Grocery store chain Sprouts Farmers Market (NASDAQ:SFM) reported results in line with analysts' expectations in Q2 FY2023, with revenue up 6.06% year on year to $1.69 billion. Sprouts made a GAAP profit of $67.3 million, improving from its profit of $62 million in the same quarter last year.

Is now the time to buy Sprouts? Find out by accessing our full research report free of charge.

Sprouts (SFM) Q2 FY2023 Highlights:

- Revenue: $1.69 billion vs analyst estimates of $1.69 billion (small beat)

- EPS: $0.65 vs analyst estimates of $0.63 (3.59% beat)

- EPS (non-GAAP) Guidance for Q3 2023 is $0.61 at the midpoint, below analyst estimates of $0.62

- Free Cash Flow of $63.3 million, down 111% from the same quarter last year

- Gross Margin (GAAP): 37%, up from 36.4% in the same quarter last year

- Same-Store Sales were up 3.2% year on year

- Store Locations: 391 at quarter end, increasing by 13 over the last 12 months

"We are encouraged by another solid quarter, as we further establish Sprouts as a go-to healthy specialty food retailer," said Jack Sinclair, chief executive officer of Sprouts Farmers Market.

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

Food is non-discretionary because it is essential for life (maybe not that ice cream?), and grocery stores cater to this need. Selling food is a notoriously tough business, as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores fit to sell everything from raw meat to ice cream to fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of buying food. Still, the online threat exists and will likely increase over time rather than dwindle.

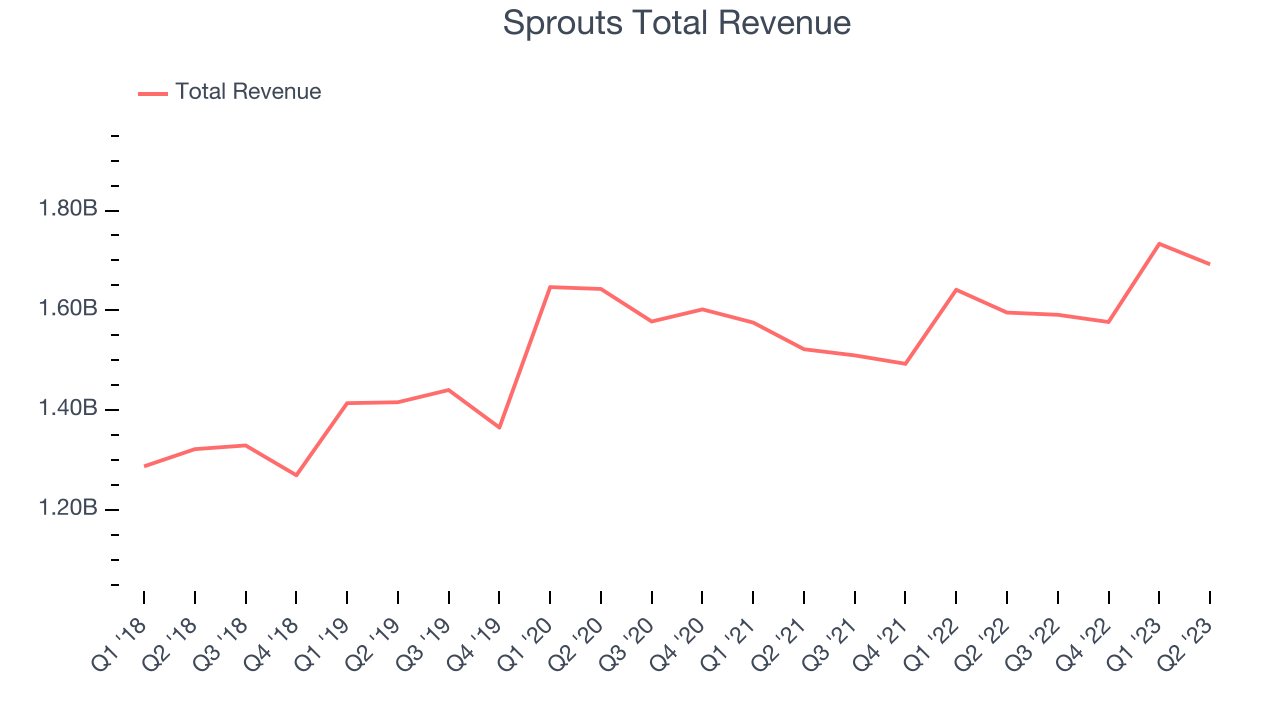

Sales Growth

Sprouts is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's annualized revenue growth rate of 4.98% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) has been mediocre as it's opened new stores and grown sales at existing, established stores.

