Higher education company Strategic Education (NASDAQ:STRA) beat analysts' expectations in Q1 CY2024, with revenue up 13.1% year on year to $290.3 million. It made a non-GAAP profit of $1.11 per share, improving from its profit of $0.24 per share in the same quarter last year.

Strategic Education (STRA) Q1 CY2024 Highlights:

- Revenue: $290.3 million vs analyst estimates of $274.3 million (5.8% beat)

- EPS (non-GAAP): $1.11 vs analyst estimates of $0.58 (90.6% beat)

- Gross Margin (GAAP): 45.7%, up from 40.4% in the same quarter last year

- Free Cash Flow of $68.44 million, up from $16.39 million in the previous quarter

- Enrolled Students: 87,731

- Market Capitalization: $2.45 billion

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ:STRA) is a career-focused higher education provider.

Strategic Education operates through several divisions. Strayer University offers undergraduate and graduate degree programs for adult learners, focusing on business administration, accounting, information technology, and public administration. Capella University is known for its competency-based online learning model, offering degree programs in fields like nursing, business, counseling, and education.

Both universities offer flexible learning options, catering to the unique needs of working adults. This includes online classes, hybrid courses, and evening and weekend study options, allowing students to balance their education with work and family commitments.

In addition to degree programs, Strategic Education has expanded its offerings to include professional education and training. This includes short courses, professional certificates, and training programs in emerging fields such as digital marketing, cybersecurity, and data analytics.

Another aspect of Strategic Education's operations is its international segment. The company has invested in educational institutions in Australia, New Zealand, and other regions to broaden its global footprint.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Strategic Education's competitors include Adtalem Global Education (NYSE:ATGE), Grand Canyon Education (NASDAQ:LOPE), Perdoceo Education (NASDAQ:PRDO), and American Public Education (NASDAQ:APEI).Sales Growth

