Residential swimming pool manufacturer Latham (NASDAQ:SWIM) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue down 19.7% year on year to $110.6 million. The company expects the full year's revenue to be around $505 million, in line with analysts' estimates. It made a GAAP loss of $0.07 per share, improving from its loss of $0.13 per share in the same quarter last year.

Latham (SWIM) Q1 CY2024 Highlights:

- Revenue: $110.6 million vs analyst estimates of $101.7 million (8.8% beat)

- Adjusted EBITDA: $12.3 million vs analyst estimates of $6.6 million (large beat)

- EPS: -$0.07 vs analyst estimates of -$0.12 (42.9% beat)

- The company reconfirmed its revenue guidance for the full year of $505 million at the midpoint

- Gross Margin (GAAP): 27.7%, up from 24.2% in the same quarter last year

- Free Cash Flow was -$39.86 million, down from $23.33 million in the previous quarter

- Market Capitalization: $340.4 million

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham was created to provide high-quality, long-lasting swimming pools and has since evolved into a globally recognized company in the residential swimming pool sector. Over time, the business expanded its reach and product line, adapting to changing consumer needs and the evolving landscape of outdoor home improvement.

Latham's primary offerings encompass a range of in-ground residential swimming pools, including fiberglass and vinyl-liner models, along with various pool-related products like covers, liners, and safety fencing. The company addresses the need for durable, aesthetically pleasing, customizable pool solutions for residential settings.

Latham generates revenue through both direct sales and an extensive dealer network spanning multiple countries. This business model allows the company to maintain a balance between broad market reach and the provision of personalized, localized service. The company's products primarily appeal to homeowners seeking to improve their properties and builders and contractors looking for reliable and high-quality pool solutions.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the outdoor recreation and water leisure industry include Brunswick (NYSE:BC), MasterCraft Boat (NASDAQ:MCFT), and Malibu Boats (NASDAQ:MBUU).Sales Growth

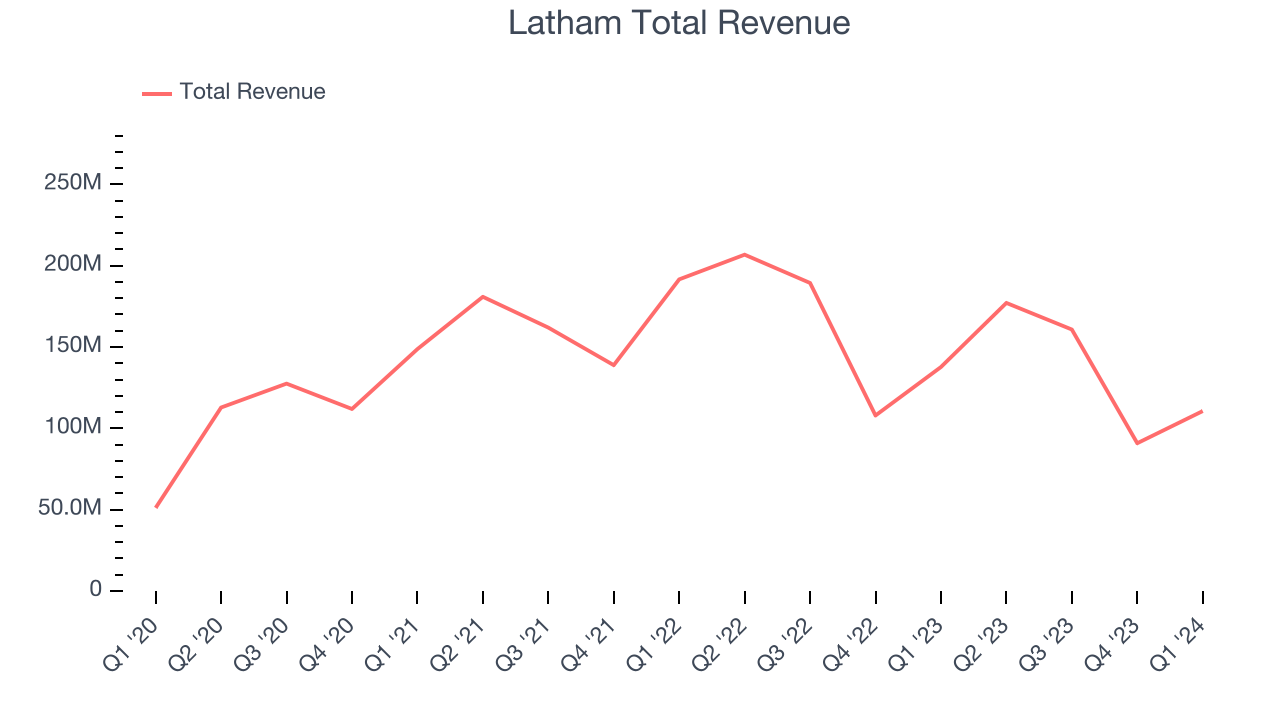

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Latham's annualized revenue growth rate of 2.5% over the last three years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Latham's recent history shows a reversal from its already weak three-year trend as its revenue has shown annualized declines of 10.5% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Latham's recent history shows a reversal from its already weak three-year trend as its revenue has shown annualized declines of 10.5% over the last two years.

