Social media management software company Sprout (NASDAQ:SPT) missed analysts' expectations in Q1 CY2024, with revenue up 28.7% year on year to $96.78 million. Next quarter's revenue guidance of $98.55 million also underwhelmed, coming in 2.9% below analysts' estimates. It made a non-GAAP profit of $0.10 per share, improving from its profit of $0.06 per share in the same quarter last year.

Sprout Social (SPT) Q1 CY2024 Highlights:

- Revenue: $96.78 million vs analyst estimates of $97.32 million (small miss)

- EPS (non-GAAP): $0.10 vs analyst estimates of $0.01 ($0.09 beat)

- Revenue Guidance for Q2 CY2024 is $98.55 million at the midpoint, below analyst estimates of $101.5 million

- The company dropped its revenue guidance for the full year from $425.4 million to $405.5 million at the midpoint, a 4.7% decrease

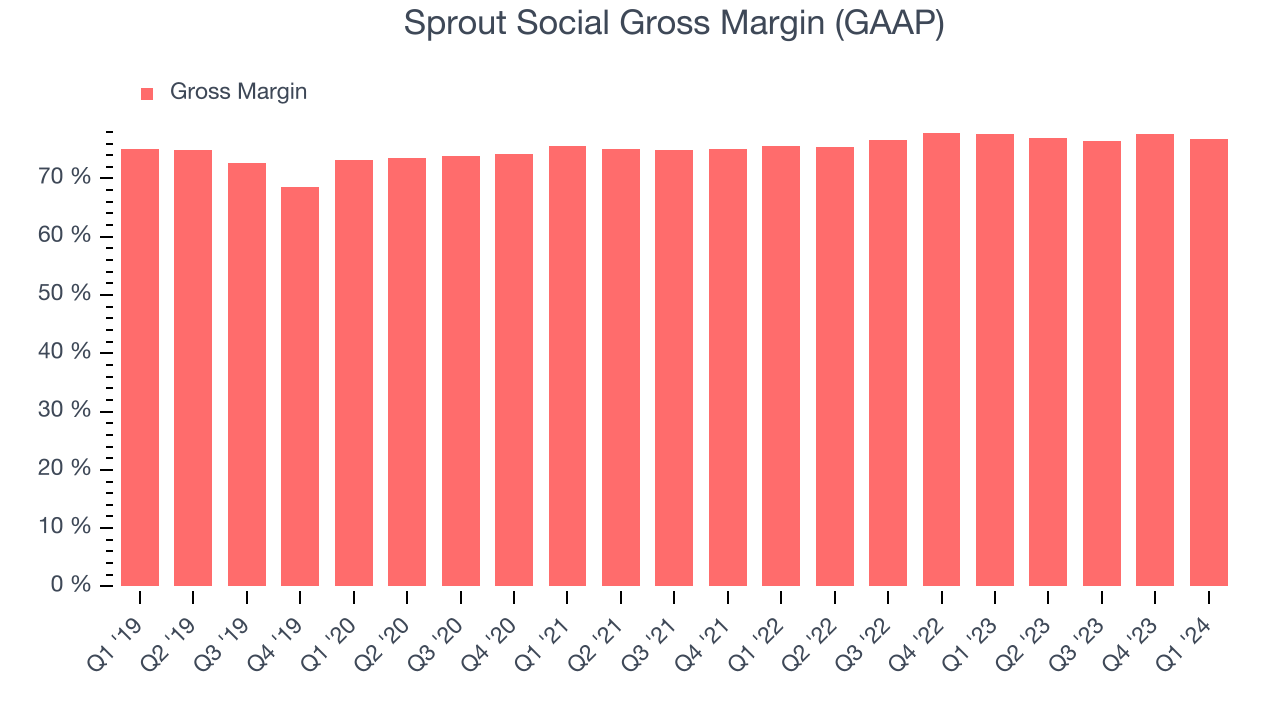

- Gross Margin (GAAP): 76.8%, in line with the same quarter last year

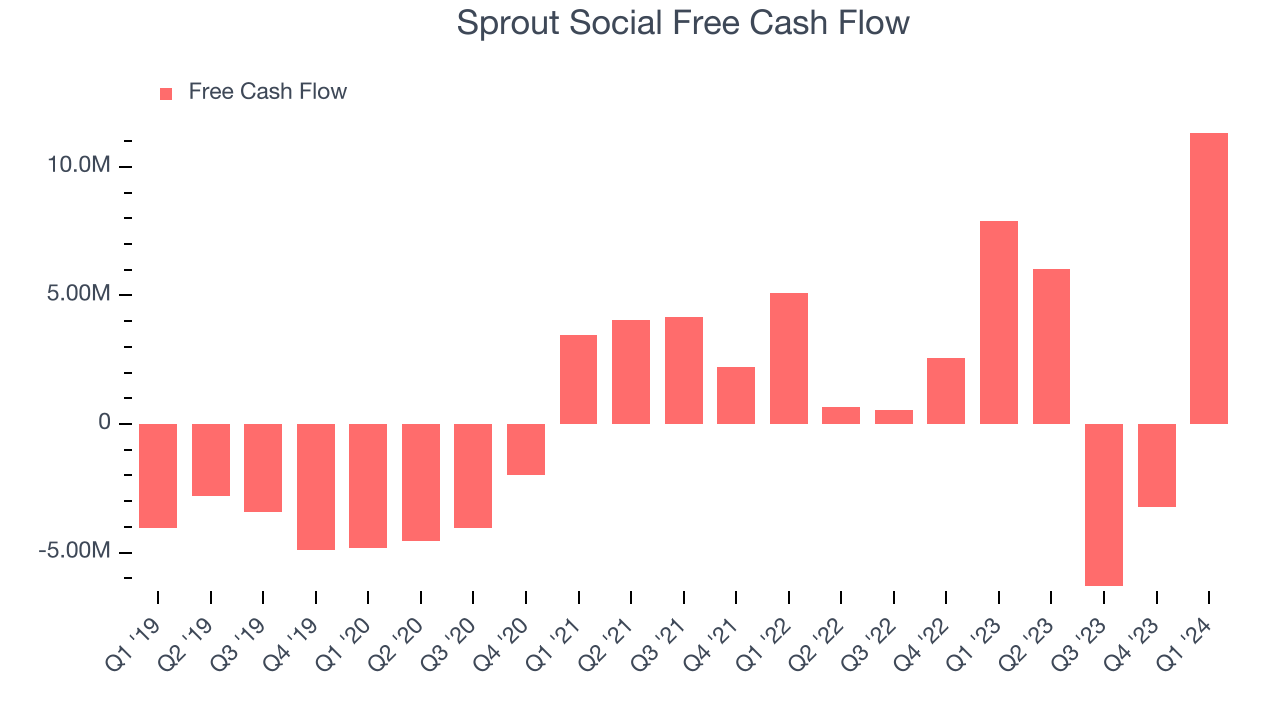

- Free Cash Flow of $11.33 million is up from -$3.23 million in the previous quarter

- Market Capitalization: $2.82 billion

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Howard, who never attended college, was inspired to create Sprout because, in his position as an enterprise software salesman, he could see that companies were not taking full advantage of social media, in part because it wasn’t easy to manage multiple social media accounts.

Like most social media management platforms, Sprout Social allows companies to measure engagement, sort and schedule posts. However, the real value to larger companies is in their Analytics and Listening products, which allow companies to derive insights for product development, measure customer sentiment, monitor competitor traction and improve paid advertising return on investment.

Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Sprout Social competes with companies such as Hootsuite, Sprinklr (NYSE:CXM), and Salesforce Social Studio.

