Smart living technology company Snap One (NASDAQ:SNPO) fell short of analysts' expectations in Q4 FY2023, with revenue down 1.4% year on year to $264.4 million. The company's full-year revenue guidance of $1.10 billion at the midpoint also came in 2.1% below analysts' estimates. It made a GAAP loss of $0.08 per share, down from its loss of $0.05 per share in the same quarter last year.

Snap One (SNPO) Q4 FY2023 Highlights:

- Revenue: $264.4 million vs analyst estimates of $266.4 million (0.8% miss)

- Adj EBITDA: $29.8 million vs analyst estimates $26.3 million (13.3% beat)

- EPS: -$0.08 vs analyst estimates of -$0.10 (19.8% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $1.10 billion at the midpoint, missing analyst estimates by 2.1% and implying 3.2% growth (vs -5.5% in FY2023) (although adjusted EBITDA guidance for the same period was ahead of expectations)

- Gross Margin (GAAP): 41.7%, up from 39.4% in the same quarter last year

- Market Capitalization: $593.9 million

Founded to revolutionize the way people interact with their homes and offices, Snap One (NASDAQ:SNPO) is a provider of smart living technology, offering innovative home automation, audio-video, and security products.

Snap One's products are diverse, encompassing solutions like automated lighting systems, advanced security cameras, high-fidelity audio systems, and comprehensive home automation platforms that allow users to control multiple aspects of their environment through a single platform. Its products are designed to seamlessly integrate into environments residential and commercial environments.

Understanding that technology can be complex, the company emphasizes simplicity and ease of use in its products. Its solutions are designed to be used with no technical experience necessary, bridging the gap between sophisticated technology and user-friendly interfaces.

The company also focuses on professional integrators, offering them a comprehensive suite of tools and products to create customized solutions for their clients.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Snap One's primary competitors include Legrand (EPA:LR), Honeywell Home (NYSE:HON), and private companies Control4 (owned by SnapAV), Crestron, Lutron, and Savant Systems.Sales Growth

