Satellite radio and media company Sirius XM (NASDAQ:SIRI) beat analysts' expectations in Q1 CY2024, with revenue flat year on year at $2.16 billion. On the other hand, the company's full-year revenue guidance of $8.75 billion at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $0.07 per share, improving from its profit of $0.06 per share in the same quarter last year.

Sirius XM (SIRI) Q1 CY2024 Highlights:

- Revenue: $2.16 billion vs analyst estimates of $2.13 billion (1.4% beat)

- EPS: $0.07 vs analyst estimates of $0.07 (in line)

- The company reconfirmed its revenue guidance for the full year of $8.75 billion at the midpoint

- Gross Margin (GAAP): 52.5%, up from 48% in the same quarter last year

- Free Cash Flow of $132 million, down 70.3% from the previous quarter

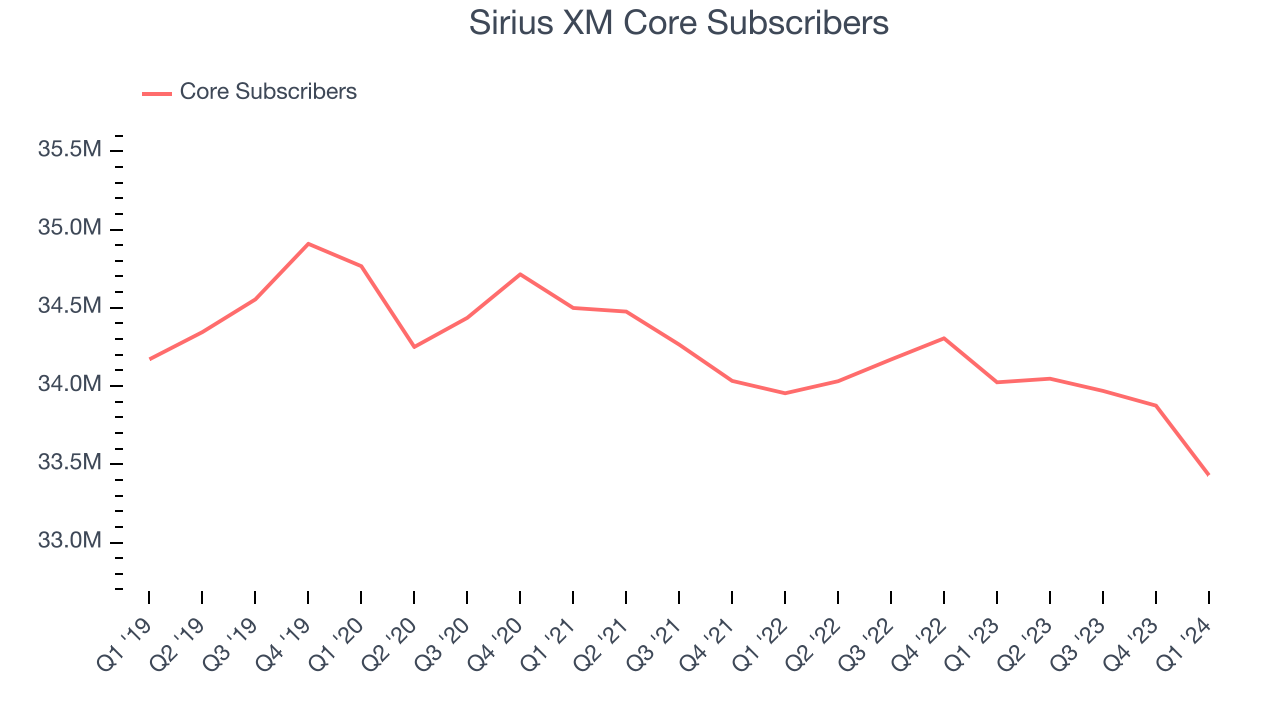

- Core Subscribers: 33.43 million

- Market Capitalization: $12.19 billion

Known for its commercial-free music channels, Sirius XM (NASDAQ:SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

Formed by the 2008 merger of Sirius Satellite Radio and XM Satellite Radio, Sirius XM offers a diverse range of radio content with broader coverage than traditional AM/FM radio. This move addressed the demand for varied and accessible nationwide content, overcoming the constraints of conventional radio broadcasts that are confined by the reach of their local radio signals.

Sirius XM delivers an extensive lineup of music, sports, news, talk shows, and entertainment through satellite and online streaming. Sirius XM differentiates itself by offering premium, hard-to-find content, appealing to listeners seeking a superior radio experience.

