Media, broadcasting, and digital services company E.W. Scripps (NASDAQ:SSP) beat analysts' expectations in Q4 FY2023, with revenue down 9.6% year on year to $615.8 million. It made a GAAP loss of $3.17 per share, down from its profit of $0.84 per share in the same quarter last year.

E.W. Scripps (SSP) Q4 FY2023 Highlights:

- Revenue: $615.8 million vs analyst estimates of $602 million (2.3% beat)

- EPS: -$3.17 vs analyst estimates of $0.01 (-$3.18 miss)

- Free Cash Flow of $45.13 million is up from -$8.78 million in the previous quarter

- Gross Margin (GAAP): 18.4%, down from 53.7% in the same quarter last year

- Market Capitalization: $456.1 million

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ:SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

Edward Willis Scripps established the company in 1878 to provide accessible news to the public. Over the years, Scripps expanded from its newspaper roots into broadcasting and digital media, reflecting the evolving preferences of consumers.

E.W. Scripps manages numerous local TV stations and national networks, offering news, information, and entertainment. It has also ventured into the digital domain with various online platforms, catering to the contemporary demand for multi-platform media access. This expansion into digital media complements Scripps’ traditional broadcasting operations, addressing the diverse preferences of modern audiences.

The company's revenue sources include advertising, retransmission fees, and subscriptions.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the local television broadcasting and digital media sector include Nexstar Media (NASDAQ:NXST), Sinclair (NASDAQ:SBGI), and TEGNA (NYSE:TGNA).Sales Growth

