Audio technology Sonos company (NASDAQ:SONO) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue down 16.9% year on year to $252.7 million. The company expects the full year's revenue to be around $1.65 billion, in line with analysts' estimates. It made a non-GAAP loss of $0.34 per share, down from its profit of $0.04 per share in the same quarter last year.

Sonos (SONO) Q1 CY2024 Highlights:

- Revenue: $252.7 million vs analyst estimates of $247.4 million (2.1% beat)

- EPS (non-GAAP): -$0.34 vs analyst expectations of -$0.25 (36% miss)

- The company reconfirmed its revenue guidance for the full year of $1.65 billion at the midpoint

- Gross Margin (GAAP): 44.3%, up from 43.3% in the same quarter last year

- Free Cash Flow was -$121.4 million, down from $269.3 million in the previous quarter

- Market Capitalization: $2.21 billion

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Each of the company's smart speakers, soundbars, and home theater equipment products emphasize superior sound quality, sleek design, and user-friendly technology.

The company's products are engineered to work seamlessly together, allowing users to create a customized audio environment in their homes. This approach enables customers to play music synchronously in multiple rooms or different tracks in each room, all controlled through the Sonos mobile app. The app integrates a variety of music streaming services, providing users access to a vast library of music and other audio content.

The company invests heavily in research and development to increase its audio performance. One such technology the company has patented is Trueplay, which tunes speakers to the specific acoustics of the room they are in, ensuring optimal sound quality.

Sonos’s design aesthetic is a critical aspect of its brand identity. The company's speakers and audio equipment feature a modern, minimalist design, making them a stylish addition to any home. This design-centric philosophy extends to the digital world as Sonos's app has garnered positive reviews for its intuitive interface and ease of use.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sonos's primary competitors include Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Samsung (KRX: 005930), and private company Bose.Sales Growth

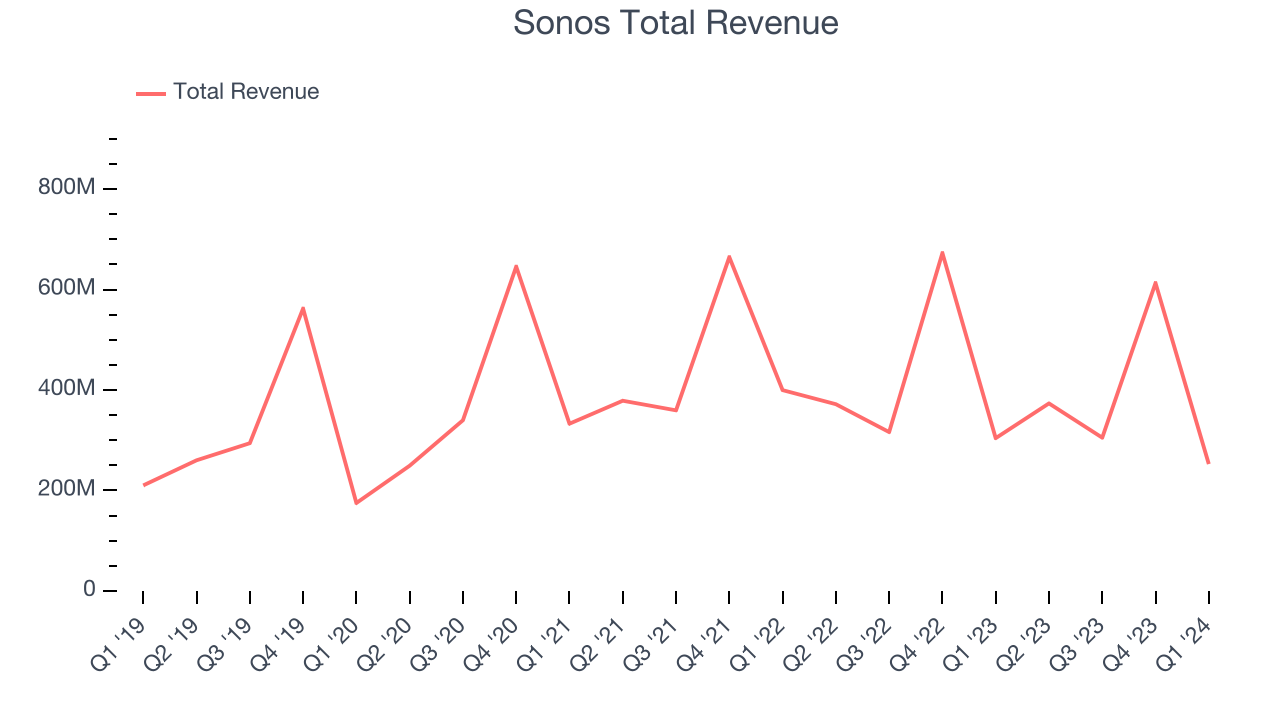

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Sonos's annualized revenue growth rate of 5.4% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Sonos's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 7.4% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Sonos's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 7.4% over the last two years.