This quarter, Latham's revenue fell 19.7% year on year to $110.6 million but beat Wall Street's estimates by 8.8%. Looking ahead, Wall Street expects revenue to decline 5.2% over the next 12 months.

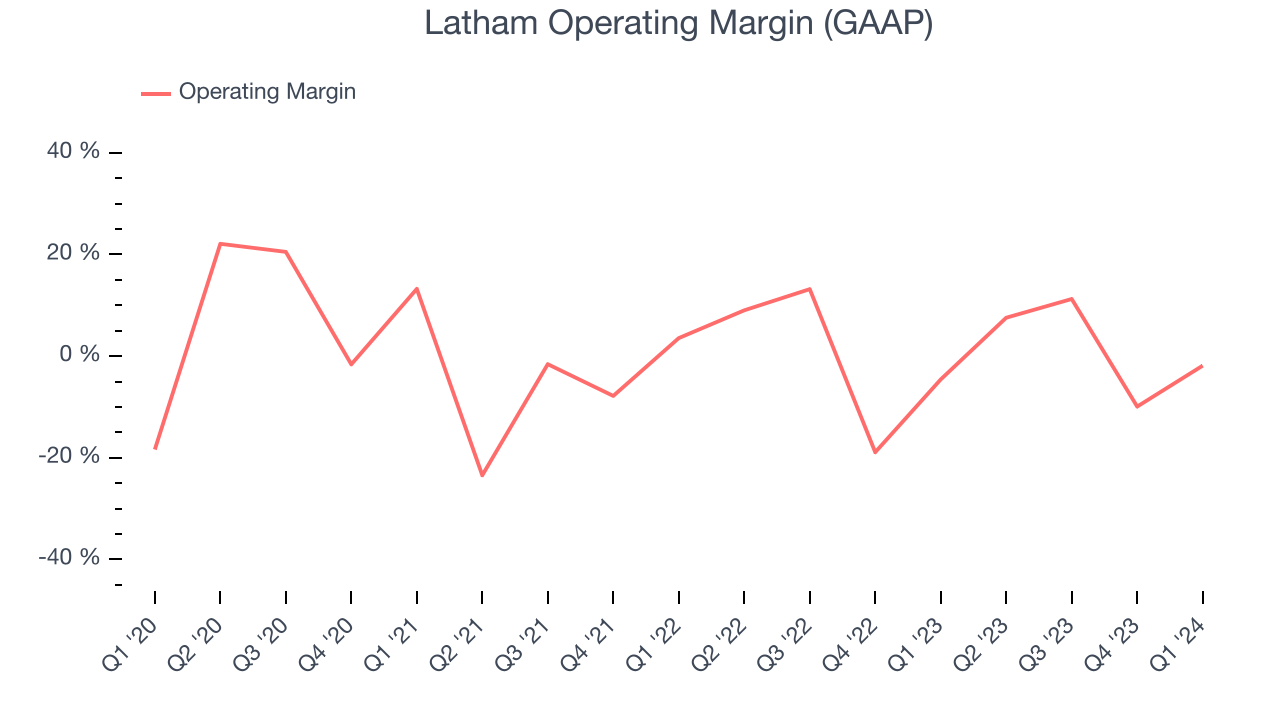

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Latham was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.2% has been paltry for a consumer discretionary business.

This quarter, Latham generated an operating profit margin of negative 1.9%, up 2.7 percentage points year on year.

Over the next 12 months, Wall Street expects Latham to break even on its operating profits. Analysts are expecting the company’s LTM operating margin of 3.8% to decline by 3.4 percentage points.EPS

