Upscale restaurant company The One Group Hospitality (NASDAQ:STKS) missed analysts' expectations in Q1 CY2024, with revenue up 3% year on year to $85 million. On the other hand, the company's full-year revenue guidance of $720 million at the midpoint came in 91.3% above analysts' estimates. It made a non-GAAP loss of $0.02 per share, down from its profit of $0.10 per share in the same quarter last year.

The ONE Group (STKS) Q1 CY2024 Highlights:

- Revenue: $85 million vs analyst estimates of $87.59 million (3% miss)

- EPS (non-GAAP): -$0.02 vs analyst estimates of $0.03 (-$0.05 miss)

- The company lifted its revenue guidance for the full year from $370 million to $720 million at the midpoint, a 94.6% increase

- Gross Margin (GAAP): 19.6%, down from 20.4% in the same quarter last year

- Same-Store Sales were down 7.9% year on year

- Market Capitalization: $151.8 million

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

STK, with locations in Downtown Manhattan and Dubai’s JBR Marina, has Japanese and Australian Wagyu steak dishes that will run you hundreds of dollars. You can complement these with some of the finest wines as well. Dark interiors featuring elevated art and plush seating give STK locations a luxurious feeling.

Kona Grill’s menu has much overlap with STK’s menu and features seafood, steak, and sushi. While prices are not as high as STK, Kona menu items are priced at a premium to the typical neighborhood chain of family restaurants. The Kona Grill ambiance is not as dark and intimate as STK, but it still exudes luxury.

In addition to owning and operating STK and Kona Grill, The One Group provides food and beverage services to hotels and casinos. The company generates management and incentive fee revenue from the restaurants and lounges it serves.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

While no publicly-traded companies are as upscale in their restaurant offerings as The One Group, competitors include Darden (NYSE:DRI), Brinker International (NYSE:EAT), The Cheesecake Factory (NASDAQ:CAKE), and all the privately-owned luxury restaurants that have geographic overlap with STK Steakhouse and Kona Grill.Sales Growth

The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

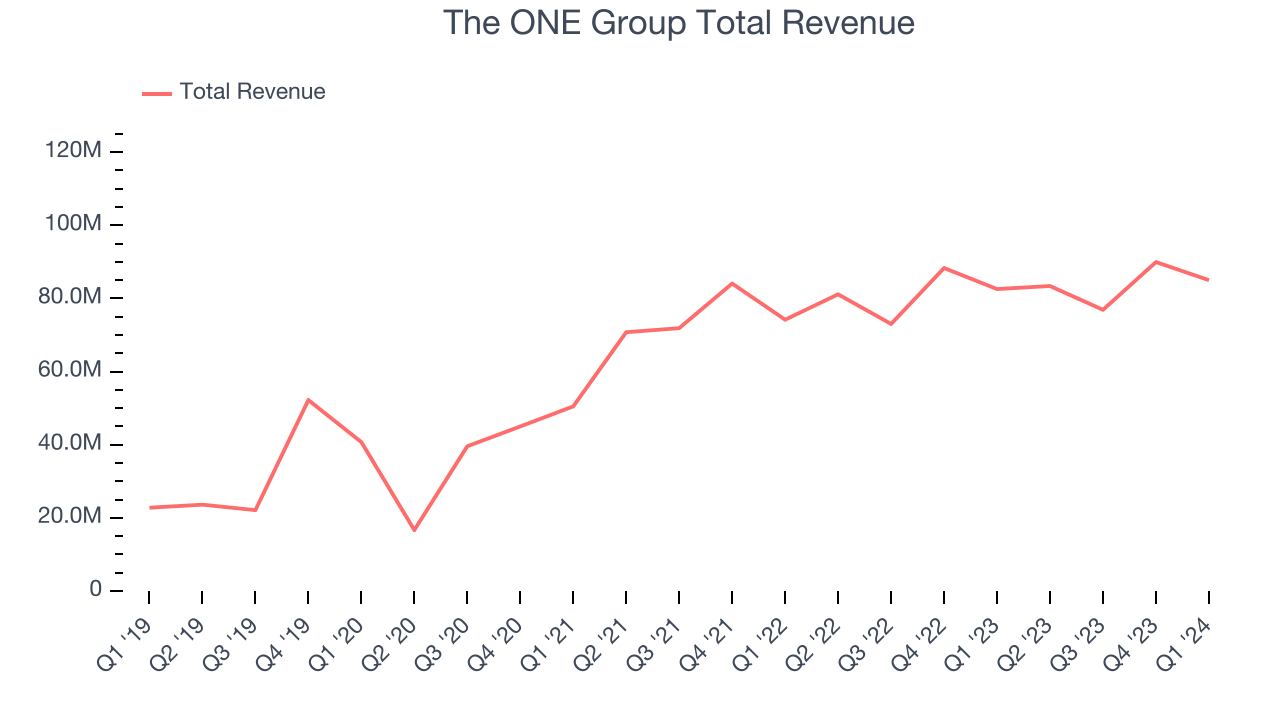

As you can see below, the company's annualized revenue growth rate of 30.4% over the last five years was incredible as it added more dining locations and expanded its reach.

