Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Teradyne (NASDAQ:TER) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 2.7% below.

Stocks--especially those trading at higher multiples--had a strong end of 2023, but this year has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some semiconductor manufacturing stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.9% since the latest earnings results.

Teradyne (NASDAQ:TER)

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ:TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

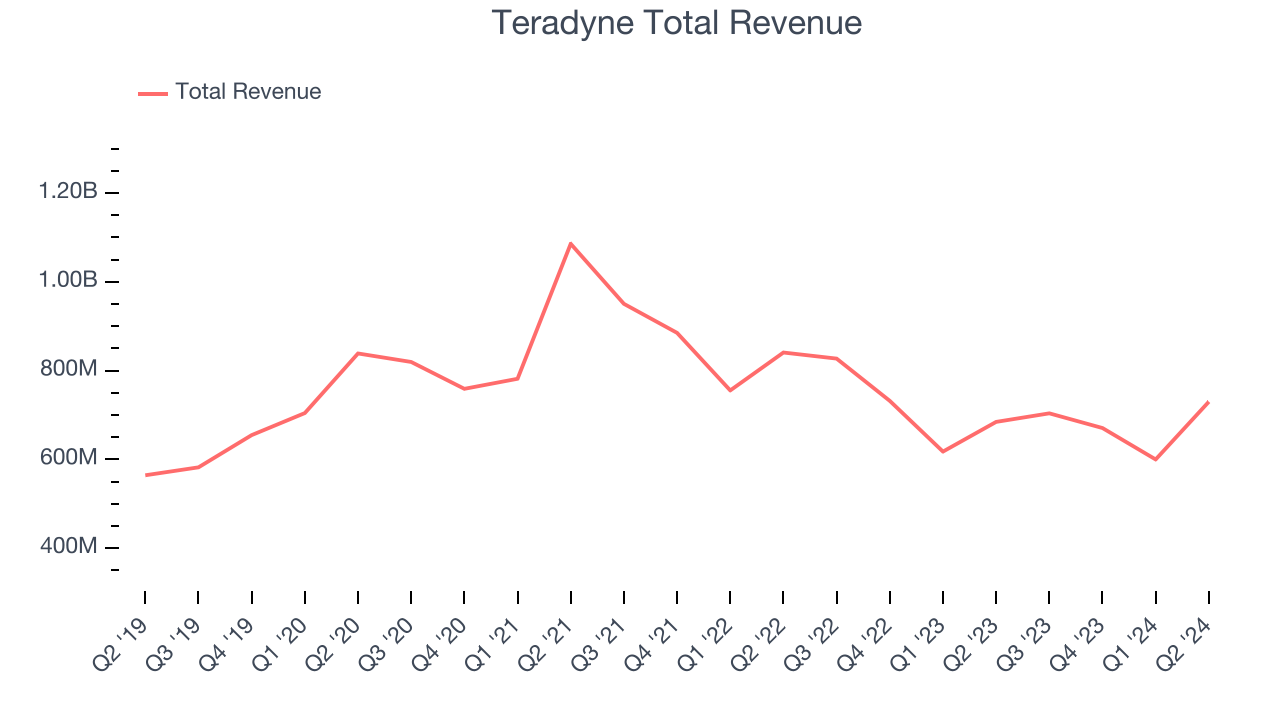

Teradyne reported revenues of $729.9 million, up 6.6% year on year. This print exceeded analysts’ expectations by 4.1%. Overall, it was a strong quarter for the company with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

“In the second quarter, AI applications drove accelerated demand from both compute and memory customers, and our robotics business grew sequentially and year-over-year,” said Teradyne CEO Greg Smith.

Unsurprisingly, the stock is down 10.7% since reporting and currently trades at $127.88.