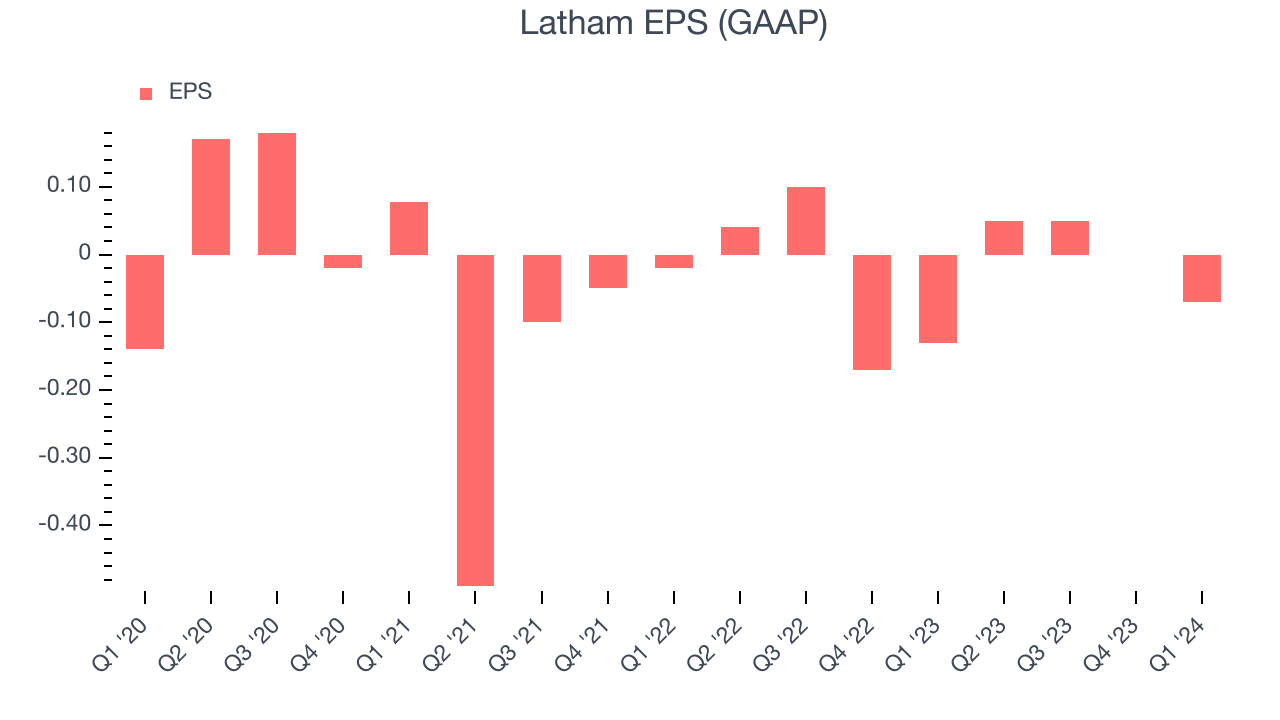

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last three years, Latham's EPS dropped 295%, translating into 58.1% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Latham reported EPS at negative $0.07, up from negative $0.13 in the same quarter last year. This print beat analysts' estimates by 42.9%. Over the next 12 months, Wall Street expects Latham to perform poorly. Analysts are projecting its LTM EPS of $0.03 to shrink to break even.

