Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Seagate Technology (NASDAQ:STX), and the best and worst performers in the semiconductors group.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 22 semiconductors stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.17%, while on average next quarter revenue guidance was 3.29% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital and semiconductors stocks have not been spared, with share prices down 22.3% since the previous earnings results, on average.

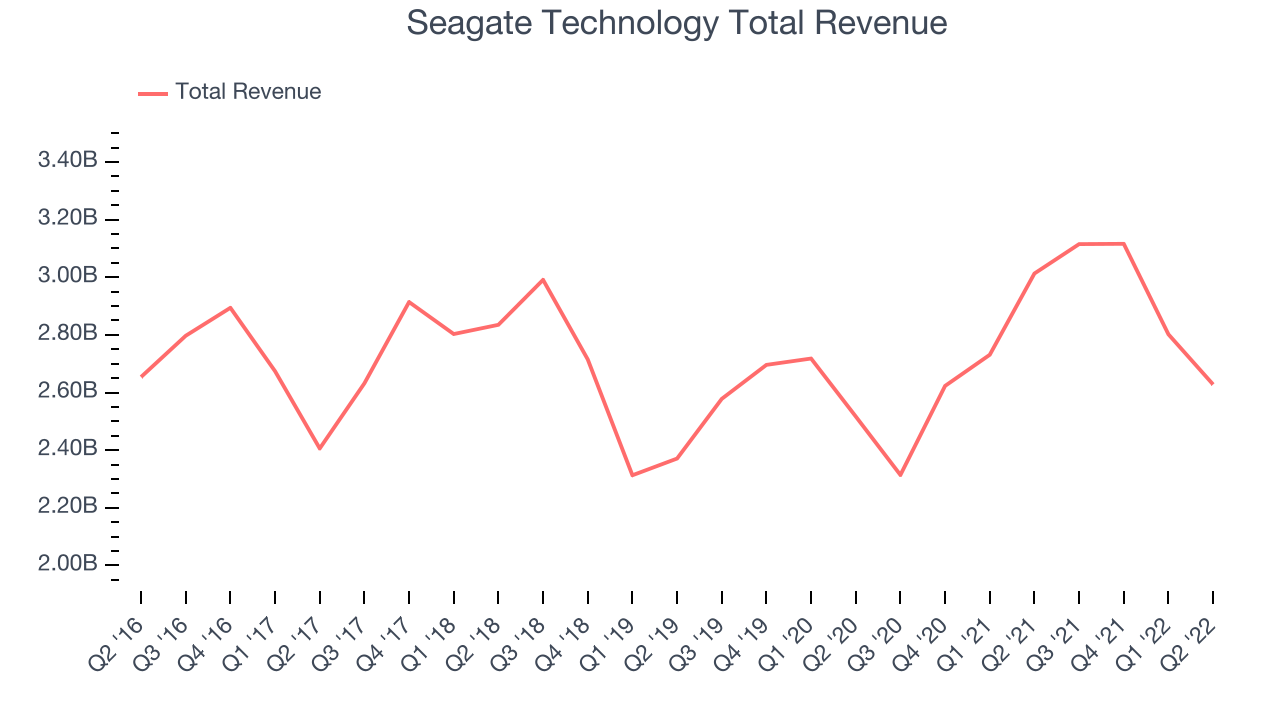

Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.62 billion, down 12.8% year on year, missing analyst expectations by 5.72%. It was a weak quarter for the company, with a revenue decline and an underwhelming revenue guidance for the next quarter.

“Our June quarter results reflect stable mass capacity storage demand, offset by the impacts of Covid restrictive measures in Asia and weakening global economic conditions on our other end markets. These impacts were most pronounced in our consumer facing Legacy markets,” said Dave Mosley, Seagate’s chief executive officer.

The stock is down 37.4% since the results and currently trades at $52.38.

Read our full report on Seagate Technology here, it's free.

