Bedding manufacturer and retailer Sleep Number (NASDAQ:SNBR) fell short of analysts' expectations in Q1 CY2024, with revenue down 10.7% year on year to $470.4 million. It made a GAAP loss of $0.33 per share, down from its profit of $0.51 per share in the same quarter last year.

Sleep Number (SNBR) Q1 CY2024 Highlights:

- Revenue: $470.4 million vs analyst estimates of $474.3 million (0.8% miss)

- EPS: -$0.33 vs analyst expectations of -$0.31 (5.8% miss)

- Gross Margin (GAAP): 58.7%, in line with the same quarter last year

- Free Cash Flow of $24.44 million, up from $3.03 million in the same quarter last year

- Same-Store Sales were down 11% year on year

- Store Locations: 661 at quarter end, decreasing by 10 over the last 12 months

- Market Capitalization: $326 million

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

The core customer is typically a homeowner who cares about quality sleep and has strong preferences when it comes to mattress feel. These customers can include a married couple where one spouse prefers a softer mattress whereas the other prefers a firmer one–Sleep Number offers mattresses where each half’s firmness can be adjusted. These customers can also include those who want more data on their sleep quality–Sleep Number offers smart mattress technology that can register movement and interpret sleep depth.

Sleep Number stores are fairly small, roughly 4,000 square feet. They are typically located in suburban shopping centers or retail districts. The stores feature products in bedroom-like settings to create an inviting atmosphere. Trying out mattresses is encouraged given how important it is for customers to find the right firmness and feel.

A dynamic unique to Sleep Number and other mattress retailers is how infrequently the average consumer is in the market for a new bed or mattress–roughly five to ten years. On the other hand, these purchases tend to be pretty big-ticket in nature, and Sleep Number products are on the more costly end of the price spectrum given the technology features.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Bedding and mattress competitors include Tempur Sealy (NYSE:TPX), Leggett & Platt (NYSE:LEG), and Purple Innovation (NASDAQ:PRPL).Sales Growth

Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

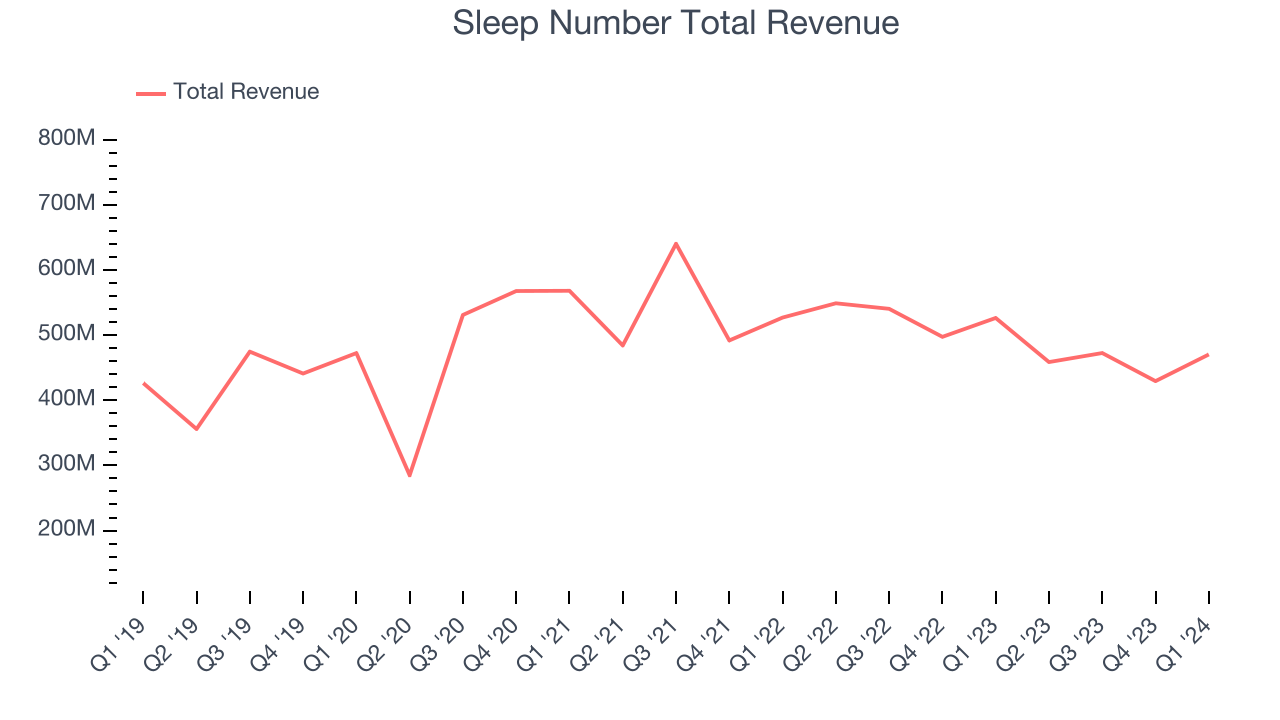

As you can see below, the company's annualized revenue growth rate of 3.1% over the last five years was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Sleep Number missed Wall Street's estimates and reported a rather uninspiring 10.7% year-on-year revenue decline, generating $470.4 million in revenue. Looking ahead, Wall Street expects revenue to decline 1.1% over the next 12 months.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

