Audio technology Sonos company (NASDAQ:SONO) announced better-than-expected results in Q1 CY2024, with revenue down 16.9% year on year to $252.7 million. The company expects the full year's revenue to be around $1.65 billion, in line with analysts' estimates. It made a non-GAAP loss of $0.34 per share, down from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy Sonos? Find out by accessing our full research report, it's free.

Sonos (SONO) Q1 CY2024 Highlights:

- Revenue: $252.7 million vs analyst estimates of $247.4 million (2.1% beat)

- EPS (non-GAAP): -$0.34 vs analyst expectations of -$0.25 (36% miss)

- The company reconfirmed its revenue guidance for the full year of $1.65 billion at the midpoint

- Gross Margin (GAAP): 44.3%, up from 43.3% in the same quarter last year

- Free Cash Flow was -$121.4 million, down from $269.3 million in the previous quarter

- Market Capitalization: $2.21 billion

“Thanks to the hard work of our team, and the strength of our brand and product portfolio, we delivered results that slightly exceeded our expectations in our second quarter despite the challenging environment,” Sonos CEO Patrick Spence commented.

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

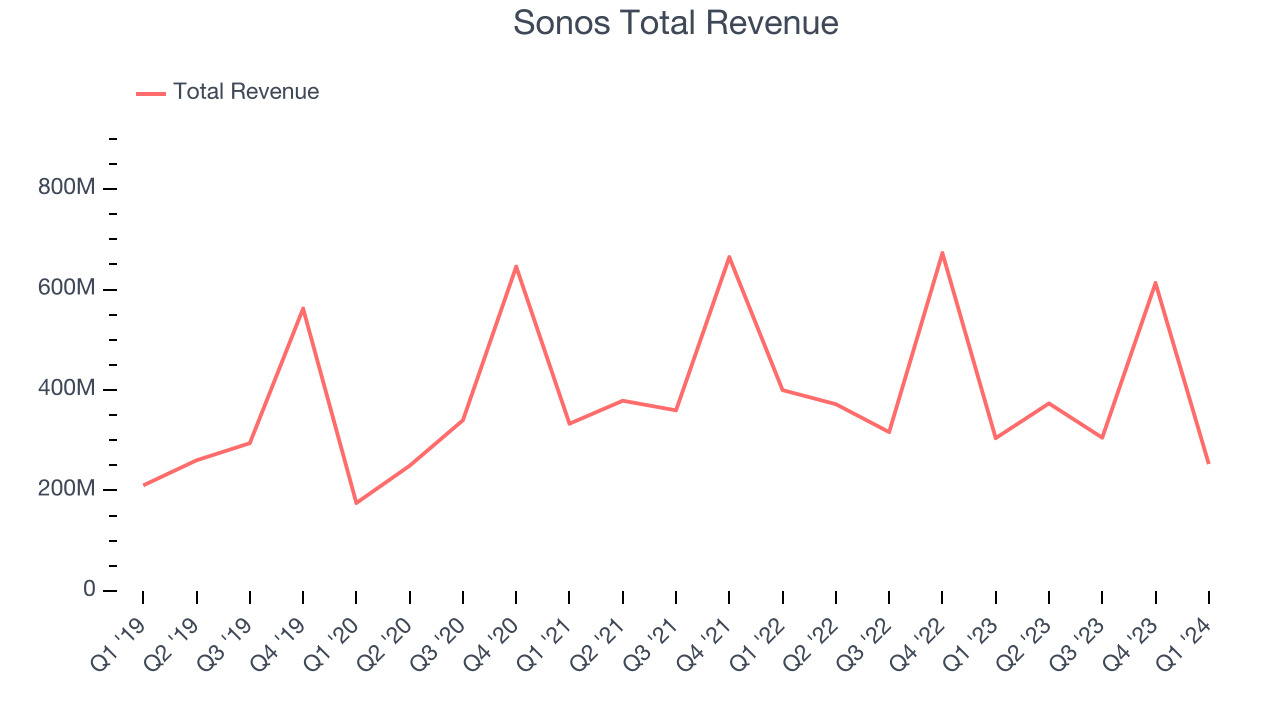

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Sonos's annualized revenue growth rate of 5.4% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Sonos's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 7.4% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Sonos's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 7.4% over the last two years.