The company's revenue model centers on subscription fees, augmented by advertising on some channels, along with equipment and service sales.

Cable and Satellite

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

Competitors in the radio broadcasting and media services sector include iHeartMedia (NASDAQ:IHRT), Cumulus Media (NASDAQ:CMLS), and Urban One (NASDAQ:UONE).Sales Growth

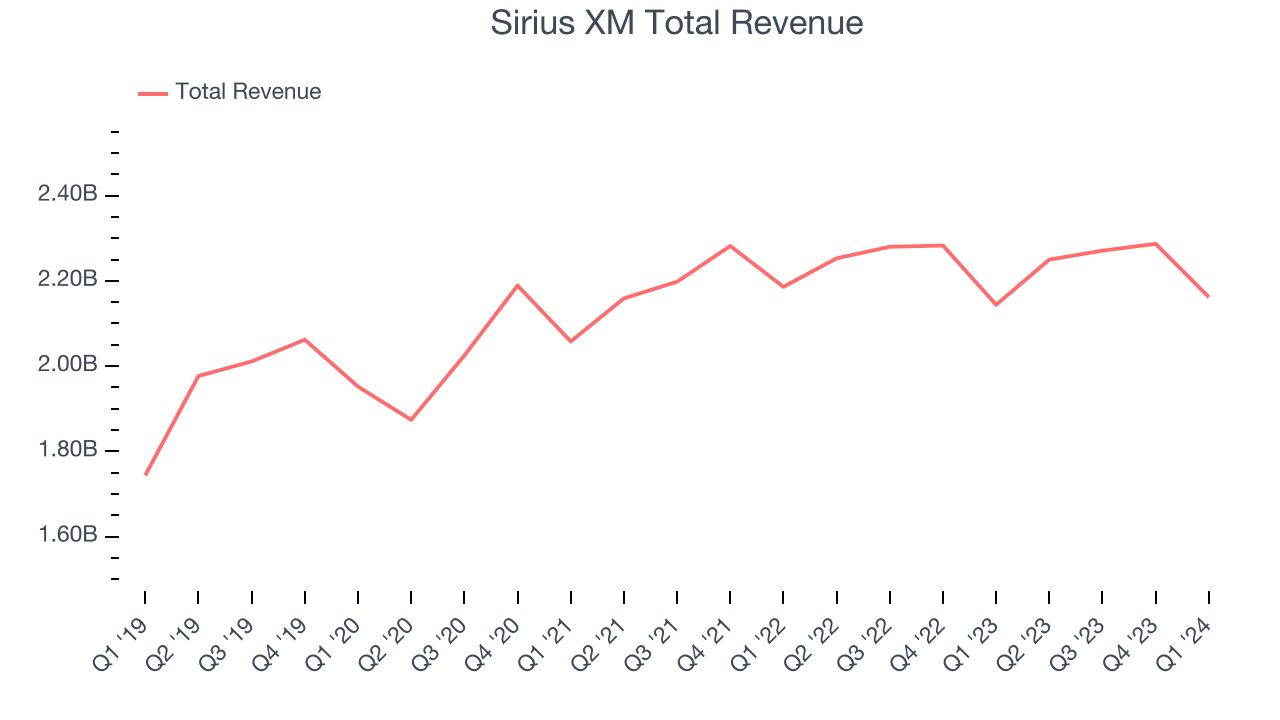

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Sirius XM's annualized revenue growth rate of 7.9% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Sirius XM's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Sirius XM's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

We can dig even further into the company's revenue dynamics by analyzing its number of core subscribers and pandora subscribers, which clocked in at 33.43 million and 5.96 million in the latest quarter. Over the last two years, Sirius XM's core subscribers were flat while its pandora subscribers averaged 3% year-on-year declines.