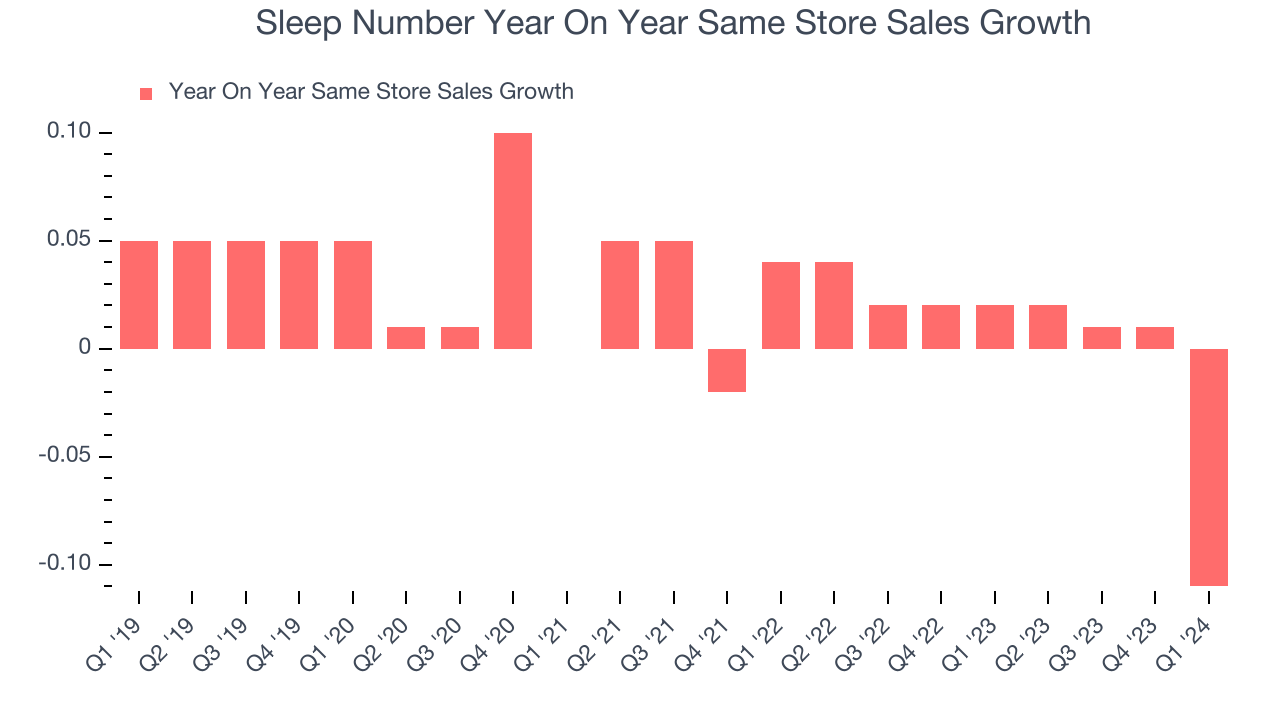

Sleep Number's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Sleep Number's same-store sales fell 11% year on year. This decline was a reversal from the 2% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Number of Stores

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like Sleep Number is opening new stores, it usually means it's investing for growth because demand is greater than supply. Sleep Number's store count shrank by 10 locations, or 1.5%, over the last 12 months to 661 total retail locations in the most recently reported quarter.

Over the last two years, the company has generally opened new stores and averaged 2.5% annual growth in its physical footprint, which is decent and on par with the broader sector. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

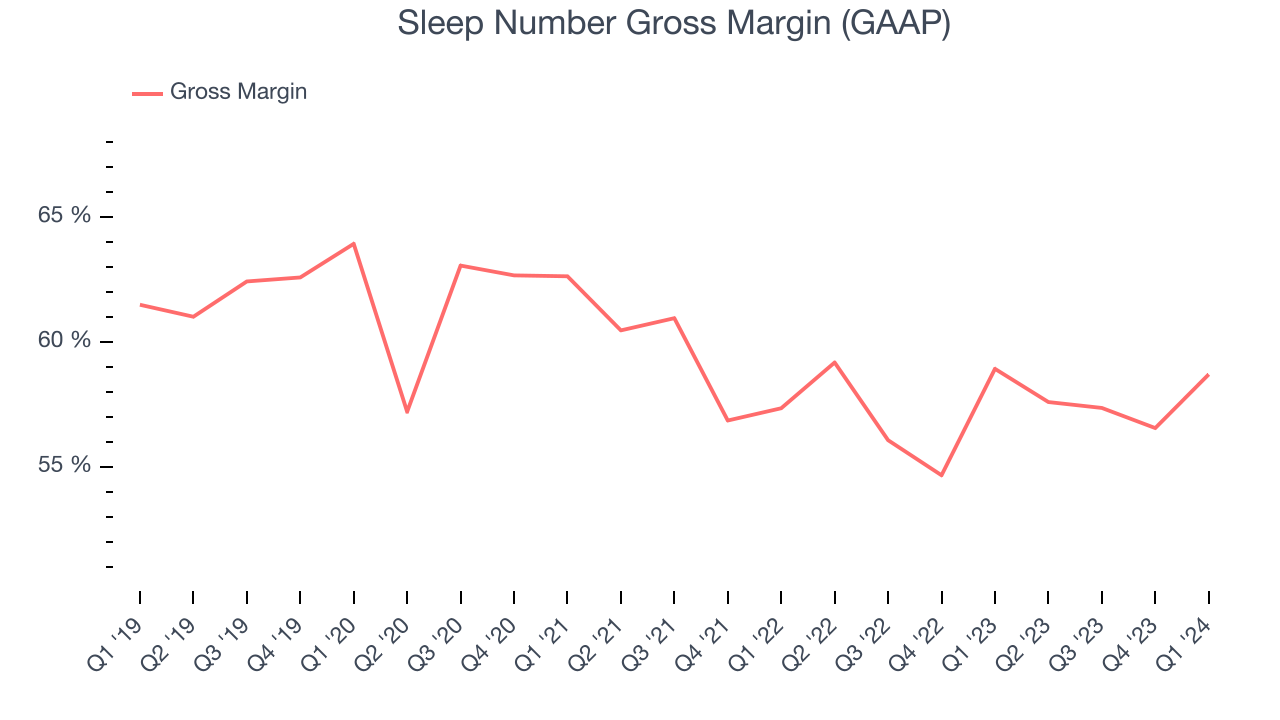

Sleep Number has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see below, it's averaged an exceptional 57.4% gross margin over the last two years. This means the company makes $0.57 for every $1 in revenue before accounting for its operating expenses.

