Skincare company BeautyHealth (NASDAQ:SKIN) beat analysts' expectations in Q1 CY2024, with revenue down 5.7% year on year to $81.4 million. On the other hand, next quarter's revenue guidance of $99 million was less impressive, coming in 8.4% below analysts' estimates. It made a GAAP loss of $0.10 per share, improving from its loss of $0.15 per share in the same quarter last year.

BeautyHealth (SKIN) Q1 CY2024 Highlights:

- Revenue: $81.4 million vs analyst estimates of $80.65 million (small beat)

- EPS: -$0.10 vs analyst estimates of -$0.14 (26.7% beat)

- Revenue Guidance for Q2 CY2024 is $99 million at the midpoint, below analyst estimates of $108.1 million

- Full year adjusted EBITDA guidance of at least $4 million was ahead

- Gross Margin (GAAP): 59.5%, down from 62.7% in the same quarter last year

- Market Capitalization: $423.5 million

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

Traditionally, getting a facial is a very labor-intensive process, involving lots of rubbing, squeezing, and tweezing. There are serums and lotions. There might even be some steam for heat and cucumbers for cooling.

Hydrafacial adds technology and takes much of the manual labor out of this process. It involves a ‘Delivery System’--which is essentially a non-invasive medical device–as well as attachments for the device and serums delivered by the device. A Hydrafacial treatment involves the use of a specialized device that applies gentle suction while simultaneously delivering customized serums to the skin.

The company’s aim is to employ the razor/razorblade selling model. The Delivery Systems, which are sold to a network of aestheticians, physicians, day spas, resorts, and other partners, are the razors that can last for years. The single-use attachments and serums used with the devices are the razorblades, creating more recurring revenue.

As mentioned, the company operates in the emerging beauty health category. The category occupies a position at the intersection of medical aesthetics and over-the-counter personal care products. Historically, these categories were viewed separately, but they are increasingly converging as consumers combine the ever-present desire to look their best with advancements in medical technology.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors in the beauty health category that employ medical technology and personal care products include AbbVie (NYSE:ABBV) and Venus Concept (NASDAQ:VERO) as well as private companies Cartessa Aesthetics and DermaSweep.Sales Growth