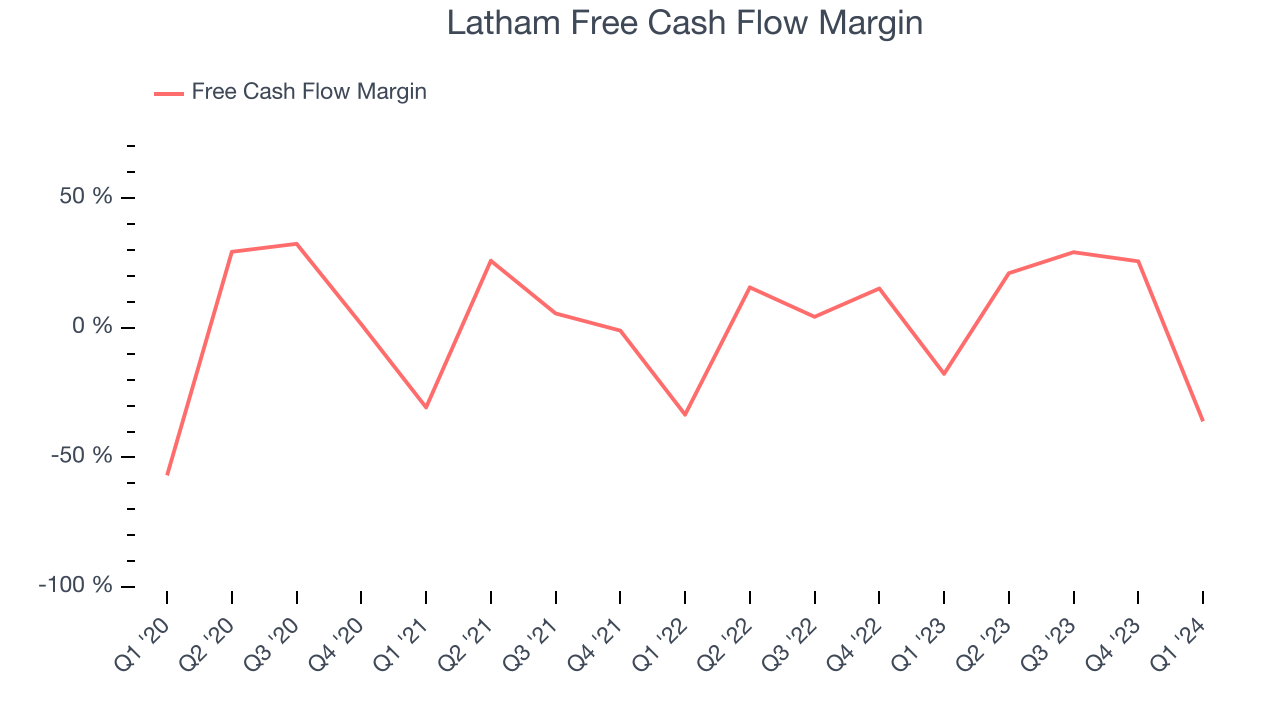

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Latham has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.5%, subpar for a consumer discretionary business.

Latham burned through $39.86 million of cash in Q1, equivalent to a negative 36% margin, reducing its cash burn by 63.2% year on year. Over the next year, analysts predict Latham's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 12.6% will decrease to 2.5%.

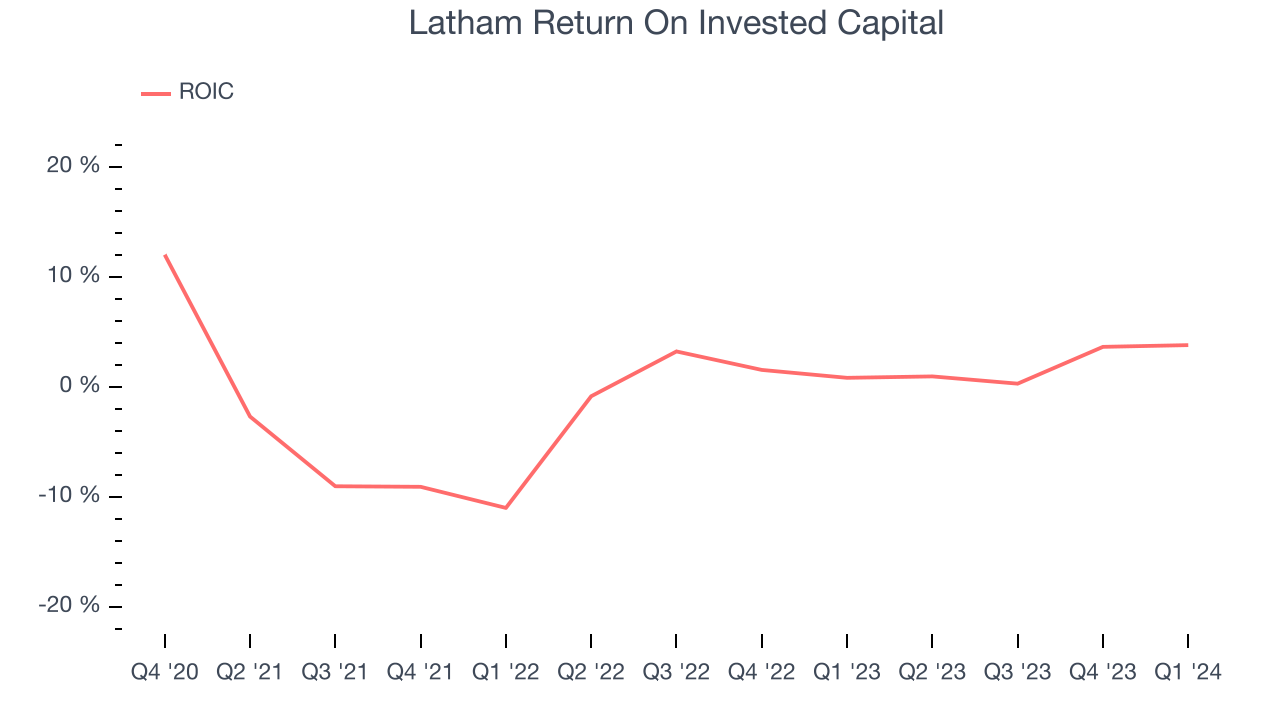

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Latham's five-year average return on invested capital was negative 2.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Latham reported $43.81 million of cash and $312.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $89.28 million of EBITDA over the last 12 months, we view Latham's 3.0x net-debt-to-EBITDA ratio as safe. We also see its $15.13 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Latham's Q1 Results

We were impressed by how significantly Latham blew past analysts' adjusted EBITDA and EPS expectations this quarter. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is flat after reporting and currently trades at $2.99 per share.

Is Now The Time?

Latham may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Latham, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here. On top of that, its declining EPS over the last three years makes it hard to trust, and its projected EPS for the next year is lacking.

While we've no doubt one can find things to like about Latham, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $3.60 per share right before these results (compared to the current share price of $2.99).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.