The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how sit-down dining stocks fared in Q2, starting with The ONE Group (NASDAQ:STKS).

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 13 sit-down dining stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, sit-down dining stocks have held steady with share prices up 1.8% on average since the latest earnings results.

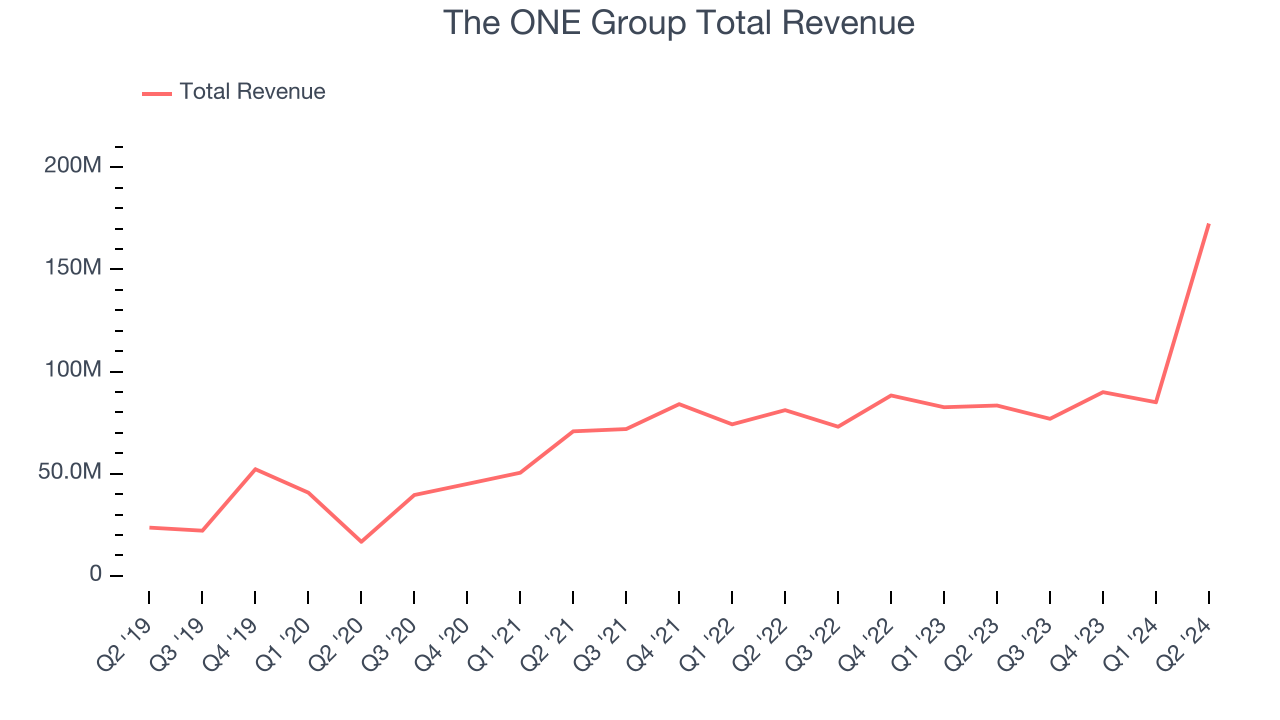

The ONE Group (NASDAQ:STKS)

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

The ONE Group reported revenues of $172.5 million, up 107% year on year. This print fell short of analysts’ expectations by 3.3%. Despite the soli topline growth, it was a mixed quarter for the company with full-year revenue guidance missing analysts’ expectations.

The ONE Group pulled off the fastest revenue growth but had the weakest performance against analyst estimates and weakest performance against analyst estimates of the whole group. Even though it had a great quarter relative to its peers, the market seems discontent with the results. The stock is down 14.2% since reporting and currently trades at $31.97.

Read our full report on The ONE Group here, it’s free.