BeautyHealth is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

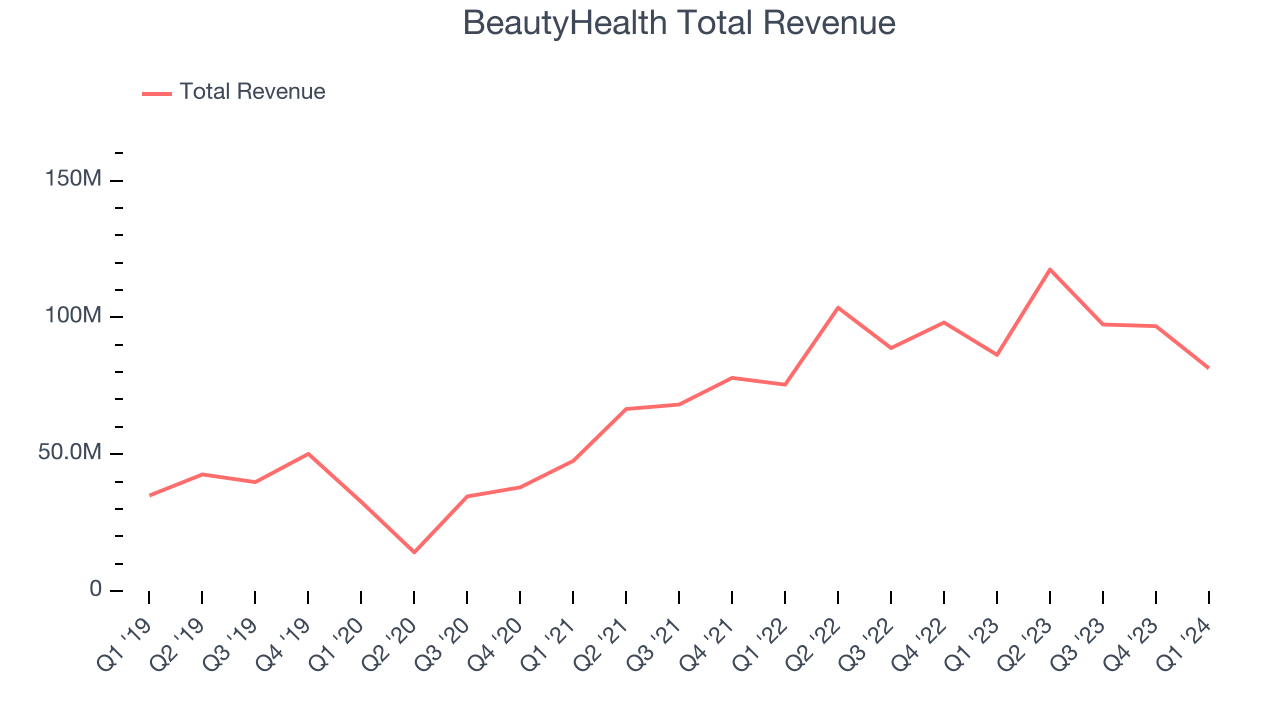

As you can see below, the company's annualized revenue growth rate of 43.1% over the last three years was incredible for a consumer staples business.

This quarter, BeautyHealth reported a rather uninspiring 5.7% year-on-year revenue decline to $81.4 million in revenue, in line with Wall Street's estimates. The company is guiding for a 15.7% year-on-year revenue decline next quarter to $99 million, a reversal from the 13.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 4.8% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

