Personalized clothing company Stitch Fix (NASDAQ:SFIX) missed analysts' expectations in Q2 FY2024, with revenue down 19.8% year on year to $330.4 million. Next quarter's revenue guidance of $305 million also underwhelmed, coming in 5.7% below analysts' estimates. It made a GAAP loss of $0.29 per share, improving from its loss of $0.58 per share in the same quarter last year.

Stitch Fix (SFIX) Q2 FY2024 Highlights:

- Revenue: $330.4 million vs analyst estimates of $332.3 million (0.6% miss)

- EPS: -$0.29 vs analyst expectations of -$0.22 (32.6% miss)

- Revenue Guidance for Q3 2024 is $305 million at the midpoint, below analyst estimates of $323.3 million

- The company dropped its revenue guidance for the full year from $1.34 billion to $1.31 billion at the midpoint, a 2.2% decrease

- Free Cash Flow was -$26.07 million, down from $16.91 million in the previous quarter

- Gross Margin (GAAP): 43.4%, up from 41% in the same quarter last year

- Active Clients: 2.81 million

- Market Capitalization: $378.4 million

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

The company’s vision is to create a convenient shopping experience that uses data to help people discover and buy clothing that truly suits their style.

Stitch Fix’s unique selling point is its combination of technology and human stylists. Customers fill out detailed online style surveys, and the company’s algorithms and human stylists select clothing items that are a potential match. This apparel, which includes everything from t-shirts to socks, is then shipped to the customer, who can select which items they'd like to purchase and send the rest back.

Stitch Fix operates as a subscription-based personal styling service, generating revenue from subscription fees and the clothing its customers purchase. Consumers who are not subscribed to Stitch Fix can also receive boxes by paying a styling fee to the company.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Stitch Fix’s competitors are Trunk Club (owned by Nordstrom, NYSE:JWN), Amazon Prime Wardrobe (NASDAQ:AMZN), and private companies Wantable and Le Tote.Sales Growth

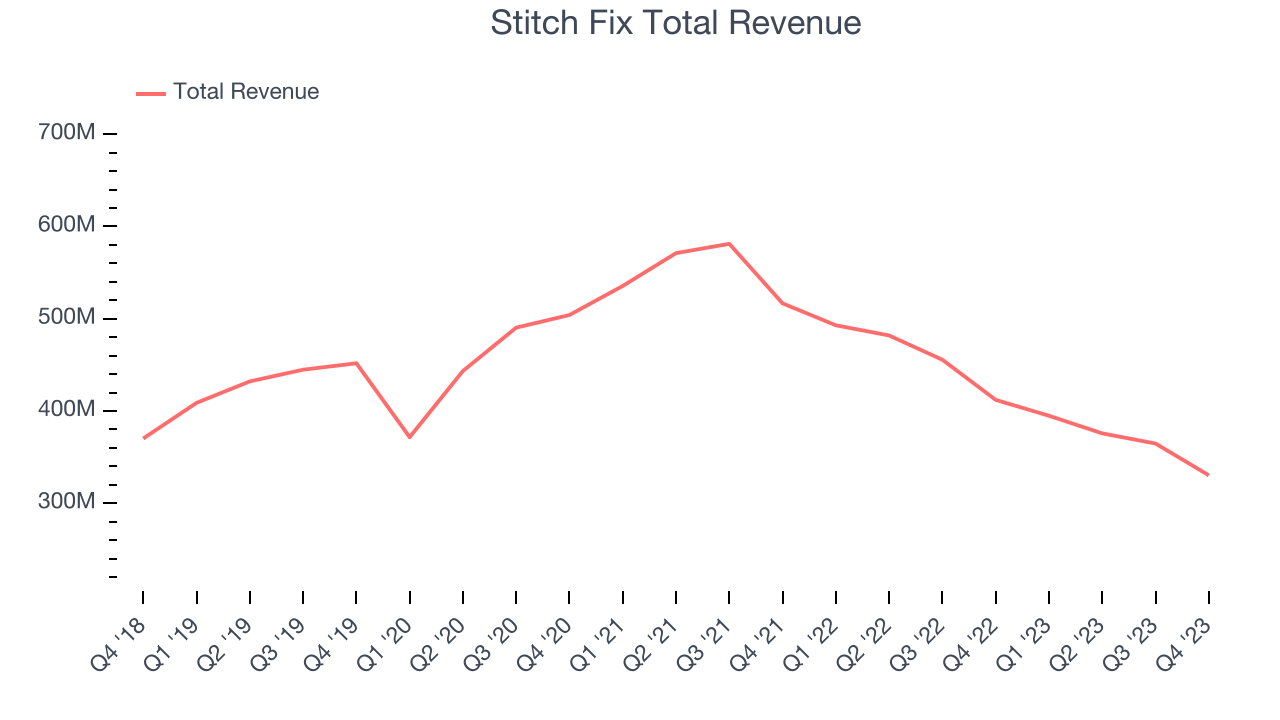

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Stitch Fix's annualized revenue growth rate of 1.3% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Stitch Fix's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 18.5% over the last two years.