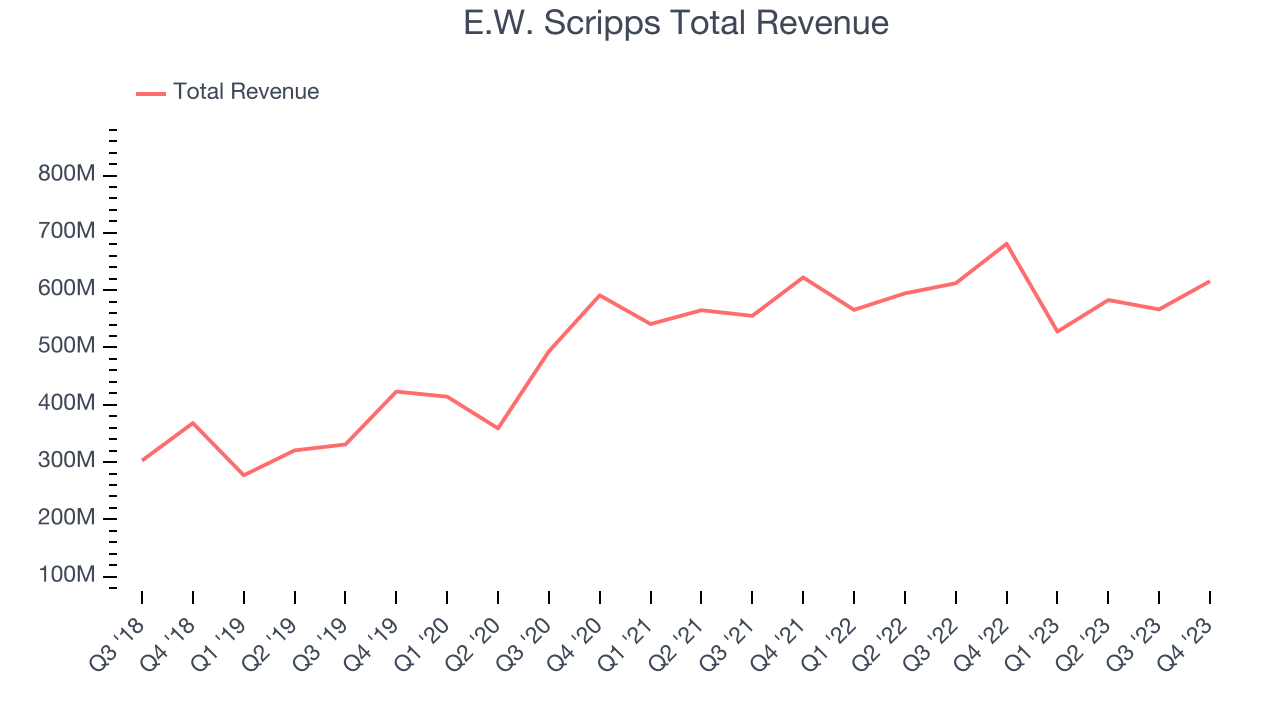

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. E.W. Scripps's annualized revenue growth rate of 13.7% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. E.W. Scripps's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. E.W. Scripps's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

This quarter, E.W. Scripps's revenue fell 9.6% year on year to $615.8 million but beat Wall Street's estimates by 2.3%. Looking ahead, Wall Street expects sales to grow 10% over the next 12 months, an acceleration from this quarter.

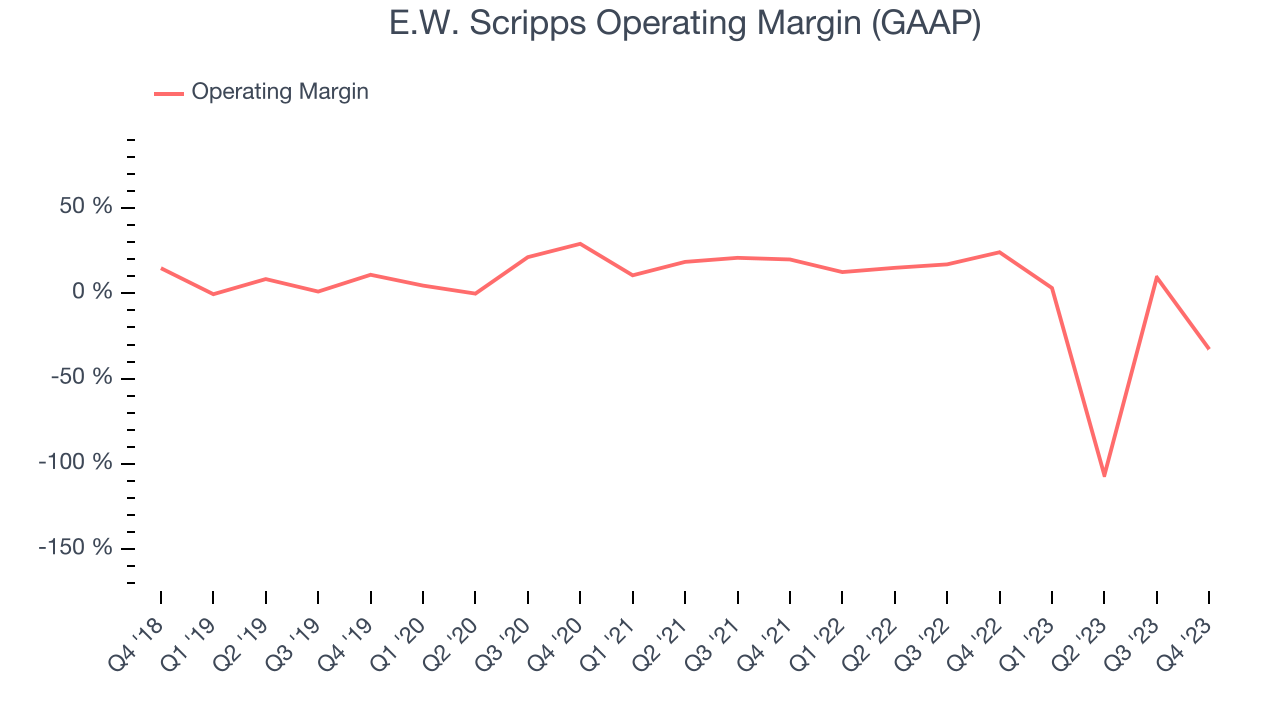

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, E.W. Scripps's high expenses have contributed to an average operating margin of negative 6.9%.