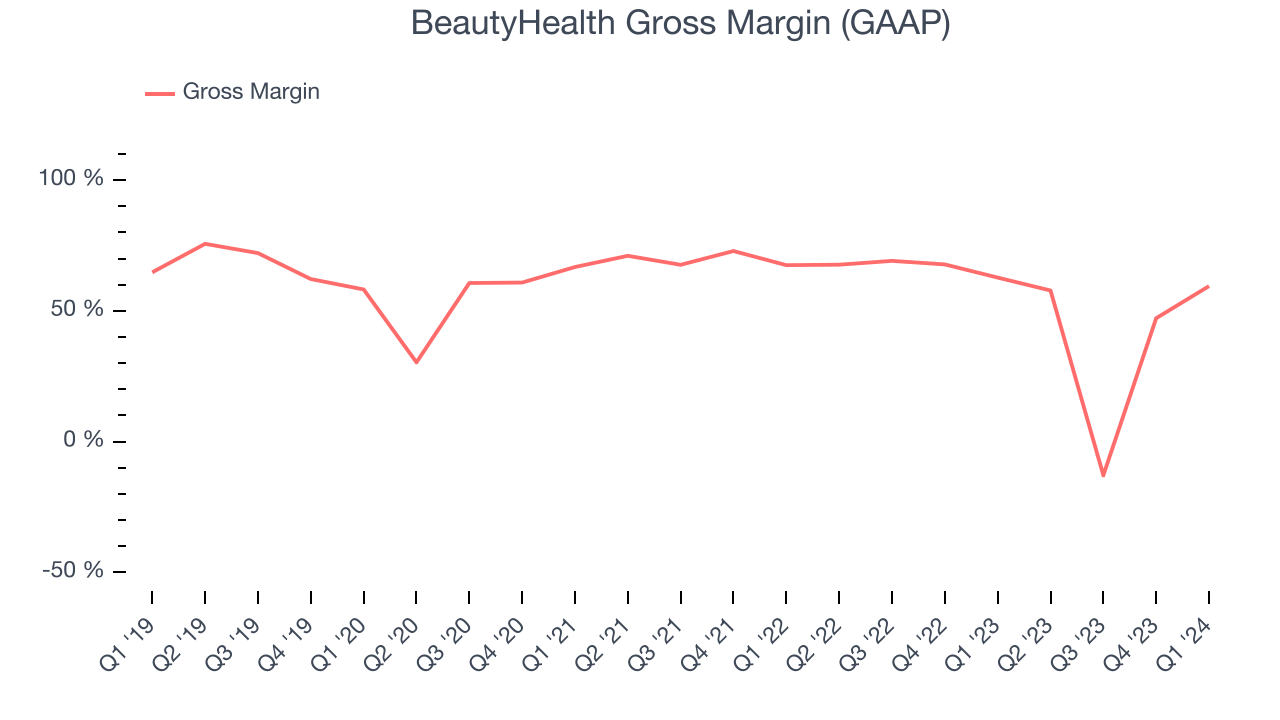

BeautyHealth's gross profit margin came in at 59.5% this quarter, down 3.3 percentage points year on year. That means for every $1 in revenue, $0.41 went towards paying for raw materials, production of goods, and distribution expenses.

BeautyHealth has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 52.1% gross margin over the last eight quarters. Its margin, however, has been trending down over the last year, averaging 42.2% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

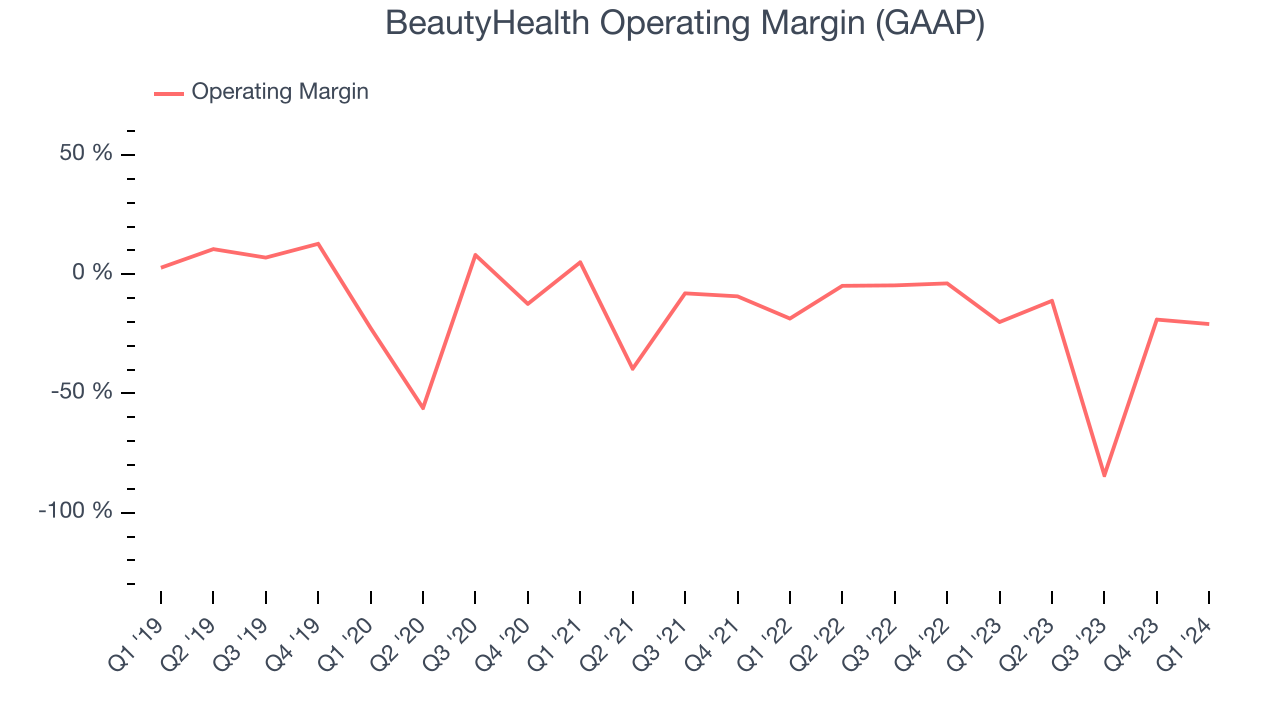

This quarter, BeautyHealth generated an operating profit margin of negative 20.9%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