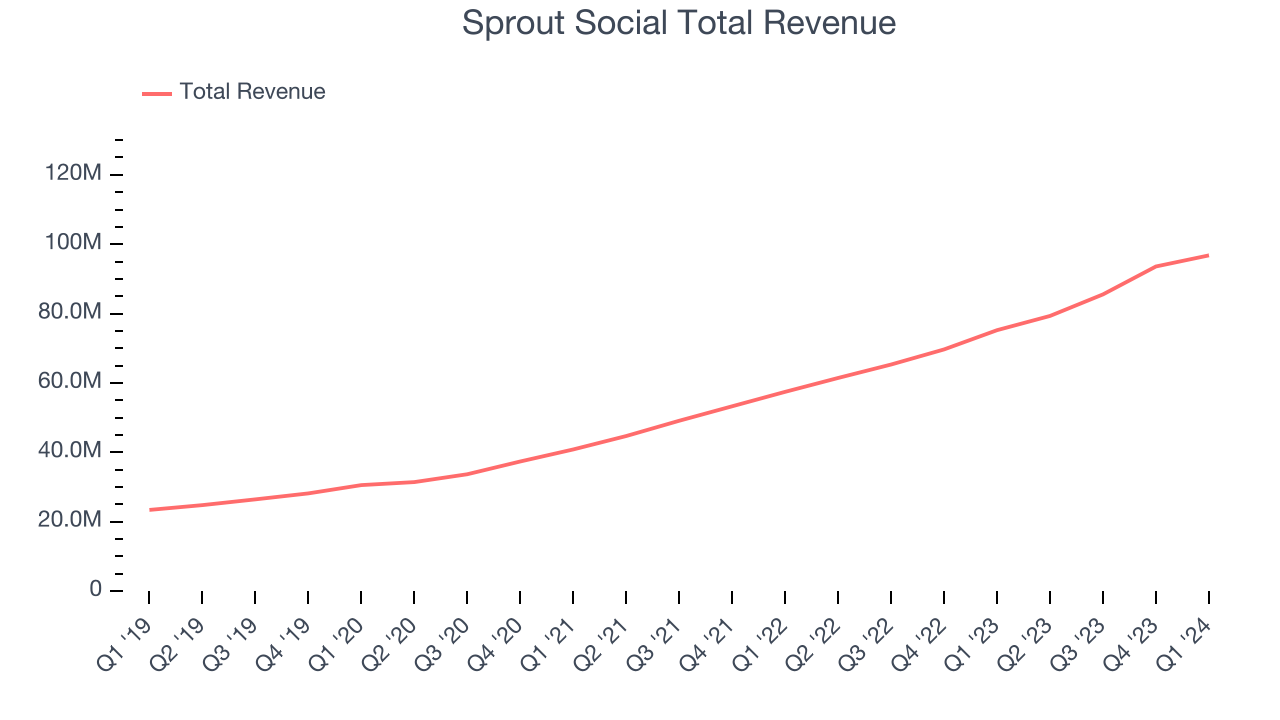

Sales Growth

As you can see below, Sprout Social's revenue growth has been very strong over the last three years, growing from $40.82 million in Q1 2021 to $96.78 million this quarter.

Even though Sprout Social fell short of analysts' revenue estimates, its quarterly revenue still grew a very solid 28.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $3.2 million in Q1 compared to $8.05 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Sprout Social is expecting revenue to grow 24.3% year on year to $98.55 million, slowing down from the 29.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 27.2% over the next 12 months before the earnings results announcement.

