Media, broadcasting, and digital services company E.W. Scripps (NASDAQ:SSP) missed analysts' expectations in Q1 CY2024, with revenue up 6.4% year on year to $561.5 million. It made a GAAP loss of $0.15 per share, improving from its loss of $0.37 per share in the same quarter last year.

E.W. Scripps (SSP) Q1 CY2024 Highlights:

- Revenue: $561.5 million vs analyst estimates of $568.7 million (1.3% miss)

- EPS: -$0.15 vs analyst estimates of -$0.24 (37.5% beat)

- Gross Margin (GAAP): 15.5%, down from 41.6% in the same quarter last year

- Market Capitalization: $358 million

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ:SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

Edward Willis Scripps established the company in 1878 to provide accessible news to the public. Over the years, Scripps expanded from its newspaper roots into broadcasting and digital media, reflecting the evolving preferences of consumers.

E.W. Scripps manages numerous local TV stations and national networks, offering news, information, and entertainment. It has also ventured into the digital domain with various online platforms, catering to the contemporary demand for multi-platform media access. This expansion into digital media complements Scripps’ traditional broadcasting operations, addressing the diverse preferences of modern audiences.

The company's revenue sources include advertising, retransmission fees, and subscriptions.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the local television broadcasting and digital media sector include Nexstar Media (NASDAQ:NXST), Sinclair (NASDAQ:SBGI), and TEGNA (NYSE:TGNA).Sales Growth

