Data storage manufacturer Seagate (NASDAQ:STX) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 11% year on year to $1.66 billion. The company expects next quarter's revenue to be around $1.85 billion, coming in 1.5% above analysts' estimates. It made a non-GAAP profit of $0.33 per share, improving from its loss of $0.28 per share in the same quarter last year.

Seagate Technology (STX) Q1 CY2024 Highlights:

- Revenue: $1.66 billion vs analyst estimates of $1.66 billion (small miss)

- EPS (non-GAAP): $0.33 vs analyst estimates of $0.26 (25.4% beat)

- Revenue Guidance for Q2 CY2024 is $1.85 billion at the midpoint, above analyst estimates of $1.82 billion (EPS for the period also guided above)

- Gross Margin (GAAP): 25.7%, up from 17.2% in the same quarter last year

- Inventory Days Outstanding: 88, up from 80 in the previous quarter

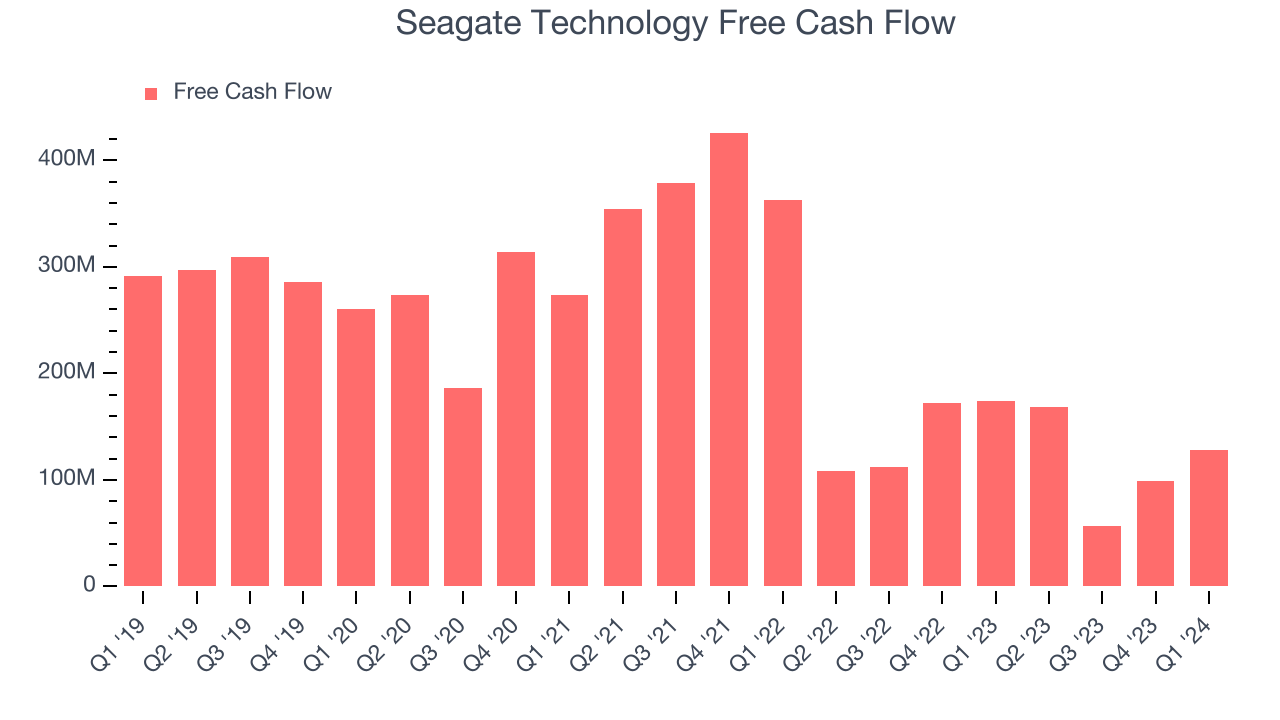

- Free Cash Flow of $128 million, up 29.3% from the previous quarter

- Market Capitalization: $17.85 billion

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagates peers and competitors include Western Digital (NASDAQ:WDC), SK Hynix (KOSI:000660), and Samsung (KOSI:005930).Memory Semiconductors

The global memory chip market has become concentrated due to the highly commoditized nature of these semiconductors. Despite the market consolidation, DRAM and NAND are subject to wide pricing swings as supply and demand ebbs and flows. This plays itself out in the business models of memory producers, where the large, fixed cost bases required to produce memory chips in volume can become very profitable during times of rising prices due to high demand and tight supply but also can result in periods of low profitability when more supply is brought online or demand drops.

