Cloud infrastructure analytics maker Sumo Logic (SUMO) reported Q3 FY2022 results beating Wall St's expectations, with revenue up 19.5% year on year to $62 million. The company expects that next quarter's revenue would be around $64.2 million, which is the midpoint of the guidance range. That was in roughly line with analyst expectations. Sumo Logic made a GAAP loss of $30.8 million, down on its loss of $23.9 million, in the same quarter last year.

Is now the time to buy Sumo Logic? Access our full analysis of the earnings results here, it's free.

Sumo Logic (SUMO) Q3 FY2022 Highlights:

- Revenue: $62 million vs analyst estimates of $60.8 million (1.9% beat)

- EPS (non-GAAP): -$0.12 vs analyst estimates of -$0.14

- Revenue guidance for Q4 2022 is $64.2 million at the midpoint, roughly in line with what analysts were expecting

- Free cash flow was negative $13.1 million, compared to negative free cash flow of $5.59 million in previous quarter

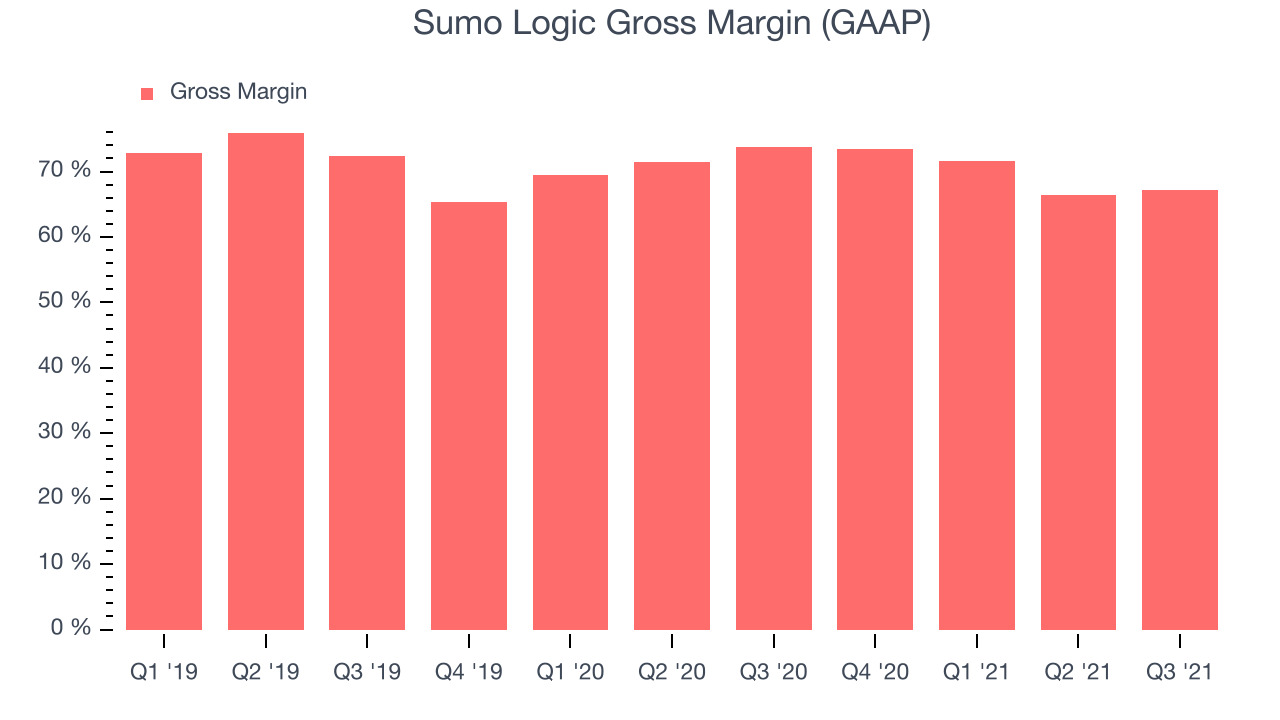

- Gross Margin (GAAP): 67.1%, down from 73.7% same quarter last year

“Sumo Logic delivered another strong quarter of revenue growth for the fiscal third quarter. Results were again driven by continued adoption of our leading Continuous Intelligence platform, which helps our customers ensure application reliability, manage and optimize multi-cloud infrastructure, as well as secure and protect against modern security threats,” said Ramin Sayar, President and CEO of Sumo Logic.

Founded in 2010 by Christian Beegden who went from driving a cab in Germany to landing an internship at Amazon,Sumo Logic (NASDAQ:SUMO) is software as a service data analytics platform that helps companies get insight into what is happening in their servers and applications.

