Skincare company Beauty Health (NASDAQ:SKIN) missed analysts' expectations in Q3 FY2023, with revenue up 9.7% year on year to $97.4 million. Its full-year revenue guidance of $392.5 million at the midpoint also came in 14.9% below analysts' estimates. Turning to EPS, Beauty Health made a GAAP loss of $0.56 per share, down from its loss of $0.03 per share in the same quarter last year.

Is now the time to buy Beauty Health? Find out by accessing our full research report, it's free.

Beauty Health (SKIN) Q3 FY2023 Highlights:

- Revenue: $97.4 million vs analyst estimates of $117.3 million (17% miss)

- EPS: -$0.56 vs analyst estimates of $0.04 (-$0.60 miss)

- The company dropped its revenue guidance for the full year from $470 million to $392.5 million at the midpoint, a 16.5% decrease

- Free Cash Flow of $17.9 million, down 13.4% from the previous quarter

- Gross Margin (GAAP): -12.9%, down from 69.3% in the same quarter last year

“We are focused on protecting Hydrafacial’s strong brand equity as we address the Syndeo provider experience challenges,” said Beauty Health Chief Financial Officer Michael Monahan.

Operating in the emerging beauty health category, the appropriately named Beauty Health (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

Personal Care

Personal care products include lotions, fragrances, shampoos, cosmetics, and nutritional supplements, among others. While these products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. As with other consumer staples categories, personal care brands must exude quality and be priced optimally given the crowded competitive landscape. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Beauty Health is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

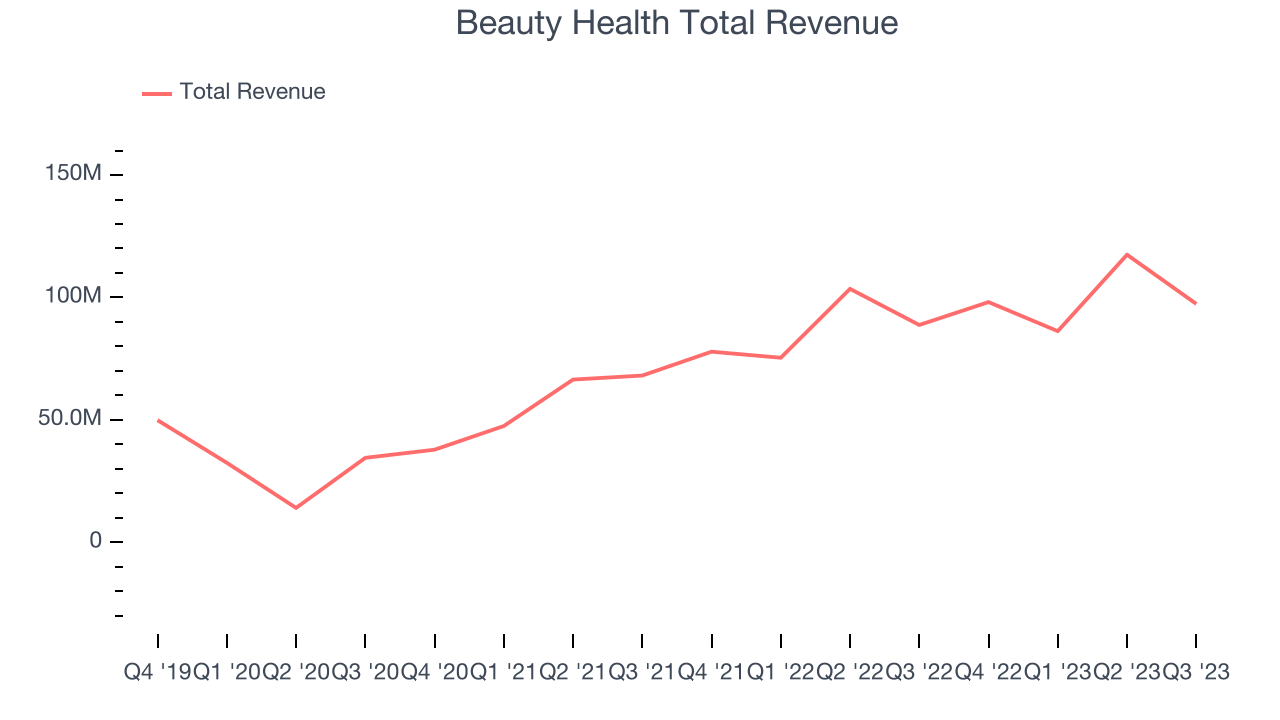

As you can see below, the company's annualized revenue growth rate of 44.9% over the last three years was incredible for a consumer staples business.