Sleep Number's gross profit margin came in at 58.7% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

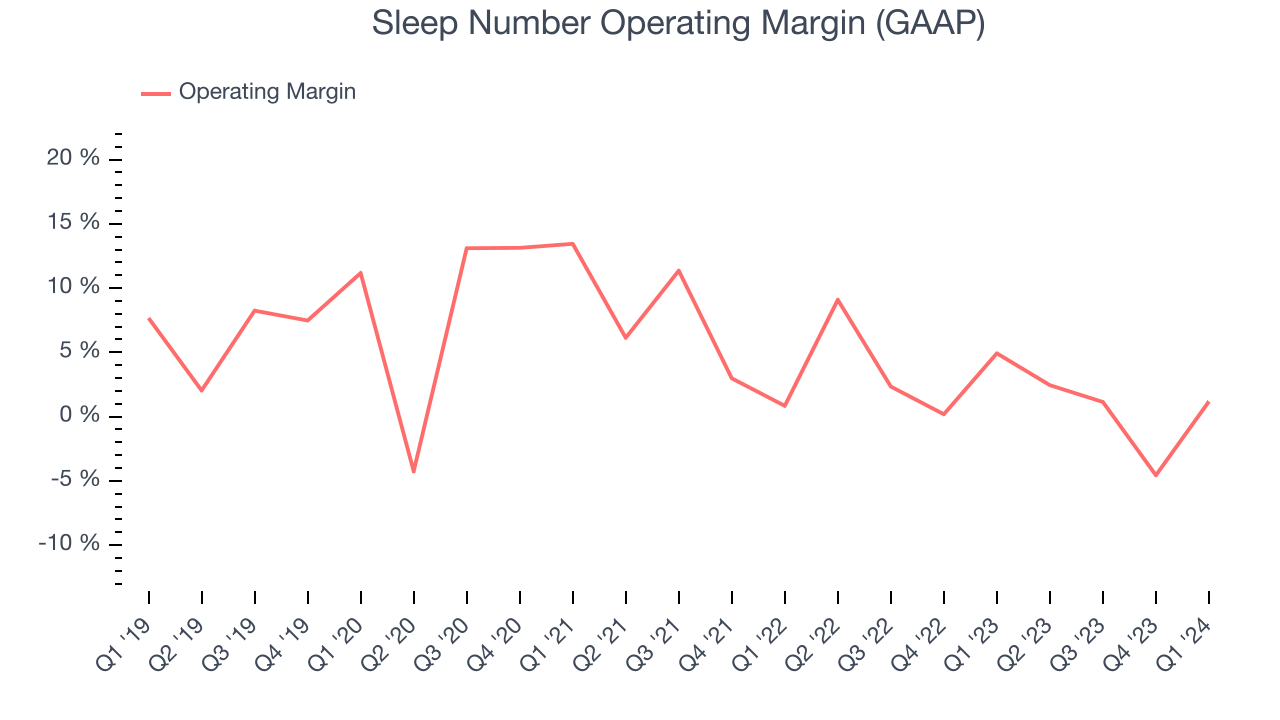

In Q1, Sleep Number generated an operating profit margin of 1.2%, down 3.7 percentage points year on year. We can infer Sleep Number was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Sleep Number was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.3% has been paltry for a consumer retail business. On top of that, Sleep Number's margin has declined, on average, by 4.1 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Sleep Number was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.3% has been paltry for a consumer retail business. On top of that, Sleep Number's margin has declined, on average, by 4.1 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