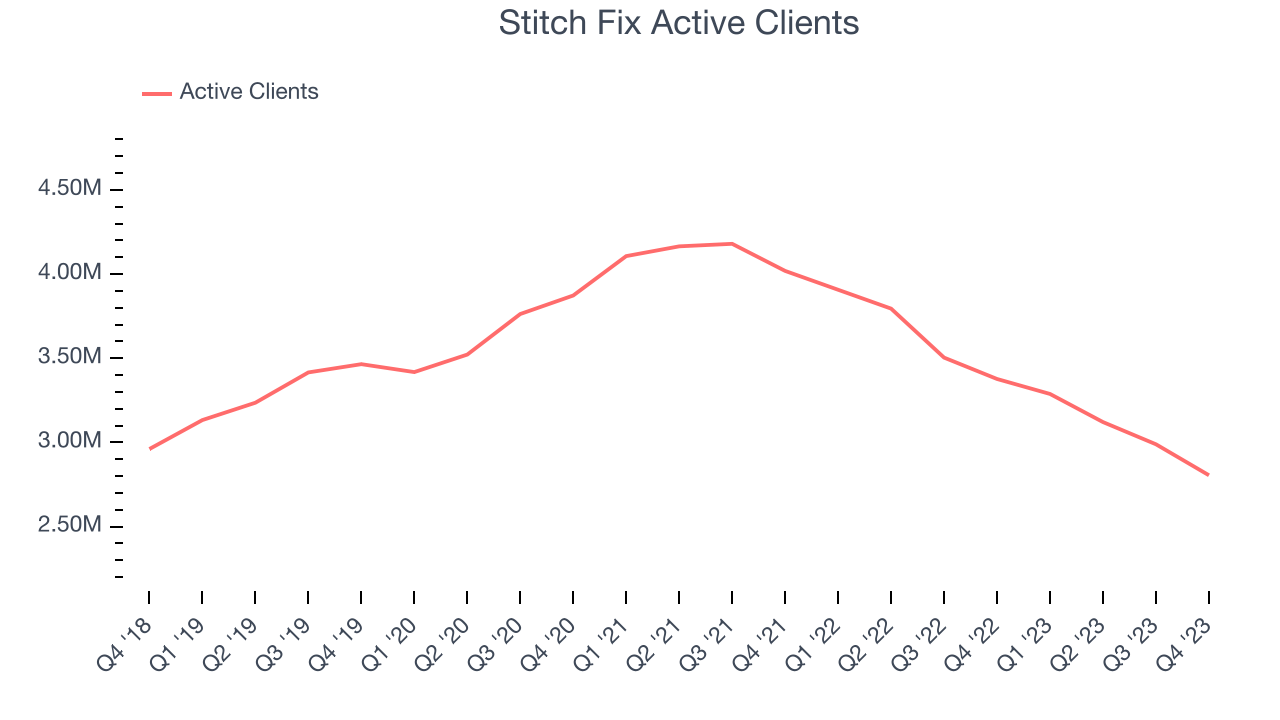

We can better understand the company's revenue dynamics by analyzing its number of active clients, which reached 2.81 million in the latest quarter. Over the last two years, Stitch Fix's active clients averaged 13.9% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, Stitch Fix missed Wall Street's estimates and reported a rather uninspiring 19.8% year-on-year revenue decline, generating $330.4 million of revenue. The company is guiding for a 22.8% year-on-year revenue decline next quarter to $305 million, a deceleration from the 19.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 5.9% over the next 12 months.