This quarter, Sirius XM's $2.16 billion of revenue was flat year on year but beat Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects revenue to decline 1.6% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

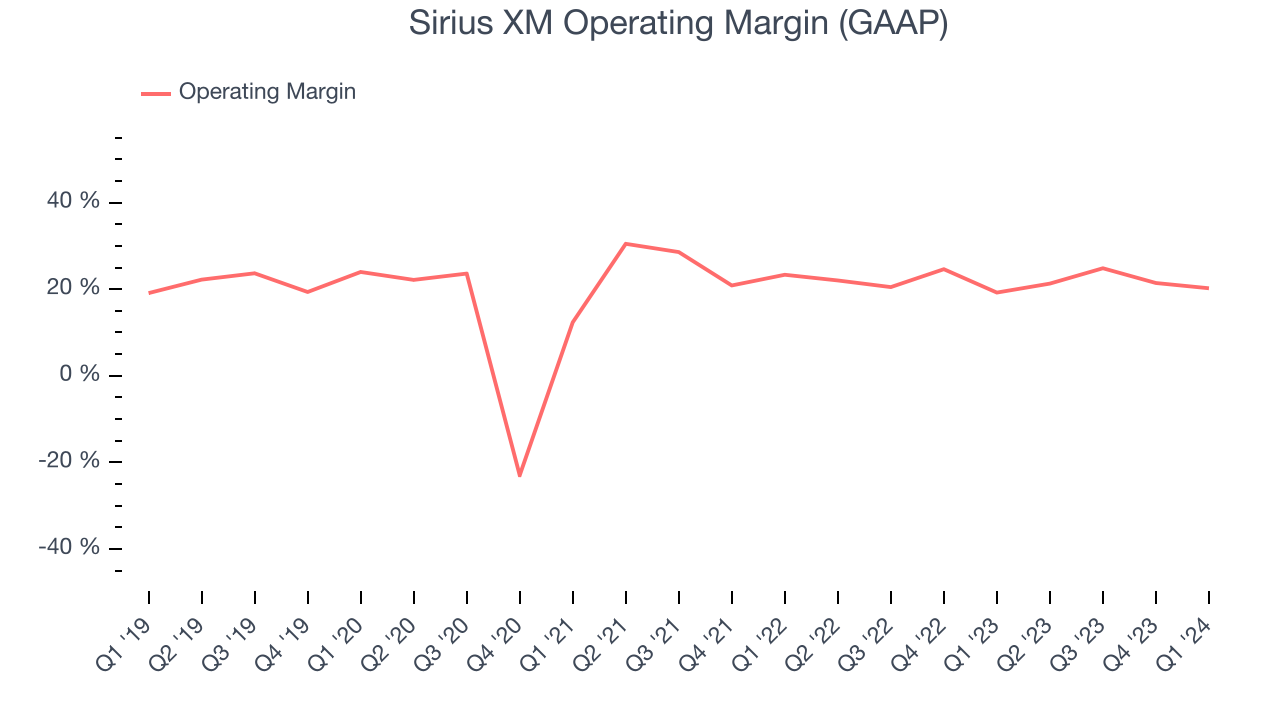

Sirius XM has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 21.8%.

In Q1, Sirius XM generated an operating profit margin of 20.2%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Sirius XM to maintain its LTM operating margin of 22%.EPS

