Social media management software company Sprout (NASDAQ:SPT) announced better-than-expected results in the Q1 FY2021 quarter, with revenue up 33.6% year on year to $40.8 million. Sprout Social made a GAAP loss of $6.36 million, improving on its loss of $10.4 million, in the same quarter last year.

Sprout Social (NASDAQ:SPT) Q1 FY2021 Highlights:

- Revenue: $40.8 million vs analyst estimates of $39.7 million (2.74% beat)

- EPS (non-GAAP): -$0.05 vs analyst estimates of -$0.10

- Revenue guidance for Q2 2021 is $43 million at the midpoint, above analyst estimates of $41.3 million

- The company lifted revenue guidance for the full year, from $172 million to $176 million at the midpoint, a 2.31% increase

- Free cash flow of $3.44 million, up from negative free cash flow of -$1.98 million in previous quarter

- Customers: 28,122, up from 26,718 in previous quarter

- Gross Margin (GAAP): 75.5%, up from 74.2% previous quarter

“Our growth rate is continuing to accelerate, reinforcing confidence in our strategy, our opportunity and the investments we’re making in our future,” said Justyn Howard, Sprout Social’s CEO and co-founder. “Social sits at the center of digital strategy for the next evolution of business. During Q1, we added a record number of net-new customers and generated positive free cash flow for the first time. We’re making aggressive investments behind growth and momentum in our business that has never been stronger.”

Putting A Consumer Platform To Business Use

Sprout Social was co-founded by Justyn Howard and Aaron Rankin in 2010. Howard, who never attended college, was inspired to create Sprout because in his position as an enterprise software salesman he could see that companies were not taking full advantage of social media, in part because it wasn’t easy to manage multiple social media accounts. Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Like most social media management platforms, Sprout Social allows companies to measure engagement, sort and schedule posts. However, the real value to larger companies is in their Analytics and Listening products, which allow companies to derive insights for product development, measure customer sentiment, monitor competitor traction and improve paid advertising return on investment.

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software like Sprout Social, and competitors like Hootsuite, become more valuable to their customers, suggesting that demand for their software will grow.

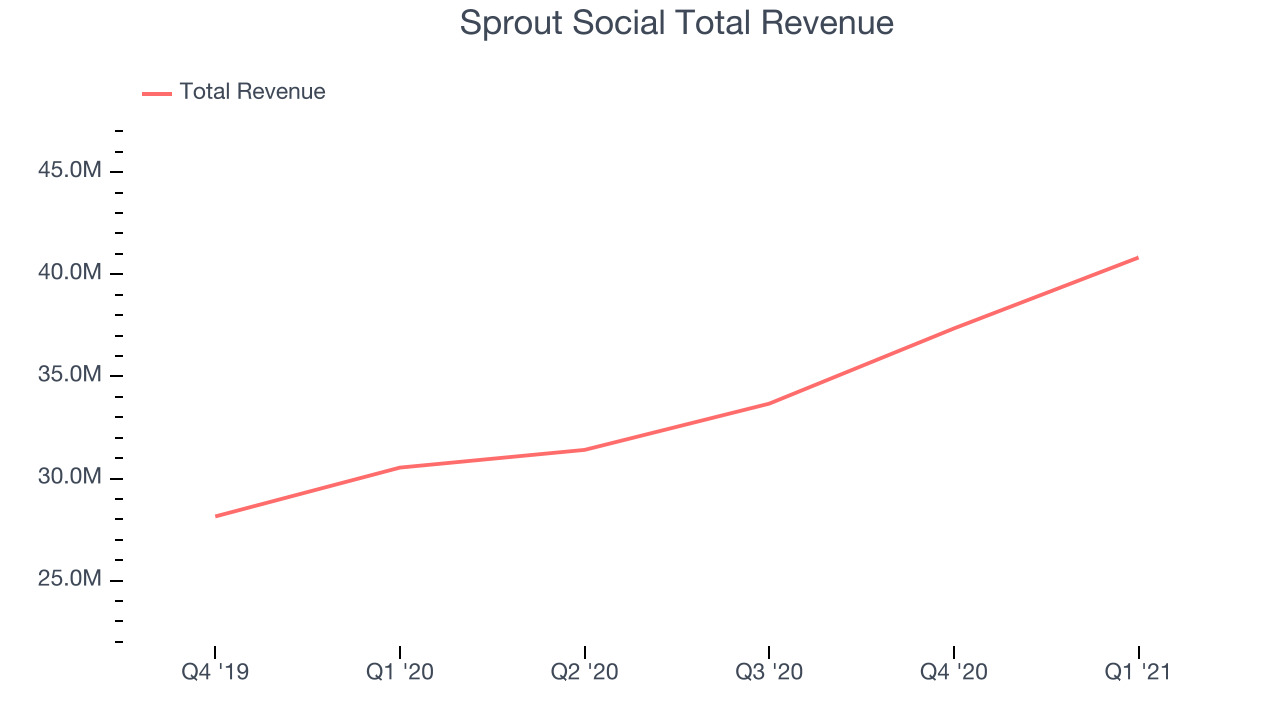

As you can see below, Sprout Social's revenue growth has been very strong over the last twelve months, growing from $30.5 million to $40.8 million.

