As analog semiconductors stocks’ Q4 earnings season wraps, let's dig into this quarter's best and worst performers, including Skyworks Solutions (NASDAQ:SWKS) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.69%, while on average next quarter revenue guidance was 2.68% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but analog semiconductors stocks held their ground better than others, with share prices down 1.71% since the previous earnings results, on average.

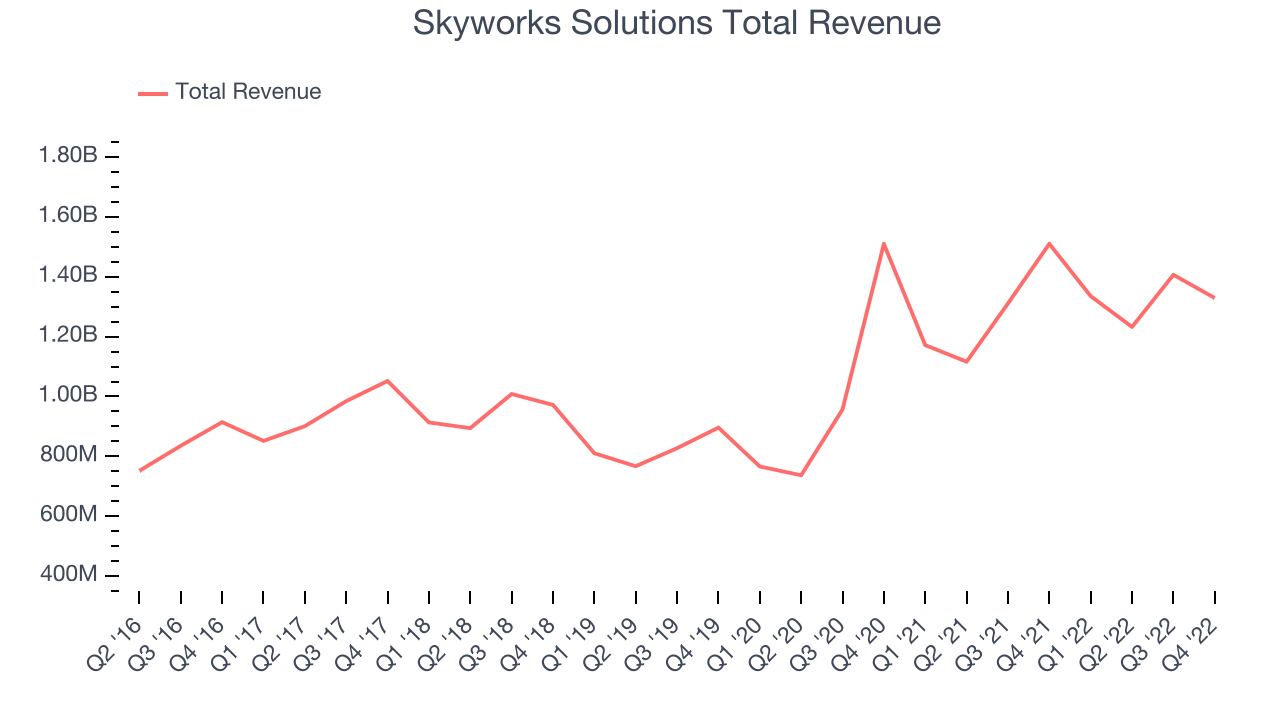

Skyworks Solutions (NASDAQ:SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.33 billion, down 12% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

The stock is up 3.89% since the results and currently trades at $113.6.

Is now the time to buy Skyworks Solutions? Access our full analysis of the earnings results here, it's free.