This quarter, The ONE Group's revenue grew 3% year on year to $85 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 16.2% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

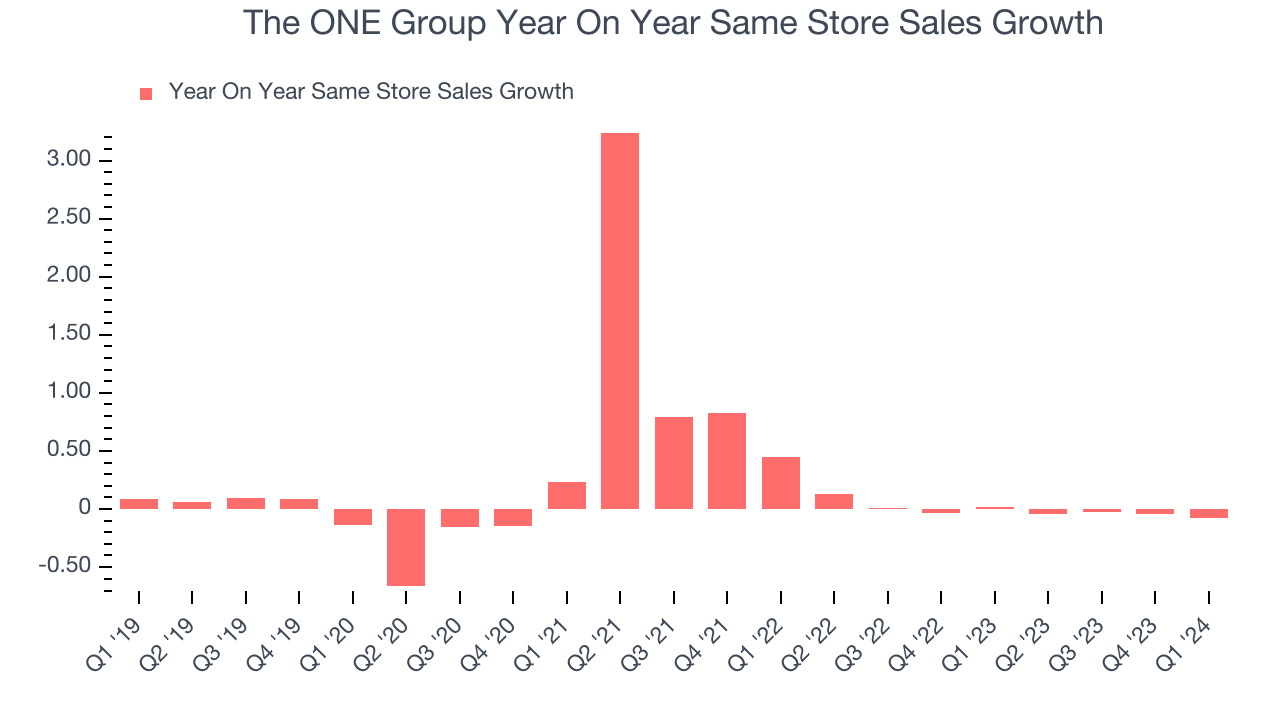

The ONE Group's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1% year on year. This performance isn't ideal and the company should reconsider its growth strategy before opening new restaurants with its precious capital.

In the latest quarter, The ONE Group's same-store sales fell 7.9% year on year. This decline was a reversal from the 1.6% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