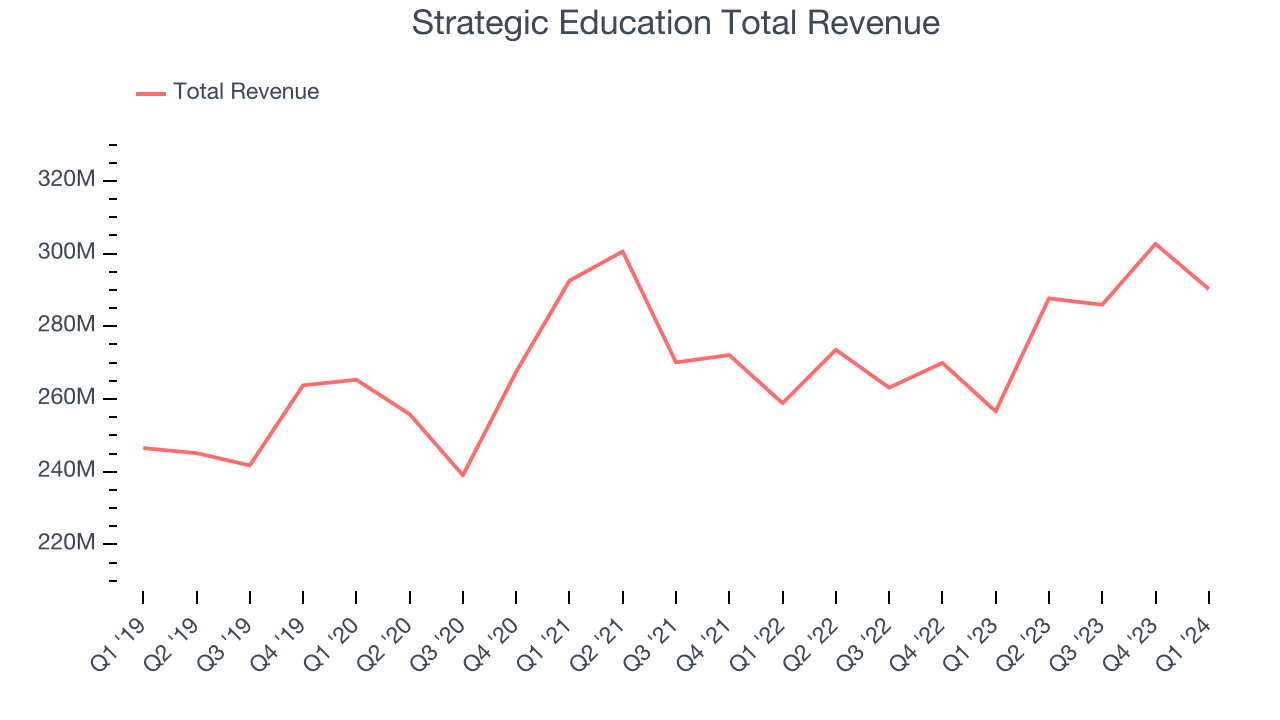

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Strategic Education's annualized revenue growth rate of 8.8% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Strategic Education's recent history shows the business has slowed as its annualized revenue growth of 2.9% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Strategic Education's recent history shows the business has slowed as its annualized revenue growth of 2.9% over the last two years is below its five-year trend.

This quarter, Strategic Education reported robust year-on-year revenue growth of 13.1%, and its $290.3 million of revenue exceeded Wall Street's estimates by 5.8%. Looking ahead, Wall Street expects sales to grow 3.3% over the next 12 months, a deceleration from this quarter.

