Semiconductor maker SMART Global Holdings (NASDAQ:SGH) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 1.7% year on year to $311.1 million. Its non-GAAP profit of $0.37 per share was also 7.6% below analysts’ consensus estimates.

Is now the time to buy SMART? Find out by accessing our full research report, it’s free.

SMART (SGH) Q3 CY2024 Highlights:

- Revenue: $311.1 million vs analyst estimates of $325 million (4.3% miss)

- Adjusted Operating Income: $33.74 million vs analyst estimates of $36.43 million (7.4% miss)

- EPS (non-GAAP): $0.37 vs analyst expectations of $0.40 (7.6% miss)

- EPS (non-GAAP) guidance for the upcoming financial year 2025 is $1.70 at the midpoint, missing analyst estimates by 11.6%

- Gross Margin (GAAP): 28%, down from 29.3% in the same quarter last year

- Inventory Days Outstanding: 61, down from 76 in the previous quarter

- Free Cash Flow was -$17.95 million, down from $29.05 million in the same quarter last year

- Market Capitalization: $1.10 billion

Company Overview

Based in the US, SMART Global Holdings (NASDAQ:SGH) is a diversified semiconductor company offering memory, digital, and LED products.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

Sales Growth

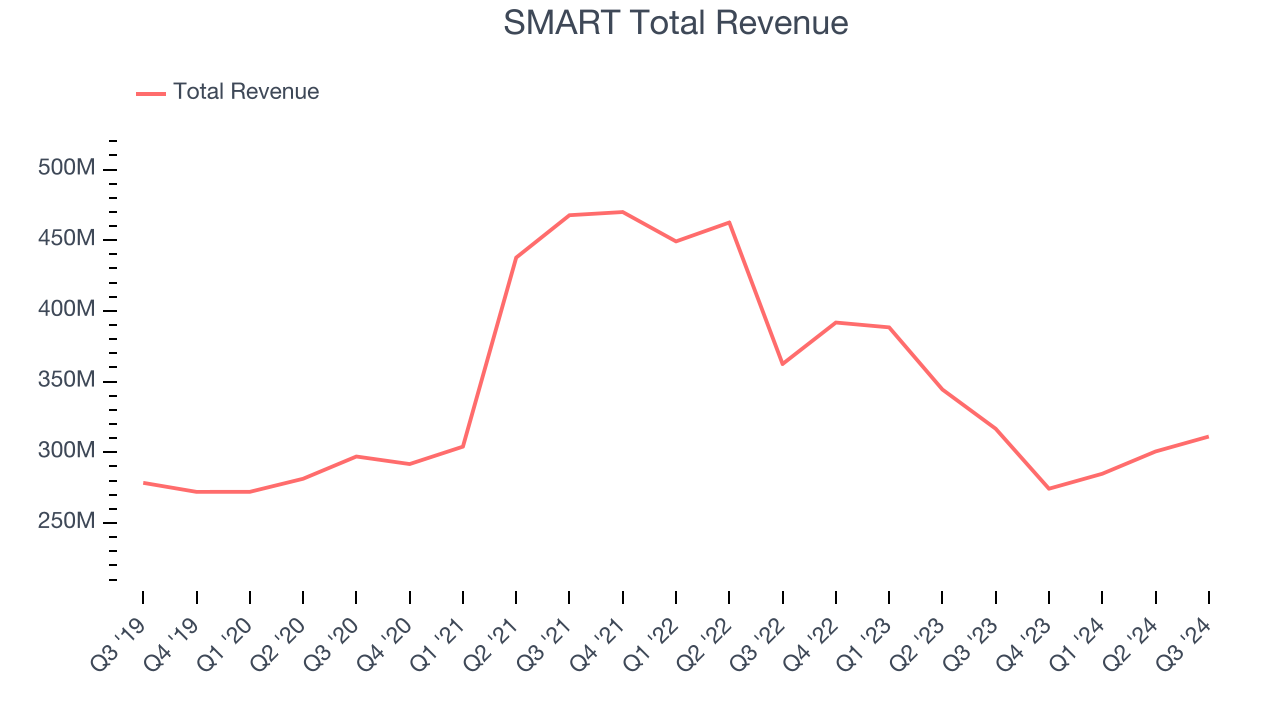

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. SMART struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss demand cycles or new industry trends like AI. SMART’s recent history shows its demand has stayed suppressed as its revenue has declined by 18.1% annually over the last two years.

