As sales and marketing software stocks’ Q4 earnings season wraps, let's dig into this quarter's best and worst performers, including Sprout Social (NASDAQ:SPT) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 26 sales and marketing software stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.76%, while on average next quarter revenue guidance was 1.09% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but sales and marketing software stocks held their ground better than others, with the share prices up 4.1% since the previous earnings results, on average.

Sprout Social (NASDAQ:SPT)

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

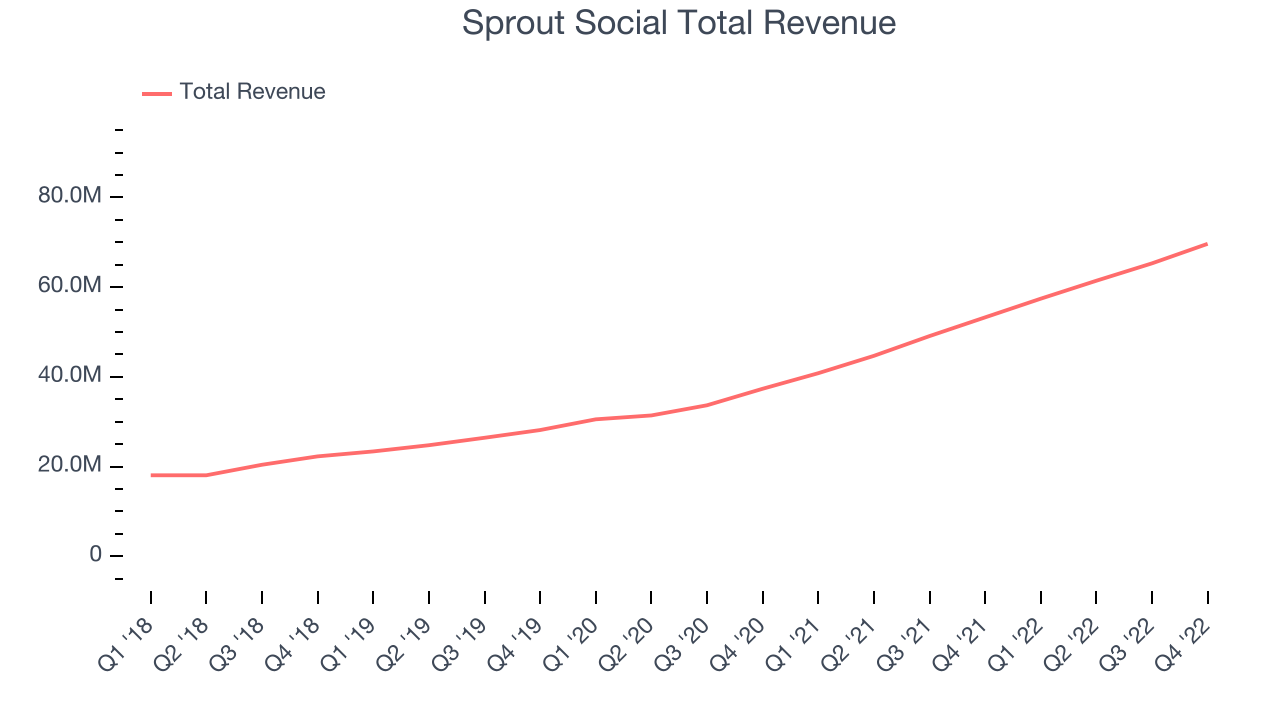

Sprout Social reported revenues of $69.7 million, up 30.8% year on year, missing analyst expectations by 0.29%. It was a mixed quarter for the company, with strong top line growth but decelerating customer growth.

“We are pleased with another exceptional quarter, anchored by record net new ARR, which we believe sets the foundation for accelerating ARR growth in 2023,” said Justyn Howard, Sprout Social’s CEO and co-founder.

The stock is down 11.9% since the results and currently trades at $51.67.

Is now the time to buy Sprout Social? Access our full analysis of the earnings results here, it's free.

Best Q4: Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.73 billion, up 25.7% year on year, beating analyst expectations by 5.11%. It was a strong quarter for the company, with a decent beat of analyst estimates and solid revenue growth.

The stock is down 13.1% since the results and currently trades at $46.37.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it's free.

Weakest Q4: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $72.4 million, up 11.6% year on year, missing analyst expectations by 1.24%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

The stock is down 27.8% since the results and currently trades at $8.19.

Read our full analysis of BigCommerce's results here.

GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.04 billion, up 2.02% year on year, missing analyst expectations by 0.31%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is down 5.26% since the results and currently trades at $76.78.

Read our full, actionable report on GoDaddy here, it's free.

LiveRamp (NYSE:RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) provides software as a service that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $158.6 million, up 12.8% year on year, in line with analyst expectations. It was a weak quarter for the company, with a decline in net revenue retention rate and decelerating customer growth.

The company added 2 enterprise customers paying more than $1m annually to a total of 94. The stock is down 14.8% since the results and currently trades at $23.19.

Read our full, actionable report on LiveRamp here, it's free.

The author has no position in any of the stocks mentioned