Sales Growth

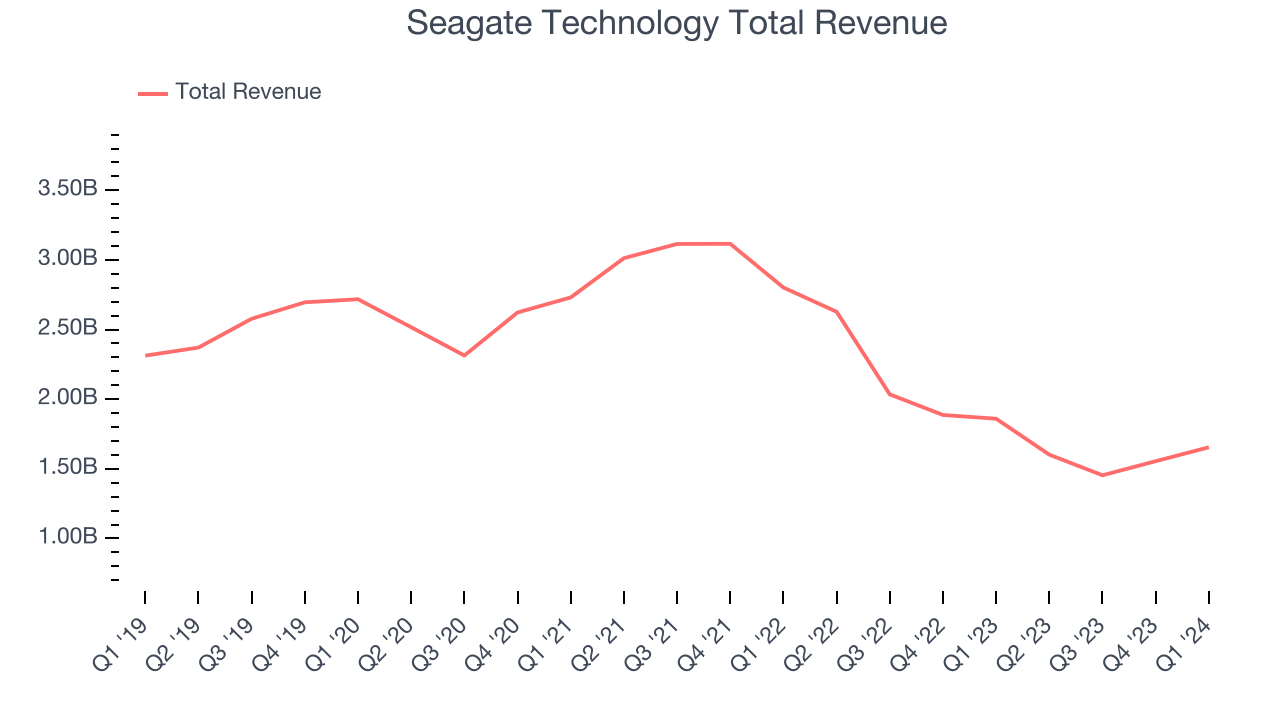

Seagate Technology's revenue has been declining over the last three years, dropping by 11.7% on average per year. This quarter, its revenue declined from $1.86 billion in the same quarter last year to $1.66 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Seagate Technology had a difficult quarter as revenue dropped 11% year on year, missing analysts' estimates by 0.4%. This could mean that the current downcycle is deepening.

Seagate Technology looks like it's on the cusp of a rebound, as it's guiding to 15.5% year-on-year revenue growth for the next quarter. Analysts seem to agree as consesus estimates call for 31.5% growth over the next 12 months.

