Outdoor specialty retailer Sportsman's Warehouse (NASDAQ:SPWH) fell short of analysts' expectations in Q4 CY2023, with revenue down 2.3% year on year to $370.4 million. The company's full-year revenue guidance of $1.19 billion at the midpoint also came in 6.7% below analysts' estimates. It made a non-GAAP loss of $0.20 per share, down from its profit of $0.49 per share in the same quarter last year.

Sportsman's Warehouse (SPWH) Q4 CY2023 Highlights:

- Revenue: $370.4 million vs analyst estimates of $372.6 million (0.6% miss)

- EPS (non-GAAP): -$0.20 vs analyst estimates of -$0.30

- Management's revenue guidance for the upcoming financial year 2024 is $1.19 billion at the midpoint, missing analyst estimates by 6.7% and implying -7.6% growth (vs -8.3% in CY2023)

- Gross Margin (GAAP): 26.8%, down from 32.4% in the same quarter last year

- Free Cash Flow of $60.18 million, up from $7.25 million in the same quarter last year

- Same-Store Sales were down 12.8% year on year

- Market Capitalization: $107.4 million

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ:SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

The company was founded in 1986 and its extensive selection encompasses everything from fishing rods and camping tents to firearms and apparel designed to withstand rugged environments.

Sportsman’s Warehouse views itself as not only a retailer but also a central pillar of the outdoor community. The company often hosts workshops, seminars, and events that provide insights into outdoor activities, gear maintenance, and safety practices.

Consistent with this theme, each store is designed to promote community building and acts as a hub for like-minded individuals to gather, exchange stories, and share their love for the outdoors. The stores feature spacious layouts that showcase a wide array of products, making it easy for customers to explore and discover the right gear for their specific interests.

Sportsman's Warehouse also staffs its stores with knowledgeable associates, often experienced outdoor enthusiasts themselves, to offer personalized recommendations, answer questions, and share insights to help customers make informed decisions.

Whether customers are seasoned outdoor veterans or newcomers looking to explore the natural world, Sportsman's Warehouse Holdings offers a comprehensive selection of products and resources to elevate their outdoor experiences.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Retailers offering sporting and outdoor goods include Academy Sports and Outdoor (NASDAQ:ASO), Camping World (NYSE:CWH), Dick’s Sporting Goods (NYSE:DKS), and Hibbett (NASDAQ:HIBB).Sales Growth