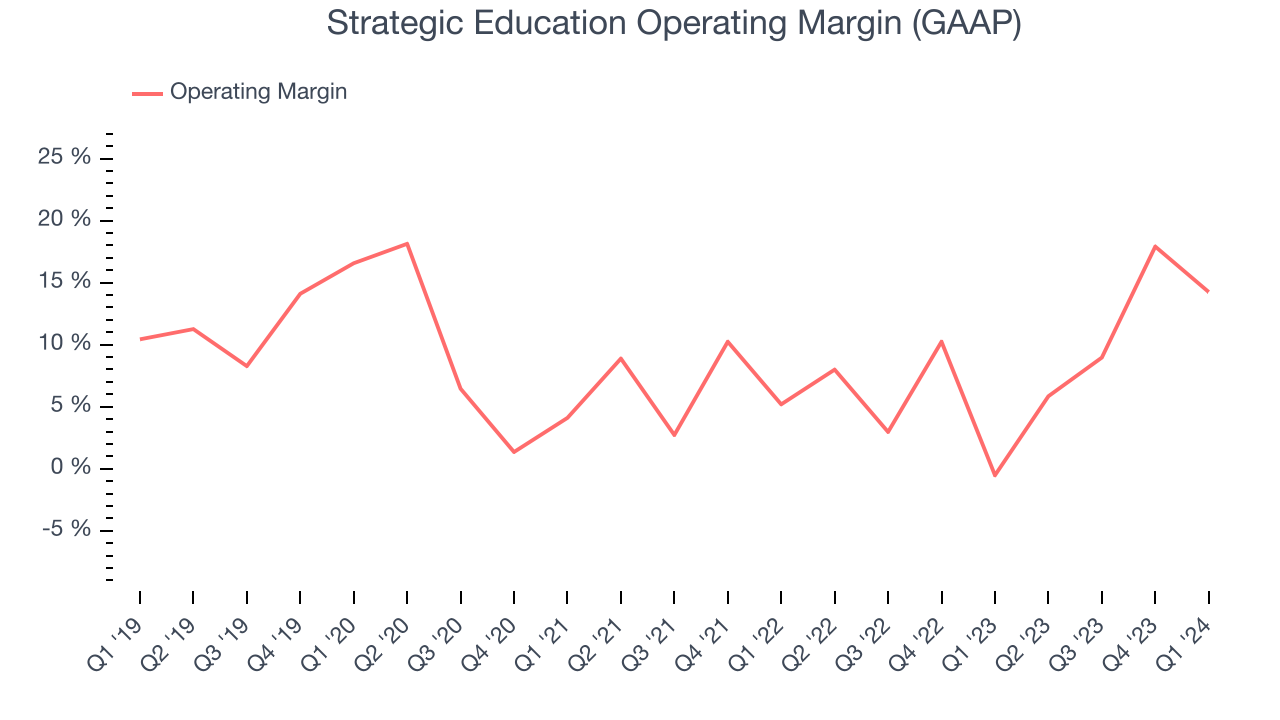

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Strategic Education was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 8.7%.

This quarter, Strategic Education generated an operating profit margin of 14.2%, up 14.8 percentage points year on year.

Over the next 12 months, Wall Street expects Strategic Education to become more profitable. Analysts are expecting the company’s LTM operating margin of 11.8% to rise to 12.9%.EPS

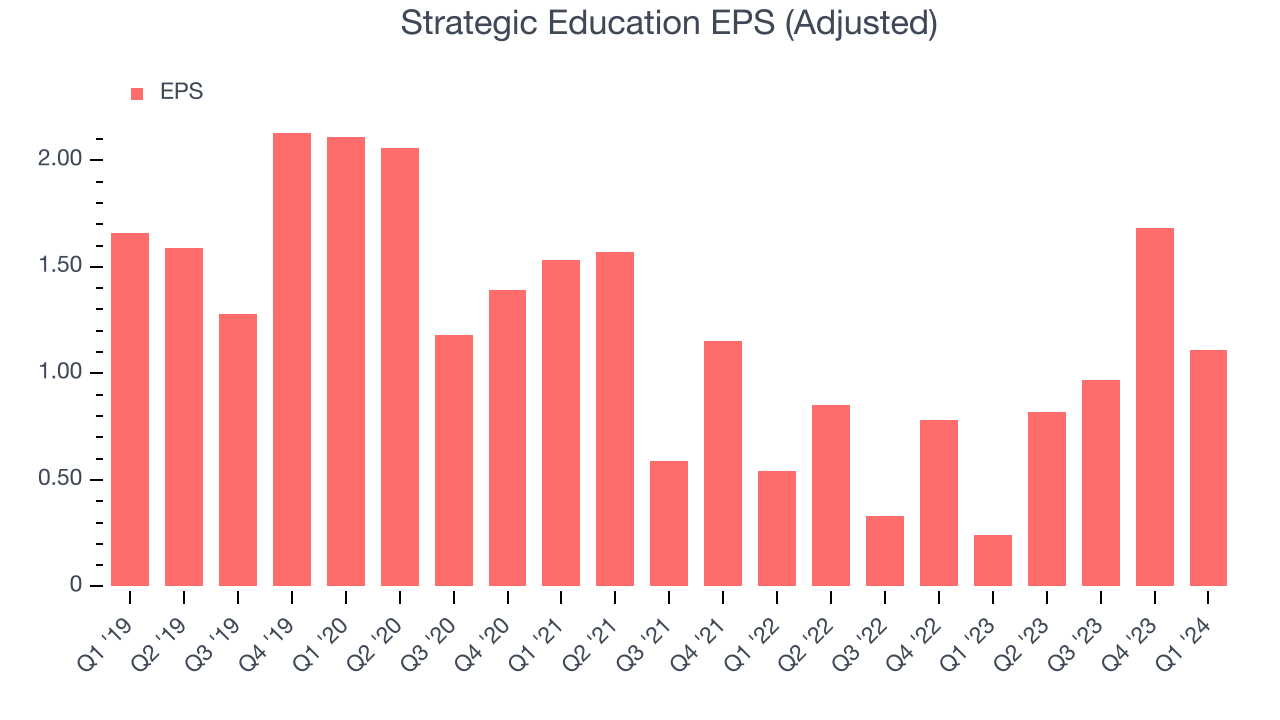

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Strategic Education's EPS dropped 9.2%, translating into 1.8% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Strategic Education reported EPS at $1.11, up from $0.24 in the same quarter last year. This print beat analysts' estimates by 90.6%. Over the next 12 months, Wall Street expects Strategic Education to grow its earnings. Analysts are projecting its LTM EPS of $4.58 to climb by 3.1% to $4.72.

