American firearms manufacturer Smith & Wesson (NASDAQ:SWBI) reported Q3 FY2024 results topping analysts' expectations, with revenue up 6.5% year on year to $137.5 million. It made a GAAP profit of $0.17 per share, down from its profit of $0.24 per share in the same quarter last year.

Smith & Wesson (SWBI) Q3 FY2024 Highlights:

- Revenue: $137.5 million vs analyst estimates of $133.5 million (2.9% beat)

- EPS: $0.17 vs analyst estimates of $0.10 ($0.07 beat)

- Free Cash Flow of $7.16 million is up from -$37.87 million in the previous quarter

- Gross Margin (GAAP): 28.7%, down from 32.7% in the same quarter last year

- Market Capitalization: $601.1 million

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson was established as a small partnership in Springfield, Massachusetts, with the vision of creating innovative firearm safety mechanisms, which led to the development of the Volcanic rifle. The company's founding was driven by the goal of enhancing the security and reliability of firearms.

Smith & Wesson offers an extensive catalog of firearms, including revolvers, semi-automatic pistols, and rifles. Its products address the need for dependable and precise firearms in situations where performance can mean the difference between life and death.

The company's revenue stems from sales of firearms, ammunition, and other accessories to the commercial, law enforcement, and military sectors.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the firearms market include Sturm, Ruger & Company (NYSE:RGR), Vista Outdoor (NYSE:VSTO), and American Outdoor Brands (NASDAQ:AOUT).Sales Growth

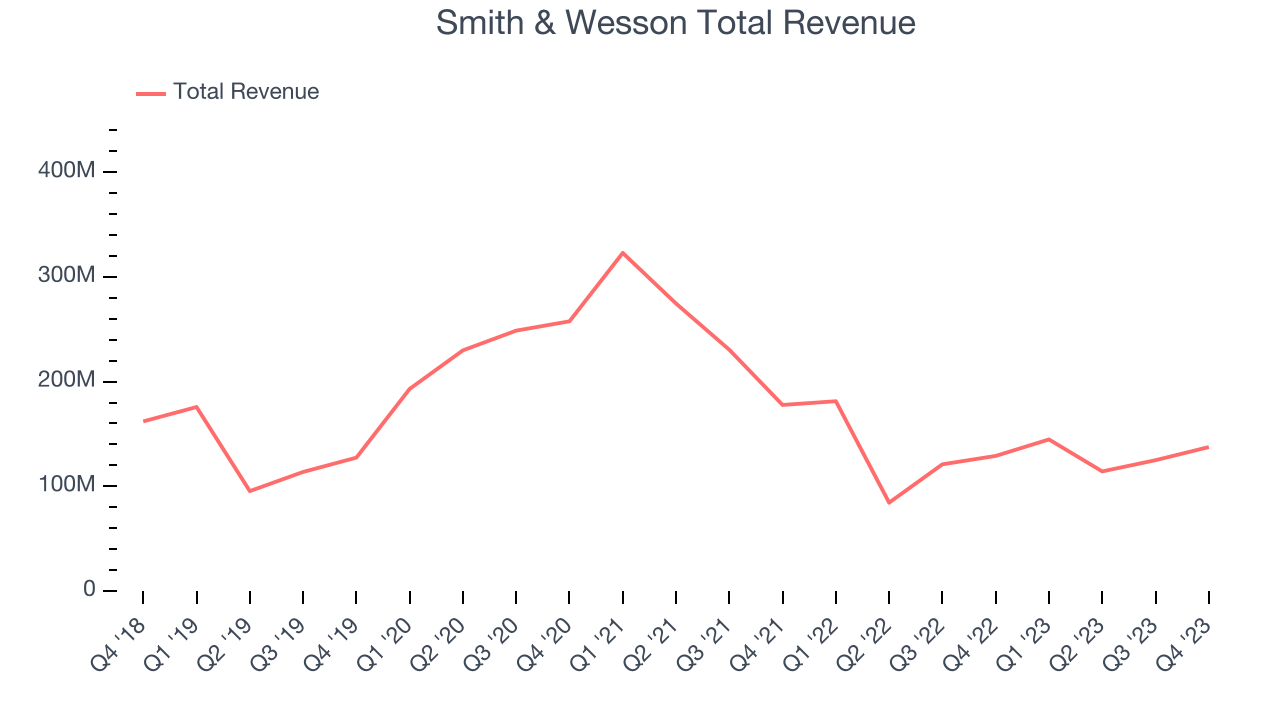

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Smith & Wesson's revenue declined over the last five years, dropping 4.1% annually.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Smith & Wesson's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 28% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Smith & Wesson's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 28% over the last two years.