Sportsman's Warehouse is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

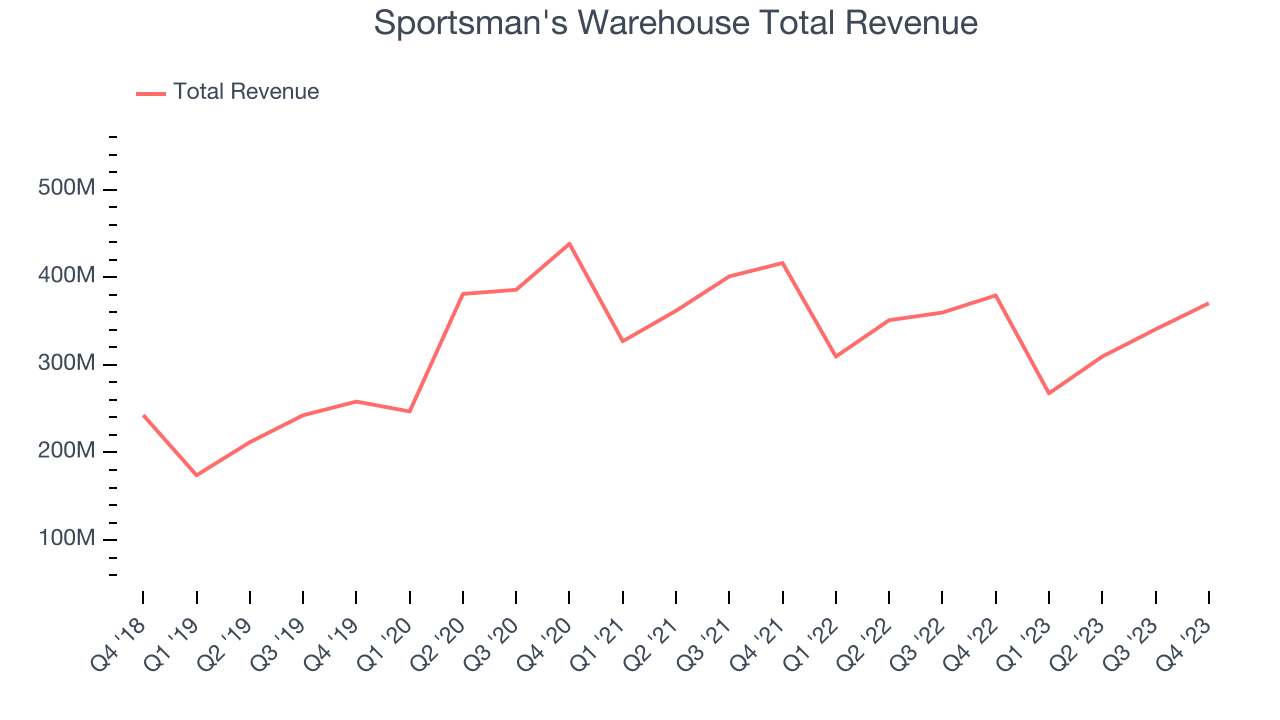

As you can see below, the company's annualized revenue growth rate of 9.8% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as it opened new stores and expanded its reach.

This quarter, Sportsman's Warehouse missed Wall Street's estimates and reported a rather uninspiring 2.3% year-on-year revenue decline, generating $370.4 million in revenue. Looking ahead, Wall Street expects revenue to decline 1% over the next 12 months.