Operating Margin

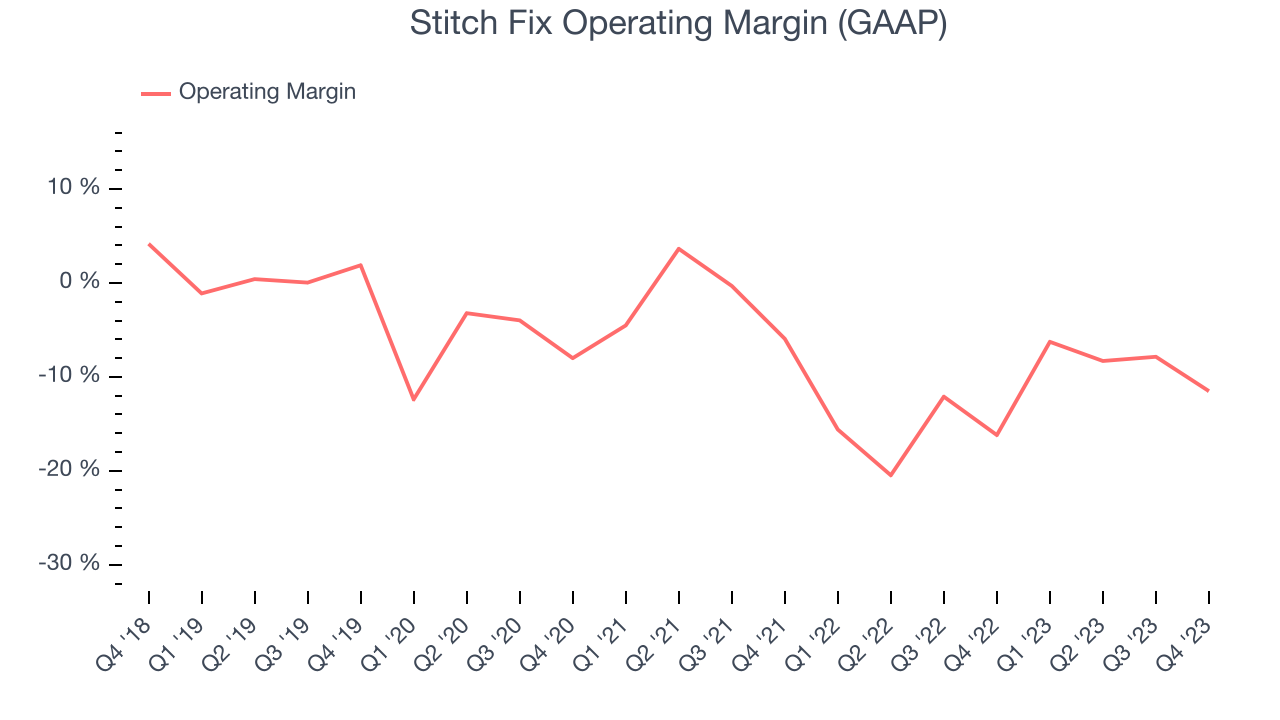

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Stitch Fix's high expenses have contributed to an average operating margin of negative 12.7%.

This quarter, Stitch Fix generated an operating profit margin of negative 11.5%, up 4.7 percentage points year on year.

Over the next 12 months, Wall Street expects Stitch Fix to maintain its LTM operating margin of negative 8.4%. We hope things change so the business can be profitable over the long term.EPS

