Let’s dig into the relative performance of Stericycle (NASDAQ:SRCL) and its peers as we unravel the now-completed Q1 waste management earnings season.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 9 waste management stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 1.9%.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

In light of this news, waste management stocks have held steady with share prices up 4.1% on average since the latest earnings results.

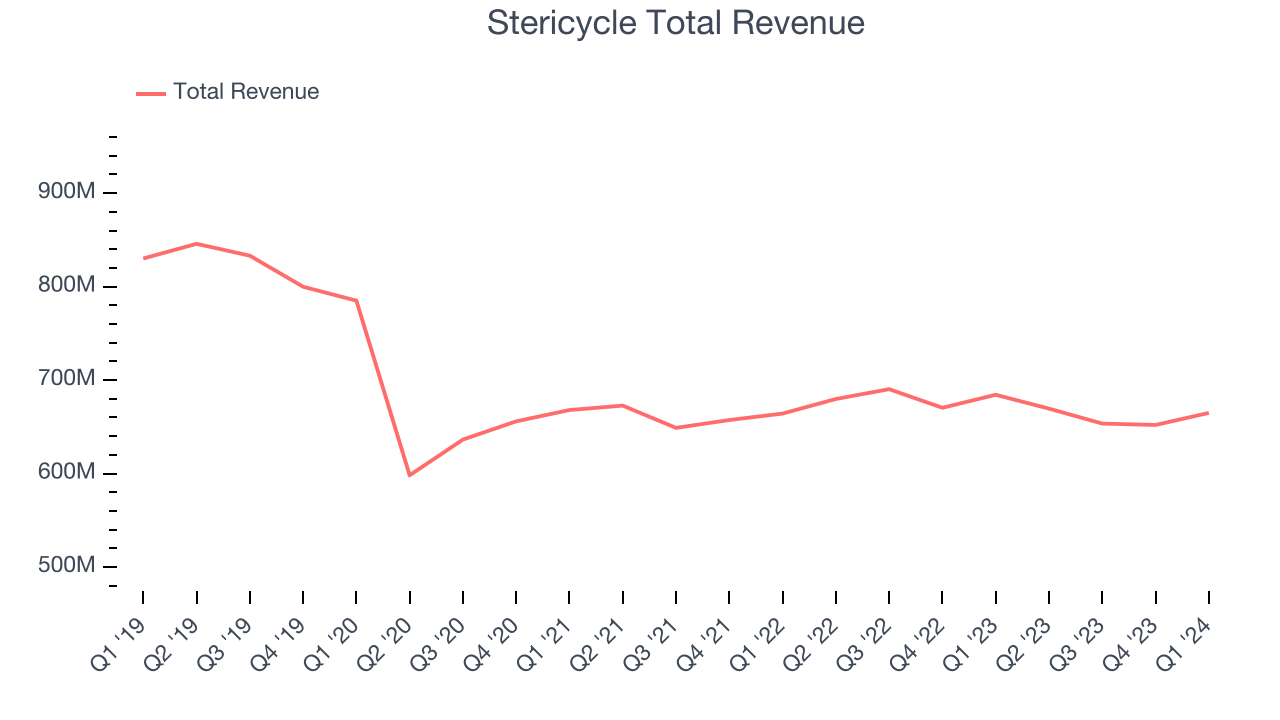

Stericycle (NASDAQ:SRCL)

Founded in 1989, Stericycle (NASDAQ:SRCL) provides waste disposal and sensitive information destruction services to healthcare organizations and other businesses.

Stericycle reported revenues of $664.9 million, down 2.8% year on year. This print fell short of analysts’ expectations by 1.7%. Overall, it was a slower quarter for the company with a miss of analysts’ organic revenue estimates.

“We are pleased with our first quarter results, which reflect improvement in adjusted EBITDA and adjusted EPS, driven by disciplined execution across our key priorities,” said Cindy J. Miller, President and Chief Executive Officer.

Interestingly, the stock is up 23.6% since reporting and currently trades at $61.66.

Read our full report on Stericycle here, it’s free.

