Online fashion resale marketplace ThredUp (NASDAQ:TDUP) fell short of analysts' expectations in Q2 CY2024, with revenue down 3.5% year on year to $79.76 million. Next quarter's revenue guidance of $70 million also underwhelmed, coming in 17.3% below analysts' estimates. It made a GAAP loss of $0.13 per share, improving from its loss of $0.18 per share in the same quarter last year.

Is now the time to buy ThredUp? Find out by accessing our full research report, it's free.

ThredUp (TDUP) Q2 CY2024 Highlights:

- Revenue: $79.76 million vs analyst estimates of $82.48 million (3.3% miss)

- EPS: -$0.13 vs analyst expectations of -$0.10 (26.8% miss)

- Revenue Guidance for Q3 CY2024 is $70 million at the midpoint, below analyst estimates of $84.66 million

- The company dropped its revenue guidance for the full year from $333 million to $300 million at the midpoint, a 9.9% decrease

- Gross Margin (GAAP): 70.4%, up from 67.4% in the same quarter last year

- Adjusted EBITDA Margin: -1.9%, up from -6.1% in the same quarter last year

- Free Cash Flow was -$6.14 million compared to -$227,000 in the previous quarter

- Active Buyers: 1.7 million at quarter end

- Market Capitalization: $202.3 million

“While this quarter presented challenges in both the U.S. and Europe, we have emerged with a renewed focus,” said ThredUp CEO and co-founder James Reinhart.

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

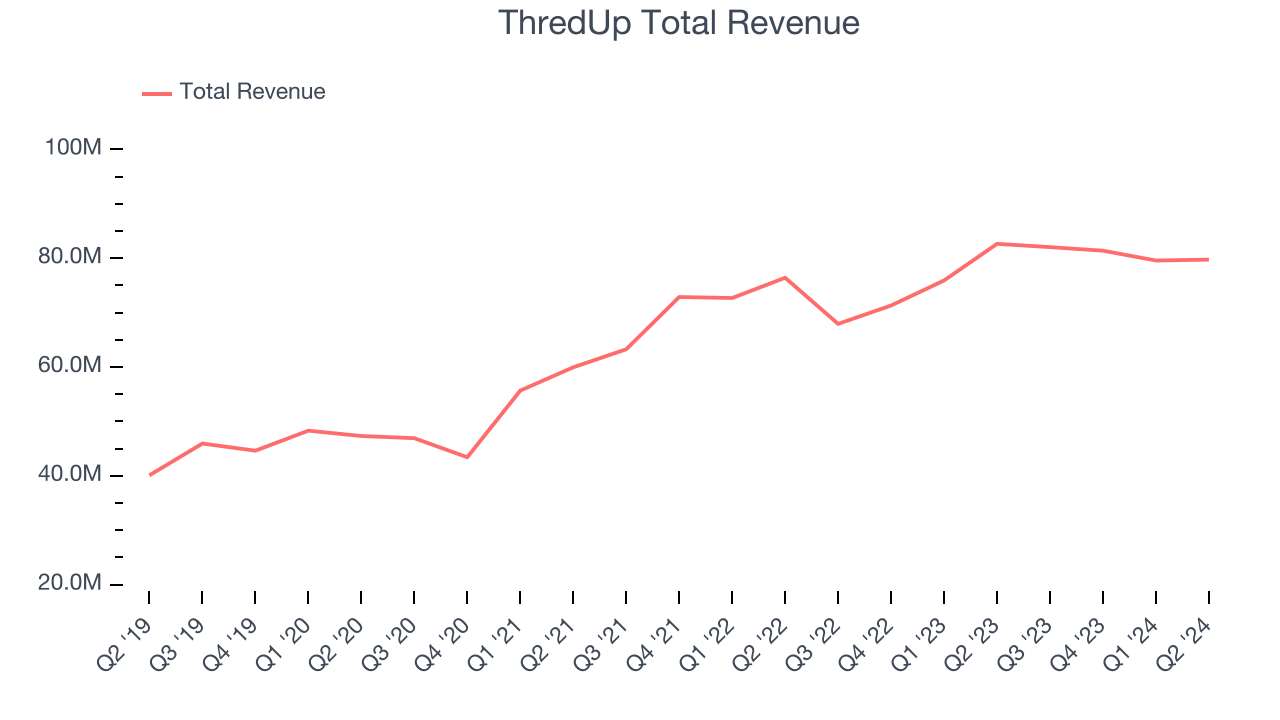

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, ThredUp grew its sales at a decent 16.8% compounded annual growth rate. This shows it was successful in expanding, a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. ThredUp's recent history shows its demand slowed as its annualized revenue growth of 6.4% over the last two years is below its five-year trend.