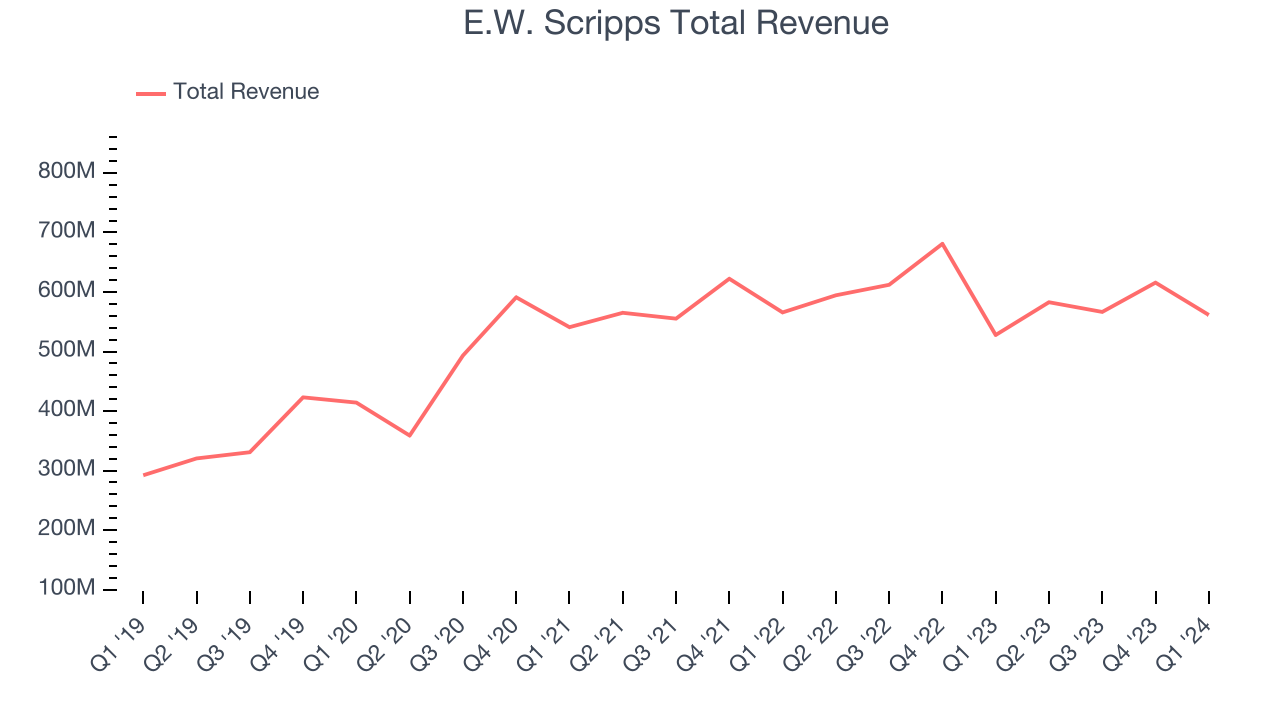

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. E.W. Scripps's annualized revenue growth rate of 13.3% over the last five years was mediocre for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. E.W. Scripps's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. E.W. Scripps's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Local Media and Scripps Networks, which are 62.8% and 37.3% of revenue. Over the last two years, E.W. Scripps's Local Media revenue (advertising and re-transmission fees) averaged 4.5% year-on-year growth. On the other hand, its Scripps Networks revenue (advertising) averaged 4.6% declines.

This quarter, E.W. Scripps's revenue grew 6.4% year on year to $561.5 million, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 8.7% over the next 12 months, an acceleration from this quarter.

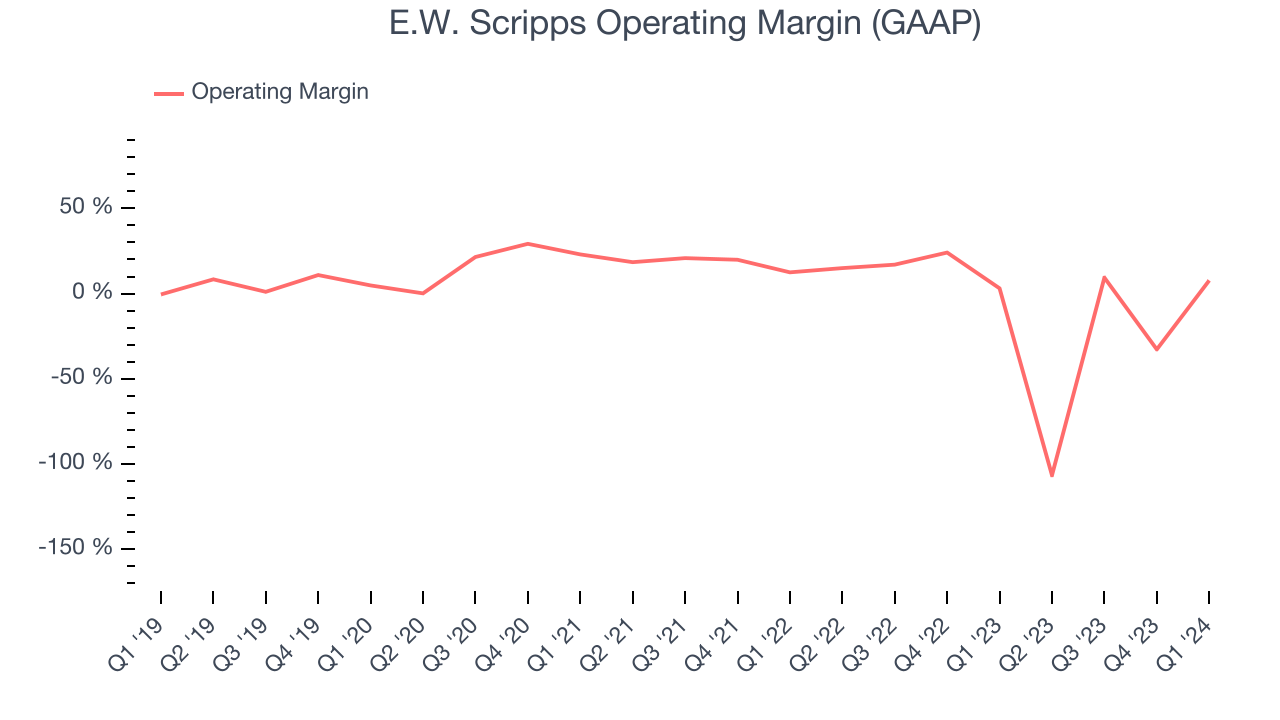

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although E.W. Scripps was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 7.4% over the last two years. This performance isn't ideal as demand in the consumer discretionary sector is volatile. We prefer to invest in companies that can weather industry downturns through consistent profitability.