This quarter, Sonos's revenue fell 16.9% year on year to $252.7 million but beat Wall Street's estimates by 2.1%. Looking ahead, Wall Street expects sales to grow 12.3% over the next 12 months, an acceleration from this quarter.

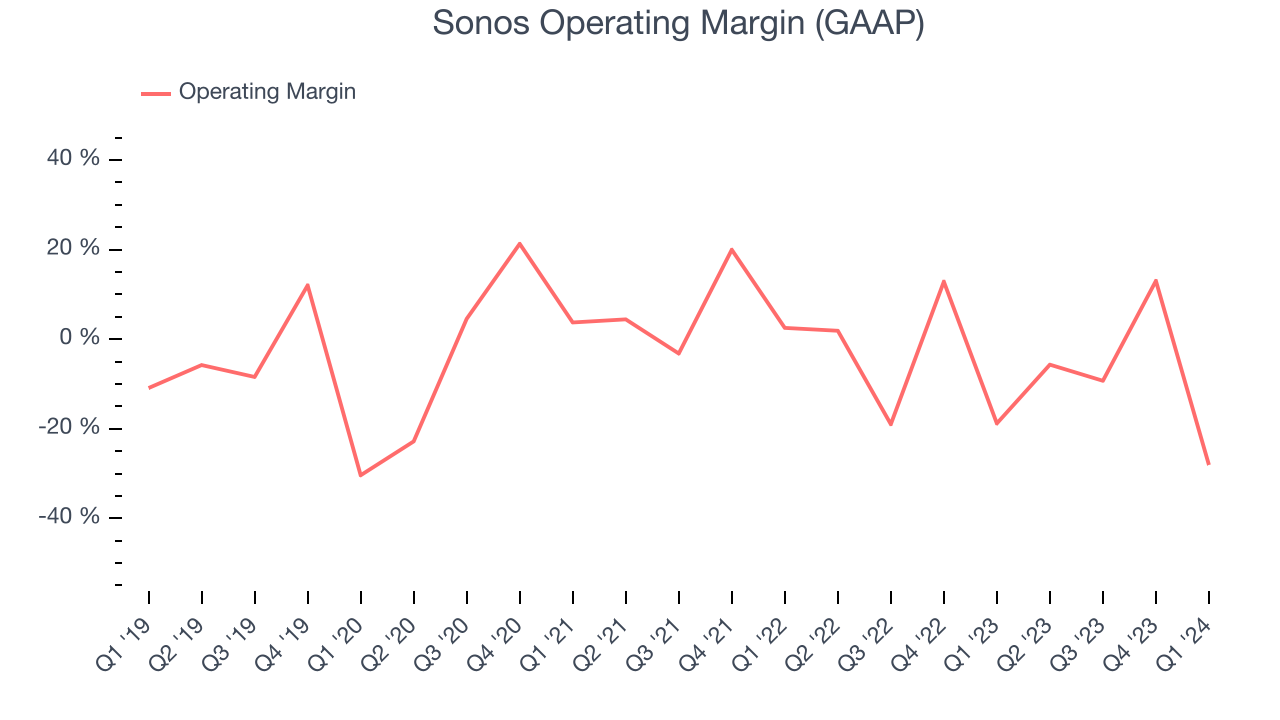

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Sonos's high expenses have contributed to an average operating margin of negative 2%.

This quarter, Sonos generated an operating profit margin of negative 28.1%, down 9.3 percentage points year on year.

Over the next 12 months, Wall Street expects Sonos to become profitable. Analysts are expecting the company’s LTM operating margin of negative 2.6% to rise to positive 7%.EPS

