IT project management software company, Atlassian (NASDAQ:TEAM) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 29.9% year on year to $1.19 billion. Guidance for next quarter's revenue was also optimistic at $1.13 billion at the midpoint, 2% above analysts' estimates. It made a non-GAAP profit of $0.89 per share, improving from its profit of $0.54 per share in the same quarter last year.

Atlassian (TEAM) Q1 CY2024 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.10 billion (8.1% beat)

- Operating profit: $316.5 million vs analyst estimates of $216.7 million (big beat)

- EPS (non-GAAP): $0.89 vs analyst estimates of $0.63 (41.9% beat)

- Revenue Guidance for Q2 CY2024 is $1.13 billion at the midpoint, above analyst estimates of $1.11 billion

- Gross Margin (GAAP): 82.1%, in line with the same quarter last year

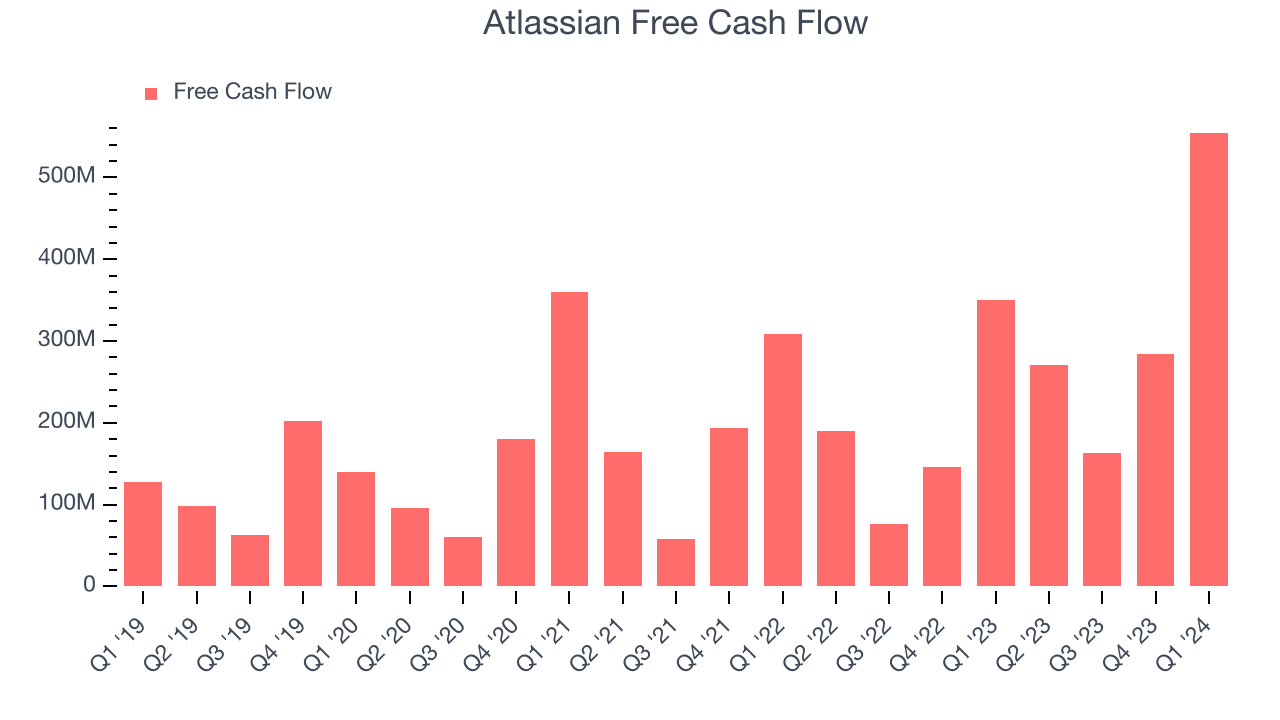

- Free Cash Flow of $554.9 million, up 95.2% from the previous quarter

- Market Capitalization: $51.62 billion

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian’s software platforms such as Jira, Confluence, Trello and Bitbucket, help staff at diverse organisations manage, maintain and develop their technology stacks, as well as drive and track collaboration more generally. For example, Jira Core is a project and task management solution that anyone in an organization can use to plan, track, and report on projects, splitting each task up into multiple steps, and facilitating code review and testing. Meanwhile, Confluence provides a workspace on the cloud for individuals to collaborate on their projects and Bitbucket is used to store and deploy codebase.