Organizations are expected to look towards modern tech platforms such as Sumo Logic to manage the growing complexity of enterprise applications and processes required to power their business.

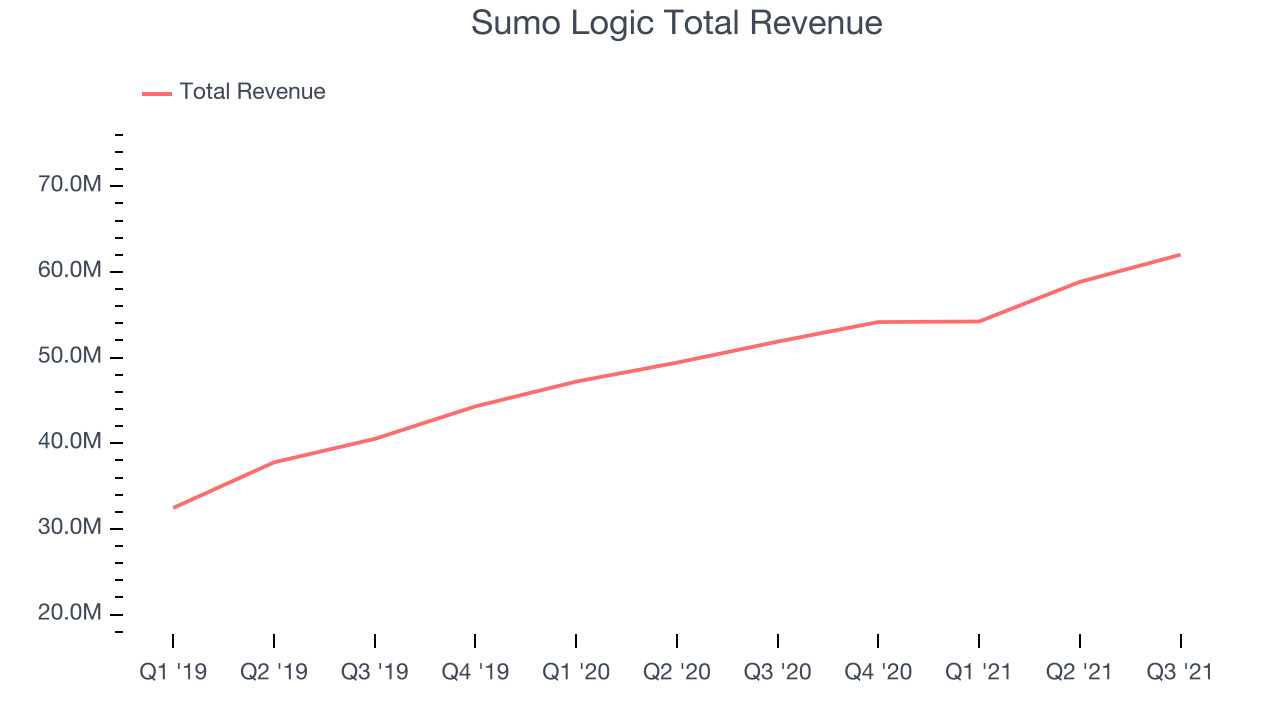

Sales Growth

As you can see below, Sumo Logic's revenue growth has been moderate over the last year, growing from quarterly revenue of $51.8 million, to $62 million.

This quarter, Sumo Logic's quarterly revenue was once again up 19.5% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $3.17 million in Q3, compared to $4.62 million in Q2 2022. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Analysts covering the company are expecting the revenues to grow 18.9% over the next twelve months, although estimates are likely to change post earnings.

There are others doing even better than Sumo Logic. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Sumo Logic's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 67.1% in Q3.

That means that for every $1 in revenue the company had $0.67 left to spend on developing new products, marketing & sales and the general administrative overhead. While it improved significantly from the previous quarter this would still be considered a low gross margin for a SaaS company and we would like to see the improvements continue.

Key Takeaways from Sumo Logic's Q3 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Sumo Logic’s balance sheet, but we note that with a market capitalization of $1.49 billion and more than $288.9 million in cash, the company has the capacity to continue to prioritise growth over profitability.

Sumo Logic topped analysts’ revenue expectations this quarter, even if just narrowly. And we were also glad to see the improvement in gross margin. Zooming out, we think this was a decent quarter, showing the company is staying on target. The company is down 3.2% on the results and currently trades at $13.26 per share.

Should you invest in Sumo Logic right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.