IT project management software company, Atlassian (NASDAQ:TEAM) reported Q4 FY2021 results beating Wall St's expectations, with revenue up 29.9% year on year to $559.5 million. Atlassian made a GAAP loss of $213 million, improving on its loss of $385.2 million, in the same quarter last year.

Is now the time to buy Atlassian? Get early access to our full analysis of the earnings results here, it's free

Atlassian (TEAM) Q4 FY2021 Highlights:

- Revenue: $559.5 million vs analyst estimates of $525.3 million (6.51% beat)

- EPS (non-GAAP): $0.24 vs analyst estimates of $0.18 (32.2% beat)

- Revenue guidance for Q1 2022 is $582.5 million at the midpoint, above analyst estimates of $541.2 million

- Free cash flow of $164.2 million, down 54.4% from previous quarter

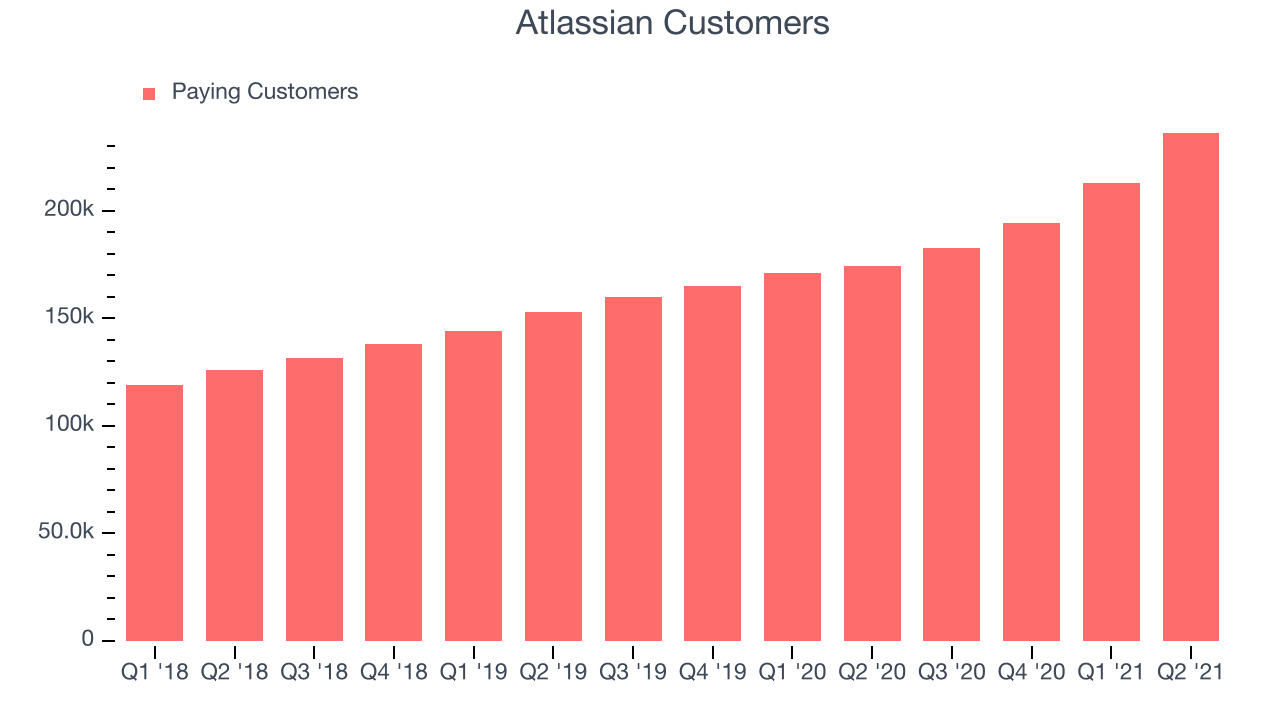

- Customers: 236,118, up from 212,807 in previous quarter

- Gross Margin (GAAP): 82.4%, down from 85% previous quarter

“Our Q4 was a ripper of a quarter - as we Aussies say - as we added over 23,000 new customers, grew subscription revenue 50 percent year-over-year, and continued to see cloud momentum build,” said Mike Cannon-Brookes, Atlassian’s co-founder and co-CEO.

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

If software is eating the world, as Marc Andreessen says, then companies like Atlassian might be very well positioned to benefit, since they provide the software that software developers use to do their jobs.