In Q1, E.W. Scripps generated an operating profit margin of 7.7%, up 4.6 percentage points year on year.

Over the next 12 months, Wall Street expects E.W. Scripps to become profitable. Analysts are expecting the company’s LTM operating margin of negative 31.2% to rise to positive 15.7%.EPS

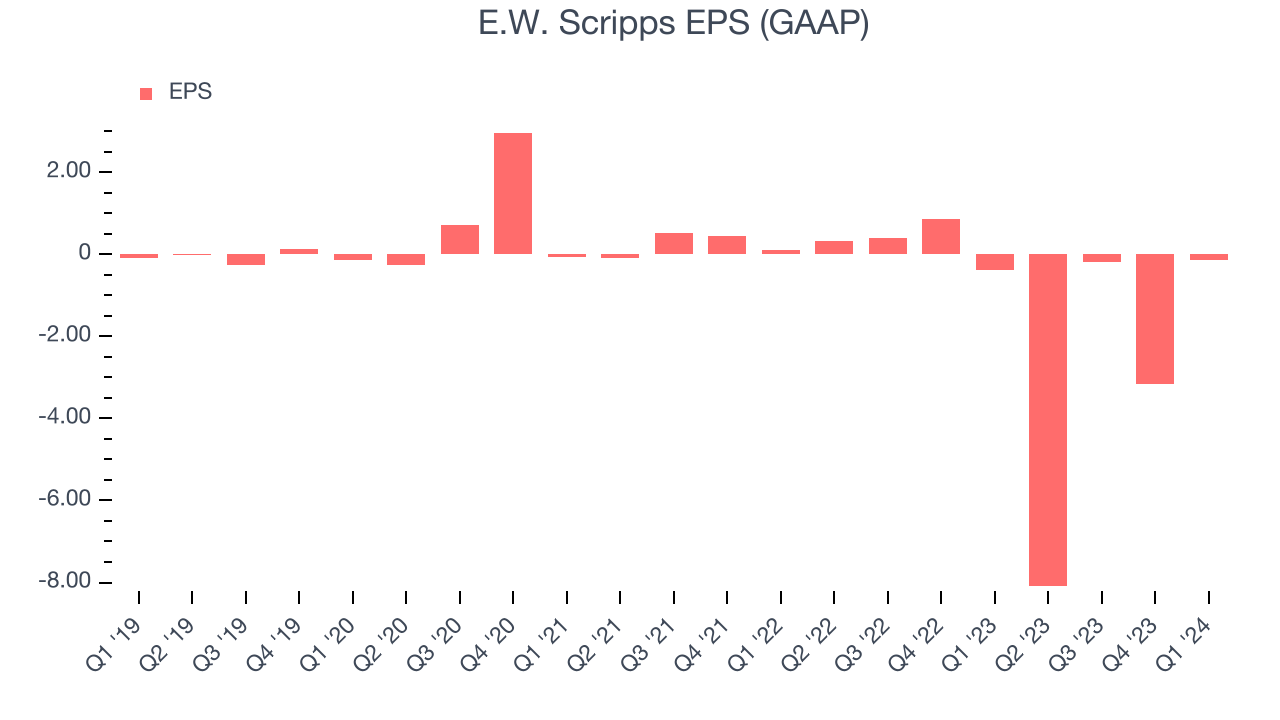

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, E.W. Scripps's EPS dropped 2,476%, translating into 91.5% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, E.W. Scripps reported EPS at negative $0.15, up from negative $0.37 in the same quarter last year. This print beat analysts' estimates by 37.5%. Over the next 12 months, Wall Street is optimistic. Analysts are projecting E.W. Scripps's LTM EPS of negative $11.61 to flip to positive $1.00.

