Personalized clothing company Stitch Fix (NASDAQ:SFIX) met Wall Street’s revenue expectations in Q2 CY2024, but sales fell 12.4% year on year to $319.6 million. On the other hand, next quarter’s revenue guidance of $306.5 million was less impressive, coming in 7.5% below analysts’ estimates. Its GAAP loss of $0.29 per share was 49.7% below analysts’ consensus estimates.

Is now the time to buy Stitch Fix? Find out by accessing our full research report, it’s free.

Stitch Fix (SFIX) Q2 CY2024 Highlights:

- Revenue: $319.6 million vs analyst estimates of $317.3 million (in line)

- EPS: -$0.29 vs analyst expectations of -$0.19 (49.7% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.14 billion at the midpoint, missing analyst estimates by 13.1% and implying -15.1% growth (vs -15.9% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $21 million at the midpoint, below analyst estimates of $30.66 million

- Gross Margin (GAAP): 44.6%, up from 41.7% in the same quarter last year

- EBITDA Margin: 3%, up from -2.9% in the same quarter last year

- Free Cash Flow Margin: 1.4%, similar to the same quarter last year

- Active Clients: 2.51 million, down 613,000 year on year

- Market Capitalization: $463.7 million

“We are executing our transformation strategy with discipline and, during the fourth quarter, we delivered results at the high end of our guidance on both the top and bottom line,” said Matt Baer, Chief Executive Officer, Stitch Fix.

