Let’s dig into the relative performance of Seagate Technology (NASDAQ:STX) and its peers as we unravel the now-completed Q2 semiconductors earnings season.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 4.4% below.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive as of late, employment measures bordered on concerning. The markets will be determining whether this rate cut (and more potential ones in 2024 and 2025) are ideal timing to support the economy or a bit too late for a macro that has already cooled too much.

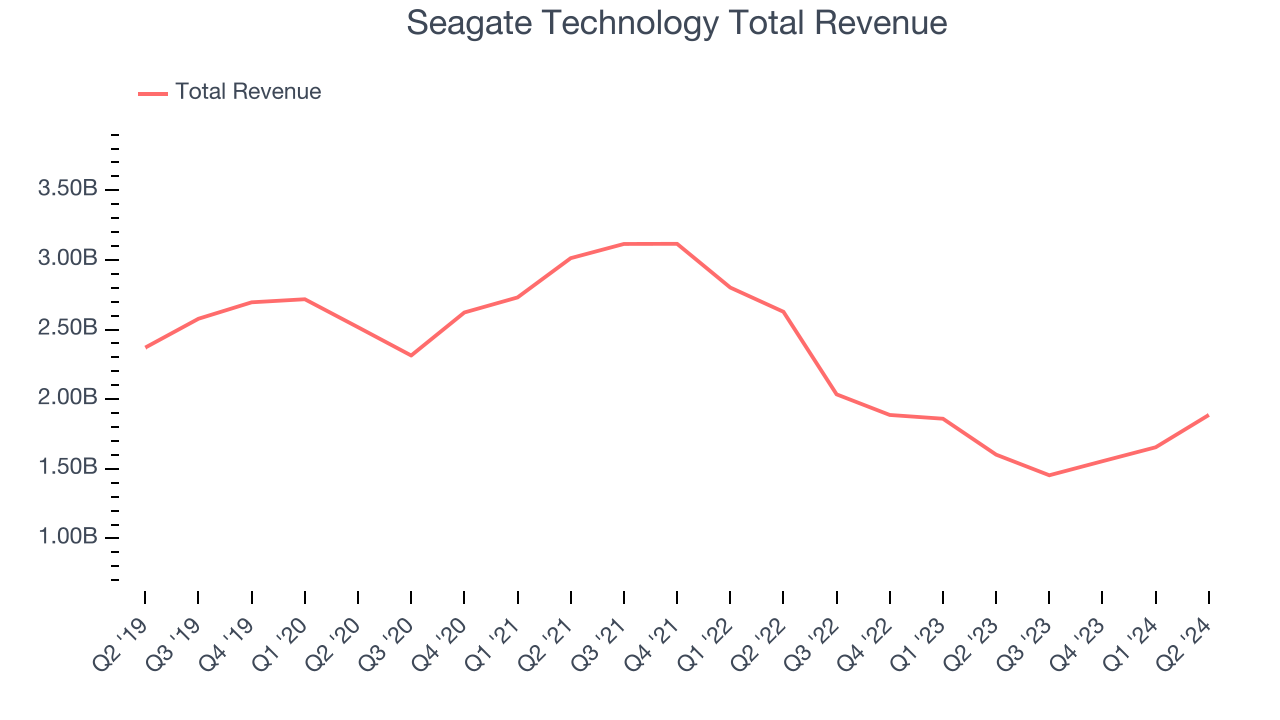

Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $1.89 billion, up 17.8% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with a significant improvement in its gross margin and an impressive beat of analysts’ EPS estimates.

“Seagate delivered robust financial performance for the June quarter amid an improving cloud demand environment, capping off a fiscal year of strong execution against our financial goals. Q4 revenue grew 18% year-over-year, non-GAAP gross margin expanded to nearly 31%, and non-GAAP EPS exceeded the high end of our guidance range,” said Dave Mosley, Seagate’s chief executive officer.

Unsurprisingly, the stock is down 2.6% since reporting and currently trades at $102.51.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it’s free.