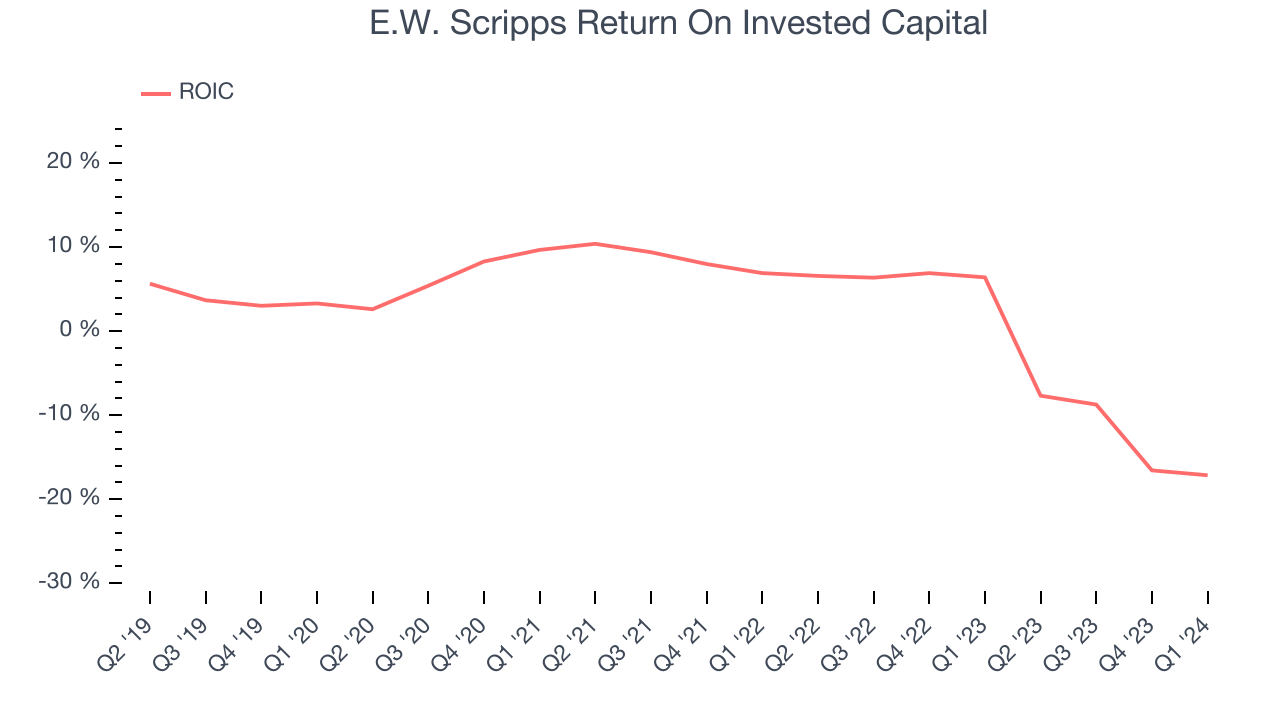

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

E.W. Scripps's five-year average return on invested capital was 1.8%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, E.W. Scripps's ROIC averaged 11.9 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

E.W. Scripps's $2.87 billion of debt exceeds the $30.23 million of cash on its balance sheet. Furthermore, its 7x net-debt-to-EBITDA ratio (based on its EBITDA of $431.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. E.W. Scripps could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope E.W. Scripps can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from E.W. Scripps's Q1 Results

We were impressed by how significantly E.W. Scripps blew past analysts' operating margin and EPS expectations this quarter. On the other hand, its revenue fell short of Wall Street's estimates as its Local Media segment underperformed. Overall, this quarter's results still seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $4.62 per share.

Is Now The Time?

E.W. Scripps may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of E.W. Scripps, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While there are some things to like about E.W. Scripps and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $10.13 per share right before these results (compared to the current share price of $4.62).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.