This quarter, E.W. Scripps generated an operating profit margin of negative 32.7%, down 56.8 percentage points year on year. The huge drop can be attributed to a one-time, non-cash goodwill impairment charge.

Over the next 12 months, Wall Street expects E.W. Scripps to become profitable. Analysts are expecting the company’s LTM operating margin of negative 32.8% to rise to positive 15.9%.

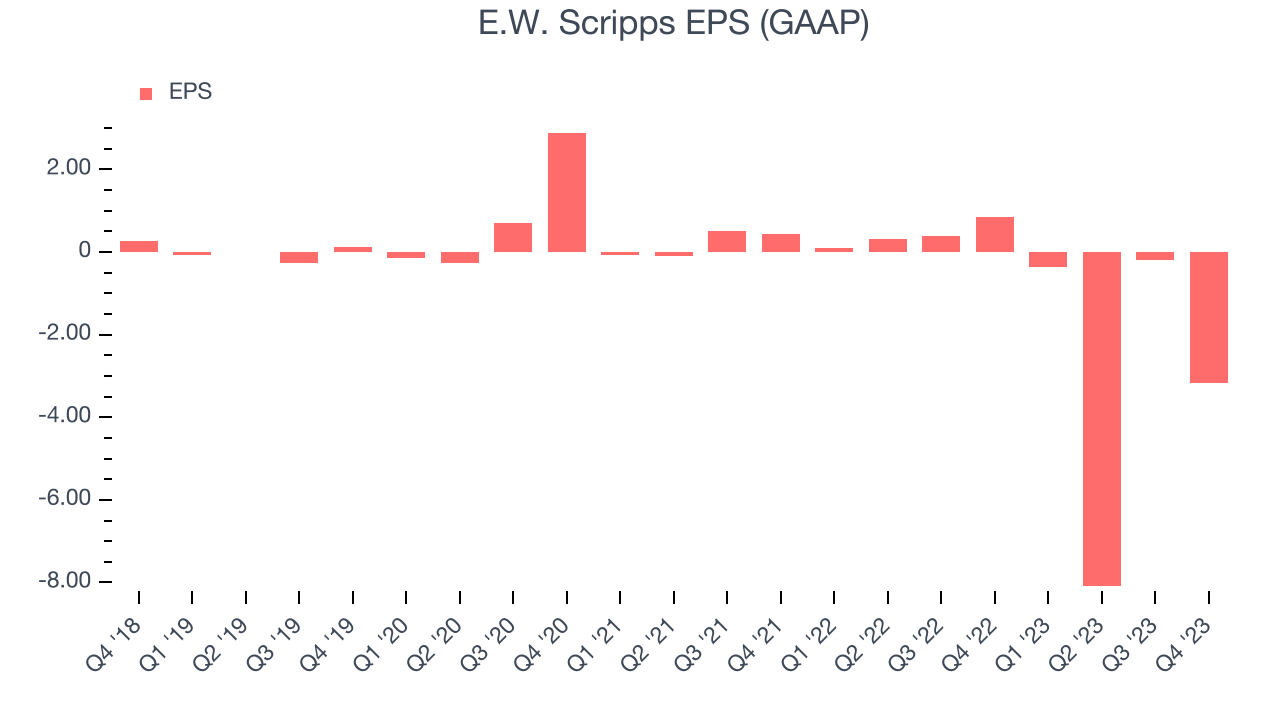

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, E.W. Scripps's EPS dropped 787%, translating into 54.7% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q4, E.W. Scripps reported EPS at negative $3.17, down from $0.84 in the same quarter a year ago. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting E.W. Scripps's LTM EPS of negative $11.83 to flip to positive $1.40.