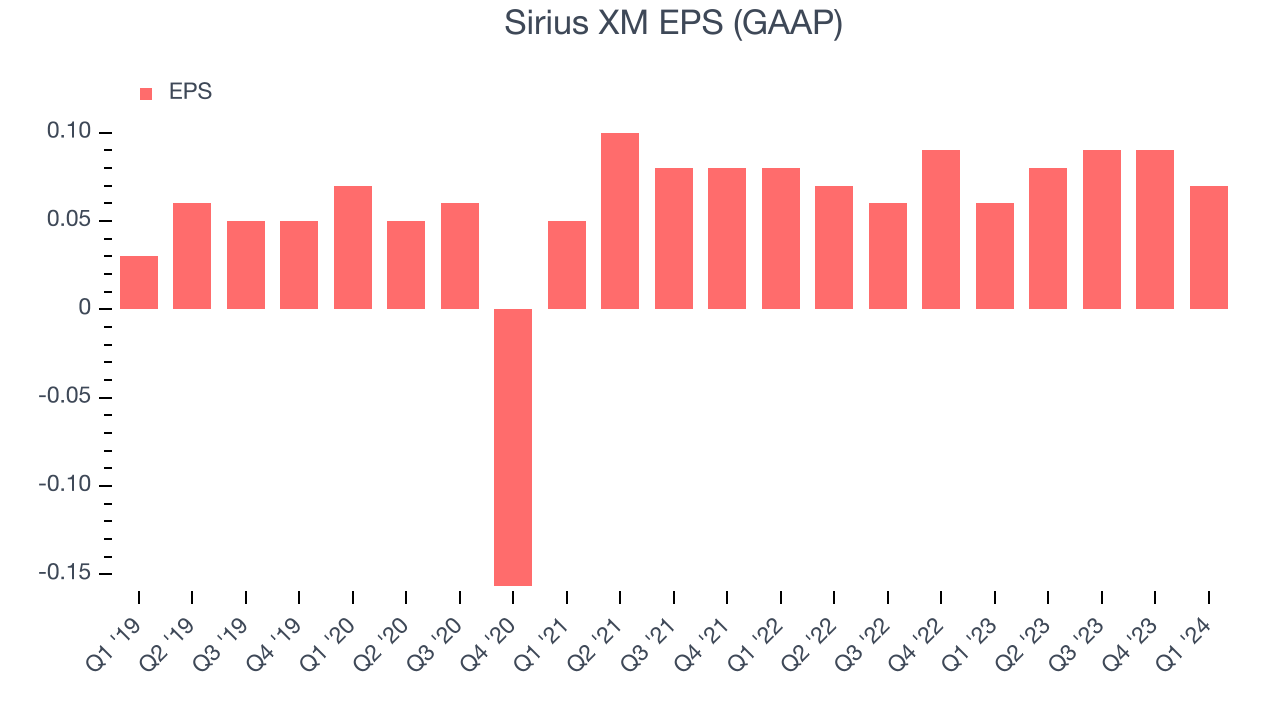

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Sirius XM's EPS grew 50%, translating into an unimpressive 8.4% compounded annual growth rate. This performance is in line with its 7.9% annualized revenue growth over the same period.

In Q1, Sirius XM reported EPS at $0.07, up from $0.06 in the same quarter last year. This print was in line with analysts' estimates. Over the next 12 months, Wall Street expects Sirius XM to perform poorly. Analysts are projecting its LTM EPS of $0.33 to shrink to break even.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

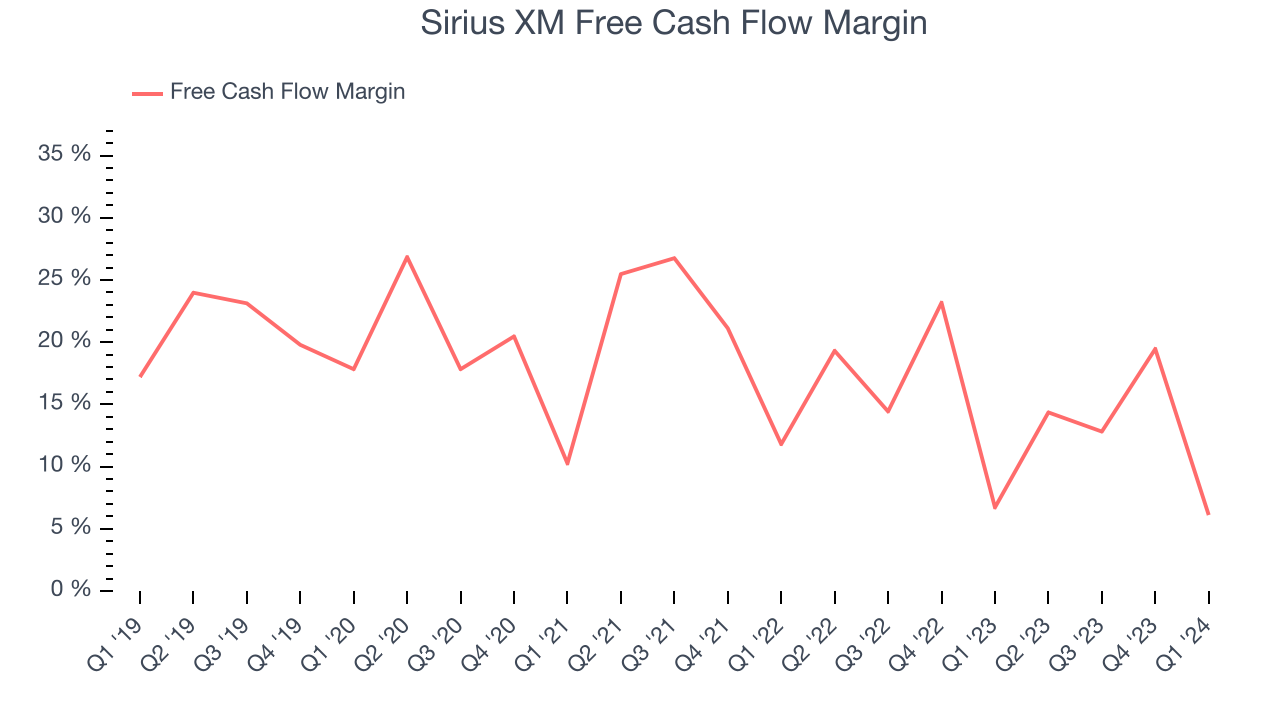

Over the last two years, Sirius XM has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 14.7%, above the broader consumer discretionary sector.