This quarter, SMART missed Wall Street’s estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $311.1 million of revenue. Looking ahead, sell-side analysts expect sales to grow 19.6% over the next 12 months, an acceleration versus the last two years. This projection is noteworthy and illustrates the market believes its newer products and services will spur faster growth.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

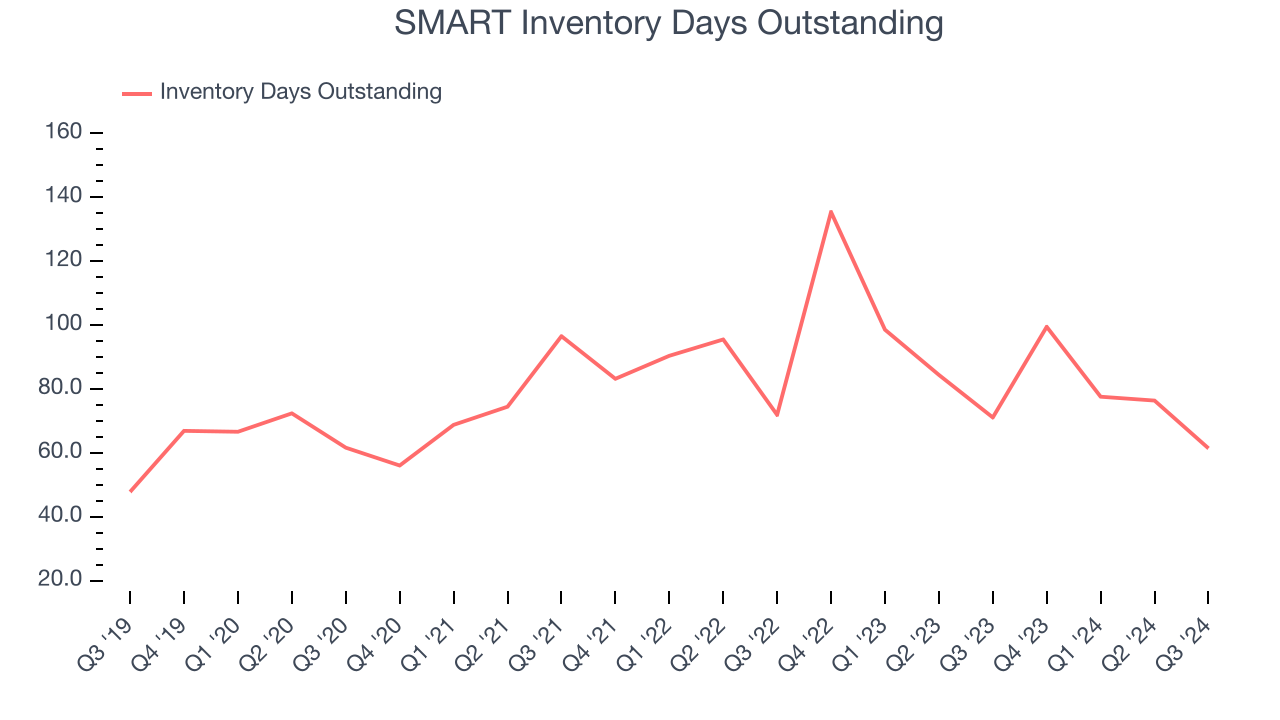

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, SMART’s DIO came in at 61, which is 19 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from SMART’s Q3 Results

We were impressed by SMART’s strong improvement in inventory levels. On the other hand, its revenue and EPS unfortunately missed analysts’ expectations, and its full-year earnings guidance fell short. Overall, this was a weaker quarter. The stock remained flat at $21 immediately after reporting.

Is SMART an attractive investment opportunity at the current price?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.