Same-Store Sales

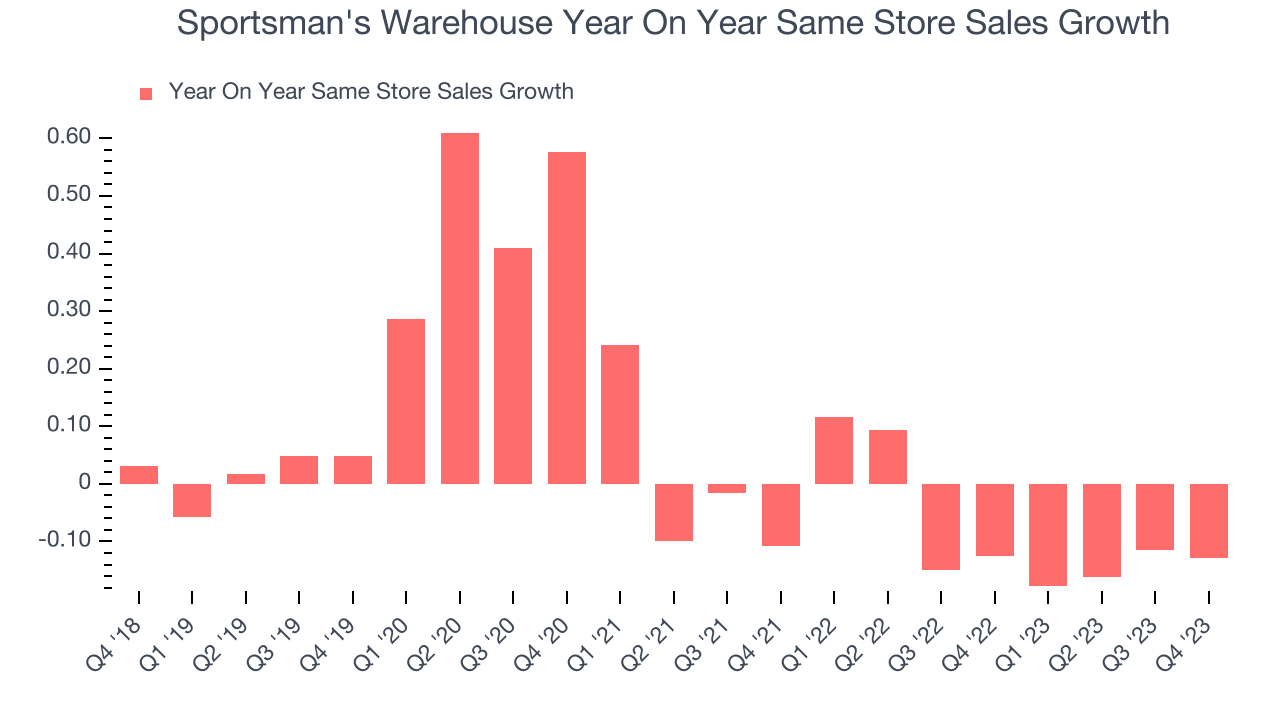

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Sportsman's Warehouse's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 8.1% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Sportsman's Warehouse's same-store sales fell 12.8% year on year. This performance was more or less in line with the same quarter last year.

Gross Margin & Pricing Power

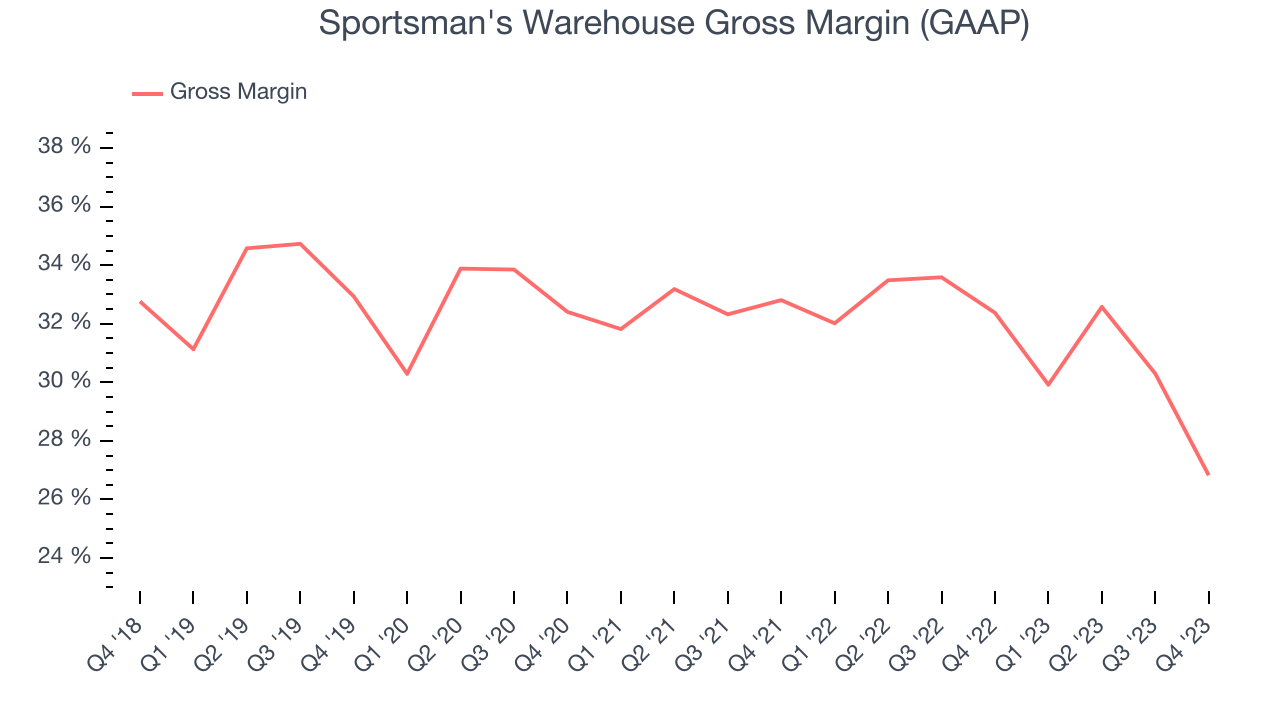

Sportsman's Warehouse has weak unit economics for a retailer, making it difficult to reinvest in the business. As you can see below, it's averaged a 31.4% gross margin over the last eight quarters. This means the company makes $0.31 for every $1 in revenue before accounting for its operating expenses.