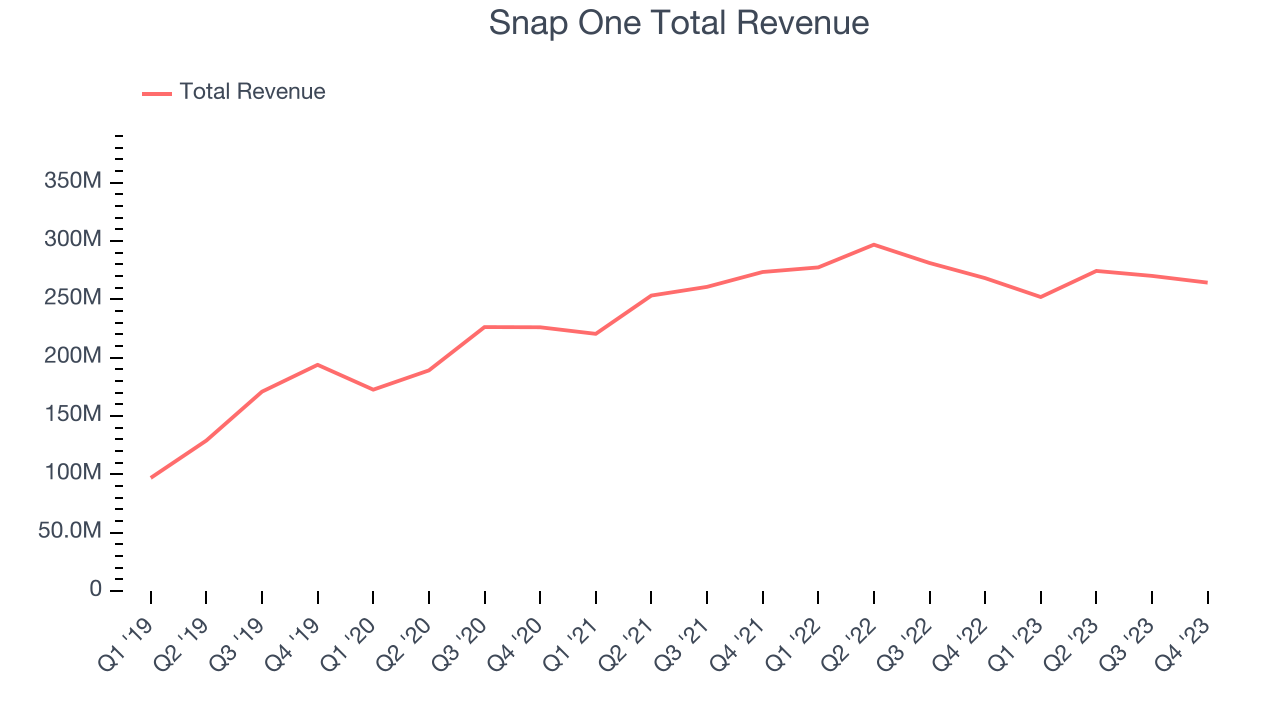

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Snap One's annualized revenue growth rate of 15.8% over the last four years was solid for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Snap One's recent history shows its momentum has slowed as its annualized revenue growth of 2.6% over the last two years is below its four-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Snap One's recent history shows its momentum has slowed as its annualized revenue growth of 2.6% over the last two years is below its four-year trend.

This quarter, Snap One missed Wall Street's estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $264.4 million of revenue. Looking ahead, Wall Street expects sales to grow 4.5% over the next 12 months, an acceleration from this quarter.

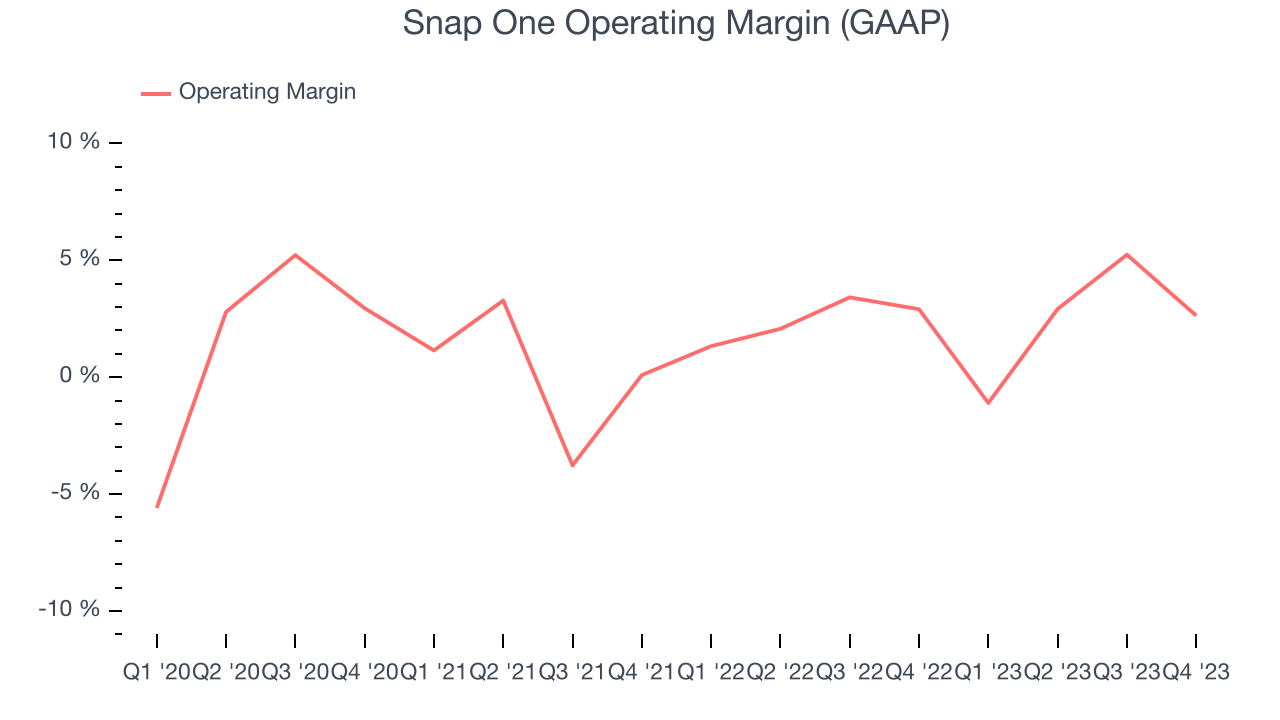

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Snap One was profitable over the last eight quarters but held back by its large expense base. Its average operating margin of 2.5% has been among the worst in the consumer discretionary sector.