Company Overview

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

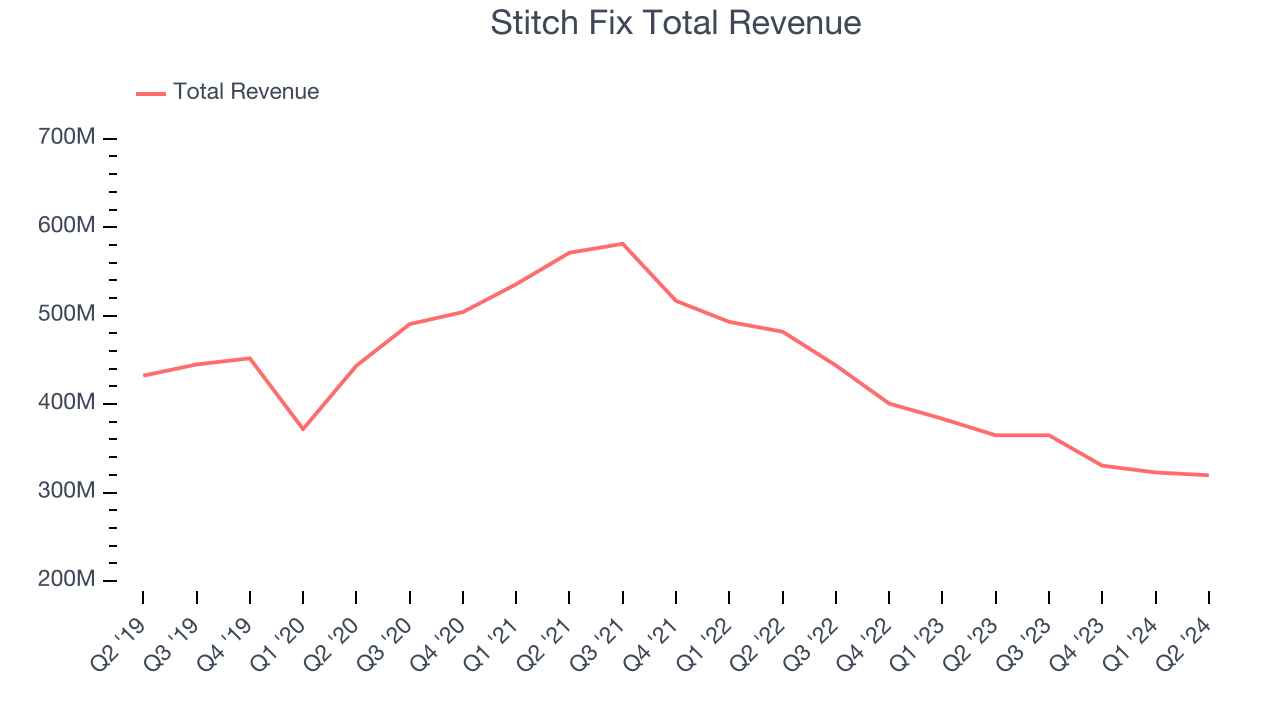

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Stitch Fix’s demand was weak over the last five years as its sales fell by 3.2% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Stitch Fix’s recent history shows its demand has stayed suppressed as its revenue has declined by 19.7% annually over the last two years.

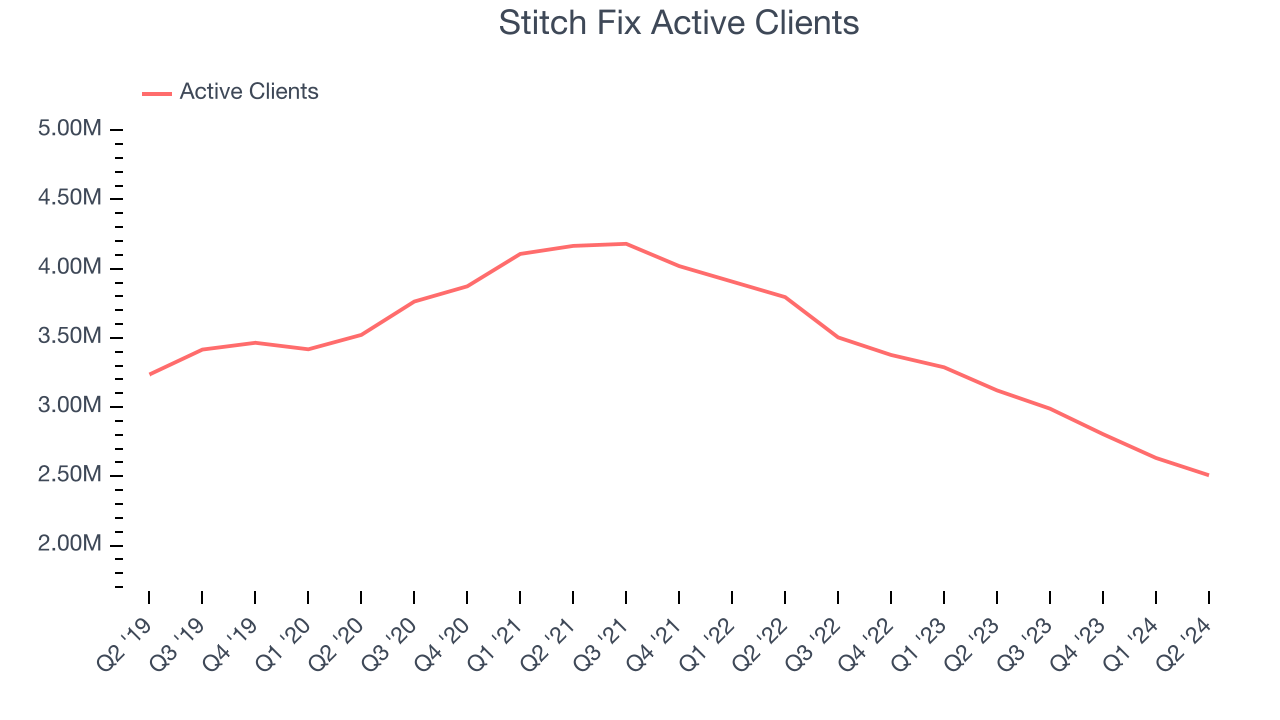

We can dig further into the company’s revenue dynamics by analyzing its number of active clients, which reached 2.51 million in the latest quarter. Over the last two years, Stitch Fix’s active clients averaged 17.1% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Stitch Fix reported a rather uninspiring 12.4% year-on-year revenue decline to $319.6 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 16% year-on-year decline next quarter. Looking even further ahead, Wall Street expects revenue to decline 2.4% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