Sportsman's Warehouse produced a 26.8% gross profit margin in Q4, marking a 5.5 percentage point decrease from 32.4% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

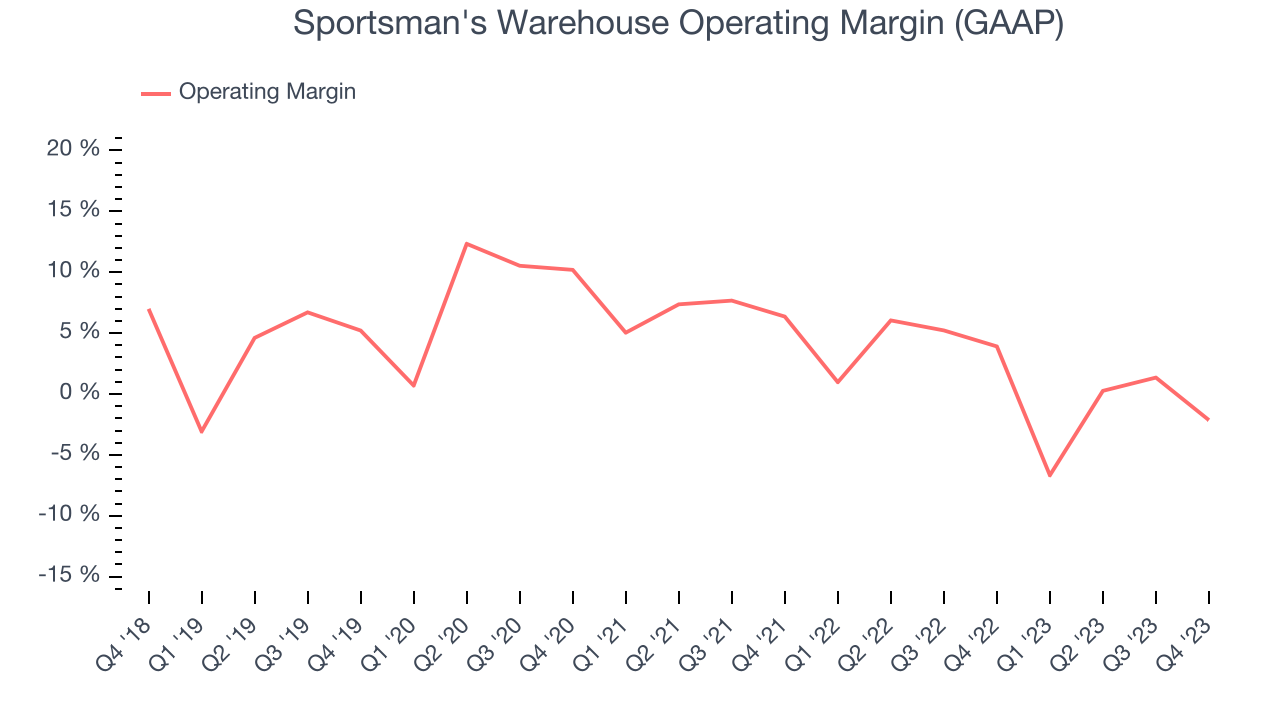

This quarter, Sportsman's Warehouse generated an operating profit margin of negative 2.1%, down 6.1 percentage points year on year. We can infer Sportsman's Warehouse was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Sportsman's Warehouse over the last eight quarters but held back by its large expense base. Its average operating margin of 1.4% has been among the worst in consumer retail. On top of that, Sportsman's Warehouse's margin has declined, on average, by 5.7 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Sportsman's Warehouse over the last eight quarters but held back by its large expense base. Its average operating margin of 1.4% has been among the worst in consumer retail. On top of that, Sportsman's Warehouse's margin has declined, on average, by 5.7 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