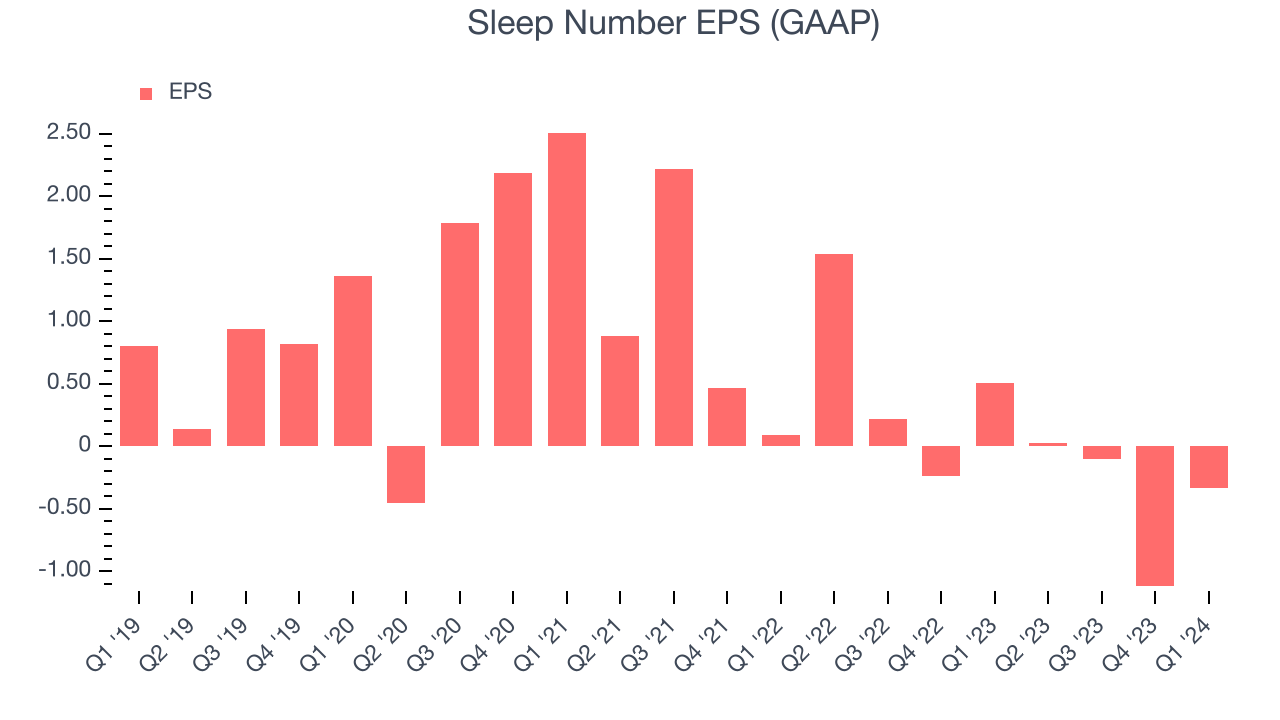

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Sleep Number reported EPS at negative $0.33, down from $0.51 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 117% year-on-year increase in EPS.

