As Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the semiconductors stocks, including Seagate Technology (NASDAQ:STX) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.1%, while on average next quarter revenue guidance was 0.46% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but semiconductors stocks held their ground better than others, with the share prices up 15.5% since the previous earnings results, on average.

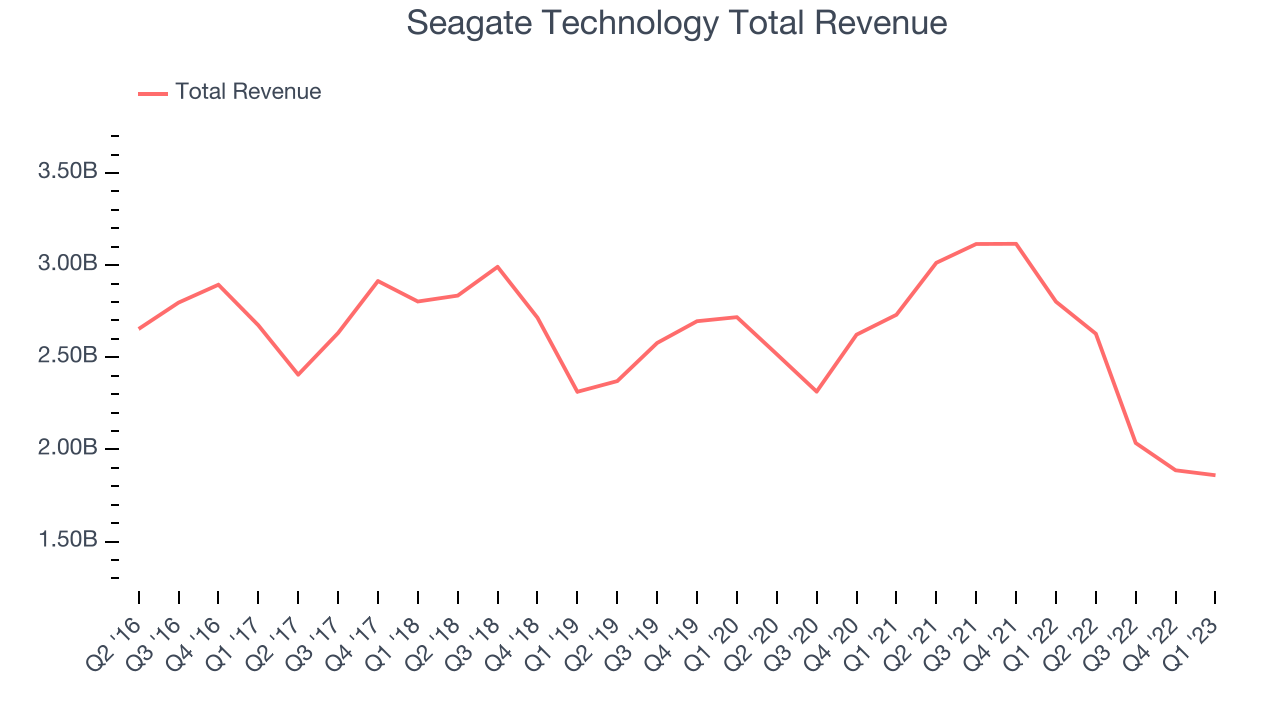

Weakest Q1: Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $1.86 billion, down 33.6% year on year, missing analyst expectations by 5.78%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

“We are seeing a more elongated customer inventory correction that led to weaker than expected nearline demand among a few large customers late in the quarter. Consequently, our March quarter revenue came in at the low-end of our guidance range, which along with underutilization charges and other factors had a severe impact on our reported margins and profitability,” said Dave Mosley, Seagate’s chief executive officer.

The stock is down 1.43% since the results and currently trades at $62.

Read our full report on Seagate Technology here, it's free.