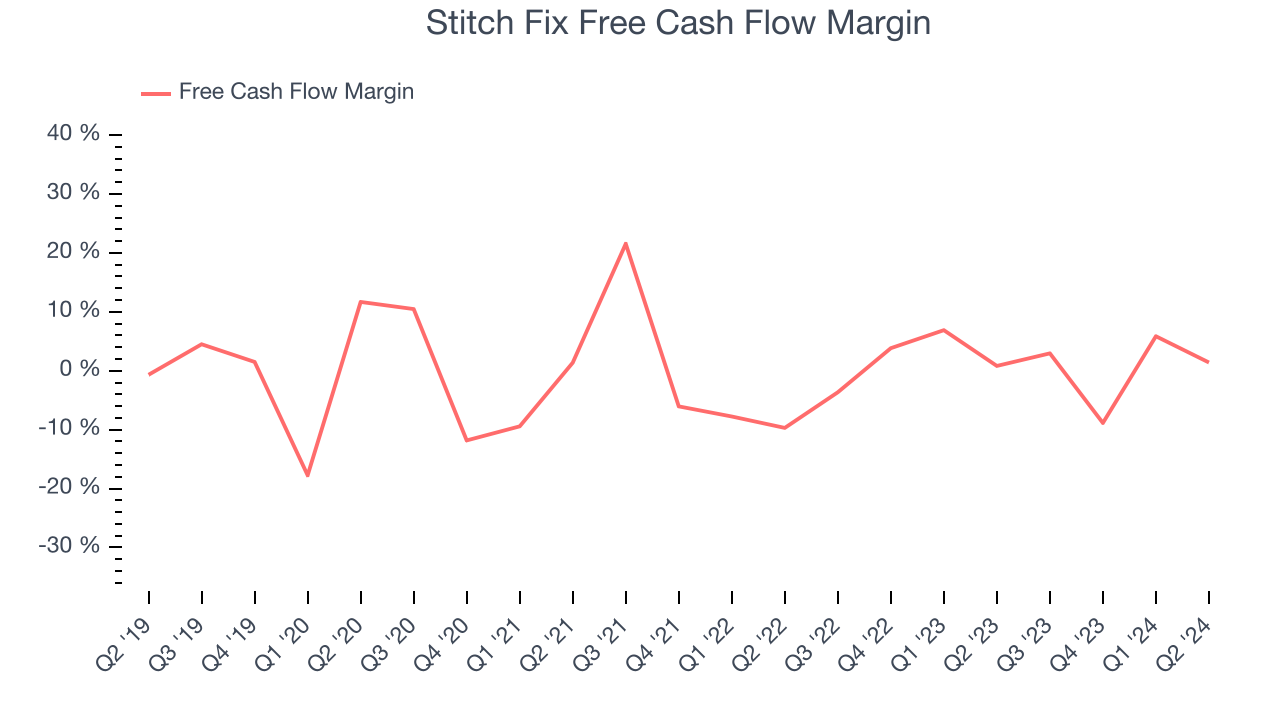

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling. Free cash flow accounts for operating and capital expenses, making it tough to manipulate. Cash is king.

Stitch Fix has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, lousy for a consumer discretionary business.

Stitch Fix’s free cash flow clocked in at $4.49 million in Q2, equivalent to a 1.4% margin. This cash profitability was in line with the comparable period last year and its two-year average.

Key Takeaways from Stitch Fix’s Q2 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance and EPS fell short of Wall Street’s estimates. Additionally, its active clients were down 613,000 year on year. Overall, this was a weaker quarter. The stock traded down 19.5% to $3.01 immediately following the results.

Stitch Fix underperformed this quarter, but does that create an opportunity to invest right now?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock.We cover that in our actionable full research report which you can read here, it’s free.