This quarter, ThredUp missed Wall Street's estimates and reported a rather uninspiring 3.5% year-on-year revenue decline, generating $79.76 million of revenue. The company is guiding for a 14.7% year-on-year revenue decline next quarter to $70 million, a reversal from the 20.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 6% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

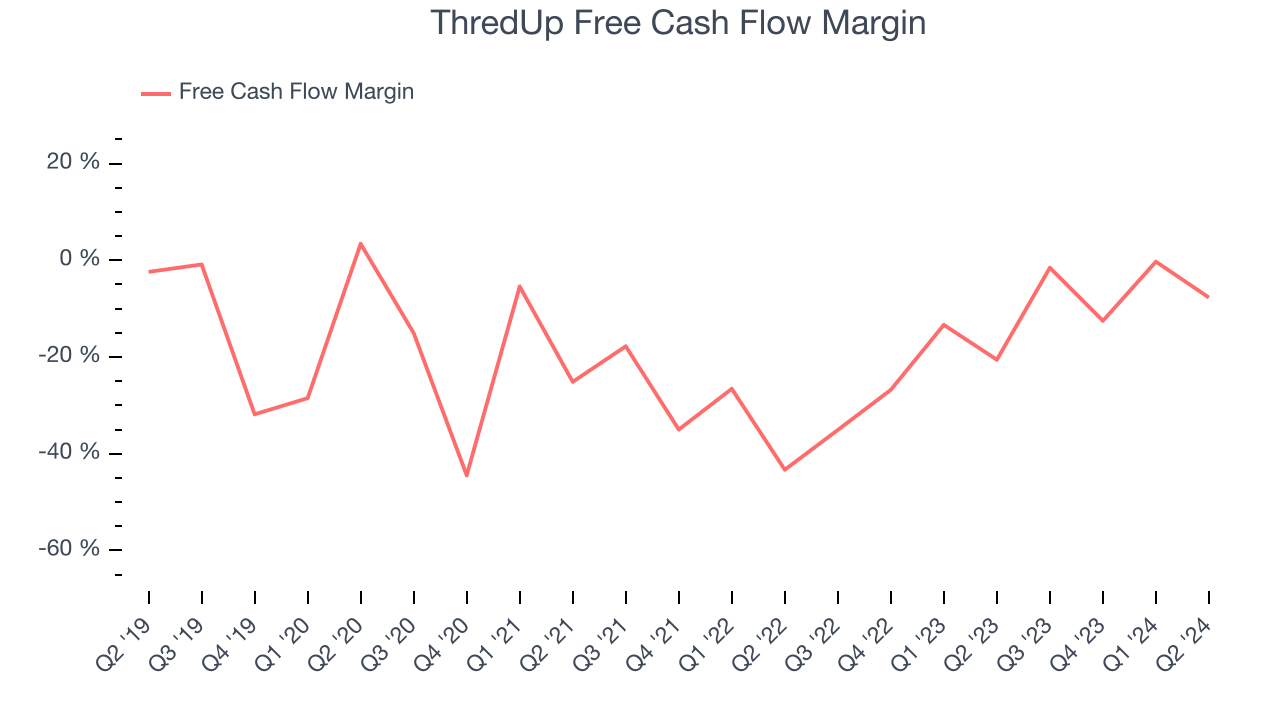

Over the last two years, ThredUp's demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin was among the worst in the consumer discretionary sector, averaging negative 14.2%.

ThredUp burned through $6.14 million of cash in Q2, equivalent to a negative 7.7% margin. The company's cash burn decreased meaningfully year on year, showing it managed its cash more conservatively.

Looking forward, analysts predict ThredUp will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 5.5% for the last 12 months will increase to positive 4.5%, giving it more money to invest.

Key Takeaways from ThredUp's Q2 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street's estimates. Overall, this was a mediocre quarter for ThredUp. The stock traded down 7.8% to $1.59 immediately following the results.

ThredUp may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.