Product Demand & Outstanding Inventory

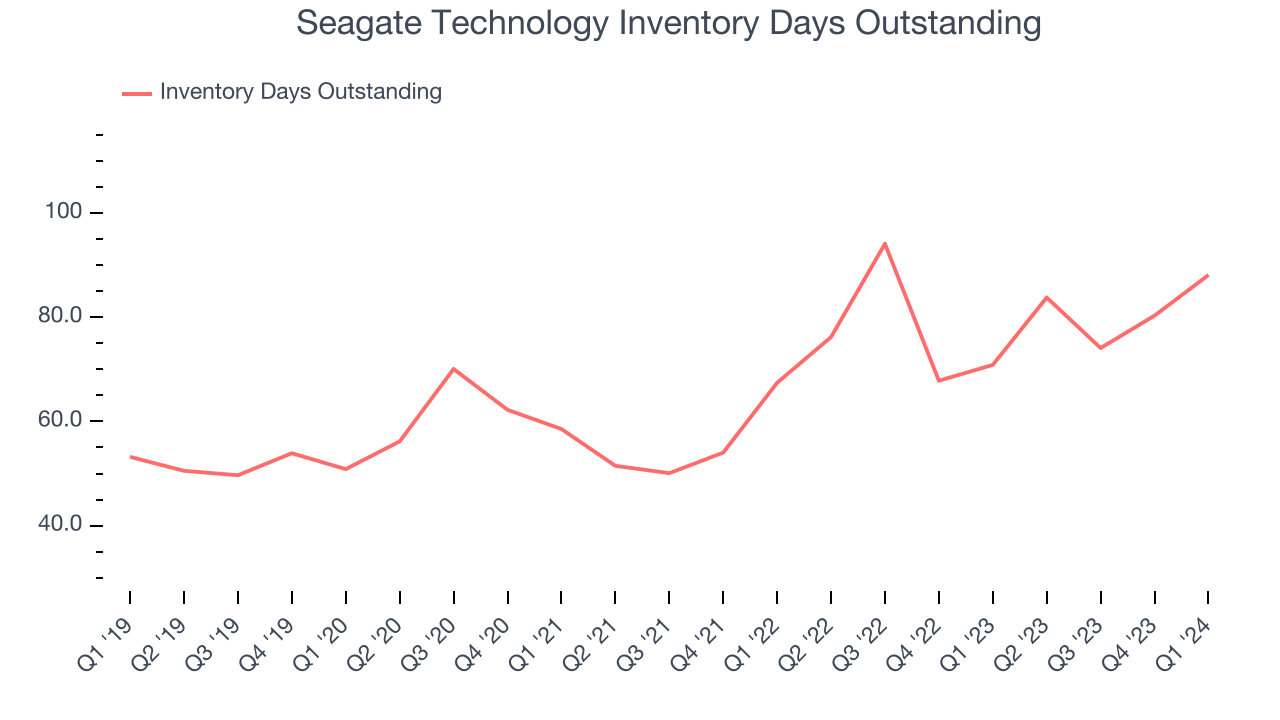

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Seagate Technology's DIO came in at 88, which is 23 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