Atlassian is somewhat remarkable amongst software companies for its low touch, or self-serve sales process. Although the company now has enterprise advocates to help its larger customers, it operated for many years by relying heavily on word of mouth marketing. With time, its ubiquity has become a strength, as so many technology workers have become accustomed to its products. Because Atlassian has a number of products, it has a wide array of competitors,

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Because Atlassian has a number of products, it has a wide array of competitors, even if a few of them offer an equally comprehensive suite. Notable competitors include Microsoft (NASDAQ:MSFT), which owns Github, a competitor to Jira, and Asana (NYSE:ASAN) which is arguably a competitor to Confluence and Trello.

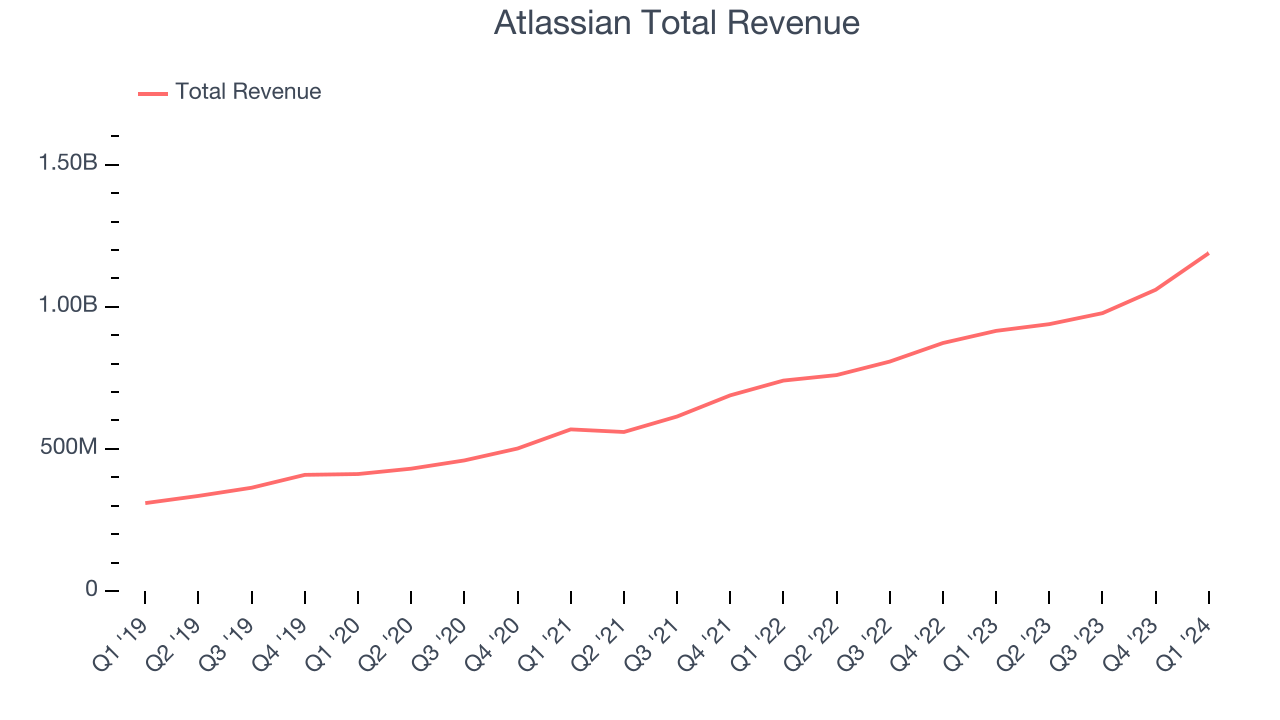

Sales Growth

As you can see below, Atlassian's revenue growth has been strong over the last three years, growing from $568.7 million in Q3 2021 to $1.19 billion this quarter.

This quarter, Atlassian's quarterly revenue was once again up a very solid 29.9% year on year. On top of that, its revenue increased $129 million quarter on quarter, a very strong improvement from the $82.34 million increase in Q4 CY2023. This is a sign of re-acceleration of growth and great to see.

Next quarter's guidance suggests that Atlassian is expecting revenue to grow 20.1% year on year to $1.13 billion, slowing down from the 23.6% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 15.5% over the next 12 months before the earnings results announcement.

