Cloud infrastructure analytics maker SumoLogic (SUMO) reported Q4 FY2021 results that beat analyst expectations, with revenue up 22.21% year on year to $54.15 million. SumoLogic made a GAAP loss of $20.59 million, improving on its loss of $34.52 million, in the same quarter last year.

SumoLogic (SUMO) Q4 FY2021 Highlights:

- Revenue: $54.15 million vs analyst estimates of $52.13 million (3.9% beat)

- EPS (non-GAAP): -$0.07 vs analyst estimates of -$0.12

- Revenue guidance for Q1 2022 is $53.70 million at the midpoint, above analyst estimates of $53.41 million

- Management's revenue guidance for FY2022 of $233.0 million at the midpoint, predicting 14.98% growth (vs 31.62% in FY2021)

- Free cash flow was negative -$1.75 million, compared to negative free cash flow of -$18.71 million in previous quarter

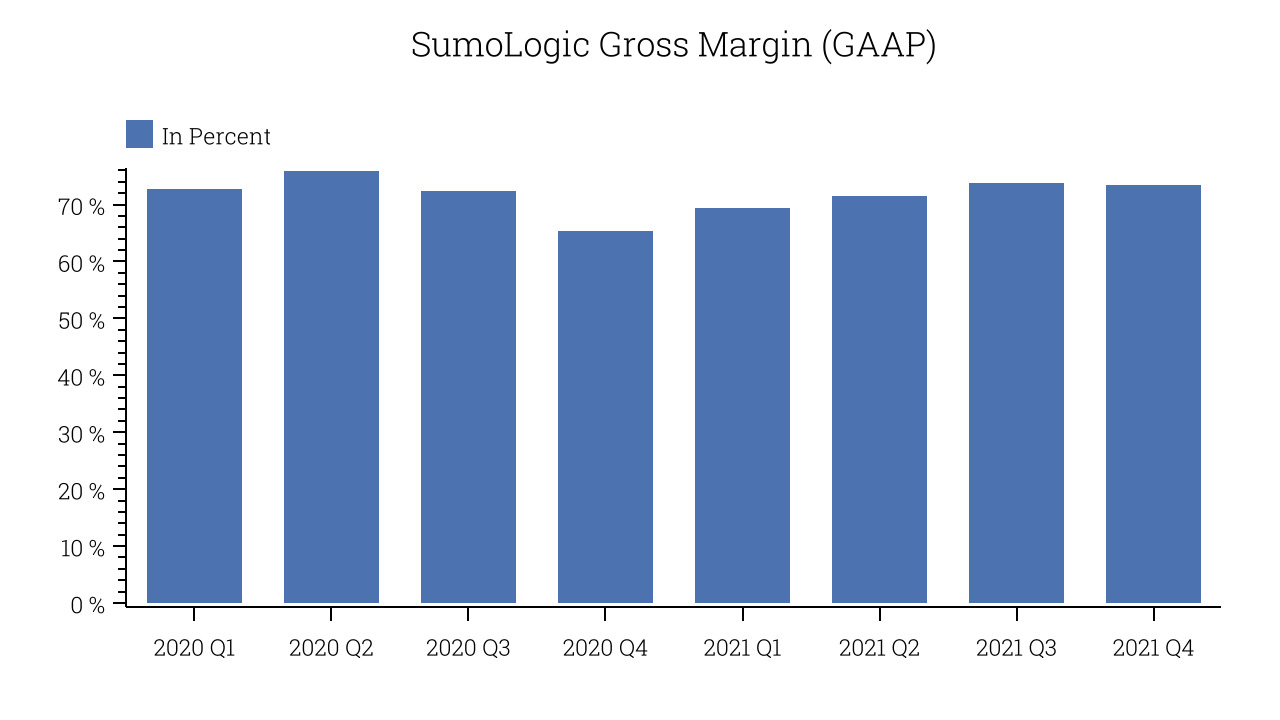

- Gross Margin (GAAP): 73.50%, in line with previous quarter

“We had a strong finish to our year driven by robust demand for Sumo Logic’s Continuous Intelligence platform. We continue to see customers of all sizes and maturities choose our platform to enable their cloud and digital transformations,” said Ramin Sayar, president and CEO of Sumo Logic. "We continue to expand our differentiated platform with investments in observability and security and are well positioned for success in the massive market opportunity in front of us."

Watching The Clouds

When the founders were starting SumoLogic in 2010, the first investment from the famous VC firm Greylock came so fast they didn’t even have a name for the company yet, and so they chose the name of one of their dogs “Sumo” as a placeholder. As is often the case, it stuck.