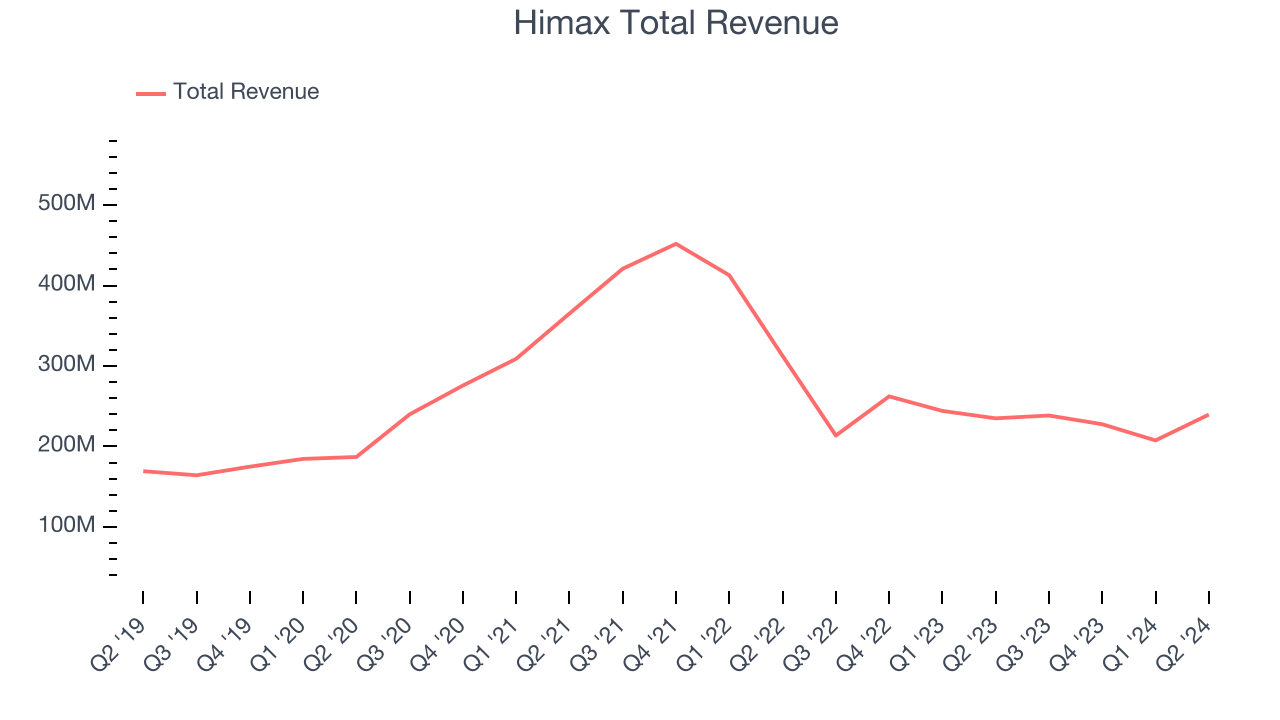

Best Q2: Himax (NASDAQ:HIMX)

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $239.6 million, up 2% year on year, outperforming analysts’ expectations by 2.9%. The business had an exceptional quarter with a significant improvement in its gross margin.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.6% since reporting. It currently trades at $5.59.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Lattice Semiconductor (NASDAQ:LSCC)

A global leader in its category, Lattice Semiconductor (NASDAQ:LSCC) is a semiconductor designer specializing in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning.

Lattice Semiconductor reported revenues of $124.1 million, down 34.7% year on year, falling short of analysts’ expectations by 4.7%. It was a disappointing quarter as it posted underwhelming revenue guidance for the next quarter and a decline in its operating margin.

As expected, the stock is down 3.1% since the results and currently trades at $53.20.

Read our full analysis of Lattice Semiconductor’s results here.

Nova (NASDAQ:NVMI)

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $156.9 million, up 27.8% year on year. This result topped analysts’ expectations by 5.9%. It was an exceptional quarter as it also logged an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

The stock is up 7.4% since reporting and currently trades at $194.71.

Read our full, actionable report on Nova here, it’s free.

Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.27 billion, down 5.1% year on year. This number surpassed analysts’ expectations by 1.5%. It was a very strong quarter as it also recorded a significant improvement in its gross margin and inventory levels.

The stock is up 4.1% since reporting and currently trades at $72.68.

Read our full, actionable report on Marvell Technology here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.