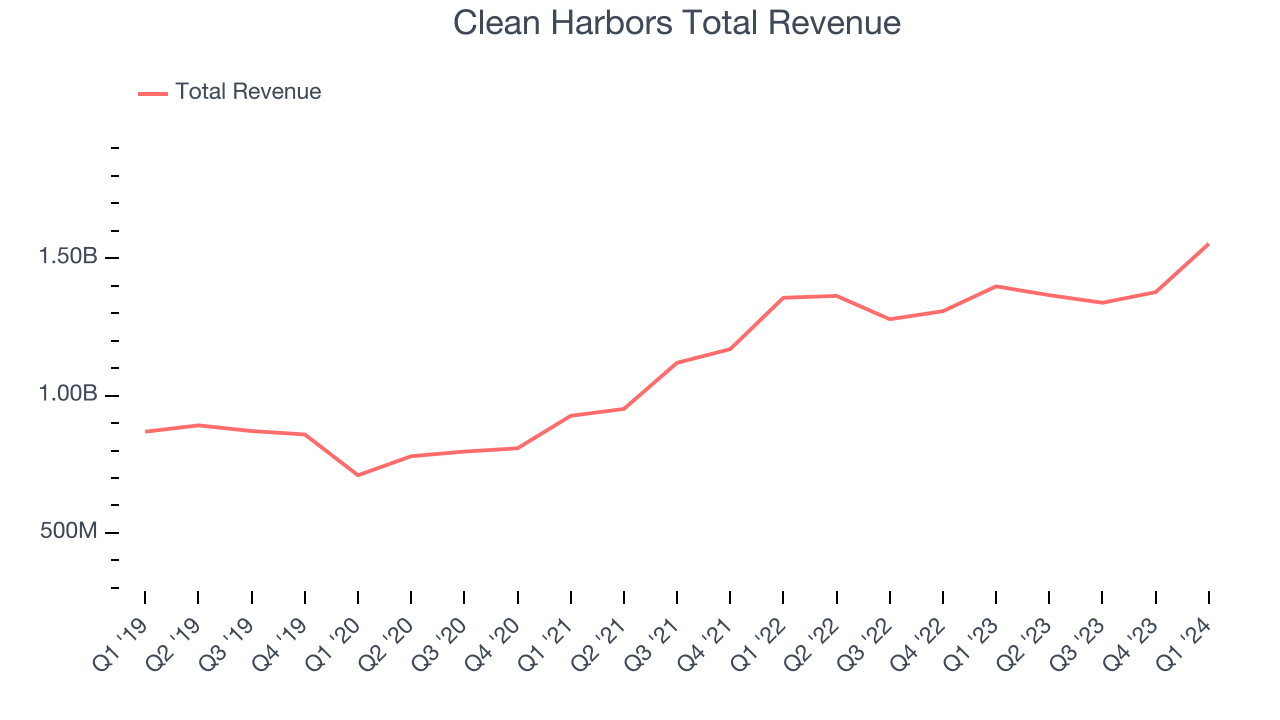

Best Q1: Clean Harbors (NYSE:CLH)

Established in 1980, Clean Harbors (NYSE:CLH) provides environmental and industrial services like hazardous and non-hazardous waste disposal and emergency spill cleanups.

Clean Harbors reported revenues of $1.55 billion, up 11.1% year on year, outperforming analysts’ expectations by 1.5%. The business had a very strong quarter with an impressive beat of analysts’ operating margin estimates and a decent beat of analysts’ earnings estimates.

Clean Harbors achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 10% since reporting. It currently trades at $246.88.

Is now the time to buy Clean Harbors? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Perma-Fix (NASDAQ:PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $13.99 million, down 44.1% year on year, falling short of analysts’ expectations by 12%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Perma-Fix delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 15.9% since the results and currently trades at $11.84.

Read our full analysis of Perma-Fix’s results here.

Waste Management (NYSE:WM)

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $5.40 billion, up 5.5% year on year. This number met analysts’ expectations. Aside from that, it was a slower quarter as it logged a miss of analysts’ earnings estimates.

The stock is down 5.9% since reporting and currently trades at $204.71.

Read our full, actionable report on Waste Management here, it’s free.

Quest Resource (NASDAQ:QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $73.15 million, down 1.8% year on year. This number lagged analysts' expectations by 4.6%. It was a disappointing quarter as it also logged a miss of analysts’ earnings estimates.

The stock is up 7.2% since reporting and currently trades at $8.94.

Read our full, actionable report on Quest Resource here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.