There are few unprofitable publicly traded consumer staples companies, and over the last two years, BeautyHealth has been one of them. Its high expenses have contributed to an average operating margin of negative 20.9%. On top of that, BeautyHealth's margin has declined by 25.2 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

There are few unprofitable publicly traded consumer staples companies, and over the last two years, BeautyHealth has been one of them. Its high expenses have contributed to an average operating margin of negative 20.9%. On top of that, BeautyHealth's margin has declined by 25.2 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

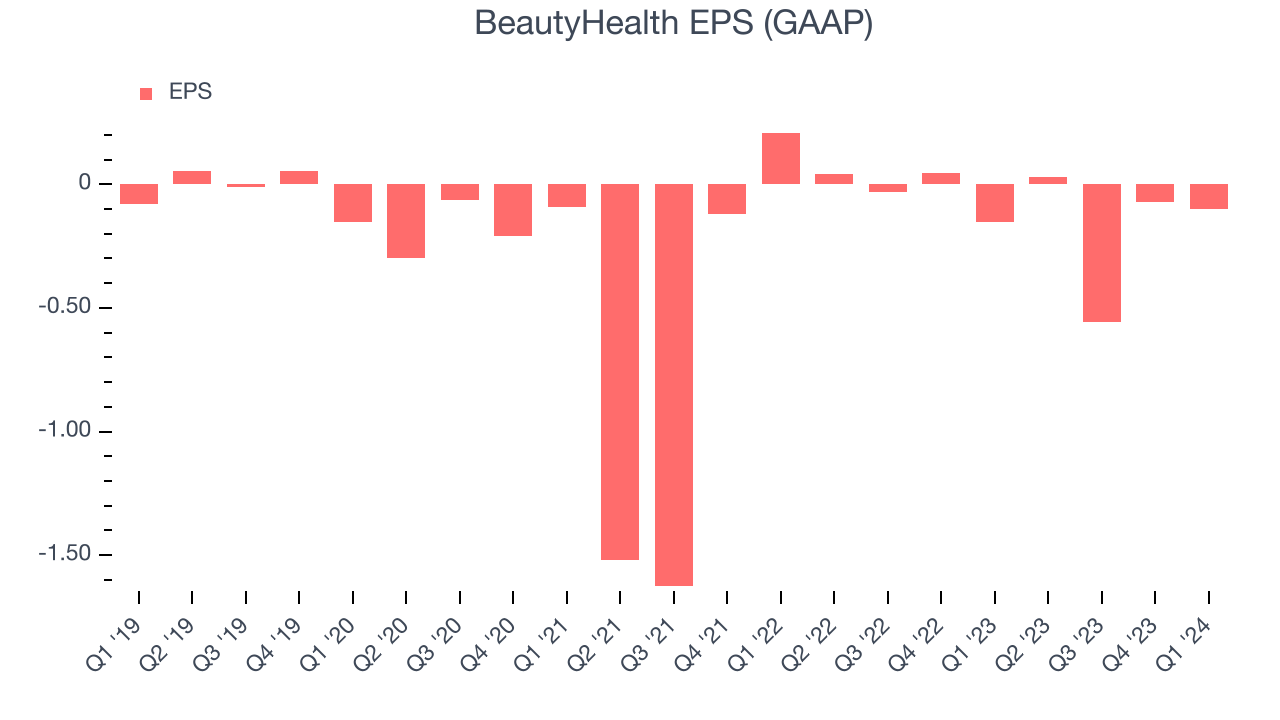

In Q1, BeautyHealth reported EPS at negative $0.10, up from negative $0.15 in the same quarter a year ago. This print beat Wall Street's estimates by 26.7%.

Between FY2021 and FY2024, BeautyHealth's EPS dropped 4.4%, translating into 1.5% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 92.4% year-on-year increase in EPS.