Profitability

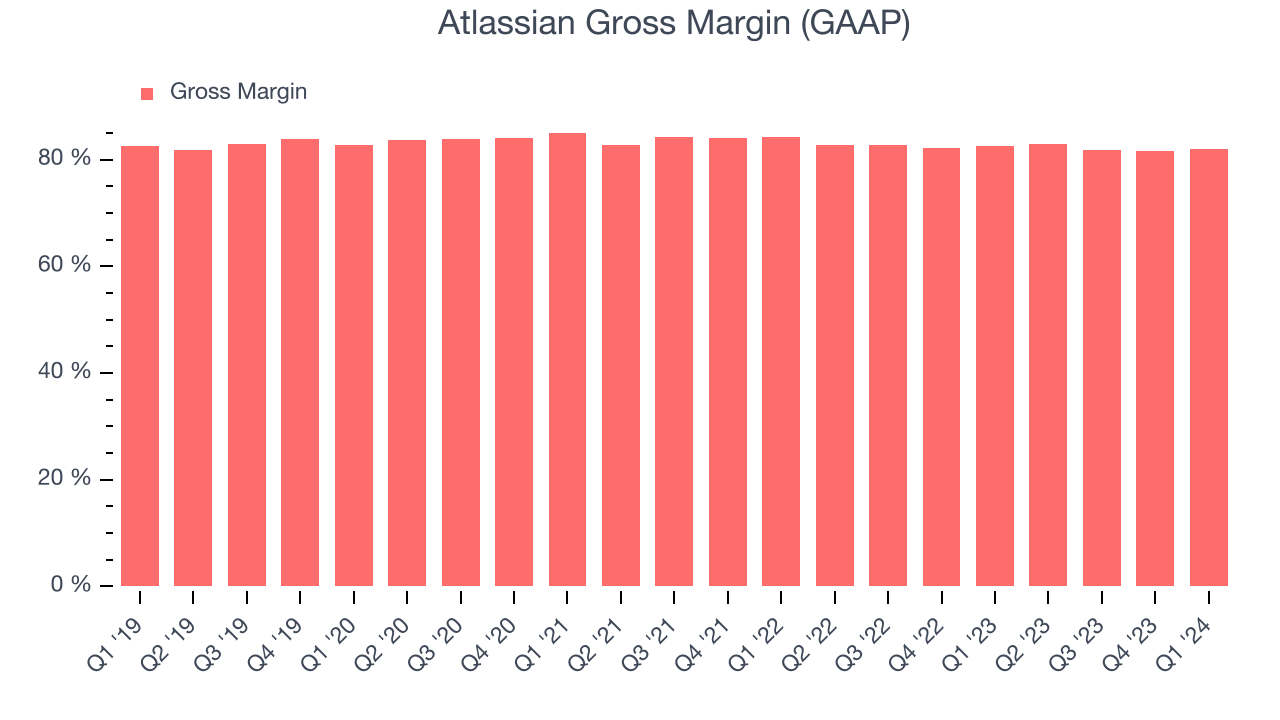

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Atlassian's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 82.1% in Q1.

That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, sales and marketing, and general administrative overhead. Atlassian's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Atlassian is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Atlassian's free cash flow came in at $554.9 million in Q1, up 58.7% year on year.

Atlassian has generated $1.27 billion in free cash flow over the last 12 months, an eye-popping 30.6% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Atlassian is a well-capitalized company with $2.11 billion of cash and $1.20 billion of debt, meaning it could pay back all its debt tomorrow and still have $915.9 million of cash on its balance sheet. This net cash position gives Atlassian the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Atlassian's Q1 Results

We were impressed by how strongly Atlassian blew past analysts' billings expectations this quarter. We were also excited its revenue and operating profit outperformed Wall Street's estimates. For the most part, guidance for next quarter was in line to slightly above expectations. There was big news not related to the financials, though. Co-CEO and co-founder "Scott Farquhar has made the decision to step down as co-CEO to spend more time with his young family, improve the world via philanthropy, and help further the technology industry globally." Co-founder Mike Cannon Brookes continuing to lead Atlassian as CEO. Zooming out, the quarter was very good, the guidance was fine, but the market could be reacting to the leadership change. Specifically, the stock is down 8.2% after reporting, trading at $182.25 per share.

Is Now The Time?

Atlassian may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Atlassian is a good business. We'd expect growth rates to moderate from here, but its revenue growth has been strong over the last three years. On top of that, its bountiful generation of free cash flow empowers it to invest in growth initiatives and its efficient customer acquisition hints at the potential for strong profitability.

Atlassian's price-to-sales ratio of 10.8x based on the next 12 months indicates the market is certainly optimistic about its growth prospects. There are definitely things to like about Atlassian, and there's no doubt it's a bit of a market darling, at least for some. But when comparing the company against the broader tech landscape, it seems there's a lot of good news already priced in.

Wall Street analysts covering the company had a one-year price target of $256.85 right before these results (compared to the current share price of $182.25).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.