Cybersecurity software maker Tenable (NASDAQ:TENB) reported Q1 FY2021 results beating Wall St's expectations, with revenue up 20% year on year to $123 million. Tenable made a GAAP loss of $7.74 million, improving on its loss of $22.9 million, in the same quarter last year.

Tenable (NASDAQ:TENB) Q1 FY2021 Highlights:

- Revenue: $123 million vs analyst estimates of $119 million (2.89% beat)

- EPS (non-GAAP): $0.13 vs analyst estimates of $0.06 ($0.07 beat)

- Revenue guidance for Q2 2021 is $125 million at the midpoint, roughly in line with what analysts were expecting

- The company lifted revenue guidance for the full year from $512 million to $580 million at the midpoint, a 13.1% increase

- Free cash flow of $37.5 million, up 124% from previous quarter

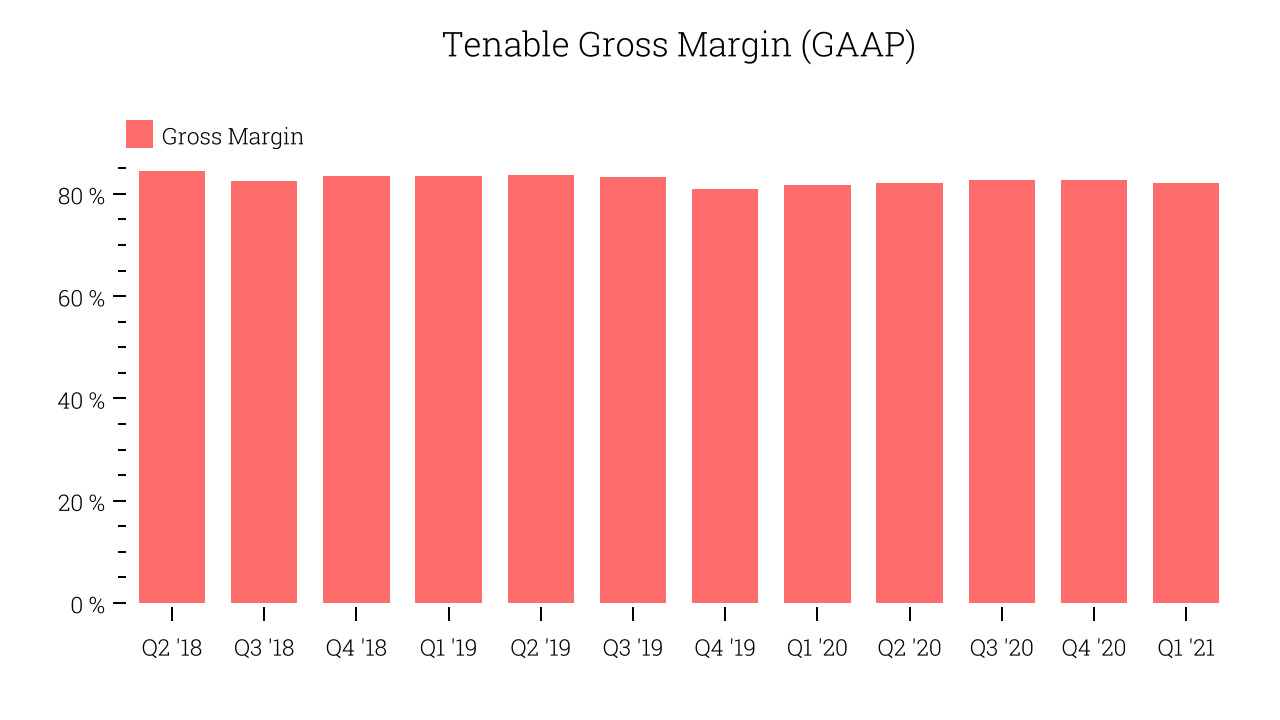

- Gross Margin (GAAP): 82%, in line with previous quarter

Founded in 2002, Tenable (NASDAQ:TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it. Tenable’s software scans all computers, servers and other devices on their customer’s network and finds vulnerabilities that can be exploited by malware or hackers, like computers that haven’t had patches installed or unsecured wifi. It then helps companies understand how severe the vulnerabilities are, alerts them if new ones appear and guides them through removing them.