This quarter, Beauty Health's revenue grew 9.7% year on year to $97.4 million, missing Wall Street's estimates. Looking ahead, analysts expect sales to grow 32.3% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

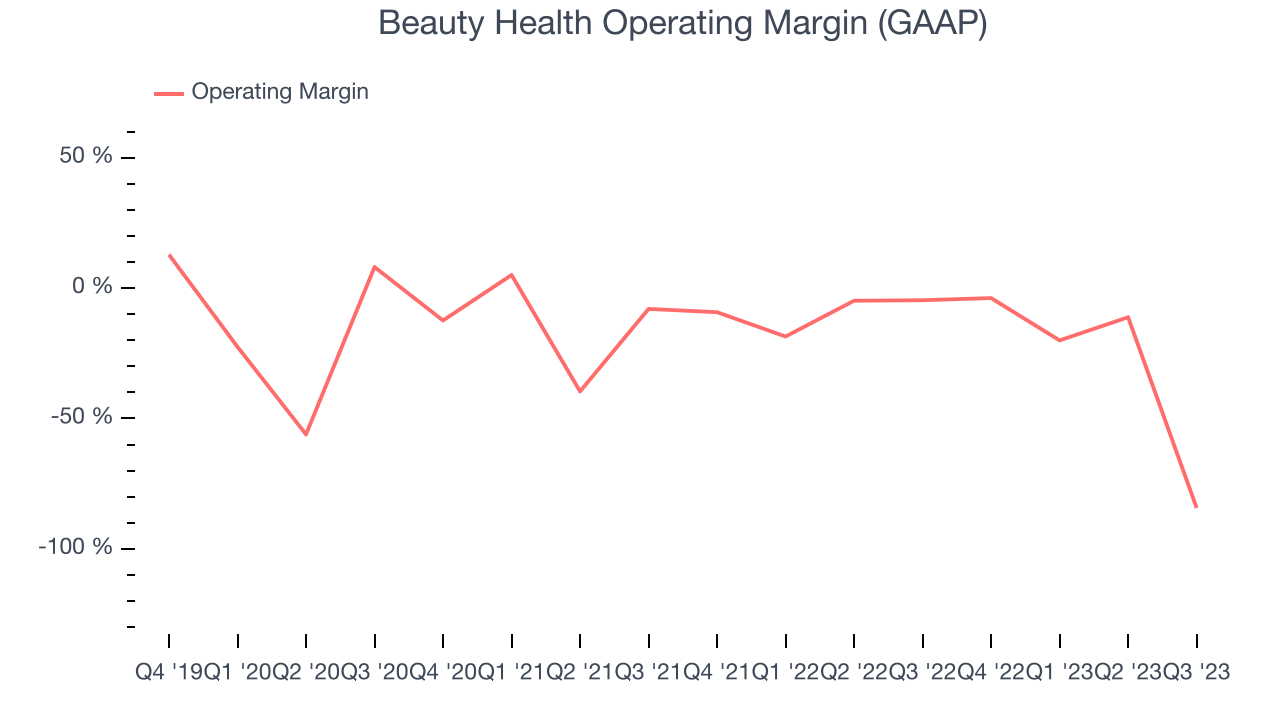

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Beauty Health generated an operating profit margin of negative 84.3%, down 79.6 percentage points year on year. Because Beauty Health's gross margin decreased more than its operating margin, we can infer the company had weaker pricing power and higher raw materials/transportation costs.

There are few unprofitable publicly traded companies in the consumer staples sector, and over the last two years, Beauty Health has been one of them. Its high expenses have contributed to an average operating margin of negative 19.6%. On top of that, Beauty Health's margin has declined by 20.5 percentage points on average each year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

There are few unprofitable publicly traded companies in the consumer staples sector, and over the last two years, Beauty Health has been one of them. Its high expenses have contributed to an average operating margin of negative 19.6%. On top of that, Beauty Health's margin has declined by 20.5 percentage points on average each year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.Key Takeaways from Beauty Health's Q3 Results

With a market capitalization of $478.4 million, Beauty Health is among smaller companies, but its more than $559.4 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We struggled to find many strong positives in these results. Its revenue, EBITDA, and EPS missed Wall Street's estimates and it lowered its full-year guidance for virtually every metric we track. Furthermore, the company observed a negative gross margin this quarter, driven by $63 million in restructuring charges related to device upgrades of its early generation Syndeo product - its versions 1 and 2 experienced quality issues and were marked as obsolete, resulting in a one-time impairment to its inventory/cost of goods sold. Overall, this was a bad quarter for Beauty Health. The company is down 34.8% on the results and currently trades at $2.55 per share.

Beauty Health may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.