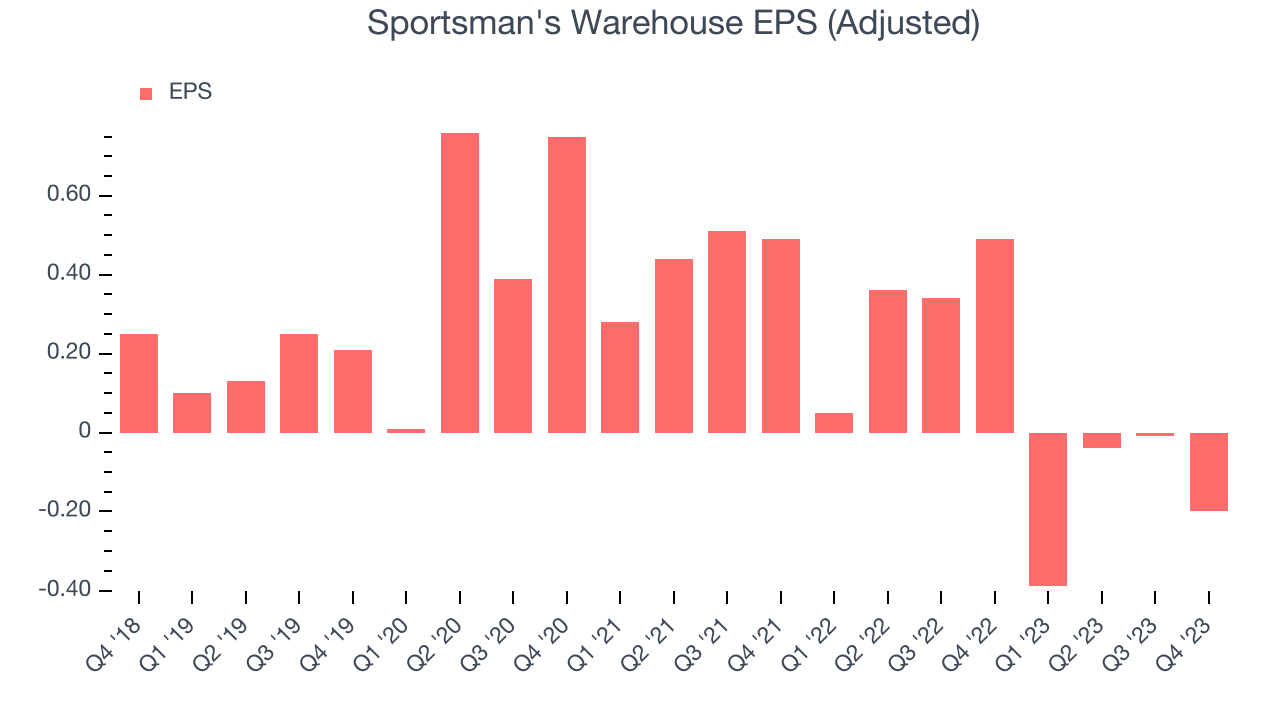

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Sportsman's Warehouse reported EPS at negative $0.20, down from $0.49 in the same quarter a year ago. This print beat Wall Street's estimates by 33.3%.

Between FY2019 and FY2023, Sportsman's Warehouse's adjusted diluted EPS dropped 77.1%, translating into 30.8% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 98.7% year-on-year increase in EPS.

