As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the semiconductors industry, including Seagate Technology (NASDAQ:STX) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 2.4% below.

While some semiconductors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.1% since the latest earnings results.

Seagate Technology (NASDAQ:STX)

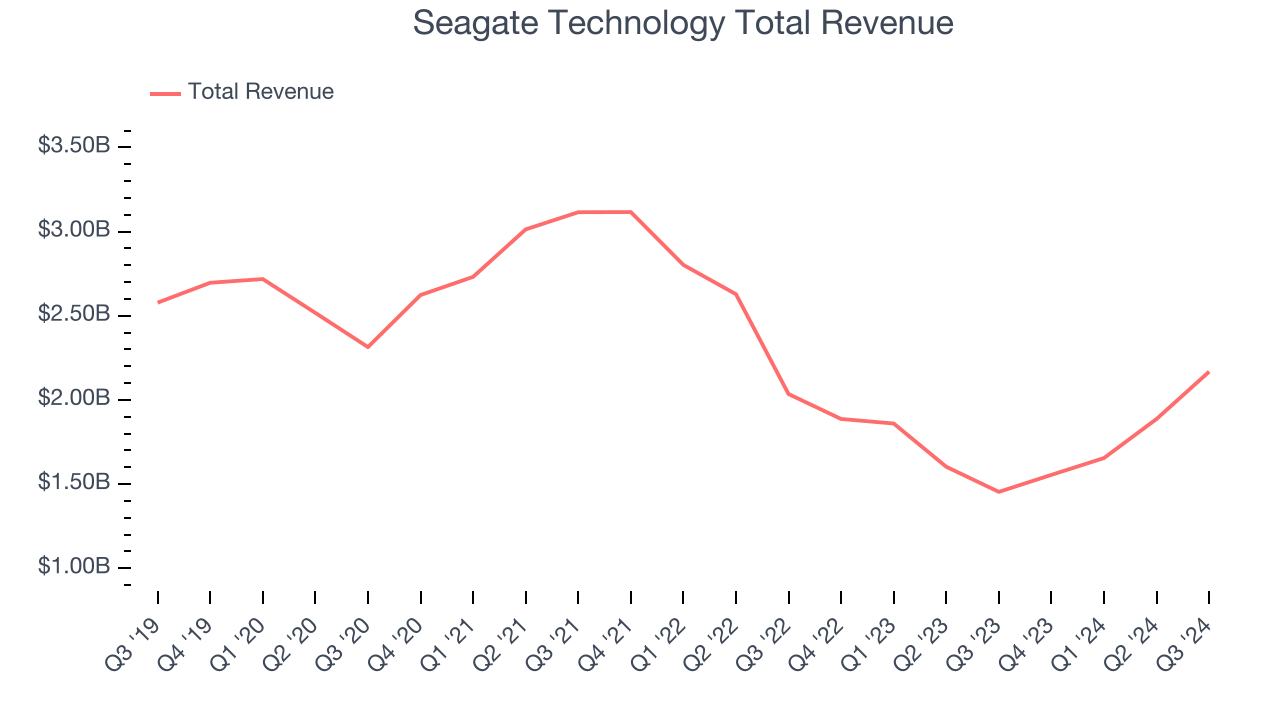

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.17 billion, up 49.1% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

"Seagate is off to an outstanding start to the fiscal year, highlighted by gross margin expanding to the highest level in more than a decade," said Dave Mosley, Seagate’s chief executive officer.

Unsurprisingly, the stock is down 13.6% since reporting and currently trades at $97.29.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it’s free.

Best Q3: Nova (NASDAQ:NVMI)

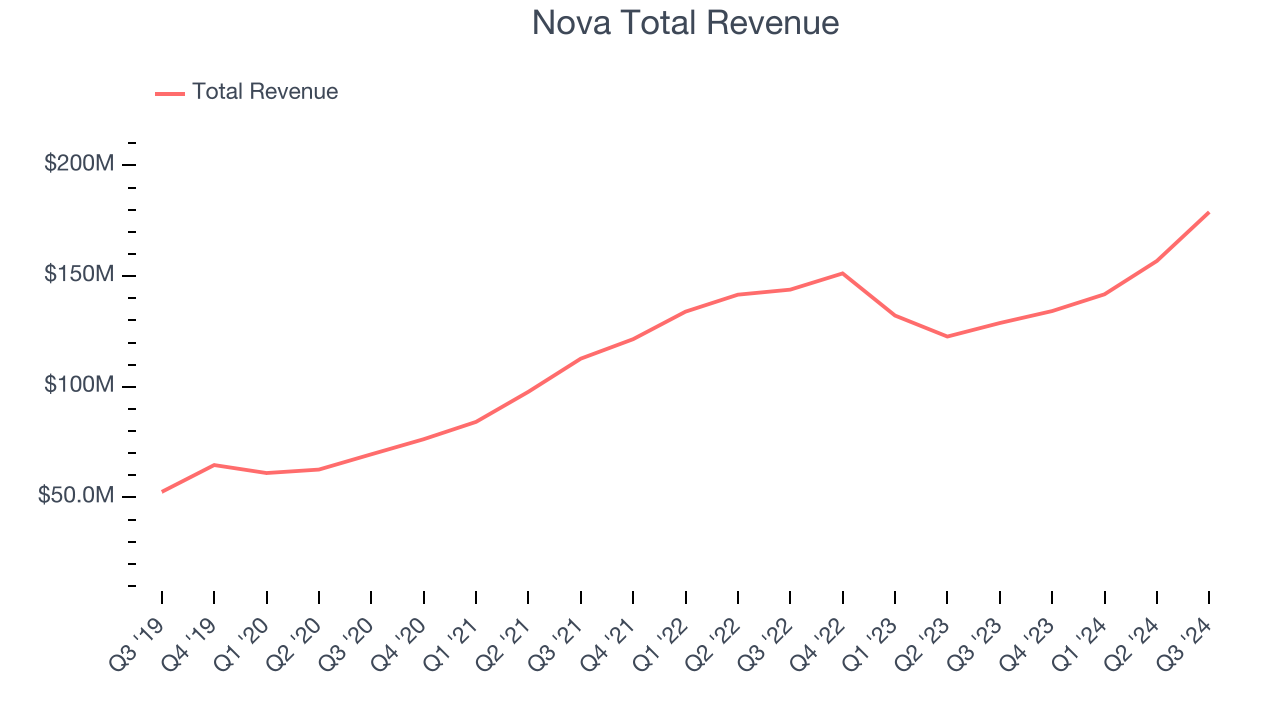

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $179 million, up 38.9% year on year, outperforming analysts’ expectations by 4.1%. The business had a very strong quarter with a significant improvement in its inventory levels and revenue guidance for next quarter beating analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $193.

Is now the time to buy Nova? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Amtech (NASDAQ:ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $24.11 million, down 13% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 8.7% since the results and currently trades at $5.56.

Read our full analysis of Amtech’s results here.

IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $233.1 million, down 22.6% year on year. This number beat analysts’ expectations by 2.3%. However, it was a slower quarter as it produced a significant miss of analysts’ adjusted operating income estimates.

The stock is down 2.1% since reporting and currently trades at $77.64.

Read our full, actionable report on IPG Photonics here, it’s free.

Photronics (NASDAQ:PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $222.6 million, down 2.1% year on year. This result surpassed analysts’ expectations by 2.1%. Overall, it was a very strong quarter as it also recorded a solid beat of analysts’ EPS estimates and revenue guidance for next quarter slightly topping analysts’ expectations.

The stock is up 5.6% since reporting and currently trades at $26.75.

Read our full, actionable report on Photronics here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.