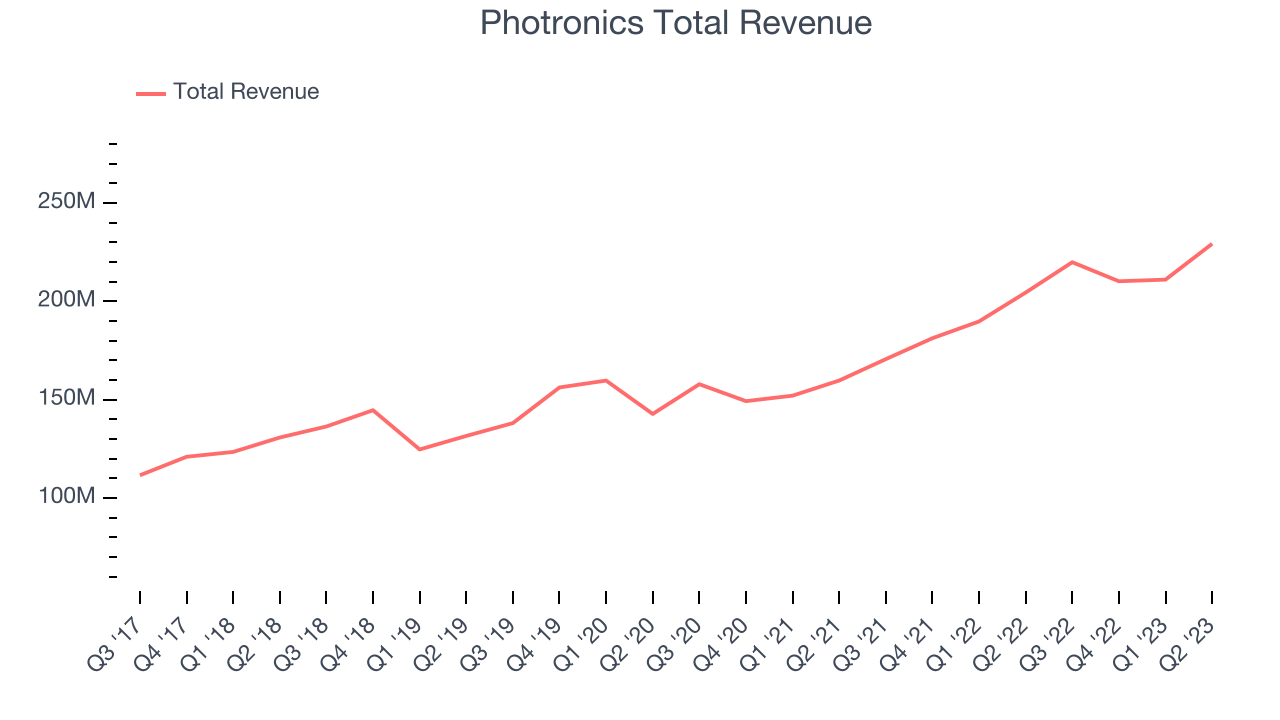

Best Q1: Photronics (NASDAQ:PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $229.3 million, up 12.1% year on year, beating analyst expectations by 8.68%. It was an exceptional quarter for the company, with a significant improvement in gross margin and strong revenue guidance for the next quarter.

The stock is up 48.8% since the results and currently trades at $25.63.

Is now the time to buy Photronics? Access our full analysis of the earnings results here, it's free.

Magnachip (NYSE:MX)

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE:MX) is a provider of analog and mixed-signal semiconductors.

Magnachip reported revenues of $57 million, down 45.2% year on year, missing analyst expectations by 6.55%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

Magnachip had the weakest performance against analyst estimates in the group. The stock is up 29.3% since the results and currently trades at $11.21.

Read our full analysis of Magnachip's results here.

Impinj (NASDAQ:PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $85.9 million, up 61.6% year on year, beating analyst expectations by 2.76%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss on the bottom line.

Impinj pulled off the fastest revenue growth among the peers. The stock is down 36.2% since the results and currently trades at $86.33.

Read our full, actionable report on Impinj here, it's free.

Nvidia (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $7.19 billion, down 13.2% year on year, beating analyst expectations by 10.3%. It was a very strong quarter for the company, with a significant improvement in inventory levels and a beat on the bottom line. The biggest highlight of Nvidia's quarter was revenue guidance for Q2, which was >50% ahead of expectations.

Nvidia scored the strongest analyst estimates beat among the peers. The stock is up 34.8% since the results and currently trades at $411.59.

Read our full, actionable report on Nvidia here, it's free.

The author has no position in any of the stocks mentioned