We think Teradyne is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q2: Nova (NASDAQ:NVMI)

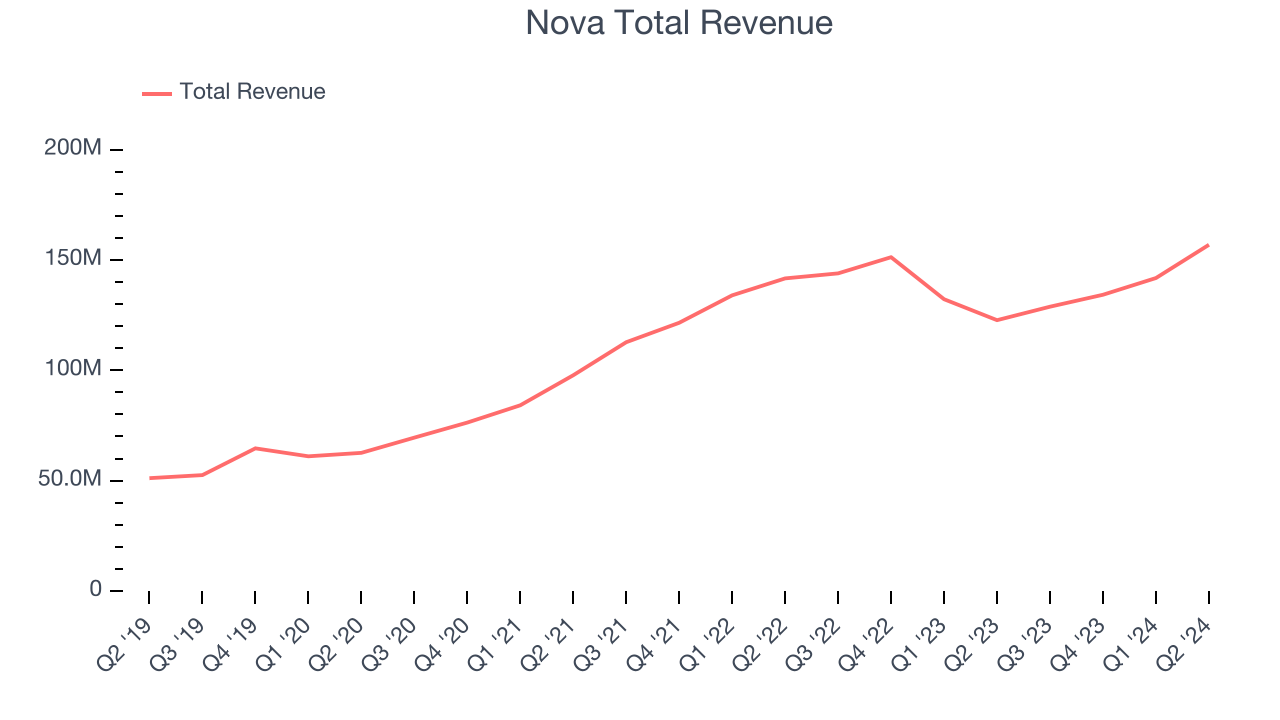

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $156.9 million, up 27.8% year on year, outperforming analysts’ expectations by 5.9%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

Nova achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 7.4% since reporting. It currently trades at $194.71.

Is now the time to buy Nova? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Photronics (NASDAQ:PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $211 million, down 5.9% year on year, falling short of analysts’ expectations by 6.2%. It was a softer quarter as it posted underwhelming revenue guidance for the next quarter and a miss of analysts’ EPS estimates.

Photronics delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 2.7% since the results and currently trades at $23.41.

Read our full analysis of Photronics’s results here.

Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.27 billion, down 5.1% year on year. This result topped analysts’ expectations by 1.5%. It was a very strong quarter as it also produced a significant improvement in its gross margin and inventory levels.

The stock is up 4.1% since reporting and currently trades at $72.68.

Read our full, actionable report on Marvell Technology here, it’s free.

Entegris (NASDAQ:ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $812.7 million, down 9.8% year on year. This result topped analysts’ expectations by 1.3%. Aside from that, it was a mixed quarter as it also recorded a significant improvement in its gross margin but underwhelming revenue guidance for the next quarter.

The stock is down 8% since reporting and currently trades at $112.50.

Read our full, actionable report on Entegris here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.