Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Steven Madden (NASDAQ:SHOO) and its peers.

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 8 footwear stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was 1.2% below.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

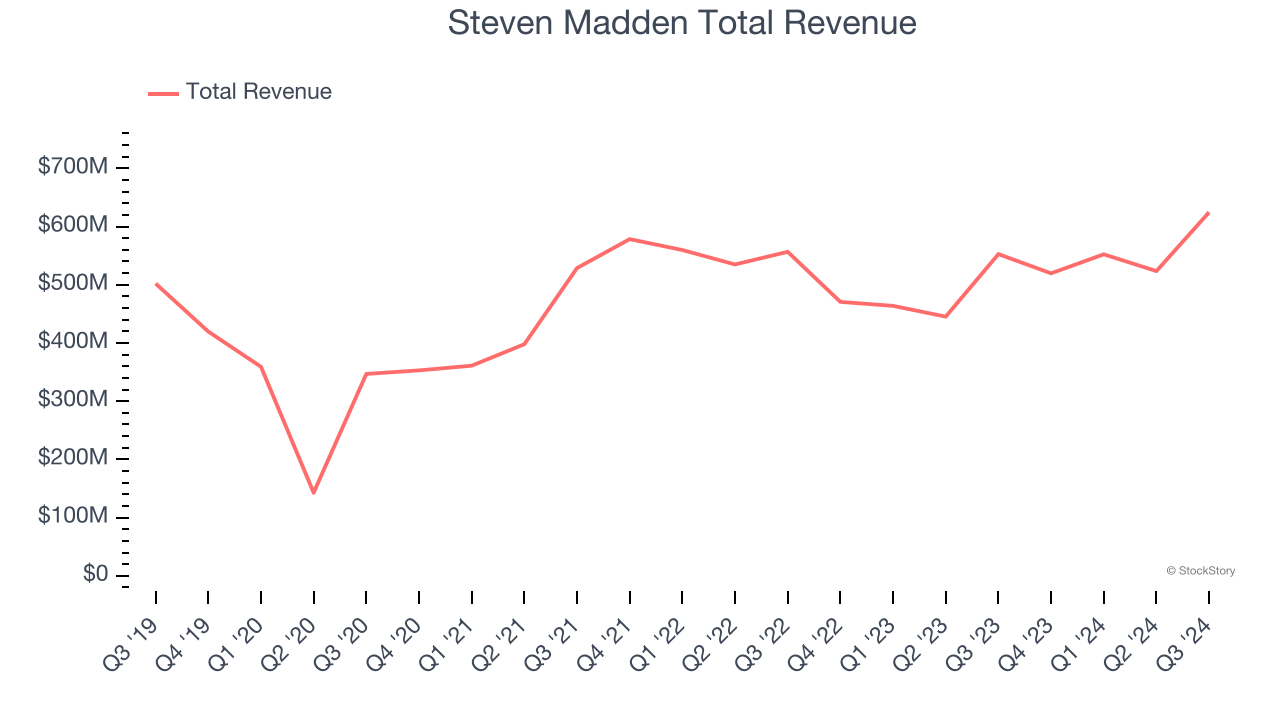

Steven Madden (NASDAQ:SHOO)

As seen in the infamous Wolf of Wall Street movie, Steven Madden (NASDAQ:SHOO) is a fashion brand famous for its trendy and innovative footwear, appealing to a young and style-conscious audience.

Steven Madden reported revenues of $624.7 million, up 13% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ adjusted operating income estimates.

Edward Rosenfeld, Chairman and Chief Executive Officer, commented, “We delivered strong results in the third quarter, with revenue and Adjusted earnings exceeding expectations. This performance was driven by outstanding growth in the accessories and apparel categories – including another quarter of exceptional performance in Steve Madden handbags and a strong contribution from newly acquired Almost Famous – and robust top line gains in international markets and direct-to-consumer channels, demonstrating our team’s strong execution of our key strategic initiatives. Based on these results, we are raising our guidance for 2024 revenue and Adjusted earnings.”

Unsurprisingly, the stock is down 5.2% since reporting and currently trades at $41.95.

Is now the time to buy Steven Madden? Access our full analysis of the earnings results here, it’s free.