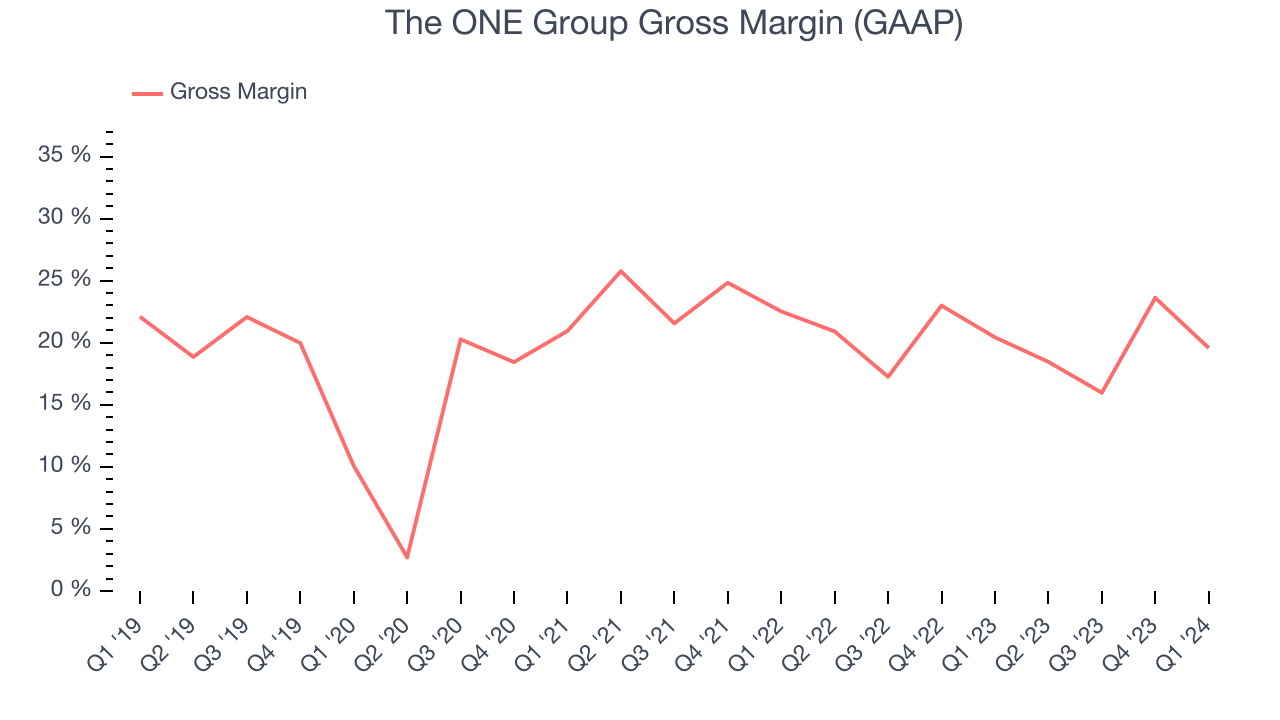

In Q1, The ONE Group's gross profit margin was 19.6%. in line with the same quarter last year. This means the company makes $0.20 for every $1 in revenue before accounting for its operating expenses.

The ONE Group has weak unit economics for a restaurant company, making it difficult to reinvest in the business. As you can see above, it's averaged a 20% gross margin over the last eight quarters. Its margin has also been trending down over the last year, averaging 5.2% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment where The ONE Group has diminishing pricing power and less favorable input costs (such as ingredients and transportation expenses).

Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

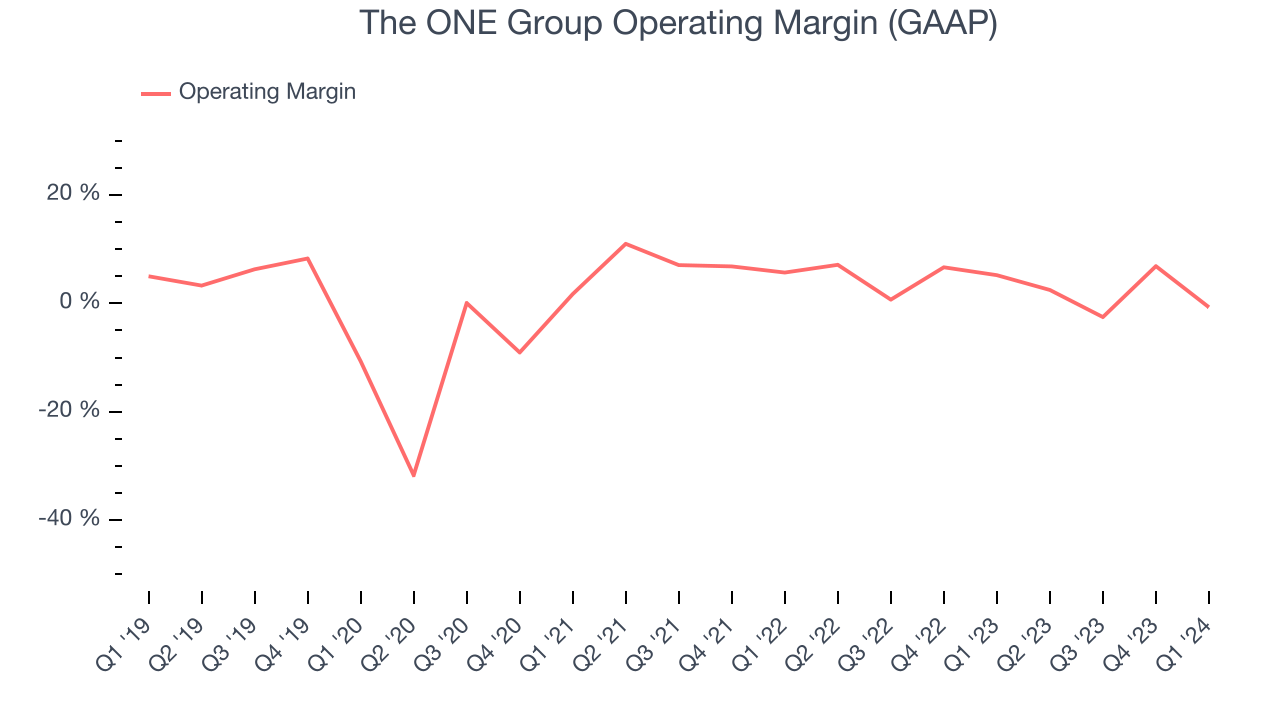

This quarter, The ONE Group generated an operating profit margin of negative 0.7%, down 5.9 percentage points year on year. Because The ONE Group's operating margin decreased more than its gross margin, we can infer the company was less efficient with its expenses or had lower leverage on its fixed costs.

Zooming out, The ONE Group was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.3% has been paltry for a restaurant business. On top of that, The ONE Group's margin has declined, on average, by 3.4 percentage points each year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

Zooming out, The ONE Group was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.3% has been paltry for a restaurant business. On top of that, The ONE Group's margin has declined, on average, by 3.4 percentage points each year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.EPS

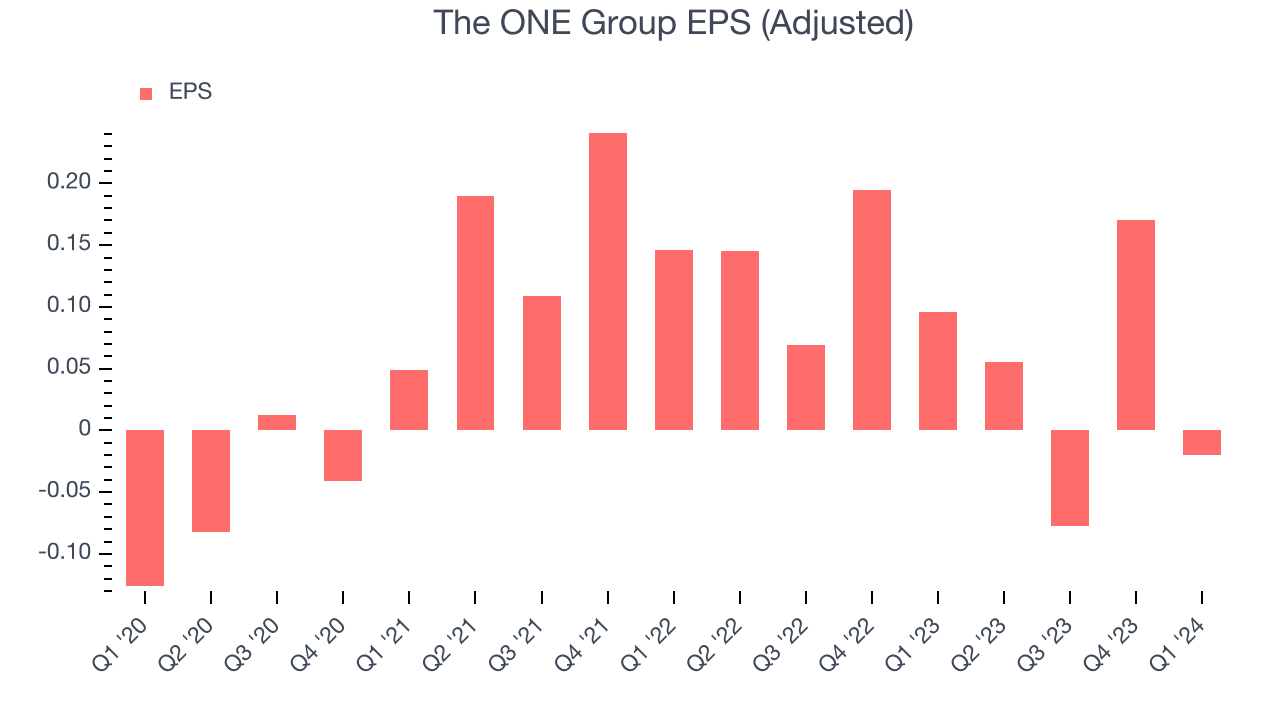

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, The ONE Group reported EPS at negative $0.02, down from $0.10 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, The ONE Group's adjusted diluted EPS grew 306%, translating into an astounding 59.5% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 110% year-on-year increase in EPS.