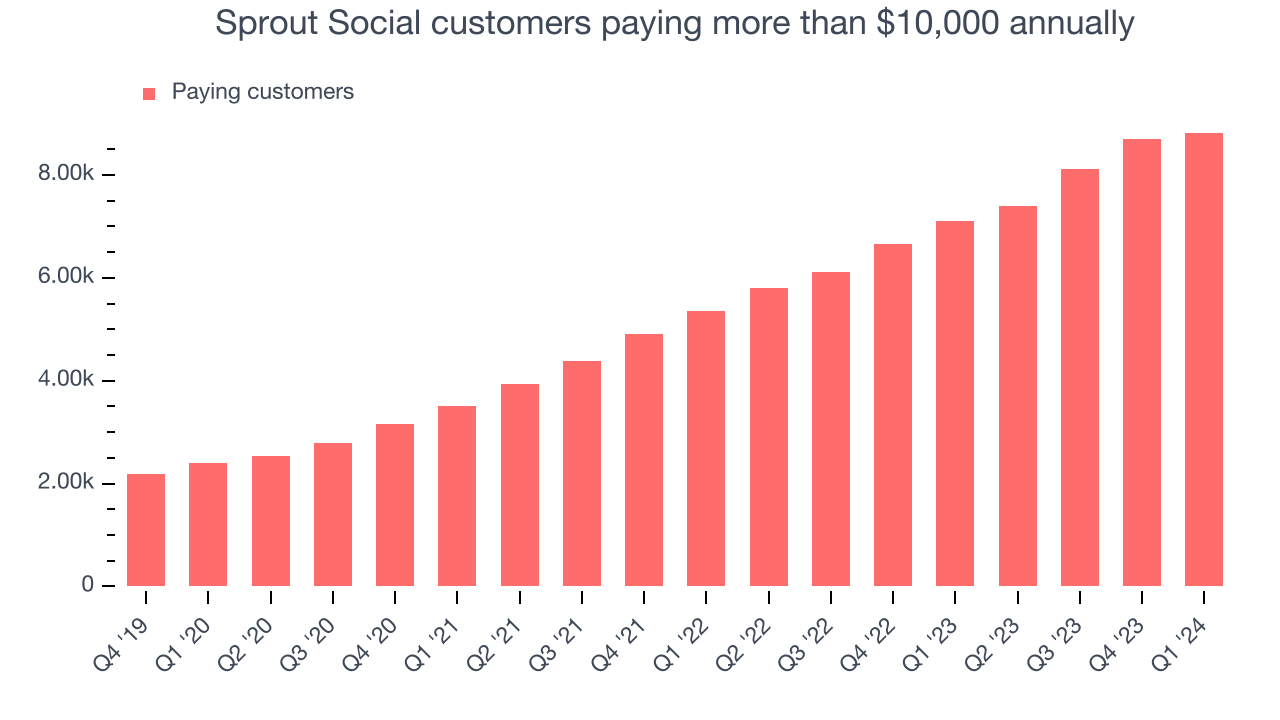

Large Customers Growth

This quarter, Sprout Social reported 8,823 enterprise customers paying more than $10,000 annually, an increase of 134 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Sprout Social's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 76.8% in Q1.

That means that for every $1 in revenue the company had $0.77 left to spend on developing new products, sales and marketing, and general administrative overhead. Sprout Social's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Sprout Social is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Sprout Social's free cash flow came in at $11.33 million in Q1, up 43.4% year on year.

Sprout Social has generated $7.81 million in free cash flow over the last 12 months, or 2.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Sprout Social's Q1 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance was below expectations and it announced a CEO succession plan. Overall, this was a bad quarter for Sprout Social. The company is down 24.7% on the results and currently trades at $36.25 per share.

Is Now The Time?

Sprout Social may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Sprout Social is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. And while its low free cash flow margins give it little breathing room, the good news is its strong gross margins suggest it can operate profitably and sustainably. On top of that, its efficient customer acquisition is better than many similar companies.

The market is certainly expecting long-term growth from Sprout Social given its price-to-sales ratio based on the next 12 months is 6.0x. But looking at the tech landscape today, Sprout Social's qualities really stand out. We are big fans at this price, even more so when considering the company is trading at a discount to its similar-growth peers.

Wall Street analysts covering the company had a one-year price target of $73 right before these results (compared to the current share price of $36.25), implying they see short-term upside potential in Sprout Social.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.