Wrapping up Q1 earnings, we look at the numbers and key takeaways for the semiconductors stocks, including Seagate Technology (NASDAQ:STX) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 22 semiconductors stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.77%, while on average next quarter revenue guidance was 0.68% under consensus. Technology stocks have been hit hard on fears of higher interest rates and while some of the semiconductors stocks have fared somewhat better, they have not been spared, with share price declining 14.5% since earnings, on average.

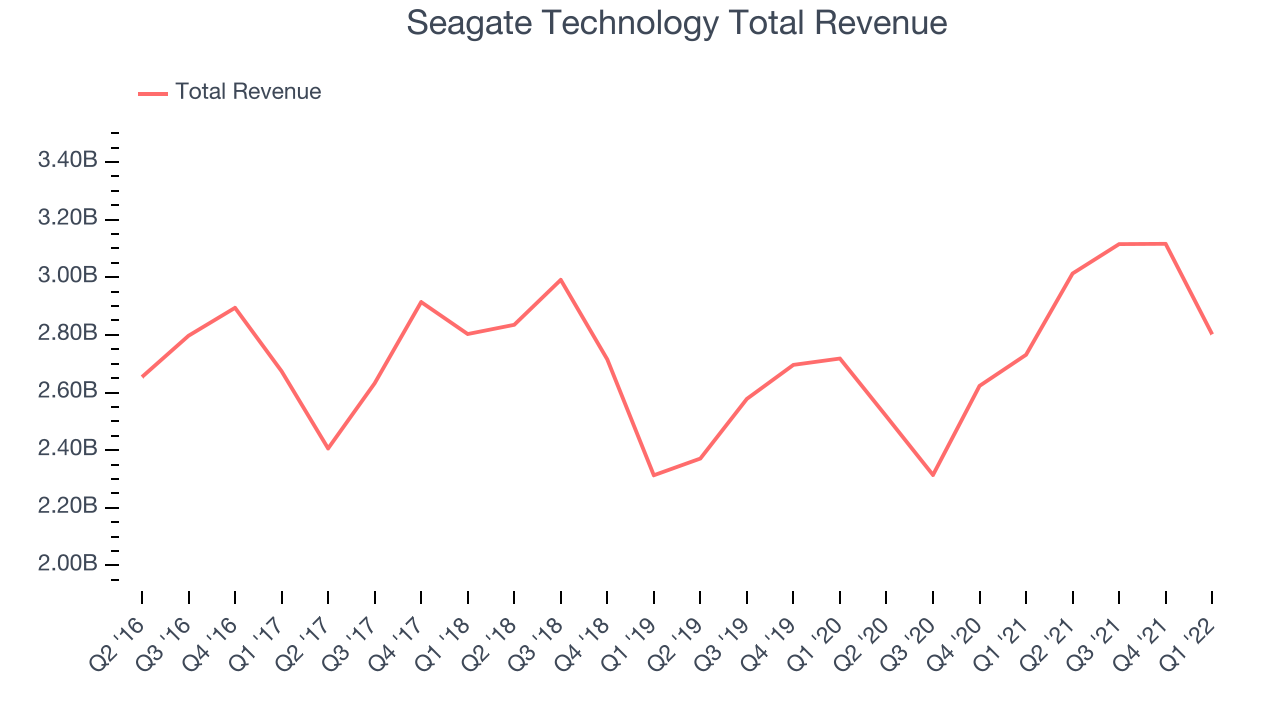

Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.8 billion, up 2.59% year on year, missing analyst expectations by 0.31%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss on the bottom line.

“Seagate's March quarter financial results were consistent with our revised outlook, with record nearline product revenue driven by cloud customers partially offsetting multiple macro related headwinds that impacted other end markets, particularly video and image applications, and pressured profitability,” said Dave Mosley, Seagate’s chief executive officer.

The stock is down 12.8% since the results and currently trades at $69.09.

Read our full report on Seagate Technology here, it's free.