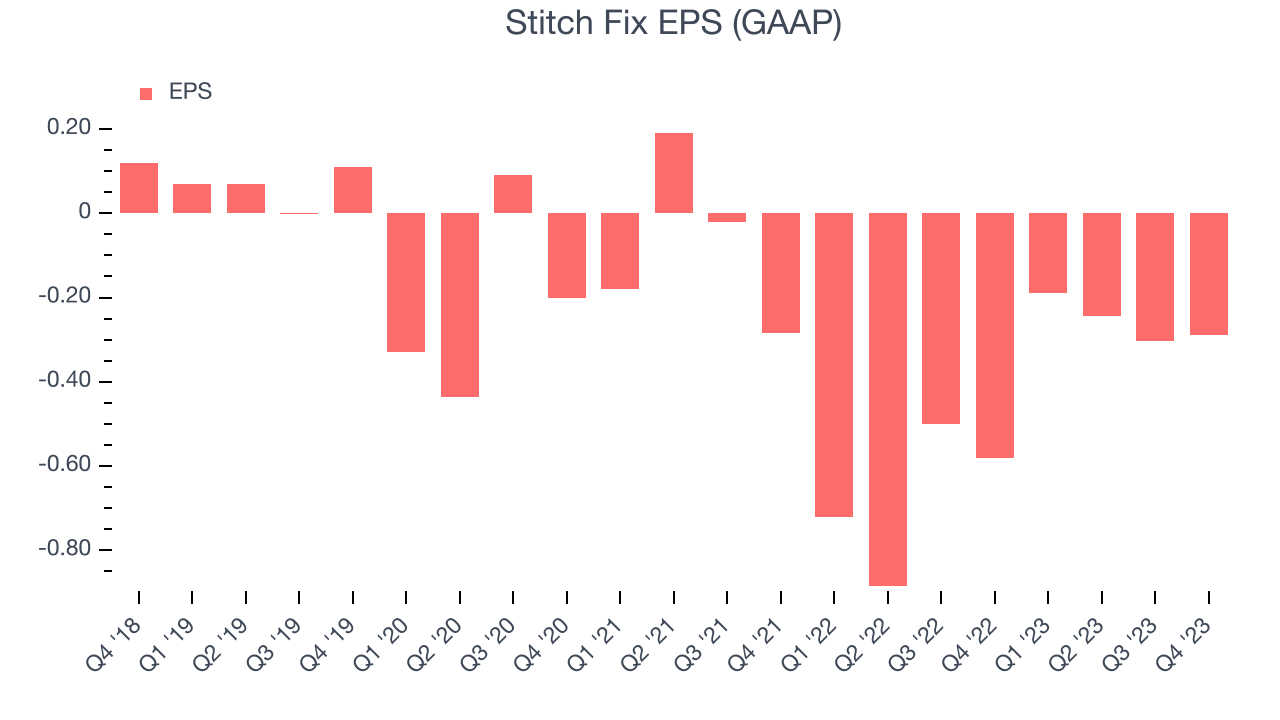

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Stitch Fix's EPS dropped 319%, translating into 33.2% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q2, Stitch Fix reported EPS at negative $0.29, up from negative $0.58 in the same quarter a year ago. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects Stitch Fix to improve its earnings losses. Analysts are projecting its LTM EPS of negative $1.03 to advance to negative $0.73.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

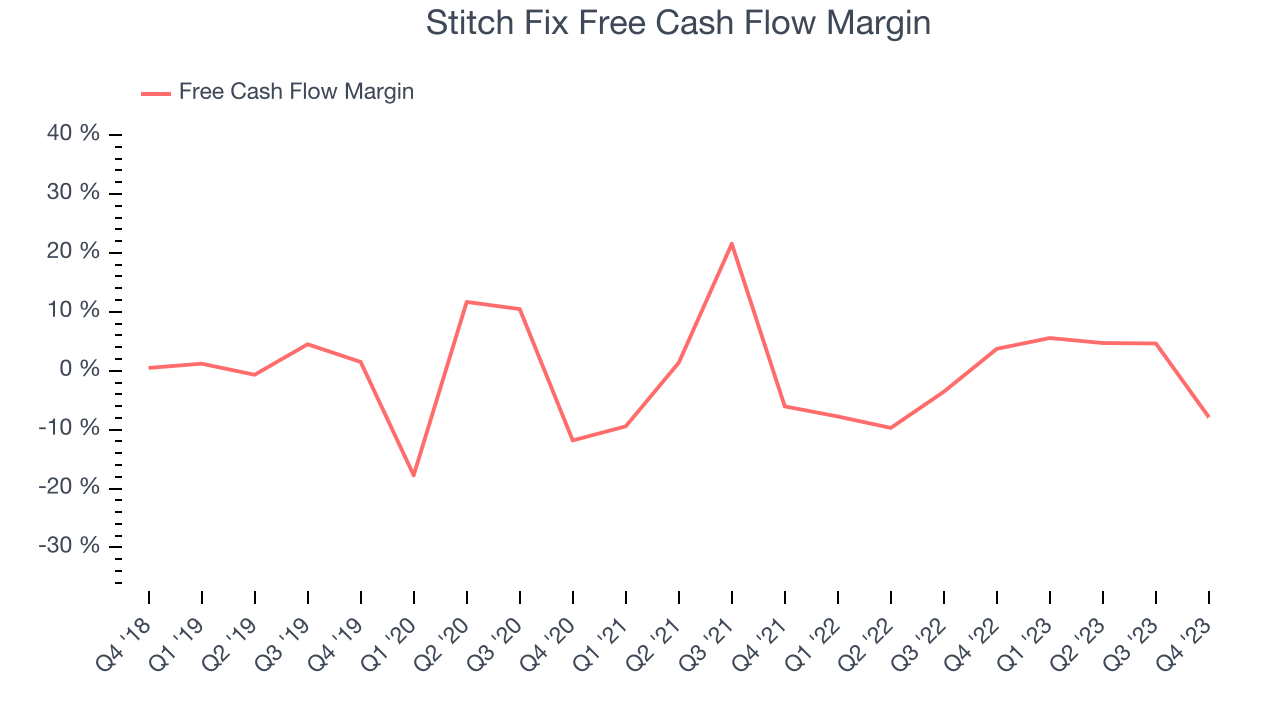

Over the last two years, Stitch Fix's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 1.7%.

Stitch Fix burned through $26.07 million of cash in Q2, equivalent to a negative 7.9% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Stitch Fix's five-year average return on invested capital was negative 30.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Stitch Fix's ROIC over the last two years averaged 37.5 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Stitch Fix's Q2 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance missed and its declining active clients fell short of Wall Street's estimates. Furthermore, its cash burn and EPS loss were much worse than expected. Overall, the results could have been better. The company is down 9.8% on the results and currently trades at $2.96 per share.

Is Now The Time?

Stitch Fix may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Stitch Fix, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its number of active clients has been disappointing. On top of that, its declining EPS over the last five years makes it hard to trust.

While we've no doubt one can find things to like about Stitch Fix, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $3.97 per share right before these results (compared to the current share price of $2.96).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.