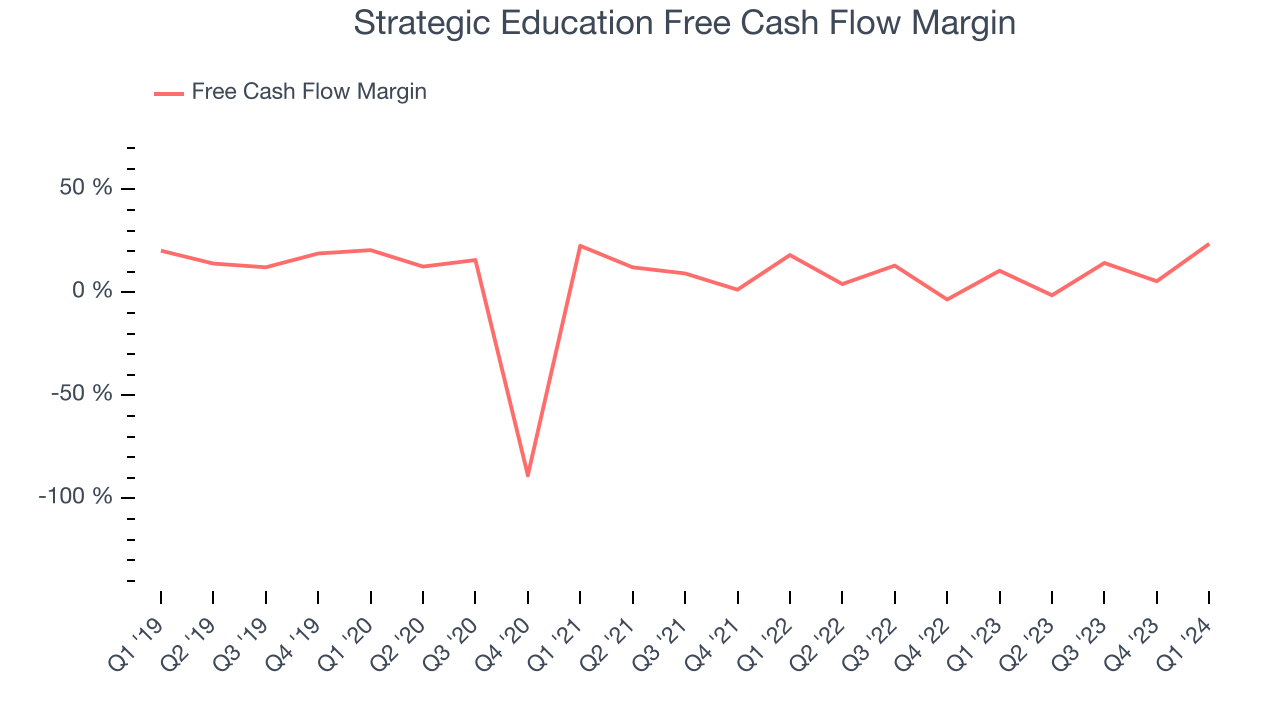

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Strategic Education has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.3%, subpar for a consumer discretionary business.

Strategic Education's free cash flow came in at $68.44 million in Q1, equivalent to a 23.6% margin and up 154% year on year. Over the next year, analysts' consensus estimates show they're expecting Strategic Education's LTM free cash flow margin of 10.4% to remain the same.