Sprouts grew its revenue by 6.06% year on year this quarter, in line with Wall Street's expectations. Looking ahead, the analysts covering the company expect sales to grow 5.9% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

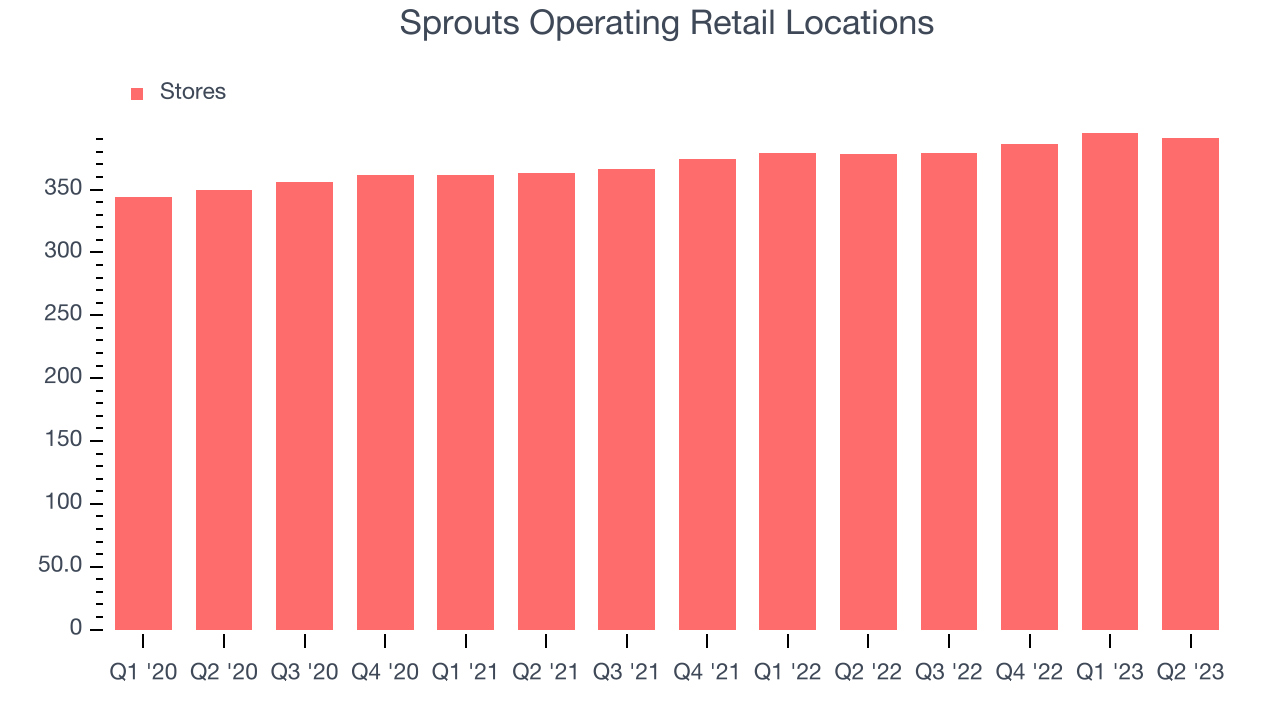

Number of Stores

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like Sprouts is opening new stores, it usually means that demand is greater than supply or that it has no locations in markets where it could be successful. Sprouts's store count increased by 13 locations, or by 3.44%, over the last 12 months to 391 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally opened new stores over the last eight quarters, averaging 3.67% annual growth in its physical footprint. This is decent store growth and in line with other retailers. If a company is operationally efficient and has strong demand, an expanding store base is usually a good thing because it means that revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Sprouts's demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company's same-store sales have grown by a mediocre 1.09% year on year. This performance suggests that its steady rollout of new stores could be beneficial for shareholders because when a company has demand, more locations should help it reach more customers seeking its products, boosting total revenue growth.

In the latest quarter, Sprouts's same-store sales rose 3.2% year on year. This growth was an acceleration from the 2% year-on-year increase it had posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Sprouts's Q2 Results

With a market capitalization of $4.04 billion, Sprouts is among smaller companies, but its $259.5 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

It was comforting to see Sprouts decrease its full-year capex guidance this quarter. That really stood out as a positive in these results and should help its free cash flow margin. Furthermore, the company slightly topped analysts' EPS expectations. Zooming out, we think this was a decent quarter, showing that the company is staying on target. The market was likely expecting more, however, and the stock is down 2.77% after reporting, trading at $37.21 per share.

So should you invest in Sprouts right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.