Pricing Power

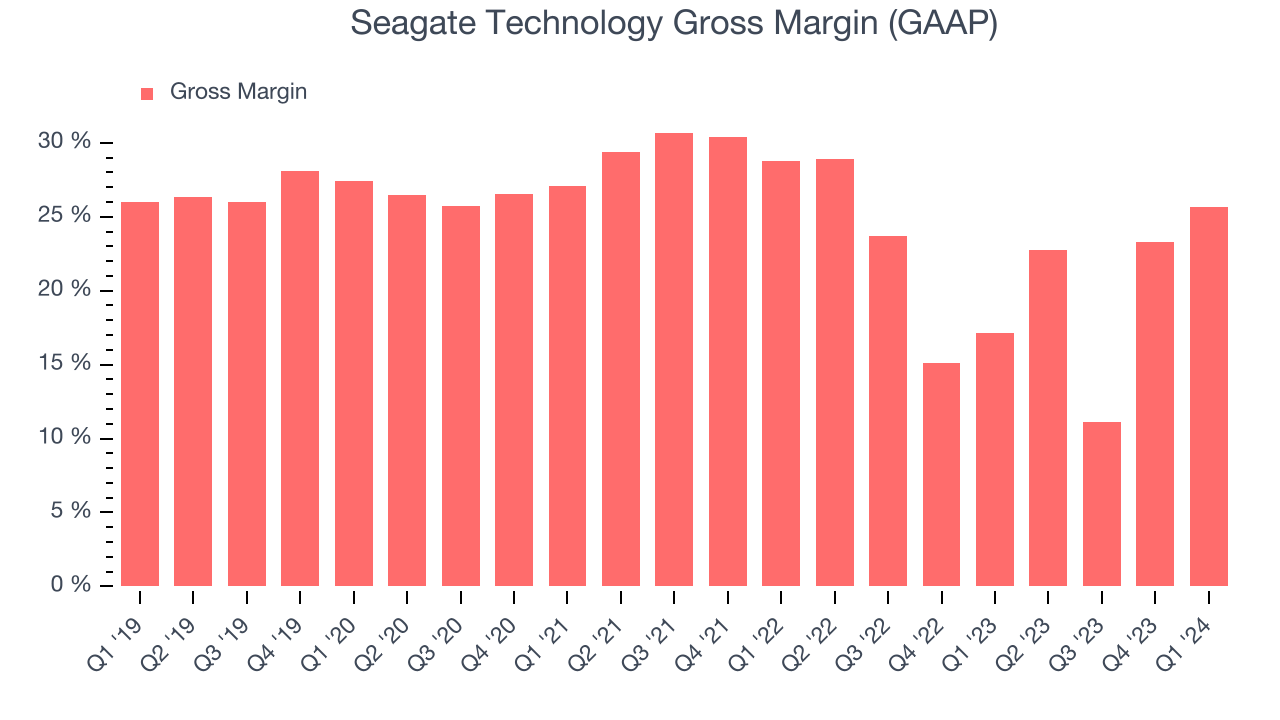

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. Seagate Technology's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 25.7% in Q1, up 8.5 percentage points year on year.

Seagate Technology's gross margins have been trending up over the last 12 months, averaging 21%. This is a welcome development, as Seagate Technology's margins are below the industry average, and rising margins could suggest improved demand and pricing power.

Profitability

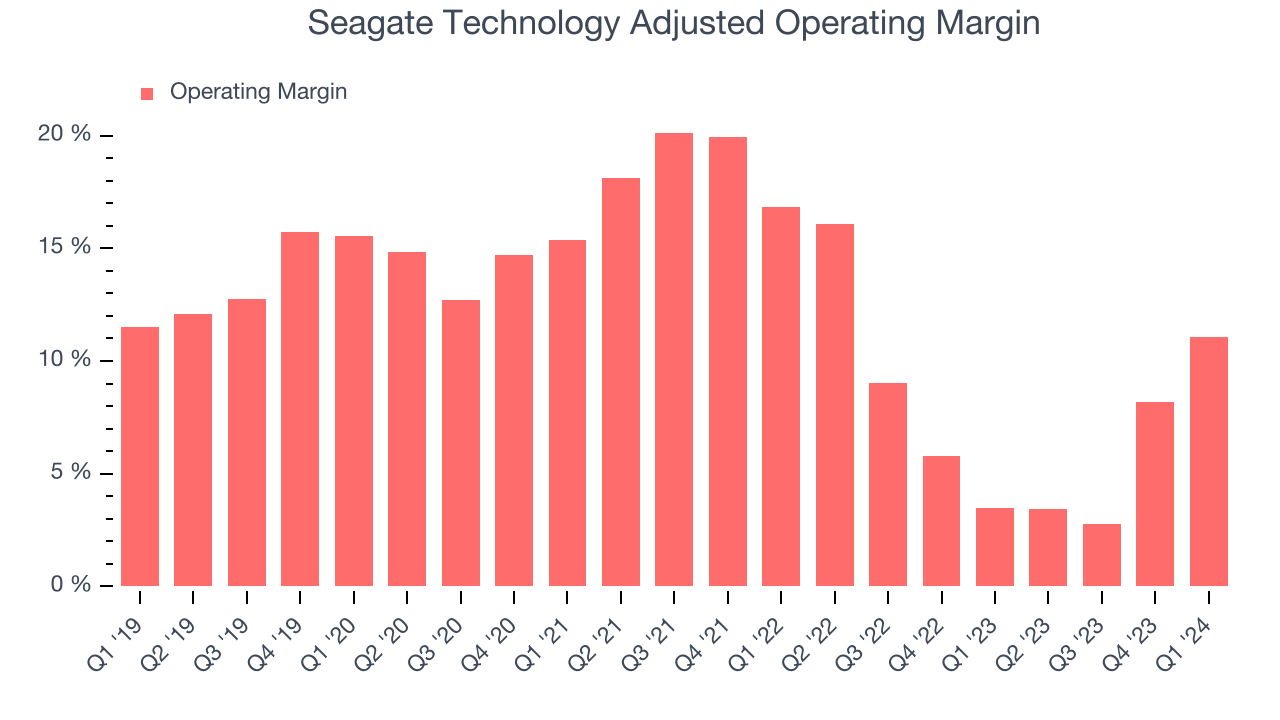

Seagate Technology reported an operating margin of 11.1% in Q1, up 7.6 percentage points year on year. Operating margins are one of the best measures of profitability because they tell us how much money a company takes home after manufacturing its products, marketing and selling them, and, importantly, keeping them relevant through research and development.

