Audio technology Sonos company (NASDAQ:SONO) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 6.4% year on year to $397.1 million. It made a non-GAAP profit of $0.23 per share, improving from its profit of $0.17 per share in the same quarter last year.

Is now the time to buy Sonos? Find out by accessing our full research report, it's free.

Sonos (SONO) Q2 CY2024 Highlights:

- Revenue: $397.1 million vs analyst estimates of $391.2 million (1.5% beat)

- EPS (non-GAAP): $0.23 vs analyst estimates of $0.17 (35.3% beat)

- Gross Margin (GAAP): 48.3%, up from 46% in the same quarter last year

- EBITDA Margin: 12.3%, up from 9.2% in the same quarter last year

- Free Cash Flow of $40.27 million is up from -$121.4 million in the previous quarter

- Market Capitalization: $1.53 billion

“Thanks to Ace, our long-awaited entry into headphones, we reported year over year revenue growth and delivered results that slightly exceeded our expectations in our third quarter,” Sonos CEO Patrick Spence commented.

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

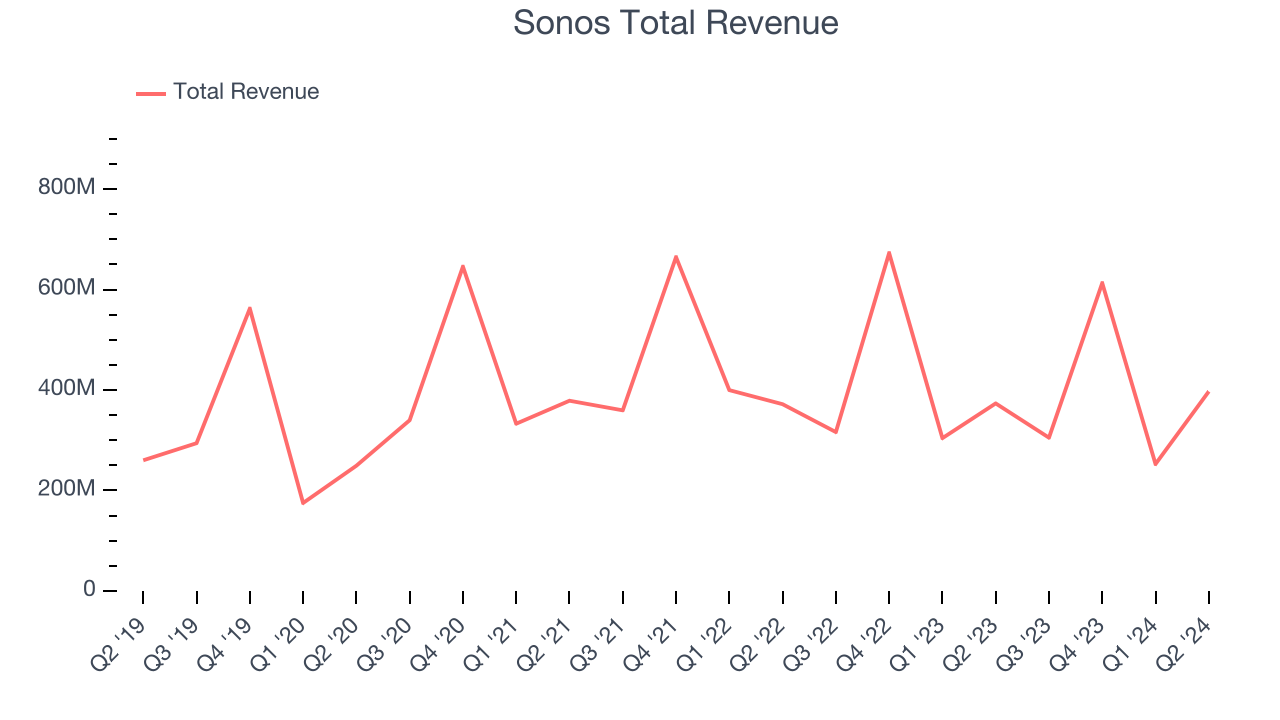

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Sonos grew its sales at a weak 4.8% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Sonos's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.6% annually.