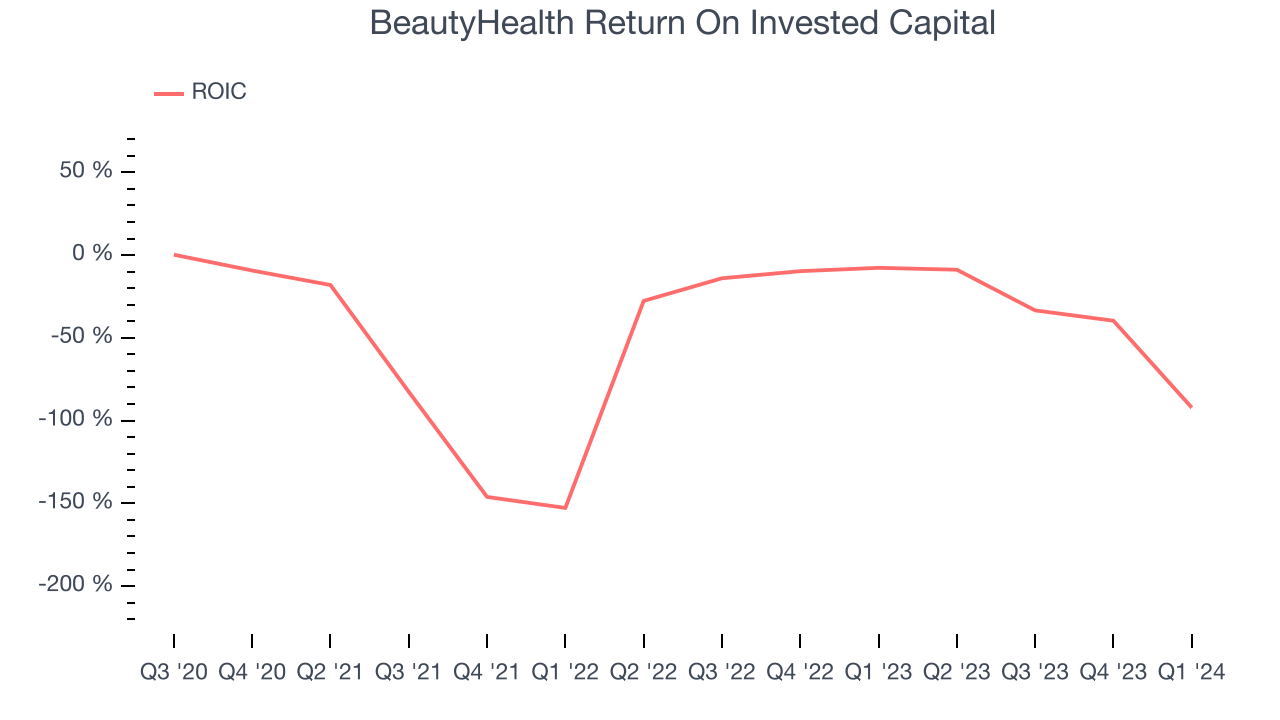

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

BeautyHealth's five-year average ROIC was negative 49.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

BeautyHealth is a well-capitalized company with $444.6 million of cash and $18.3 million of debt, meaning it could pay back all its debt tomorrow and still have $426.3 million of cash on its balance sheet. This net cash position gives BeautyHealth the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from BeautyHealth's Q1 Results

We enjoyed seeing BeautyHealth exceed analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. For the full year, the company's adjusted EBITDA guidance of at least $40 million is ahead of expectations. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its gross margin missed Wall Street's estimates. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $3.59 per share.

Is Now The Time?

BeautyHealth may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of BeautyHealth, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last three years, its brand caters to a niche market. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has struggled to grow profits historically.

BeautyHealth's price-to-earnings ratio based on the next 12 months is 29.9x. While we've no doubt one can find things to like about BeautyHealth, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.49 per share right before these results (compared to the current share price of $3.59).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.