And unsurprisingly, this was another great quarter for Sprout Social with revenue up an absolutely stunning 33.6% year on year. Quarter on quarter the revenue increased by $3.47 million in Q1, which was in line with Q4 2020. This steady quarter-on-quarter growth shows the company is able to maintain a strong growth trajectory.

Increasing Access To Social Media Data Mining

One of Sprout Social’s strengths is that its product led marketing strategy allows all customers to use the software for free, and a single premium user is reasonably affordable, making it possible for small businesses to use the software. However, the company can create more value, and thus profit, from larger businesses that make use of premium features.

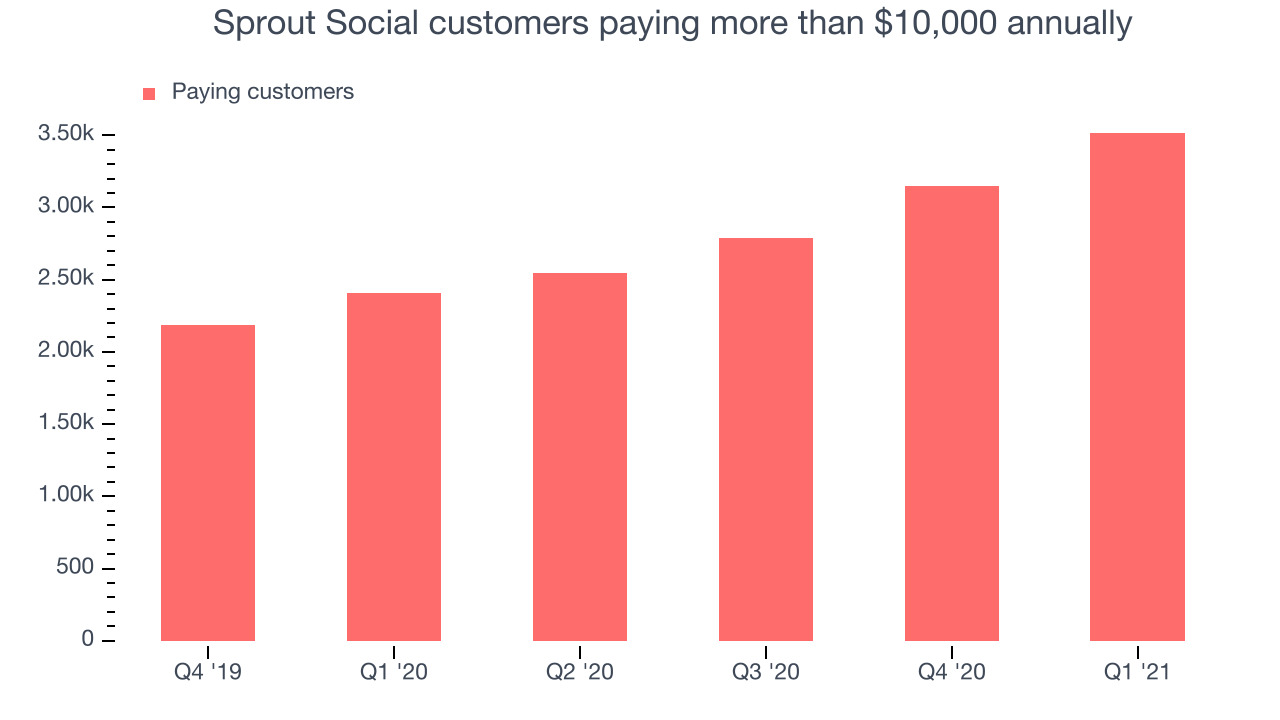

Given that many of Sprout's customers pay very little, we track how many customers are spending more than $10,000 per year to observe how many clients are getting more significant value from the platform. This number should benefit both from Sprout winning larger customers as its reputation grows, but also as smaller customers flourish and increase their spending.

You can see below that at the end of the quarter Sprout Social reported 3,514 enterprise customers paying more than $10,000 annually, an increase of 365 on last quarter. That's in line with the number of contracts wins in the last quarter and quite a bit again above what we have typically seen over the last year, confirming the company is sustaining a good pace of sales.

Key Takeaways from Sprout Social's Q1 Results

With market capitalisation of $3.51 billion Sprout Social is among smaller companies, but its more than $102 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We were impressed by the very optimistic revenue guidance Sprout Social provided for the next quarter. And we were also excited to see the really strong revenue growth. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. Therefore, we think Sprout Social will look more attractive to growth investors after these results.

PS. Have you noticed we published this analysis in less than 300 seconds since Sprout Social made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.