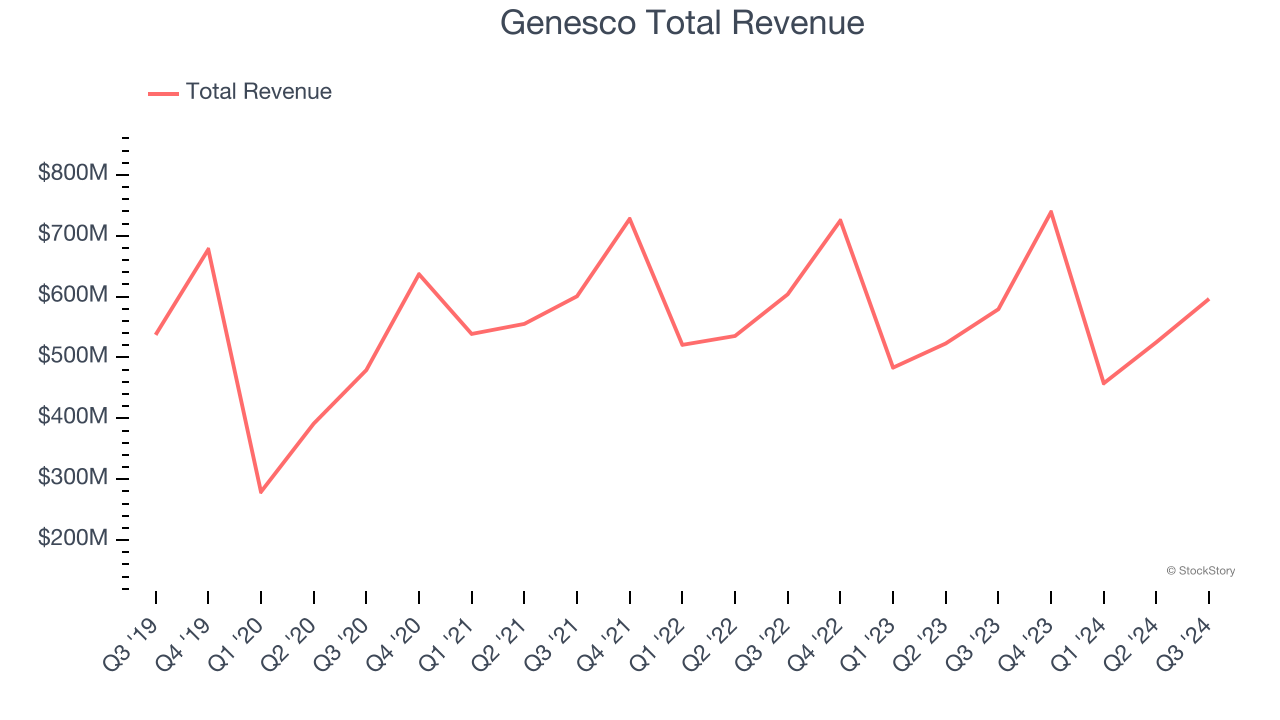

Best Q3: Genesco (NYSE:GCO)

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Genesco reported revenues of $596.3 million, up 2.9% year on year, outperforming analysts’ expectations by 3.2%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 11.6% since reporting. It currently trades at $41.77.

Is now the time to buy Genesco? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Caleres (NYSE:CAL)

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

Caleres reported revenues of $740.9 million, down 2.8% year on year, falling short of analysts’ expectations by 1.4%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

Caleres delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 30.3% since the results and currently trades at $23.16.

Read our full analysis of Caleres’s results here.

Skechers (NYSE:SKX)

Synonymous with "dad shoe", Skechers (NYSE:SKX) is a footwear company renowned for its comfortable, stylish, and affordable shoes for all ages.

Skechers reported revenues of $2.35 billion, up 15.9% year on year. This result surpassed analysts’ expectations by 1.8%. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ constant currency revenue estimates but a miss of analysts’ adjusted operating income estimates.

The stock is up 9.1% since reporting and currently trades at $67.24.

Read our full, actionable report on Skechers here, it’s free.

Crocs (NASDAQ:CROX)

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

Crocs reported revenues of $1.06 billion, up 1.6% year on year. This print topped analysts’ expectations by 1%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ constant currency revenue estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

The stock is down 20.9% since reporting and currently trades at $109.15.

Read our full, actionable report on Crocs here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.