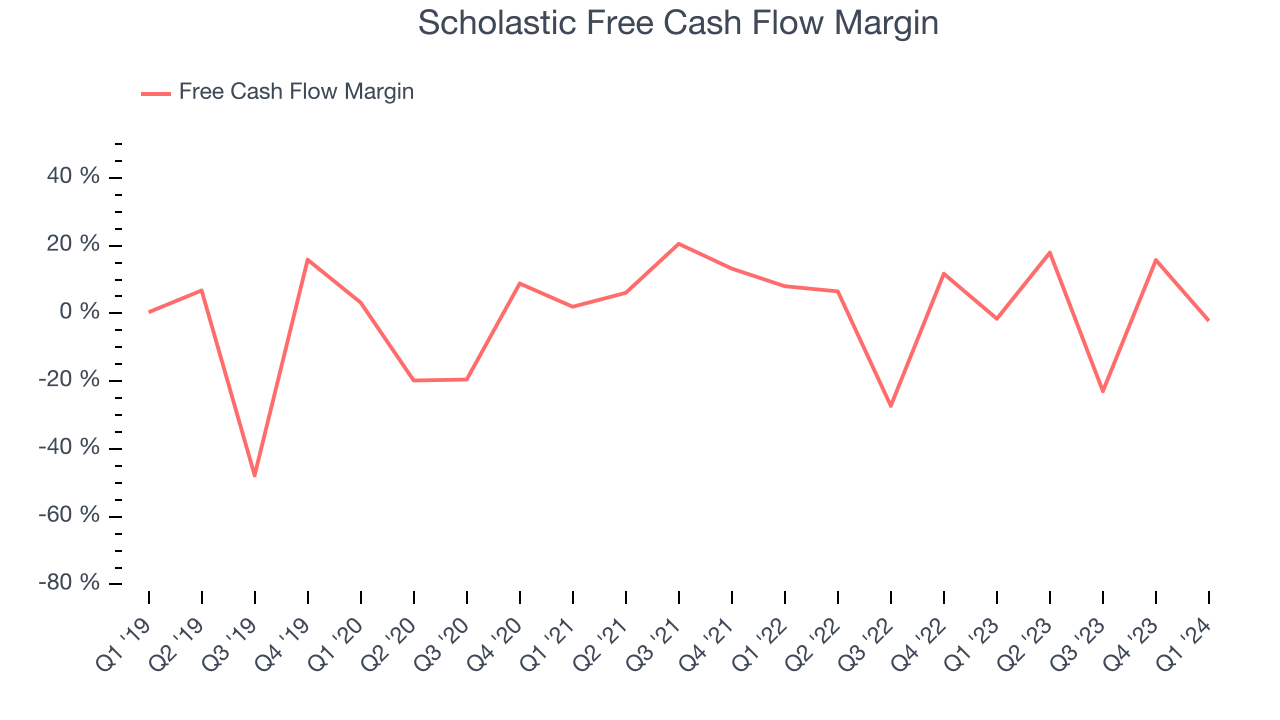

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Scholastic has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.5%, subpar for a consumer discretionary business.

Scholastic burned through $7.1 million of cash in Q1, equivalent to a negative 2.2% margin, reducing its cash burn by 39.2% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Scholastic's five-year average return on invested capital was 4.8%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Scholastic's ROIC averaged 6 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

Key Takeaways from Scholastic's Q1 Results

We struggled to find many strong positives in these results. Its EPS missed and its revenue fell short of Wall Street's estimates, driven by weakness in its Book Clubs segment - revenue was down 52% year on year as the company ran fewer promotional offers.

During the quarter, Scholastic acquired 9 Story Media Group to expand into animated and live-action children's content. The deal was priced at $186 million, or just over 15% of Scholastic's current market capitalization. Only time will tell if this was a good strategic decision.

Overall, this was a mixed quarter for Scholastic. The company is down 7.6% on the results and trades at $35 per share.

Is Now The Time?

Scholastic may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Scholastic, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. On top of that, its declining EPS over the last five years makes it hard to trust.

Scholastic's price-to-earnings ratio based on the next 12 months is 13.0x. While the price is reasonable and there are some things to like about Scholastic, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $54 per share right before these results (compared to the current share price of $35).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.