The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the sales and marketing software stocks have fared in Q1, starting with Sprout Social (NASDAQ:SPT).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a weak Q1; on average, revenues beat analyst consensus estimates by 2.49%, while on average next quarter revenue guidance was 0.04% under consensus. Tech stocks have had a rocky start in 2022 and while some of the sales and marketing software stocks have fared somewhat better, they have not been spared, with share price declining 10.4% since earnings, on average.

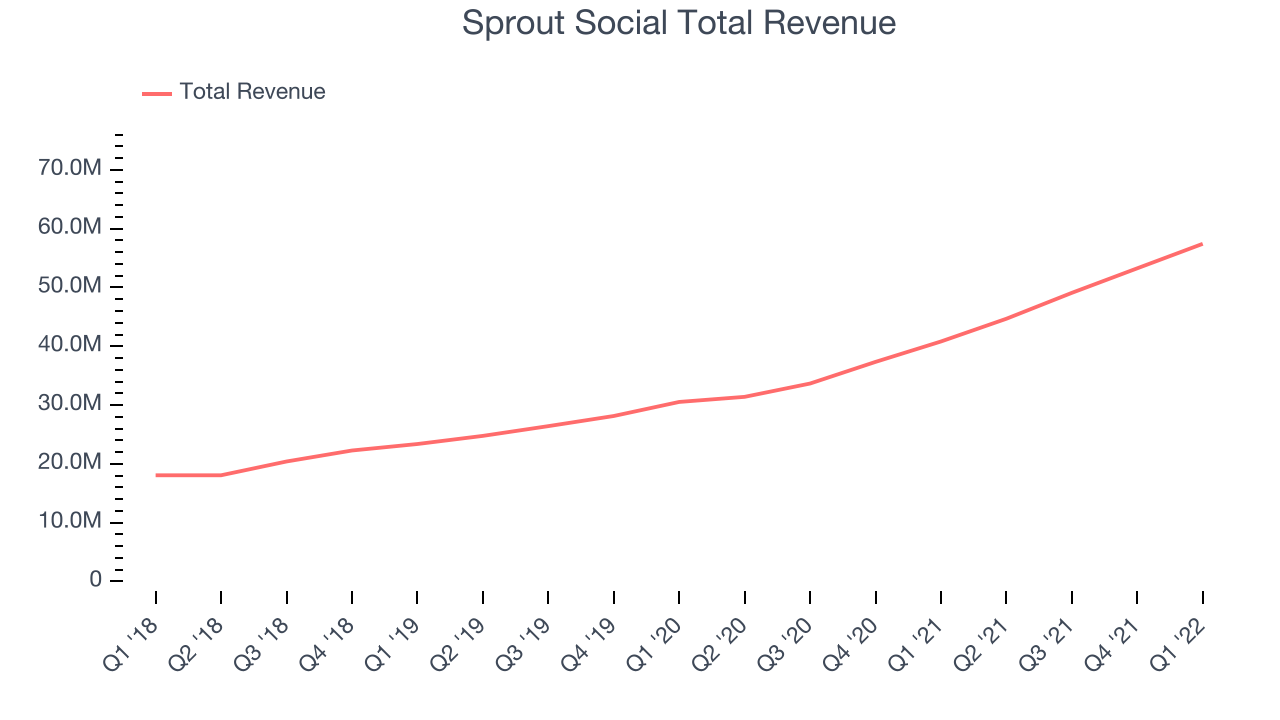

Sprout Social (NASDAQ:SPT)

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Sprout Social reported revenues of $57.4 million, up 40.6% year on year, beating analyst expectations by 2.07%. It was a solid quarter for the company, with an exceptional revenue growth and a strong sales guidance for the next quarter.

“2022 is off to a great start and we believe it's shaping up to be a transformative year for our company,” said Justyn Howard, Sprout Social’s CEO and co-founder.

The stock is down 14.8% since the results and currently trades at $53.38.