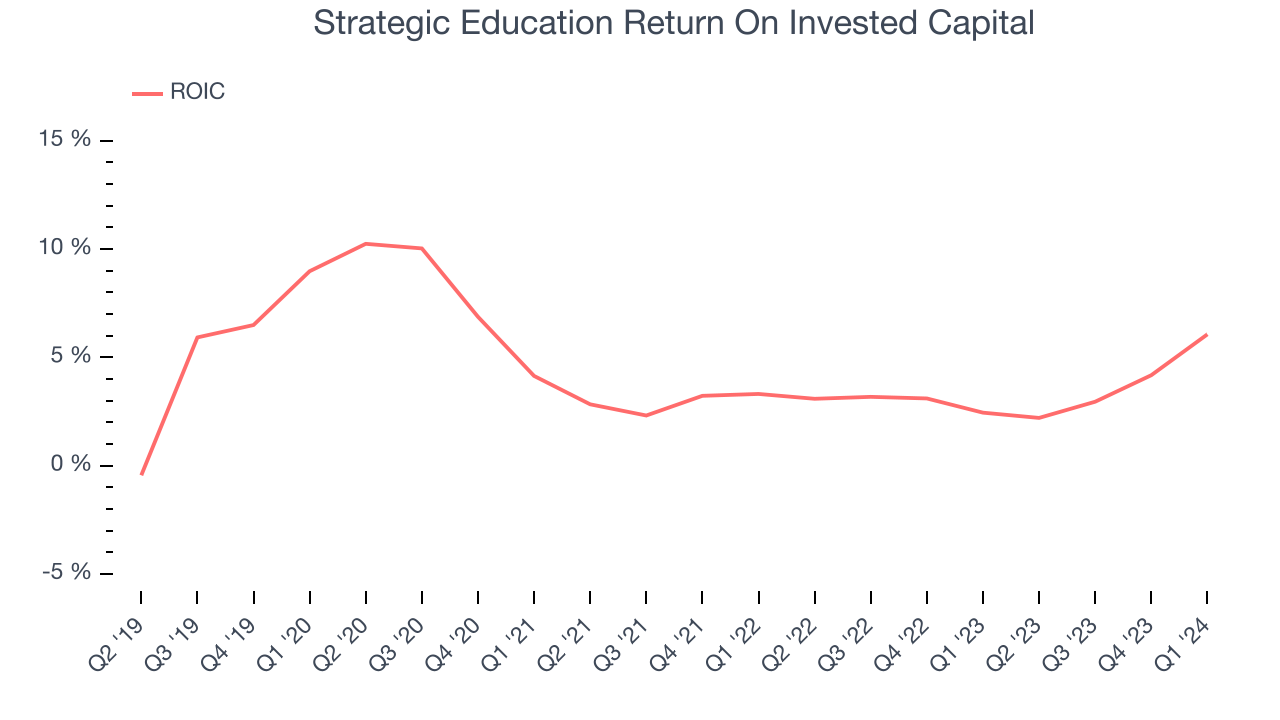

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Strategic Education's five-year average return on invested capital was 5%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Strategic Education's ROIC averaged 2.3 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Strategic Education is a profitable, well-capitalized company with $253.6 million of cash and $200.9 million of debt, meaning it could pay back all its debt tomorrow and still have $52.64 million of cash on its balance sheet. This net cash position gives Strategic Education the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Strategic Education's Q1 Results

We were impressed by how significantly Strategic Education blew past analysts' EPS expectations this quarter. We were also excited its revenue and operating margin outperformed, driven by better-than-expected student enrollments across the globe and employer-affiliated enrollment in its education technology services segment.

Strategic Education also announced a quarterly dividend of $0.60 per share that will be paid on June 3, 2024 to shareholders as of May 24, 2024.

Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 7.3% after reporting and currently trades at $108 per share.

Is Now The Time?

Strategic Education may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Strategic Education, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities, and its declining EPS over the last five years makes it hard to trust.

Strategic Education's price-to-earnings ratio based on the next 12 months is 21.3x. While we've no doubt one can find things to like about Strategic Education, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $124.25 per share right before these results (compared to the current share price of $108).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.