This quarter, Sonos reported solid year-on-year revenue growth of 6.4%, and its $397.1 million of revenue outperformed Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects sales to grow 11.4% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

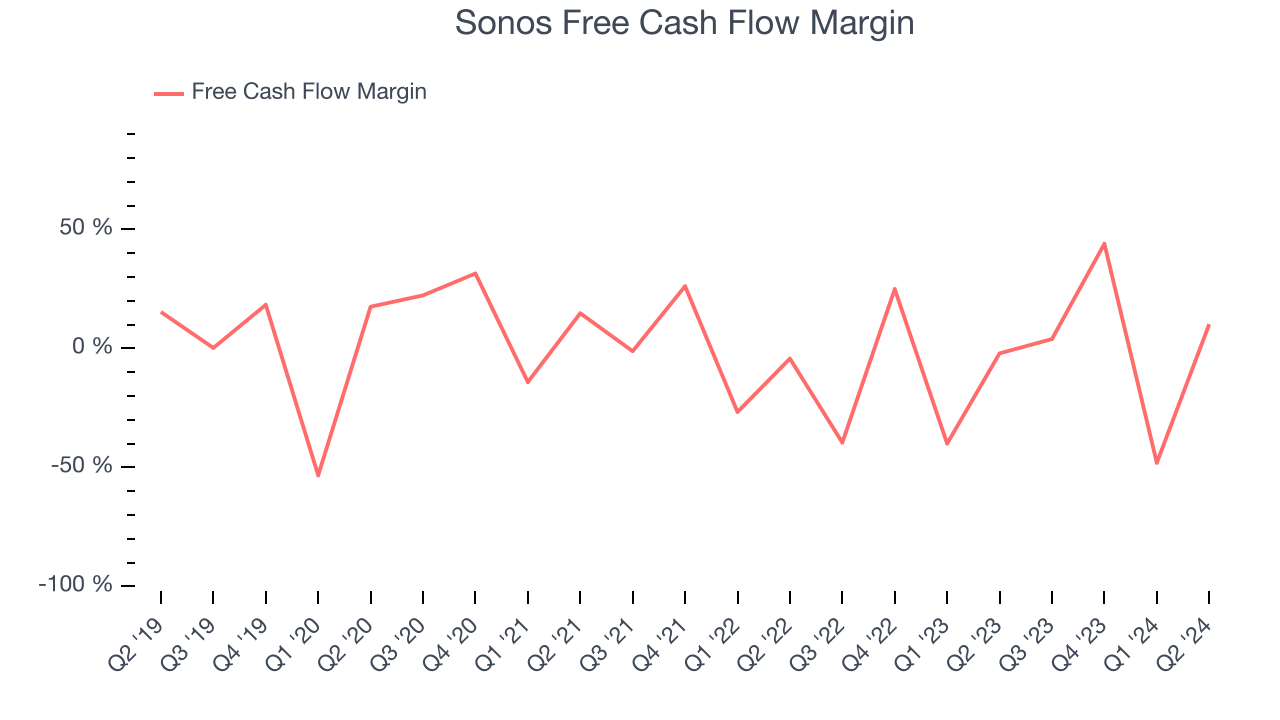

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Sonos has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, lousy for a consumer discretionary business.

Sonos's free cash flow clocked in at $40.27 million in Q2, equivalent to a 10.1% margin. This quarter's result was nice as its cash flow turned positive after being negative in the same quarter last year, but we wouldn't read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Sonos's cash conversion will fall. Their consensus estimates imply its free cash flow margin of 12.8% for the last 12 months will decrease to 5.8%.

Key Takeaways from Sonos's Q2 Results

We were impressed by how significantly Sonos blew past analysts' EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. Zooming out, we think this quarter featured some important positives. The market seemed to focus on the negatives, and the stock traded down 7.6% to $11.06 immediately after reporting.

So should you invest in Sonos right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.