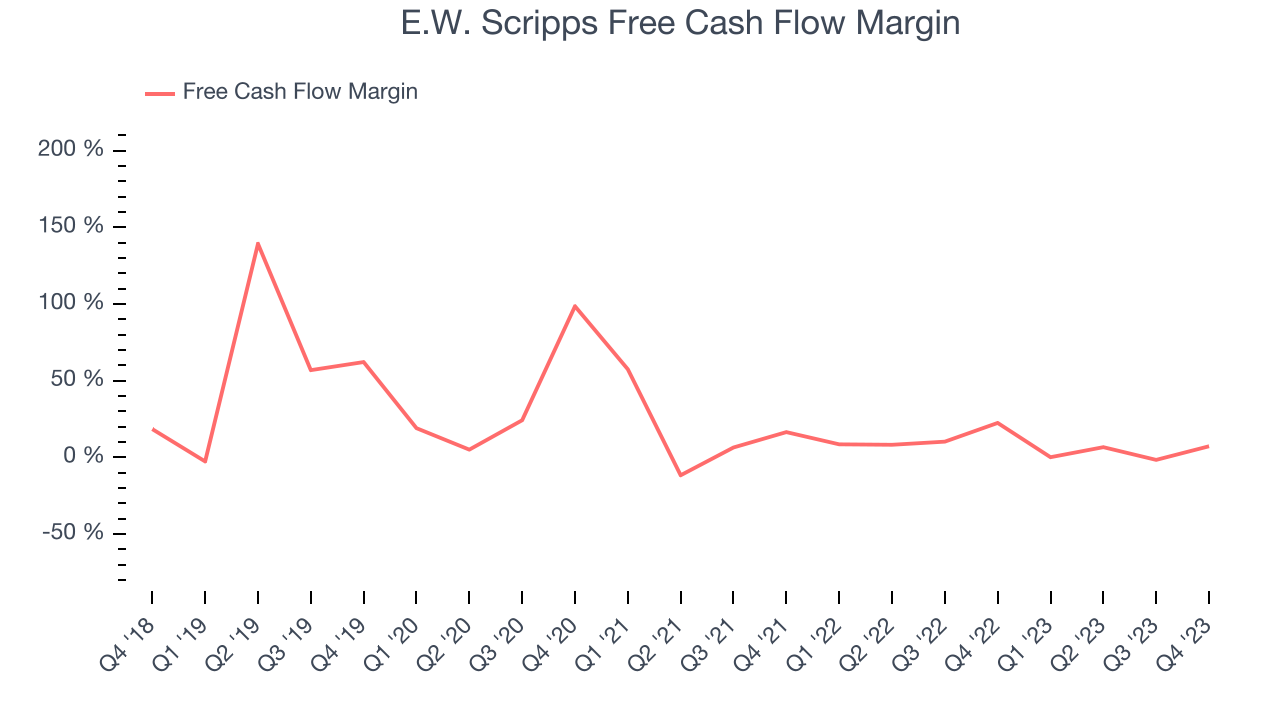

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, E.W. Scripps has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.2%, subpar for a consumer discretionary business.

E.W. Scripps's free cash flow came in at $45.13 million in Q4, equivalent to a 7.3% margin and down 70.6% year on year. Over the next year, analysts predict E.W. Scripps's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 3.3% will increase to 8.6%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

E.W. Scripps's five-year average return on invested capital was 1.6%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, E.W. Scripps's ROIC over the last two years averaged 10.5 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from E.W. Scripps's Q4 Results

It was good to see E.W. Scripps beat analysts' revenue expectations this quarter, driven by better-than-expected performance in its Scripps Networks segment (national news). That stood out as a positive in these results. On the other hand, its operating margin and EPS fell short of Wall Street's estimates as it had a significant one-time, non-cash goodwill impairment charge affecting the results. Overall, this was a mixed quarter for E.W. Scripps. The stock is up 9.1% after reporting and currently trades at $5.89 per share.

Is Now The Time?

E.W. Scripps may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of E.W. Scripps, we'll be cheering from the sidelines. Although its revenue growth has been decent over the last five years, its declining EPS over the last five years makes it hard to trust. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While the price is reasonable and there are some things to like about E.W. Scripps, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $11.40 per share right before these results (compared to the current share price of $5.89).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.