This quarter, Sonos's revenue fell 16.9% year on year to $252.7 million but beat Wall Street's estimates by 2.1%. Looking ahead, Wall Street expects sales to grow 12.3% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

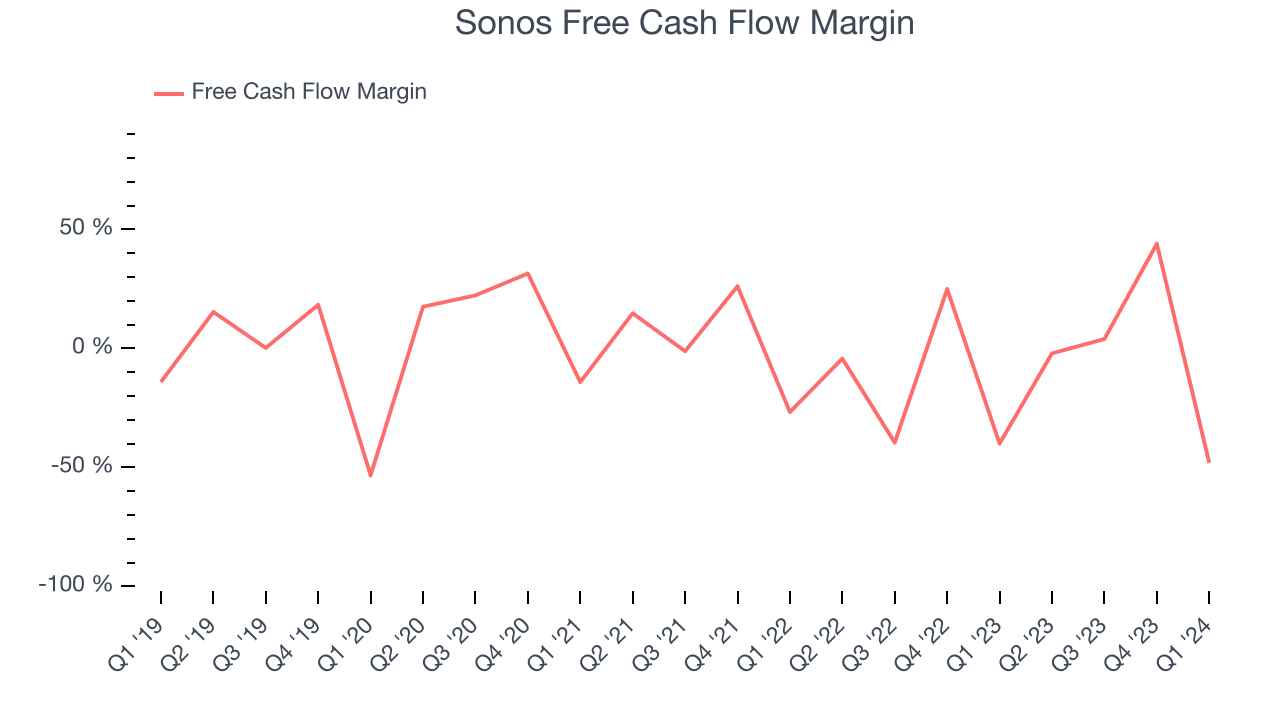

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Sonos has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.8%, subpar for a consumer discretionary business.

Sonos burned through $121.4 million of cash in Q1, equivalent to a negative 48.1% margin and in line with its cash burn last year. Over the next year, analysts predict Sonos's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 9.9% will decrease to 6%.

Key Takeaways from Sonos's Q1 Results

It was good to see Sonos beat analysts' revenue expectations this quarter. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, the results could have been better. The company is down 6.1% on the results and currently trades at $16.5 per share.

Sonos may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.