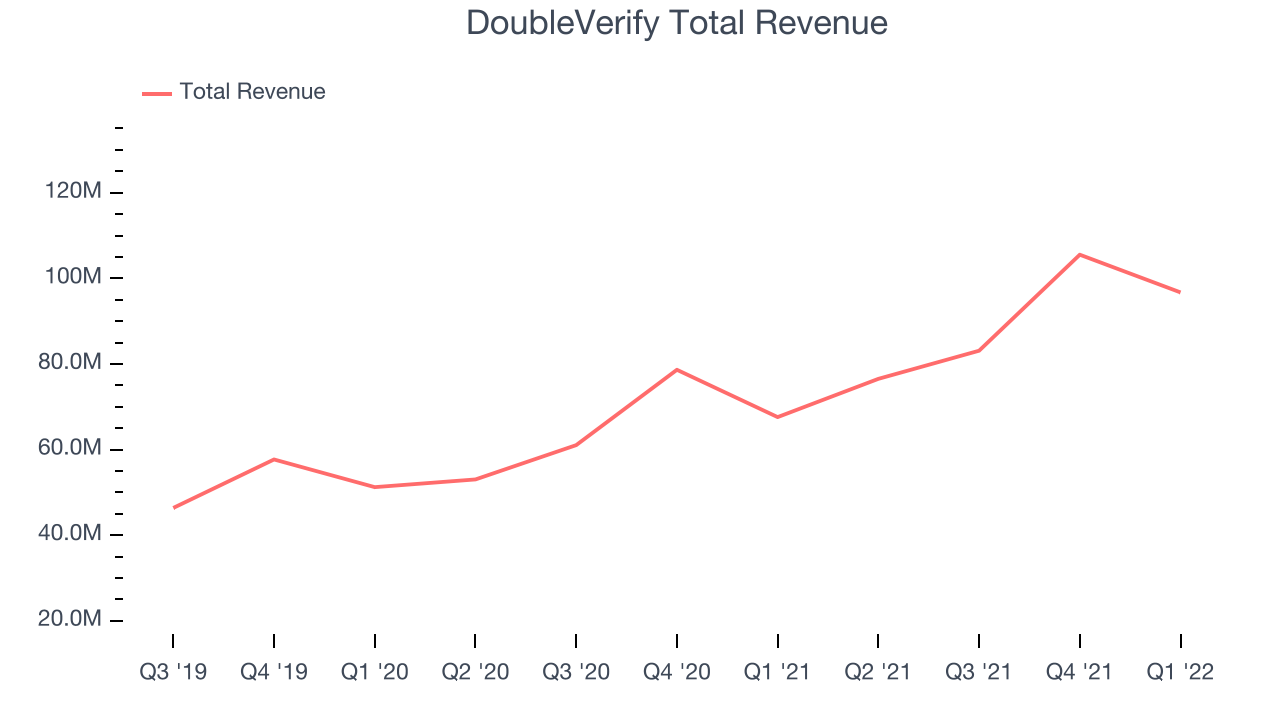

Best Q1: DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $96.7 million, up 43.1% year on year, beating analyst expectations by 7.58%. It was a very strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

DoubleVerify achieved the strongest analyst estimates beat among its peers. The stock is up 24.9% since the results and currently trades at $22.83.

Is now the time to buy DoubleVerify? Access our full analysis of the earnings results here, it's free.

Weakest Q1: ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $48.4 million, down 3.21% year on year, beating analyst expectations by 1.88%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations and a slow revenue growth.

ON24 had the slowest revenue growth and weakest full year guidance update in the group. The stock is down 12.1% since the results and currently trades at $9.46.

Read our full analysis of ON24's results here.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium sized businesses.

Freshworks reported revenues of $114.6 million, up 42.2% year on year, beating analyst expectations by 5.91%. It was a very strong quarter for the company, with an exceptional revenue growth.

The company added 825 enterprise customers paying more than $5,000 annually to a total of 15,639. The stock is down 28.6% since the results and currently trades at $12.12.

Read our full, actionable report on Freshworks here, it's free.

The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place and target their online ads.

The Trade Desk reported revenues of $315.3 million, up 43.4% year on year, beating analyst expectations by 3.63%. It was a mixed quarter for the company, with an exceptional revenue growth but a decline in gross margin.

The stock is down 0.94% since the results and currently trades at $43.33.

Read our full, actionable report on The Trade Desk here, it's free.

The author has no position in any of the stocks mentioned