Cash Is King

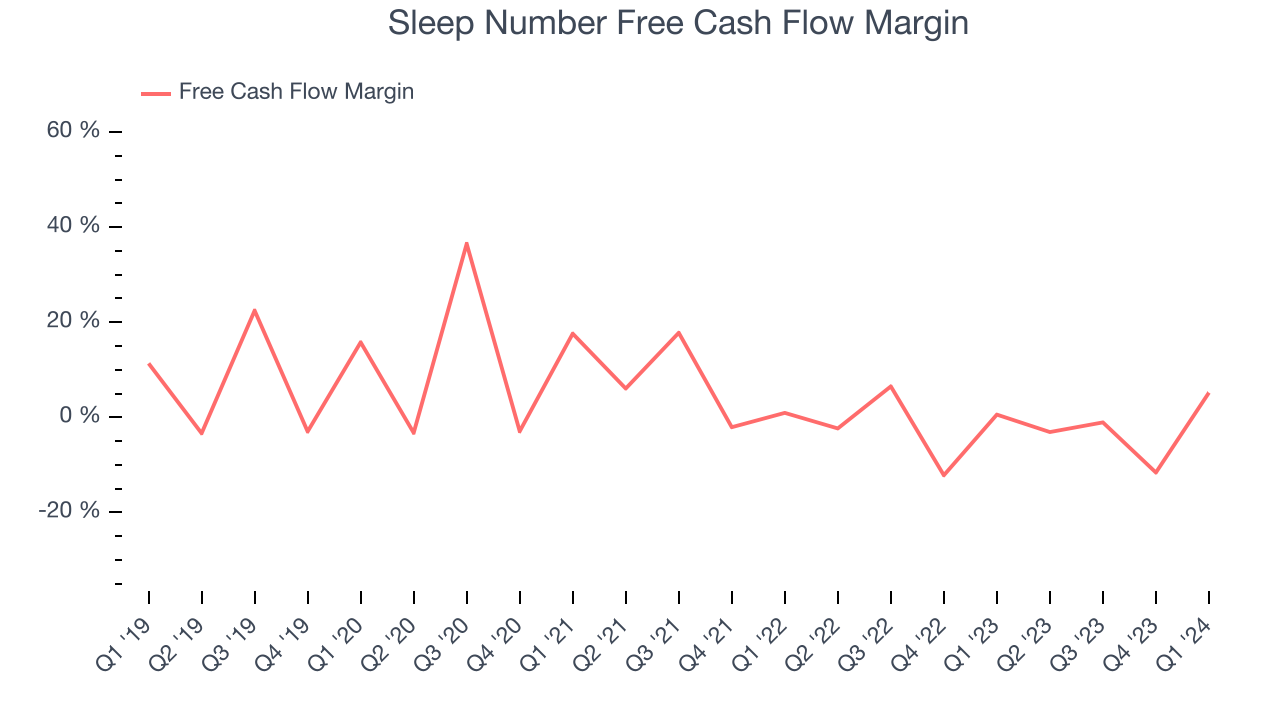

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Sleep Number's free cash flow came in at $24.44 million in Q1, up 708% year on year. This result represents a 5.2% margin.

While Sleep Number posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Sleep Number's capital-intensive business model and demanding reinvestment strategy have consumed many company resources. Its free cash flow margin has averaged negative 2%, weak for a consumer retail business. Investors are likely hoping for consistent free cash flow generation in the future.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Sleep Number hasn't been the highest-quality company lately because of its poor top-line performance, it historically did an excellent job investing in profitable business initiatives. Its five-year average ROIC was 24.6%, impressive for a retailer.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Sleep Number's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Sleep Number reported $2.07 million of cash and $424.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $115.5 million of EBITDA over the last 12 months, we view Sleep Number's 3.7x net-debt-to-EBITDA ratio as safe. We also see its $21.29 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Sleep Number's Q1 Results

It was good to see Sleep Number beat analysts' gross margin expectations this quarter. On the other hand, its revenue and EPS unfortunately missed Wall Street's estimates as its same-store sales declined 11%. Overall, this was a mixed quarter for Sleep Number. The stock is up 1.3% after reporting and currently trades at $13.75 per share.

Is Now The Time?

When considering an investment in Sleep Number, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Sleep Number, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last five years, and analysts expect growth to deteriorate from here. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its poor same-store sales performance has been a headwind. On top of that, its declining EPS over the last five years makes it hard to trust.

Sleep Number's price-to-earnings ratio based on the next 12 months is 48.2x. While we've no doubt one can find things to like about Sleep Number, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $12.50 per share right before these results (compared to the current share price of $13.75), implying they didn't see much short-term potential in Sleep Number.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.