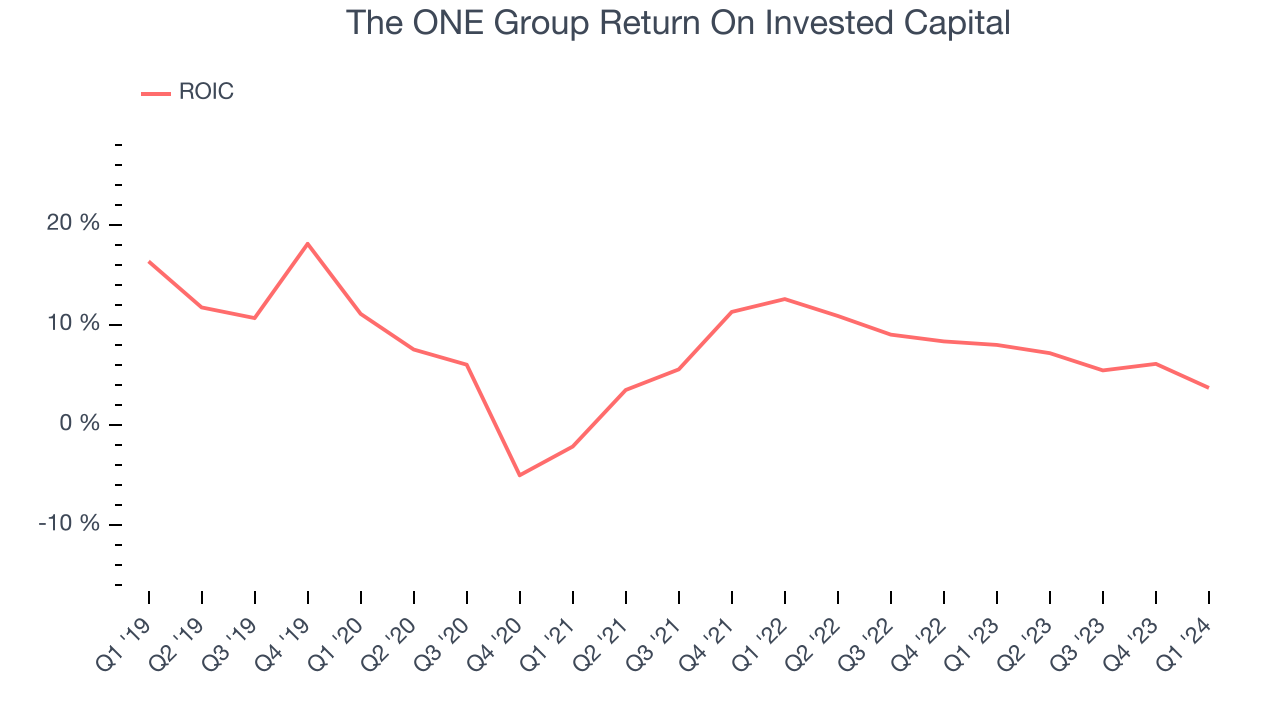

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

The ONE Group's five-year average ROIC was 6.7%, somewhat low compared to the best restaurant companies that consistently pump out 15%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, The ONE Group's ROIC averaged 1.4 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

The ONE Group reported $15.37 million of cash and $192.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $39.41 million of EBITDA over the last 12 months, we view The ONE Group's 4.5x net-debt-to-EBITDA ratio as safe. We also see its $3.16 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from The ONE Group's Q1 Results

We were impressed by The ONE Group's optimistic full-year revenue guidance, which blew past analysts' expectations. We were also excited its gross margin outperformed. On the other hand, its EPS and revenue missed Wall Street's estimates. Overall, the results could have been better. The stock is flat after reporting and currently trades at $4.8 per share.

Is Now The Time?

The ONE Group may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

The ONE Group isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been exceptional over the last five years, its brand caters to a niche market. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

The ONE Group's price-to-earnings ratio based on the next 12 months is 17.9x. In the end, beauty is in the eye of the beholder. While The ONE Group wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $7.33 per share right before these results (compared to the current share price of $4.80).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.