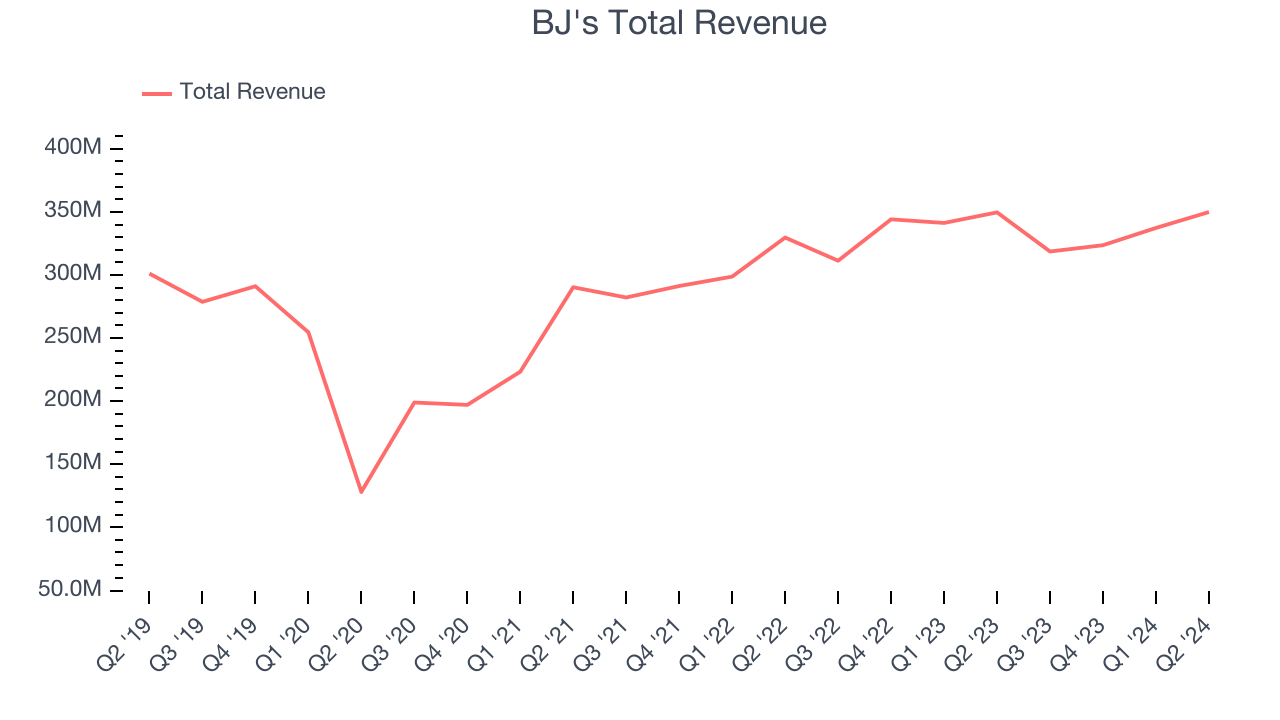

Best Q2: BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

BJ's reported revenues of $349.9 million, flat year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ earnings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 14.2% since reporting. It currently trades at $31.97.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Denny's (NASDAQ:DENN)

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $115.9 million, flat year on year, falling short of analysts’ expectations by 2.6%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 17.3% since the results and currently trades at $6.34.

Read our full analysis of Denny’s results here.

Texas Roadhouse (NASDAQ:TXRH)

With locations often featuring Western-inspired decor, Texas Roadhouse (NASDAQ:TXRH) is an American restaurant chain specializing in Southern-style cuisine and steaks.

Texas Roadhouse reported revenues of $1.34 billion, up 14.5% year on year. This result met analysts’ expectations. Overall, it was a satisfactory quarter as it also logged a decent beat of analysts’ earnings estimates.

The stock is up 5.8% since reporting and currently trades at $175.69.

Read our full, actionable report on Texas Roadhouse here, it’s free.

Red Robin (NASDAQ:RRGB)

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Red Robin reported revenues of $300.2 million, flat year on year. This number topped analysts’ expectations by 2.7%. It was a strong quarter as it also put up full-year revenue guidance topping analysts’ expectations.

The stock is down 4.4% since reporting and currently trades at $4.53.

Read our full, actionable report on Red Robin here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.