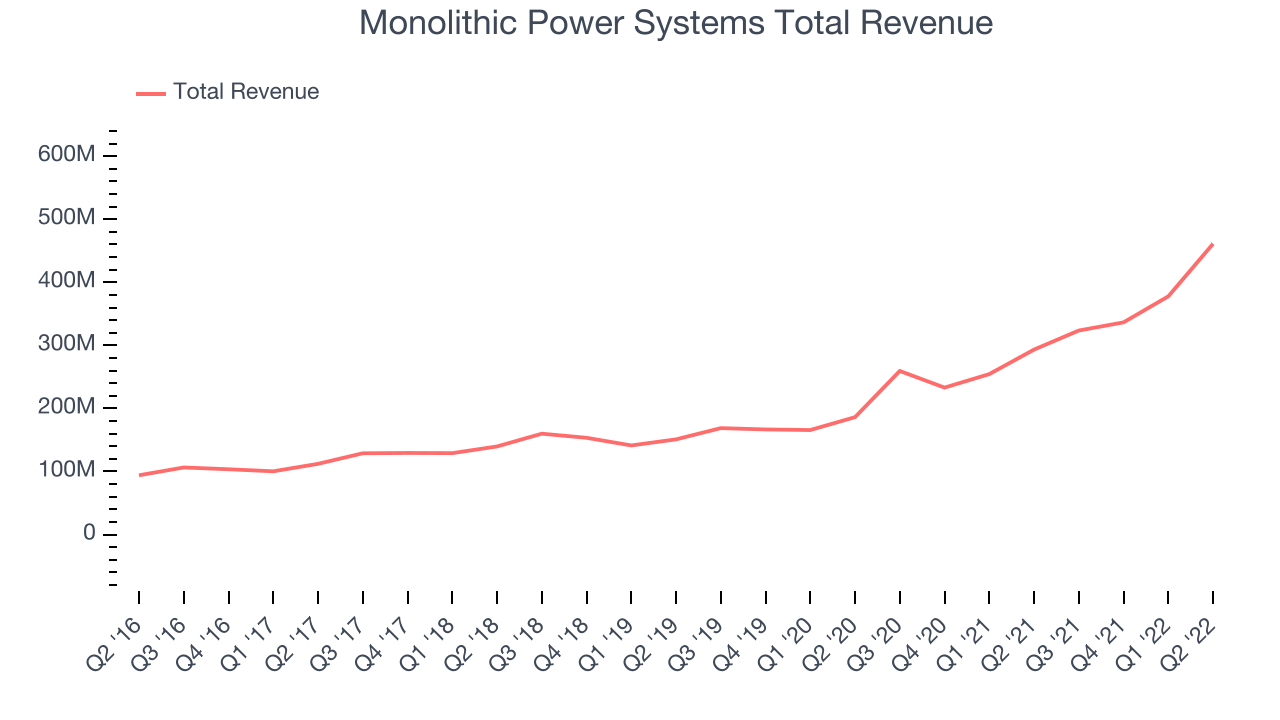

Best Q2: Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $461 million, up 57.1% year on year, beating analyst expectations by 7.06%. It was an exceptional quarter for the company, with a beat on the bottom line and a significant improvement in operating margin.

The stock is down 28.9% since the results and currently trades at $328.13.

Is now the time to buy Monolithic Power Systems? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Intel (NASDAQ:INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $15.3 billion, down 22% year on year, missing analyst expectations by 14.5%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year guidance missing analysts' expectations.

Intel had the weakest performance against analyst estimates, worst YoY revenue, and least impressive full year guidance update in the group. The stock is down 36.6% since the results and currently trades at $25.15.

Read our full analysis of Intel's results here.

NXP Semiconductors (NASDAQ:NXPI)

Spun off from Dutch electronics giant Philips in 2006, NXP Semiconductors (NASDAQ: NXPI) is a designer and manufacturer of chips used in autos, industrial manufacturing, mobile devices, and communications infrastructure.

NXP Semiconductors reported revenues of $3.31 billion, up 27.5% year on year, beating analyst expectations by 1.43%. It was a decent quarter for the company, with a significant improvement in operating margin but an increase in inventory levels.

The stock is down 17% since the results and currently trades at $144.56.

Read our full, actionable report on NXP Semiconductors here, it's free.

Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.51 billion, up 40.9% year on year, in line with analyst expectations. It was a slower quarter for the company, with an underwhelming revenue guidance for the next quarter and a decline in operating margin.

The stock is down 29.8% since the results and currently trades at $38.70.

Read our full, actionable report on Marvell Technology here, it's free.

The author has no position in any of the stocks mentioned