Sales Growth

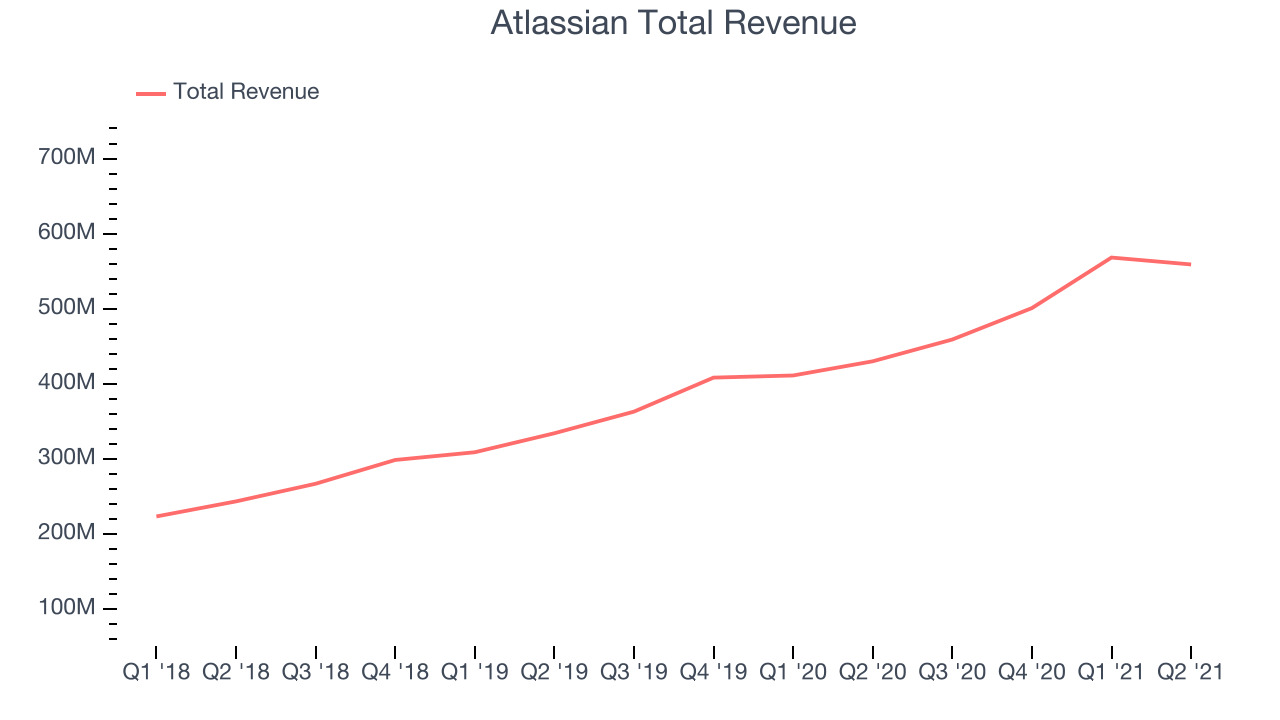

As you can see below, Atlassian's revenue growth has been strong over the last year, growing from quarterly revenue of $430.4 million, to $559.5 million.

This quarter, Atlassian's quarterly revenue was once again up a very solid 29.9% year on year. But the revenue actually decreased by -$9.19 million in Q4, compared to $67.3 million increase in Q3 2021. We'd like to see revenue increase each quarter, but a one-off fluctuation is usually not concerning and the management is guiding for growth to rebound in the next quarter.

Analysts covering the company are expecting the revenues to grow 13.3% over the next twelve months, although we would expect them to review their estimates once they get to read these results.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Customer Growth

You can see below that Atlassian reported 236,118 customers at the end of the quarter, an increase of 23,311 on last quarter. That is quite a bit better customer growth than last quarter and quite a bit above the typical customer growth we have seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Atlassian's Q4 Results

Sporting a market capitalisation of $67.5 billion, more than $1.23 billion in cash and with positive operating free cash flow over the last twelve months, we're confident that Atlassian has the resources it needs to pursue a high growth business strategy.

We were impressed by the very optimistic revenue guidance Atlassian provided for the next quarter. And we were also excited to see it that it outperformed Wall St’s revenue expectations. On the other hand, it was unfortunate to see the deterioration in gross margin. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. The company is up 6.37% on the results and currently trades at $284 per share.

Atlassian may have had a good quarter, but investors should also consider its valuation and business qualities, when assessing the investment opportunity. Is now the right time to invest? Are there better opportunities? Get access to our full analysis here, it's free.

The author has no position in any of the stocks mentioned.