This quarter, Snap One generated an operating profit margin of 2.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Snap One to maintain its LTM operating margin of 2.5%.EPS

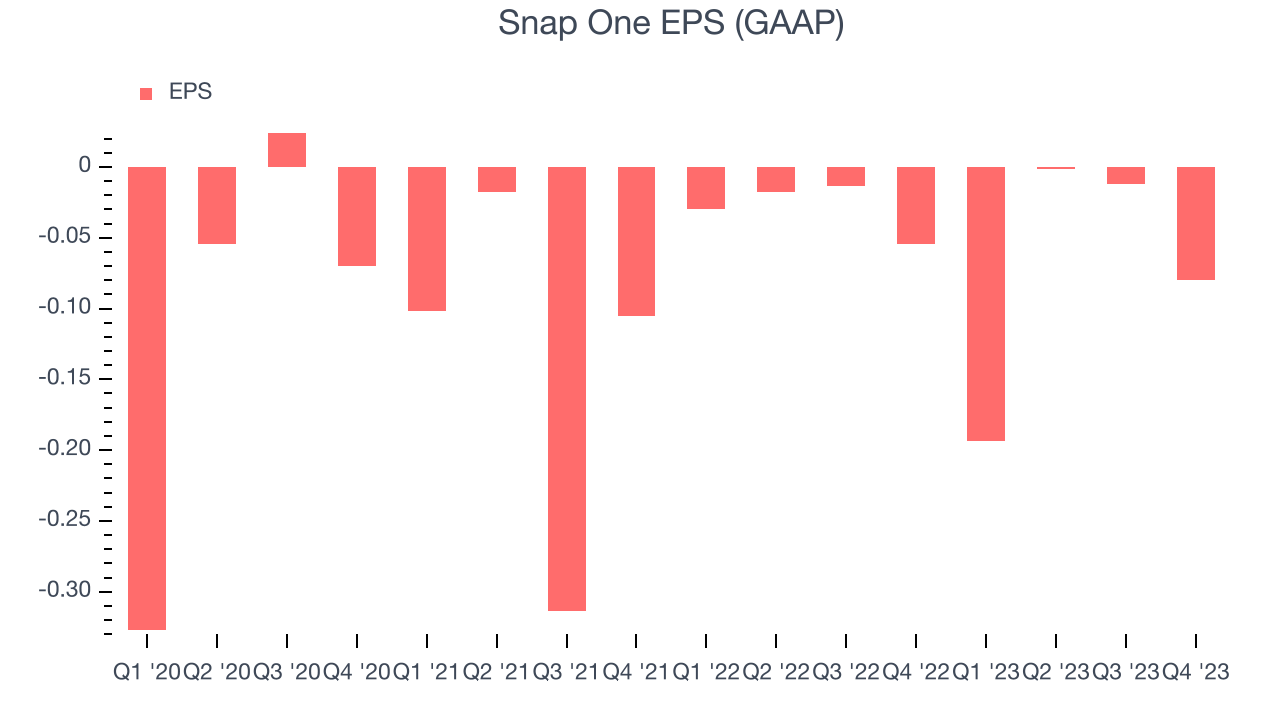

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last three years, Snap One cut its earnings losses and improved its EPS by 12.5% each year.

In Q4, Snap One reported EPS at negative $0.08, down from negative $0.05 in the same quarter a year ago. This print beat analysts' estimates by 19.8%. Over the next 12 months, Wall Street expects Snap One to improve its earnings losses. Analysts are projecting its LTM EPS of negative $0.29 to advance to negative $0.22.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Snap One's five-year average return on invested capital was 2.2%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Snap One's ROIC averaged 1 percentage point increases each year. This is a good sign and we hope the company can continue to improving.

Key Takeaways from Snap One's Q4 Results

We enjoyed seeing Snap One exceed analysts' adjusted EBITDA and EPS expectations this quarter. We were also glad its full year adjusted EBITDA guidance outperformance expectations. On the other hand, its full-year revenue guidance missed and its revenue fell short of Wall Street's estimates, although the market seems to be overlooking topline weakness in favor of better profitability. Overall, this was a decent quarter for Snap One. The stock is up 4% after reporting and currently trades at $7.82 per share.

Is Now The Time?

Snap One may have had a fine quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Snap One, we'll be cheering from the sidelines. Although its revenue growth has been good over the last four years, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its low free cash flow margins give it little breathing room.

Snap One's price-to-earnings ratio based on the next 12 months is 13.5x. While the price is reasonable and there are some things to like about Snap One, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $11.21 per share right before these results (compared to the current share price of $7.82).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.