This quarter, Smith & Wesson reported solid year-on-year revenue growth of 6.5%, and its $137.5 million of revenue outperformed Wall Street's estimates by 2.9%. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, a deceleration from this quarter.

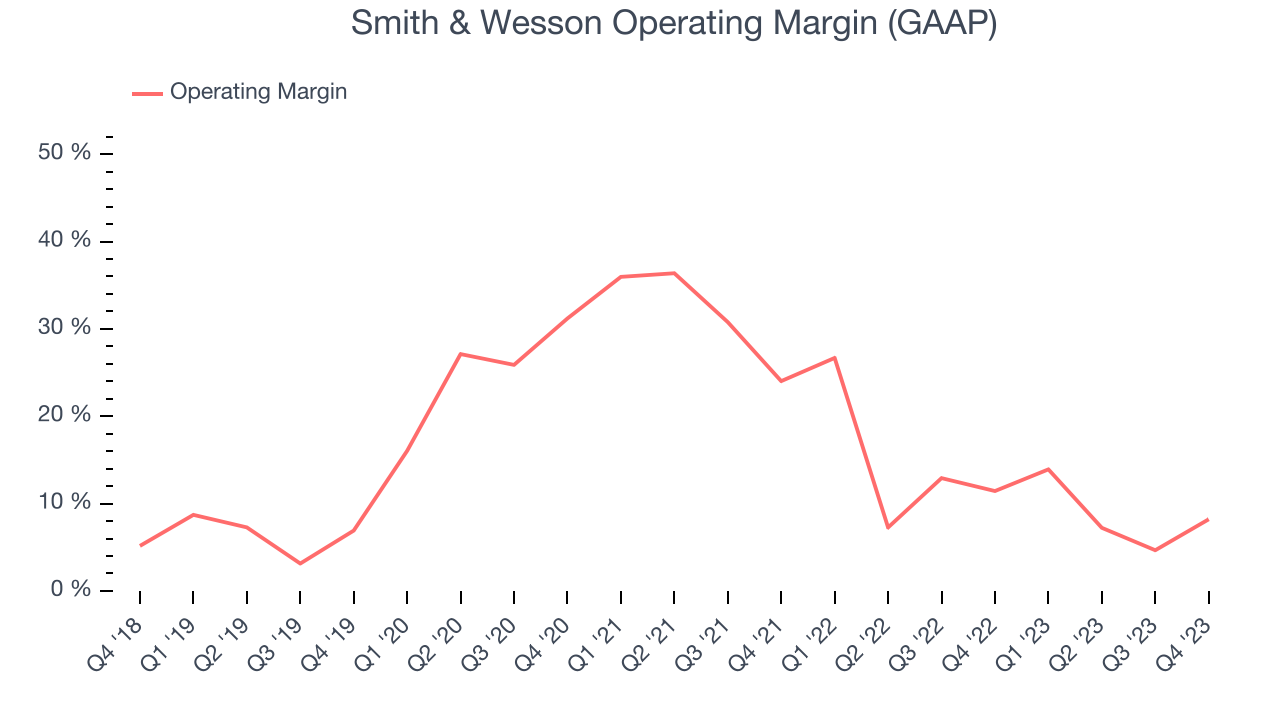

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Smith & Wesson has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.6%, higher than the broader consumer discretionary sector.

This quarter, Smith & Wesson generated an operating profit margin of 8.2%, down 3.2 percentage points year on year.

Over the next 12 months, Wall Street expects Smith & Wesson to become more profitable. Analysts are expecting the company’s LTM operating margin of 8.7% to rise to 10.8%.EPS