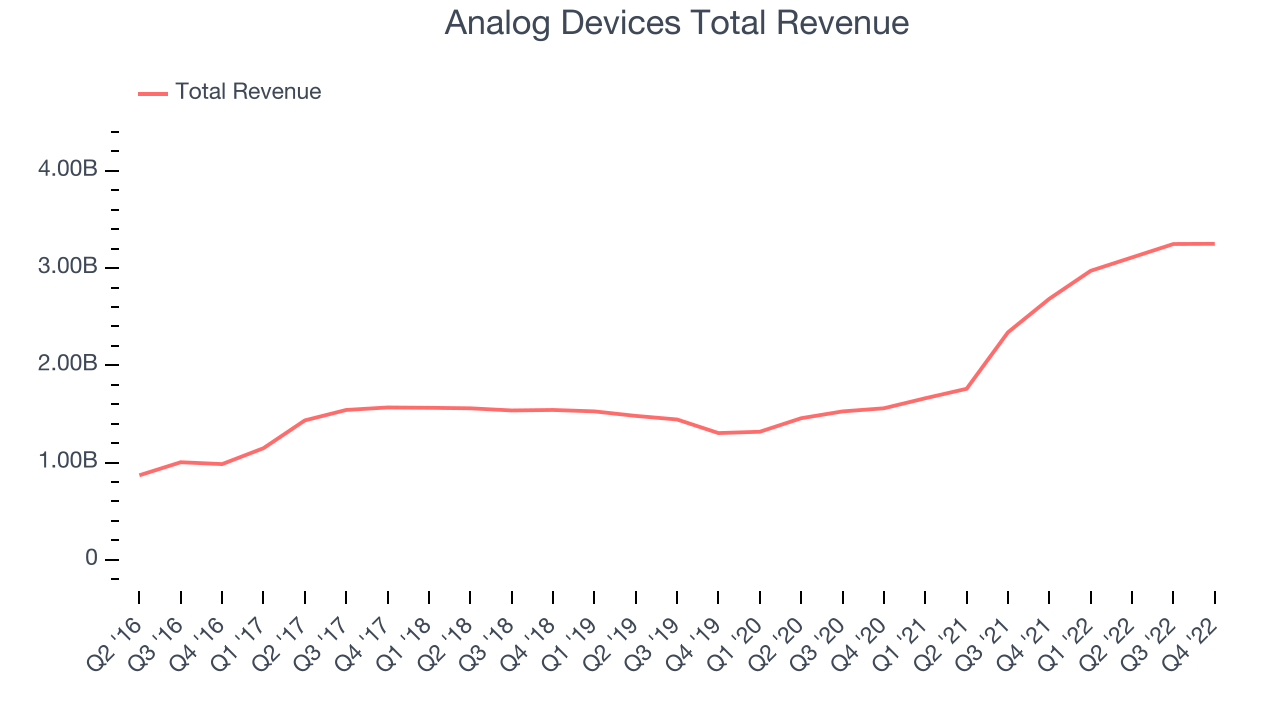

Best Q4: Analog Devices (NASDAQ:ADI)

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ:ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

Analog Devices reported revenues of $3.25 billion, up 21.1% year on year, beating analyst expectations by 3.16%. It was a strong quarter for the company, with very optimistic guidance for the next quarter and a beat on the bottom line.

The stock is up 1.28% since the results and currently trades at $184.8.

Is now the time to buy Analog Devices? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $855.3 million, up 1.45% year on year, missing analyst expectations by 3.1%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

Vishay Intertechnology had the weakest performance against analyst estimates in the group. The stock is down 8.7% since the results and currently trades at $21.92.

Read our full analysis of Vishay Intertechnology's results here.

MACOM Technology (NASDAQ:MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM Technology reported revenues of $180.1 million, up 12.8% year on year, in line with analyst expectations. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter and an increase in inventory levels.

The stock is up 2.54% since the results and currently trades at $70.21.

Read our full, actionable report on MACOM Technology here, it's free.

Himax (NASDAQ:HIMX)

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops and mobile phones.

Himax reported revenues of $262.3 million, down 42% year on year, inline with analyst expectations. It was a weaker quarter for the company, with slow revenue growth and a decline in operating margin.

The stock is down 4.72% since the results and currently trades at $7.87.

Read our full, actionable report on Himax here, it's free.

The author has no position in any of the stocks mentioned