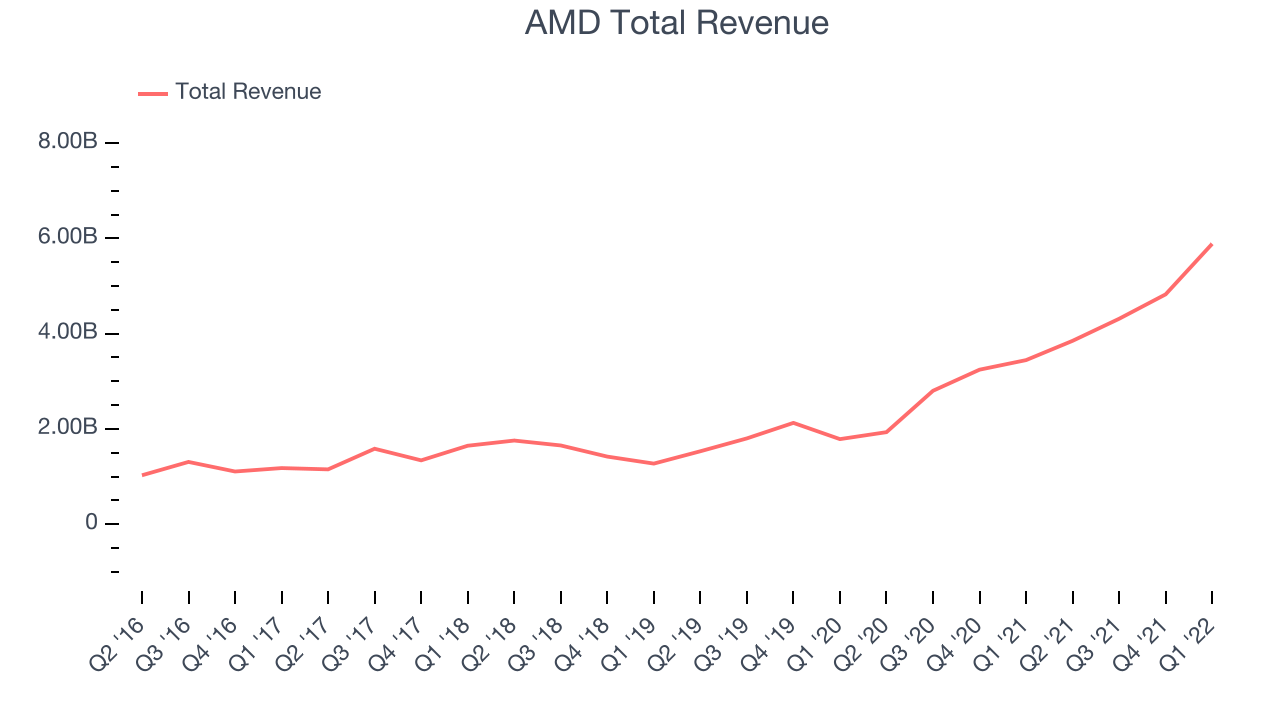

Best Q1: AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $5.88 billion, up 70.8% year on year, beating analyst expectations by 6.47%. It was an impressive quarter for the company, with a beat on the bottom line and a significant improvement in operating margin.

AMD delivered the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 19.4% since the results and currently trades at $73.43.

Is now the time to buy AMD? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Lam Research (NASDAQ:LRCX)

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $4.06 billion, up 5.52% year on year, missing analyst expectations by 4.33%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

Lam Research had the weakest performance against analyst estimates in the group. The stock is down 18.5% since the results and currently trades at $393.

Read our full analysis of Lam Research's results here.

Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $377.7 million, up 48.4% year on year, beating analyst expectations by 4.8%. It was a very strong quarter for the company, with a beat on the bottom line.

The stock is down 10.2% since the results and currently trades at $368.90.

Read our full, actionable report on Monolithic Power Systems here, it's free.

Micron Technology (NASDAQ:MU)

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron Technology reported revenues of $8.64 billion, up 16.4% year on year, missing analyst expectations by 0.03%. It was a mixed quarter for the company, with a significant improvement in gross margin but revenue guidance for the next quarter below analysts' estimates.

The stock is down 3.87% since the results and currently trades at $53.30.

Read our full, actionable report on Micron Technology here, it's free.

The author has no position in any of the stocks mentioned