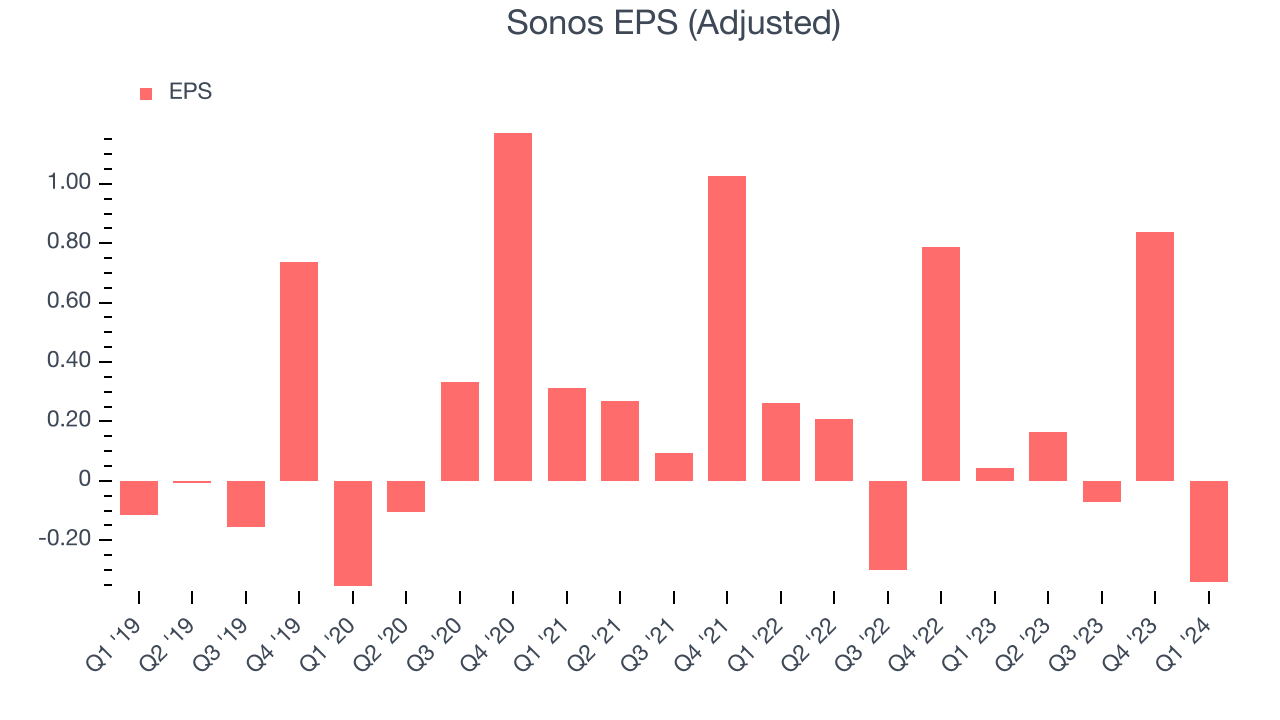

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Sonos's EPS grew 80.5%, translating into a decent 12.5% compounded annual growth rate.

In Q1, Sonos reported EPS at negative $0.34, down from $0.04 in the same quarter last year. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Sonos to grow its earnings. Analysts are projecting its LTM EPS of $0.59 to climb by 61.5% to $0.96.