SumoLogic (SUMO) is software as a service data analytics platform that helps companies get insight into what is happening in their servers and applications. Sumo plugs into their cloud customers services and gathers logs about how are they being used, analyses the data and then makes them accessible through collaborative dashboards. It helps their customers reduce downtime by alerting them about performance issues of their applications and mitigates security risks by flagging suspicious traffic and visitor behaviour.

SumoLogic along with its competitors like Datadog (DDOG) or Elastic (ESTC) belong to the type of tech infrastructure companies that are benefiting from the growing digital economy and overall migration to cloud-based services, regardless of the industry.

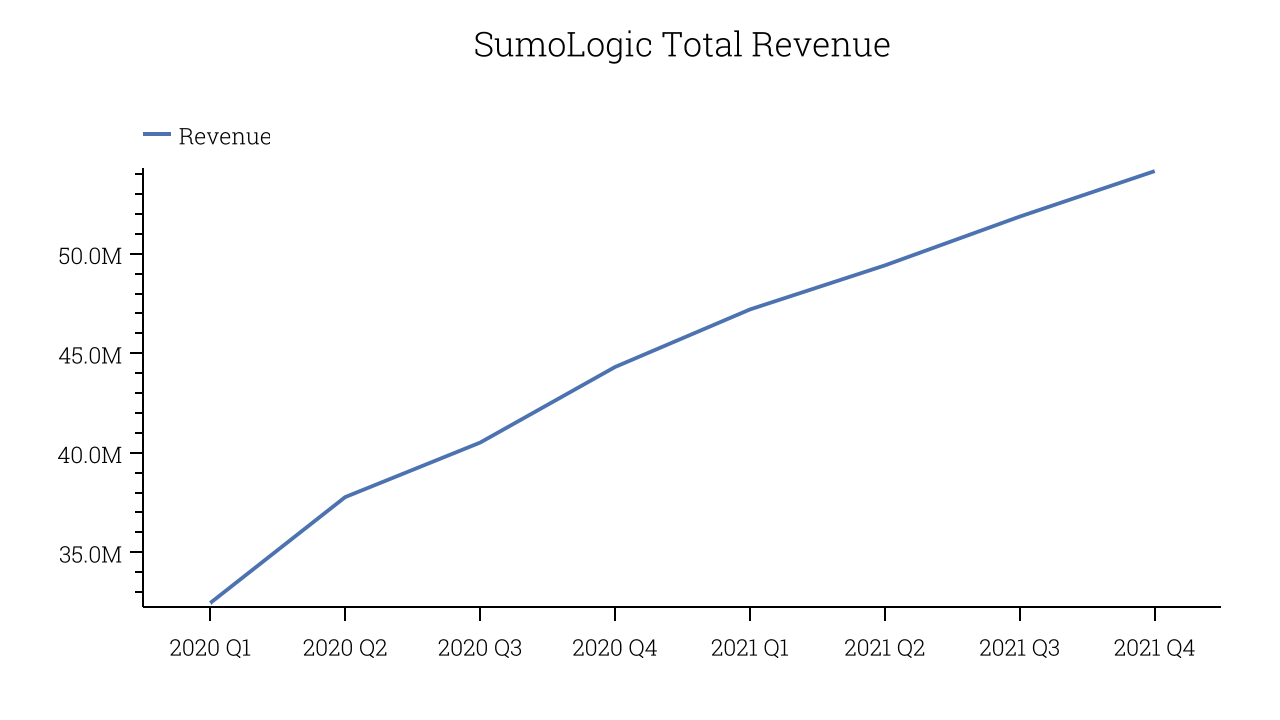

As you can see below, SumoLogic's revenue growth has been very strong over the last twelve months, growing from $44.31 million to $54.15 million.

This quarter, SumoLogic's quarterly revenue was once again up a very solid 22.21% year on year. Quarter on quarter the revenue increased by $2.284 million in Q4, which was in line with Q3 2021. This steady quarter-on-quarter growth shows the company is able to maintain its steady growth trajectory.

SumoLogic's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 73.50% in Q4. That means that from every $1 in revenue the company had $0.73 left to spend on developing new products, marketing & sales and the general administrative overhead. Trending up over the last year this is around the average what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market, so it is important to track.

Key Takeaways from SumoLogic's Q4 Results

Since it is still burning cash it is worth keeping an eye on SumoLogic’s balance sheet, but we note that with $404.1 million cash and market capitalization of $2.763 billion the company is in a strong position to invest in growth.

It was good to see SumoLogic outperform Wall St’s revenue expectations. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was disappointing that the revenue guidance for next year was quite weak. Overall, this quarter's results were not the best we've seen from SumoLogic. SumoLogic wasn't our first pick going into these results, and nothing we have seen today changed that.

The author has no position in any of the stocks mentioned.