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud and are becoming exposed to attacks and malware. Employees working remotely have also made it harder for companies to keep their networks secure, and increased demand for software that helps protect from breaches. Cybersecurity is a competitive space and while Tenable is a leader in vulnerability assessment, it face competition from companies like Qualys (NASDAQ:QLYS), Rapid7 (NASDAQ:RPD) and Crowdstrike (NASDAQ:CRWD).

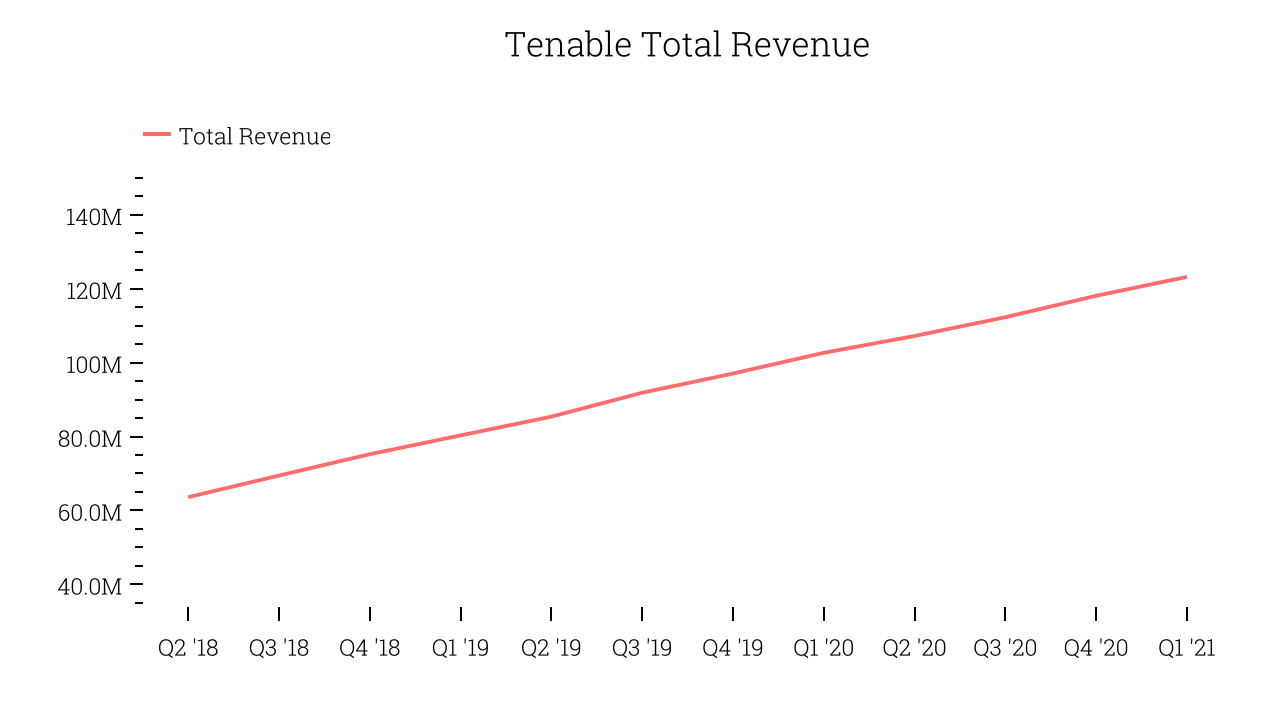

As you can see below, Tenable's revenue growth has been strong over the last twelve months, growing from $102 million to $123 million.

This quarter, Tenable's quarterly revenue was once again up a very solid 20% year on year. But the growth did slow down a little compared to last quarter, as Tenable increased revenue by $5.1 million in Q1, compared to $5.8 million revenue add in Q4 2020. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

What makes the software as a service business model so powerful is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers.

Tenable's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 82% in Q1. That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a great gross margin that will allow Tenable to fund large investments in product and sales during periods of rapid growth and be profitable when it reaches maturity. It is good to see that the gross margin is staying stable which indicates that Tenable is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Tenable's Q1 Results

With market capitalisation of $4.54 billion Tenable is among smaller companies, but its more than $340 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

It was good to see Tenable outperform Wall St’s revenue expectations this quarter and upgrade sales guidance for the full year. Zooming out, we think this was a decent quarter. While the market has high expectations of Tenable, its track record makes it look like a good growth stock, and nothing we've seen today has meaningfully changed that.

The author has no position in any of the stocks mentioned.