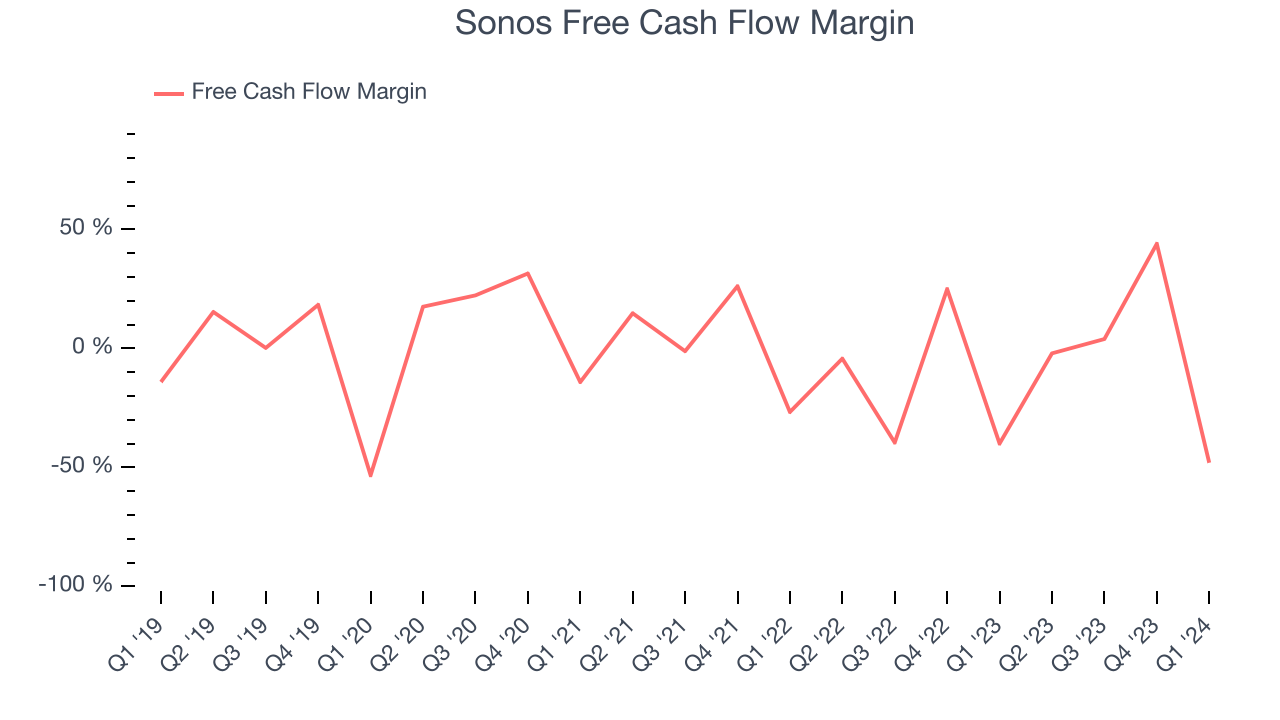

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Sonos has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.8%, subpar for a consumer discretionary business.

Sonos burned through $121.4 million of cash in Q1, equivalent to a negative 48.1% margin and in line with its cash burn last year. Over the next year, analysts predict Sonos's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 9.9% will decrease to 6%.

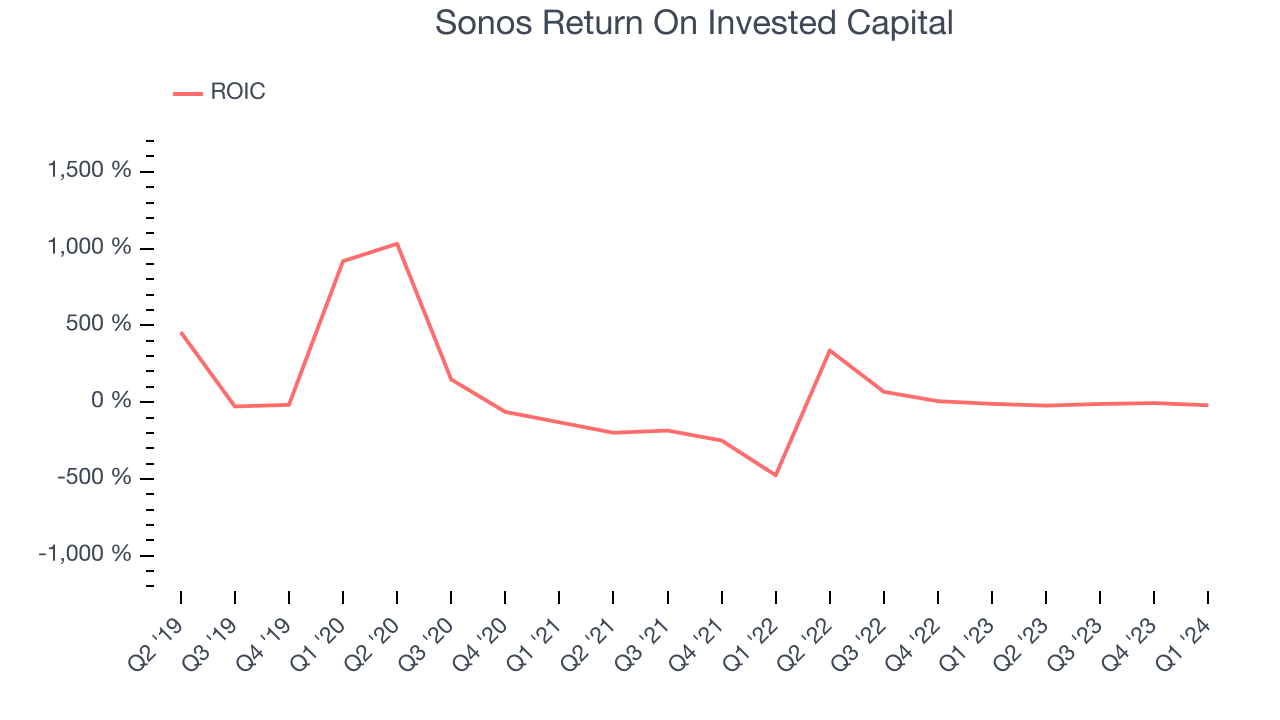

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Sonos's five-year average return on invested capital was negative 15.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Sonos is a well-capitalized company with $291.6 million of cash and $51.98 million of debt, meaning it could pay back all its debt tomorrow and still have $239.6 million of cash on its balance sheet. This net cash position gives Sonos the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Sonos's Q1 Results

It was good to see Sonos beat analysts' revenue expectations this quarter. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Sonos. The company is down 6.1% on the results and currently trades at $16.5 per share.

Is Now The Time?

Sonos may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Sonos, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. On top of that, its operating margins reveal poor profitability compared to other consumer discretionary companies.

Sonos's price-to-earnings ratio based on the next 12 months is 18.4x. While we've no doubt one can find things to like about Sonos, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $23.80 per share right before these results (compared to the current share price of $16.50).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.