Sirius XM's free cash flow came in at $132 million in Q1, equivalent to a 6.1% margin and down 8.3% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

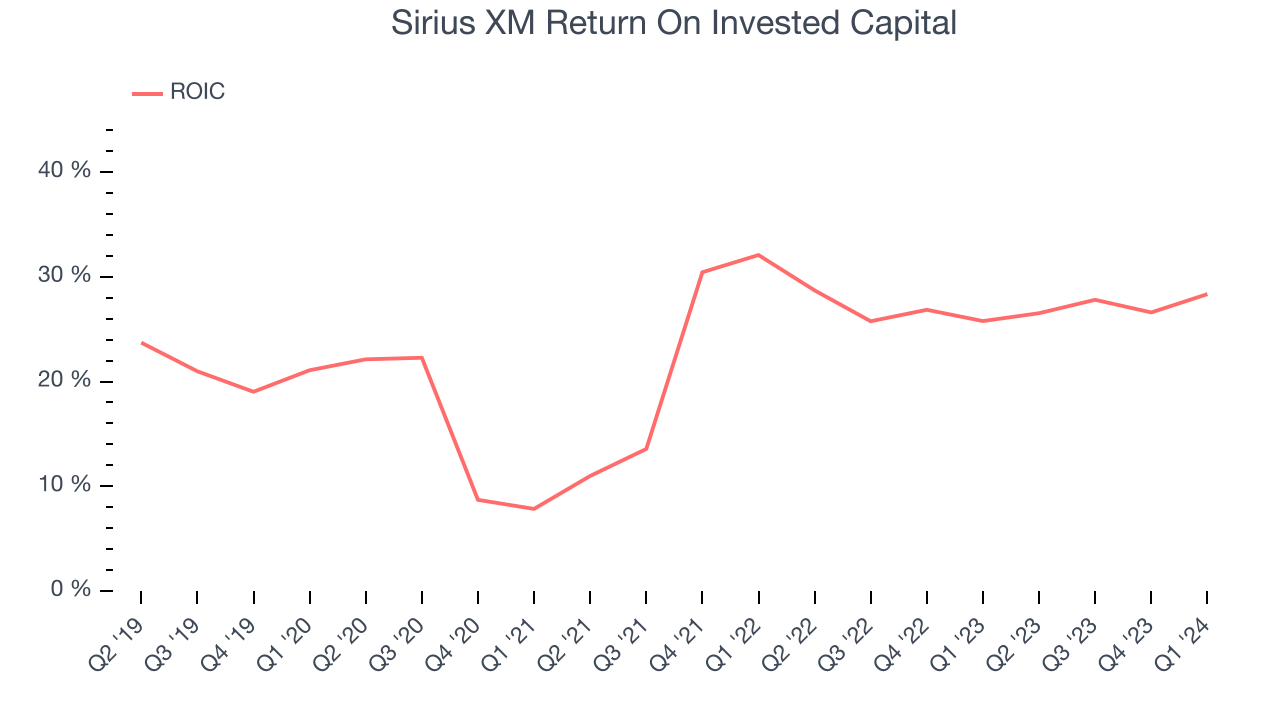

Although Sirius XM hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 23%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Sirius XM's ROIC averaged 12.6 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Sirius XM reported $71 million of cash and $9.53 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.81 billion of EBITDA over the last 12 months, we view Sirius XM's 3.4x net-debt-to-EBITDA ratio as safe. We also see its $214 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Sirius XM's Q1 Results

It was encouraging to see Sirius XM slightly top analysts' revenue expectations this quarter thanks to better-than-expected advertising revenue. On the other hand, its core subscribers churned and its full-year revenue guidance fell short of Wall Street's estimates. Its full-year EBITDA and free cash flow guidance were in line. Overall, this was a mixed quarter for Sirius XM. The stock is up 1.3% after reporting and currently trades at $3.22 per share.

Is Now The Time?

When considering an investment in Sirius XM, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Sirius XM, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its number of core subscribers has been disappointing. On top of that, its projected EPS for the next year is lacking.

While there are some things to like about Sirius XM and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $4.78 per share right before these results (compared to the current share price of $3.22).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.