Cash Is King

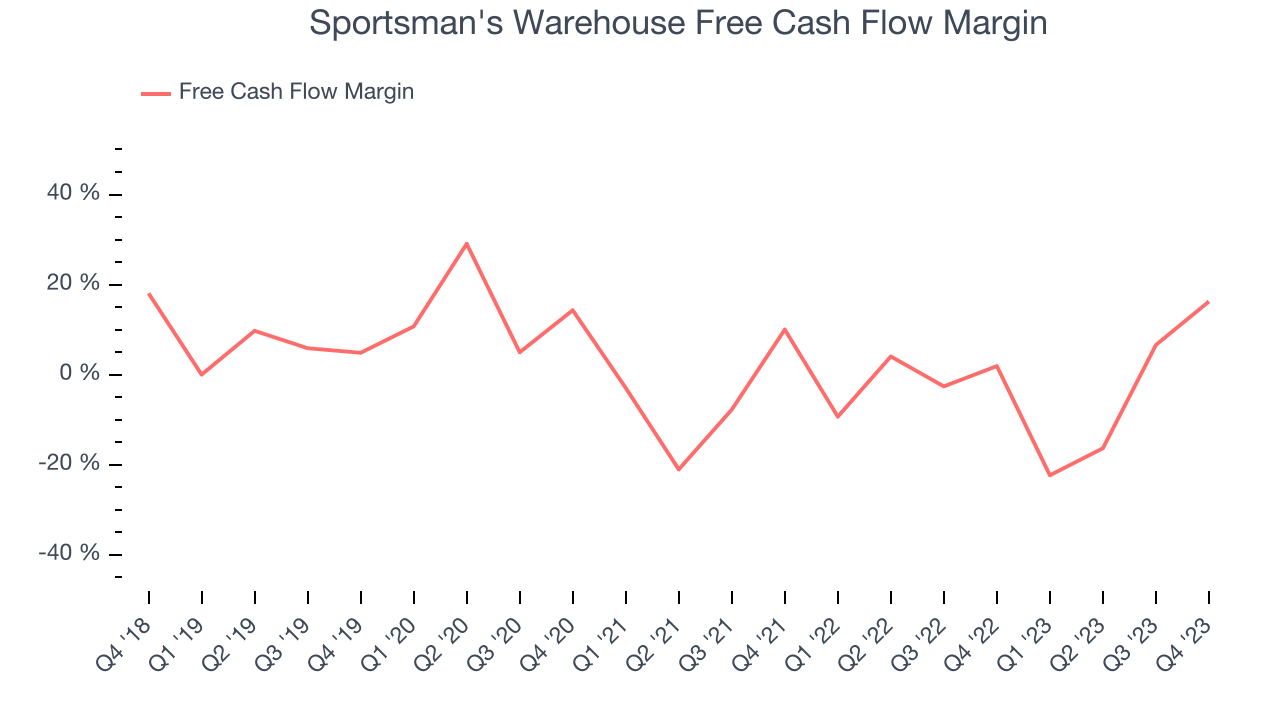

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Sportsman's Warehouse's free cash flow came in at $60.18 million in Q4, up 730% year on year. This result represents a 16.2% margin.

While Sportsman's Warehouse posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Sportsman's Warehouse's capital-intensive business model and large investments in new store buildouts have consumed many company resources. Its free cash flow margin has averaged negative 1.7%, weak for a consumer retail business. Investors are likely hoping for consistent free cash flow generation in the future.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Sportsman's Warehouse's five-year average ROIC was 10.4%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Sportsman's Warehouse's ROIC over the last two years averaged 14.3 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Sportsman's Warehouse's Q4 Results

We were impressed by how Sportsman's Warehouse blew past analysts' EPS expectations this quarter. We were also excited it reduced its excess inventory and outperformed Wall Street's free cash flow estimates. On the other hand, its revenue missed as same-store sales decreased 12.8% (vs an estimated 8% decrease). That decline was slightly offset by 15 new store openings.

Looking ahead, Sportsman's Warehouse expects its demand to remain troubled in 2024, but its forecasted EBITDA profitability was better than expected. Overall, this quarter's results still seemed fairly positive and shareholders should feel optimistic. The stock is up 2.4% after reporting and currently trades at $3.2 per share.

Is Now The Time?

Sportsman's Warehouse may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Sportsman's Warehouse, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last four years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last four years makes it hard to trust. On top of that, its shrinking same-store sales suggests it'll need to change its strategy to succeed.

While we've no doubt one can find things to like about Sportsman's Warehouse, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $5.13 per share right before these results (compared to the current share price of $3.20).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.