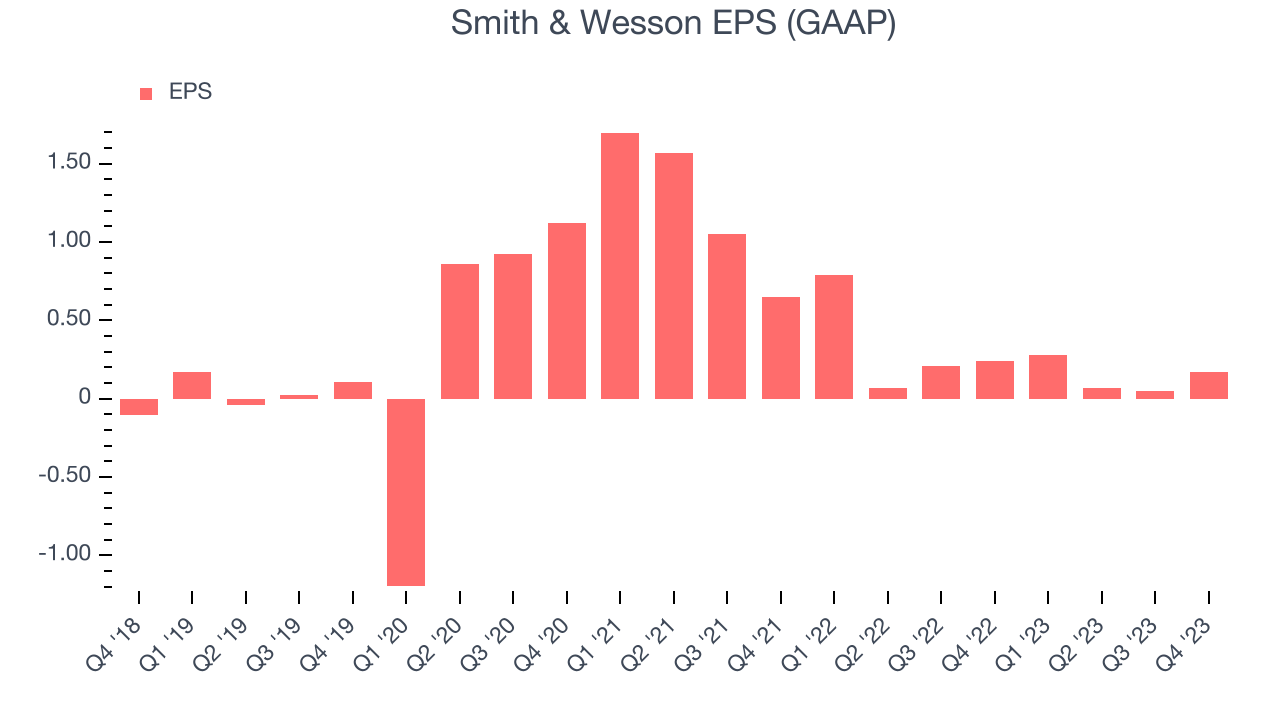

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Smith & Wesson's EPS grew 1,363%, translating into an astounding 71% compounded annual growth rate. This performance is materially higher than its 4.1% annualized revenue declines over the same period. Let's dig into why. While we mentioned earlier that Smith & Wesson's operating margin declined this quarter, a five-year view shows its margin has expanded 3 percentage points while its share count has shrunk 15.6%. Improving profitability and share buybacks are positive signs as they juice EPS growth relative to revenue growth.

In Q3, Smith & Wesson reported EPS at $0.17, down from $0.24 in the same quarter a year ago. This print beat analysts' estimates by 75.9%. Over the next 12 months, Wall Street expects Smith & Wesson to grow its earnings. Analysts are projecting its LTM EPS of $0.57 to climb by 60.5% to $0.91.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Smith & Wesson hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 24.8%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Smith & Wesson's ROIC over the last two years averaged 17.7 percentage point decreases each year. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Smith & Wesson's Q3 Results

We were impressed by how significantly Smith & Wesson blew past analysts' operating margin and EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. Management noted it "gained market share as our shipments outpaced the overall firearm market" and that it "expects the firearm market to experience healthy demand through the 2024 election cycle". For context, firearm sales typically rise in each election year as consumers fear potential policy changes and stockpile goods.

Smith & Wesson's Board also authorized a $0.12 per share quarterly dividend that will be paid on April 4, 2024 to stockholders of record on March 21, 2024. This dividend represents a ~3.5% annual yield based on today's stock price.

Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 3.6% after reporting and currently trades at $13.93 per share.

Is Now The Time?

Smith & Wesson may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Smith & Wesson isn't a bad business, but it probably wouldn't be one of our picks. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term.

Smith & Wesson's price-to-earnings ratio based on the next 12 months is 14.3x. In the end, beauty is in the eye of the beholder. While Smith & Wesson wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $16.17 per share right before these results (compared to the current share price of $13.93).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.