Seagate Technology's operating margins have been trending up over the last year, averaging 6.5%. This is a welcome development for Seagate Technology, whose cost structure isn't as efficient as it could be, as indicated by its slightly below-average margins.

Earnings, Cash & Competitive Moat

Analysts covering Seagate Technology expect earnings per share to grow 538% over the next 12 months, although estimates will likely change after earnings.

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. Seagate Technology's free cash flow came in at $128 million in Q1, down 26.4% year on year.

Seagate Technology has generated $452 million in free cash flow over the last 12 months, or 7.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Return on Invested Capital (ROIC)

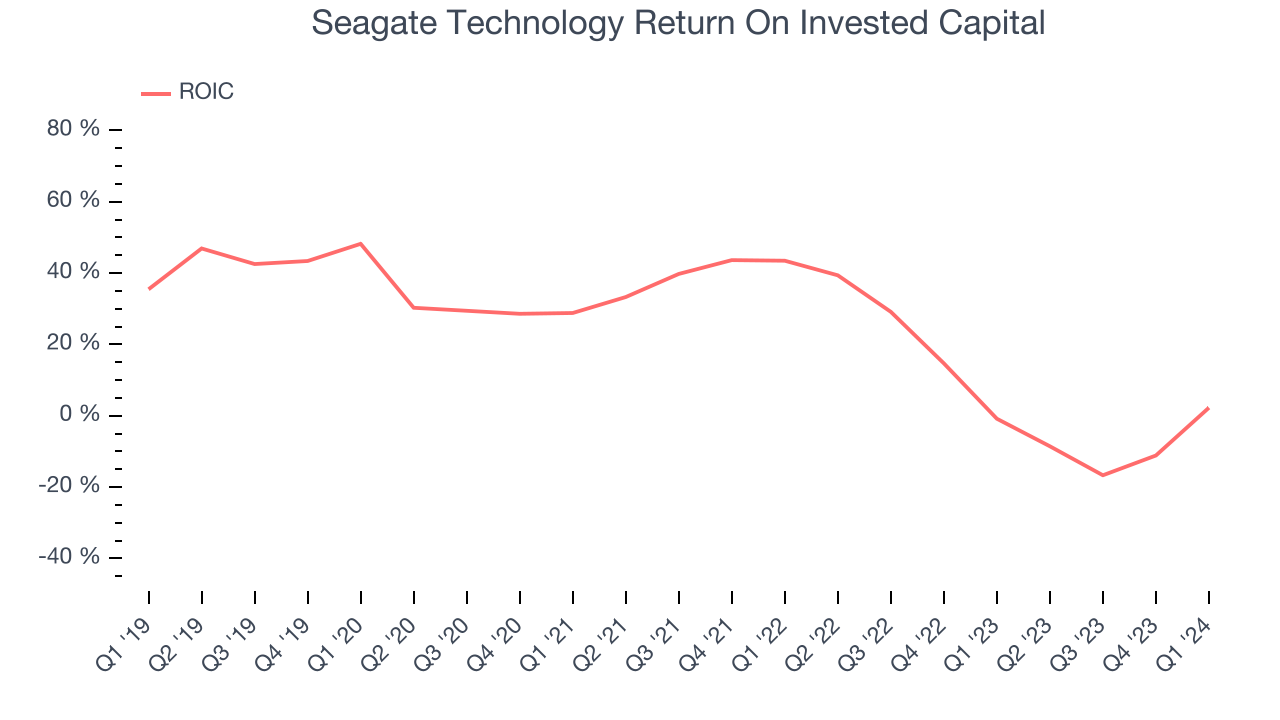

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Seagate Technology hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 24.4%, higher than most semiconductor companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Seagate Technology's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Seagate Technology's Q1 Results

We liked that gross margin and EPS outperformed Wall Street's estimates. Guidance for next quarter was also ahead for revenue and EPS, which is encouraging. On the other hand, its inventory levels increased. Overall, we think this was still a strong quarter that should satisfy shareholders. The stock is flat after reporting and currently trades at $86.53 per share.

Is Now The Time?

When considering an investment in Seagate Technology, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in the case of Seagate Technology, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its solid ROIC suggests it has grown profitably in the past, the downside is its gross margin indicate some combination of pricing pressures or rising production costs. On top of that, its operating margins reveal subpar cost controls compared to other semiconductor businesses.

Seagate Technology's price-to-earnings ratio based on the next 12 months is 21.6x. While there are some things to like about Seagate Technology and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $91.76 per share right before these results (compared to the current share price of $86.53).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.